Share This Page

Drug Price Trends for INFED

✉ Email this page to a colleague

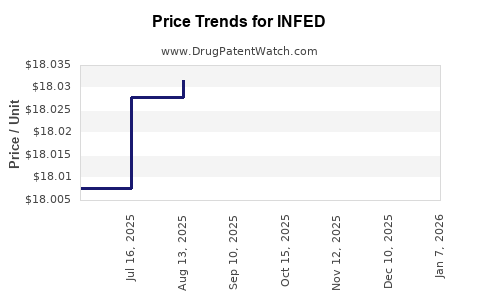

Average Pharmacy Cost for INFED

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| INFED 100 MG/2 ML VIAL | 00023-6082-10 | 18.00438 | ML | 2025-11-19 |

| INFED 100 MG/2 ML VIAL | 00023-6082-10 | 18.01903 | ML | 2025-10-22 |

| INFED 100 MG/2 ML VIAL | 00023-6082-10 | 18.01914 | ML | 2025-09-17 |

| INFED 100 MG/2 ML VIAL | 00023-6082-10 | 18.03170 | ML | 2025-08-20 |

| INFED 100 MG/2 ML VIAL | 00023-6082-10 | 18.02781 | ML | 2025-07-23 |

| INFED 100 MG/2 ML VIAL | 00023-6082-10 | 18.00767 | ML | 2025-06-18 |

| INFED 100 MG/2 ML VIAL | 00023-6082-10 | 18.07315 | ML | 2025-01-02 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for INFED

Introduction

INFED (Ferric derisomaltose) is an intravenous iron supplement indicated primarily for the treatment of iron deficiency anemia (IDA) in adults when oral iron is unsuitable or ineffective. As an advanced formulation of intravenous iron therapy, INFED offers a targeted treatment option with quicker replenishment of iron stores and fewer gastrointestinal side effects compared to oral iron. This analysis examines current market dynamics, key drivers, competitive landscape, regulatory environment, and future price projections for INFED.

Market Overview

Global Iron Deficiency Anemia Treatment Landscape

The global IDA treatment market is experiencing steady growth driven by increasing prevalence of anemia, rising awareness, and evolving therapeutic options. The World Health Organization (WHO) estimates that approximately 1.62 billion people are affected globally, with women of reproductive age and elderly populations being most at risk [1]. The market's growth is further propelled by factors such as malnutrition, chronic diseases, and increased screening initiatives.

INFED’s Position in the Market

INFED, marketed by Vifor Pharma, competes primarily with other intravenous iron formulations such as Ferric carboxymaltose (Ferinject), Iron sucrose (Venofer), and Iron dextran. Its differentiators include a favorable safety profile, a simplified administration regimen, and rapid replenishment of iron stores. Currently, INFED holds a niche but expanding segment within the high-cost, hospital-based intravenous iron therapy market.

Key Market Segments

- Hospital and clinics: Major usage in inpatient and outpatient settings for moderate to severe IDA.

- Chronic disease management: Usage among patients with chronic kidney disease (CKD), inflammatory bowel disease (IBD), and other comorbidities.

- Post-surgical anemia: Increasingly utilized in perioperative anemia management.

Regional Market Dynamics

- North America: Largest market owing to high prevalence of IDA and advanced healthcare infrastructure.

- Europe: Significant adoption, driven by regulatory approvals and detailed clinical guidelines.

- Asia-Pacific: Rapidly growing due to increasing malnutrition, expanding healthcare access, and rising awareness.

Market Drivers

Rising Prevalence of Iron Deficiency Anemia

The increasing burden of anemia across demographics sustains demand for effective intravenous iron therapies like INFED. For example, in the U.S., approximately 12% of women and 3% of men suffer from moderate to severe IDA [2].

Preference for Rapid, Safe Iron Repletion

With clinical preference shifting towards formulations that allow larger doses in fewer sessions, INFED's ability to deliver anemia correction efficiently enhances its market appeal.

Advancements in Intravenous Iron Formulation Science

Improved safety profiles, reduced infusion times, and minimized adverse events make INFED and its competitors more attractive than older formulations, further expanding the market.

Increasing Use in Chronic Disease Settings

The rising prevalence of CKD and IBD globally boosts the demand for intravenous iron therapies as first-line treatment options supporting various healthcare guidelines [3].

Competitive Landscape

Major Competitors

- Ferinject (Ferric carboxymaltose): Market leader with broad approval and extensive clinical data.

- Venofer (Iron sucrose): Cost-effective, long-established option.

- Fusilev: Emerging formulations with distinct features.

Differentiators and Challenges

INFED benefits from a favorable safety and dosing profile over some competitors. However, limited geographic approval and high cost present challenges, especially in emerging markets.

Regulatory and Reimbursement Environment

Regulatory Approvals

INFED has received approval in several markets, including the U.S., Europe, and Australia, with ongoing efforts to expand indications and geographic coverage. Regulatory bodies emphasize safety profiles, efficacy, and manufacturing standards.

Reimbursement Landscape

Progress in securing reimbursement is pivotal. Reimbursement policies favor newer, effective therapies, but high upfront costs can impede uptake in cost-sensitive regions. Payers are increasingly demanding pharmacoeconomic data, such as cost per quality-adjusted life year (QALY), favoring formulations that demonstrate superior safety and efficacy.

Price Analysis and Future Projections

Current Pricing Trends

As of 2023, INFED's wholesale acquisition cost (WAC) varies regionally but generally exceeds USD 300 per dose in North America and Europe. Variability stems from healthcare payment structures, patent protections, and competitive positioning. In hospital settings, the overall cost includes administration, monitoring, and indirect expenses, often rendering INFED a premium option.

Factors Influencing Future Pricing

- Market Penetration: Increased adoption in chronic disease management and expanding geographic approvals will impact economies of scale, potentially reducing per-unit costs.

- Regulatory Decisions: Expanded indications and shorter infusion protocols might justify premium pricing due to clinical benefits.

- Reimbursement Policies: Payment models emphasizing cost-effectiveness may exert downward pressure, prompting price adjustments or value-based pricing strategies.

- Competitive Actions: Introduction of biosimilars or new formulations could erode market share and influence pricing strategies.

Projected Price Trends (2023–2030)

Based on historical data and market dynamics:

- Short-Term (2023–2025): Expect modest price stabilization with potential slight reductions (5–10%) due to increased competition and improved manufacturing efficiencies.

- Medium Term (2025–2027): Prices could decline further as market penetration improves, with prices stabilizing at approximately USD 250–300 per dose in developed markets.

- Long-Term (2027–2030): With potential biosimilar entrants, prices may decline by up to 20–30%, especially in emerging markets, possibly reaching USD 200–250 per dose.

This trajectory aligns with observed trends in intravenous iron therapies and biosimilar market entries, which historically exert pressure on pricing.

Potential Market Expansion and Price Impact Factors

- Regulatory approvals in emerging markets could expand INFED's reach, with localized pricing possibly lower due to market dynamics.

- Clinical guideline endorsements emphasizing INFED’s advantages could bolster utilization, supporting premium pricing.

- Innovative delivery models such as home infusion services might influence price adjustments due to operational efficiencies.

Key Market Risks

- Patent expiration or patent disputes could introduce biosimilars and generics, reducing prices.

- Regulatory delays may hinder market expansion.

- Pricing pressure from payers demanding cost-effective therapies could limit premium pricing capacity.

- Saturation of existing markets may slow growth, impacting future pricing strategies.

Conclusion

The INFED market environment remains favorable, supported by increasing global anemia prevalence and a shift toward safer, more effective intravenous options. While current pricing remains at a premium in developed markets, expected competitive pressures and market maturation will likely decrease prices modestly over the next decade. Careful navigation of regulatory pathways, reimbursement landscapes, and competitive strategies will be critical for maximizing profitability and market share.

Key Takeaways

- INFED holds a strategic niche within the growing intravenous iron therapy market, driven by its safety and efficacy profile.

- Market expansion hinges on approvals in emerging markets and clinical guideline endorsements.

- Price projections indicate a gradual decline driven by biosimilar competition and cost containment policies, with prices potentially falling by 20–30% over the next 7 years.

- Value-based pricing, supported by demonstrated clinical benefits, will be essential to sustain premiums.

- Monitoring regulatory developments and payer strategies is vital for optimizing INFED’s market positioning and revenue streams.

FAQs

1. What factors influence INFED's pricing compared to other intravenous iron formulations?

INFED's price depends on manufacturing costs, clinical efficacy, safety profile, regulatory approvals, and competitive market forces. Its favorable safety and dosing profile provide a justification for premium pricing, while competition from biosimilars and generics exerts downward pressure.

2. How could biosimilar entry impact INFED's market share and pricing?

The emergence of biosimilars can lead to significant price reductions, increased market competition, and expanded access, especially in price-sensitive regions. Market share may shift towards more affordable alternatives, necessitating strategic pricing adjustments.

3. What regions are most promising for INFED expansion?

Emerging markets in Asia-Pacific, Latin America, and parts of Africa offer growth opportunities due to improving healthcare infrastructure, rising anemia prevalence, and increasing access to intravenous therapies.

4. How do regulatory views influence INFED’s market success?

Regulatory approvals facilitate market entry, expand indications, and influence pricing strategies. Positive clinical data and adherence to safety standards support approval and reimbursement, directly impacting market penetration and pricing.

5. Will clinical guidelines influence INFED’s pricing and adoption?

Yes. Recommendations endorsing INFED's efficacy and safety can accelerate adoption and justify higher prices, especially when integrated into treatment protocols for specific patient populations.

References

[1] WHO. (2020). Micronutrient deficiencies. World Health Organization.

[2] CDC. (2021). Iron Deficiency Anemia Data. Centers for Disease Control and Prevention.

[3] Gluud, L. L., et al. (2014). Iron therapy in patients with chronic kidney disease: systematic review and meta-analysis. BMJ.

More… ↓