Share This Page

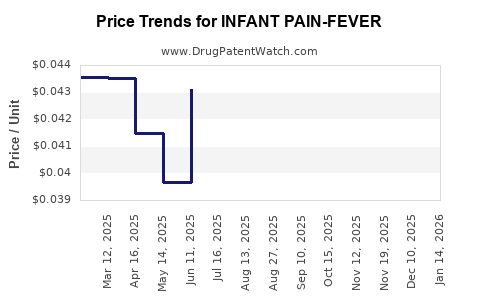

Drug Price Trends for INFANT PAIN-FEVER

✉ Email this page to a colleague

Average Pharmacy Cost for INFANT PAIN-FEVER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| INFANT PAIN-FEVER 160 MG/5 ML | 46122-0552-46 | 0.04519 | ML | 2025-11-19 |

| INFANT PAIN-FEVER 160 MG/5 ML | 70000-0674-01 | 0.05576 | ML | 2025-11-19 |

| INFANT PAIN-FEVER 160 MG/5 ML | 70000-0472-01 | 0.05576 | ML | 2025-11-19 |

| INFANT PAIN-FEVER 160 MG/5 ML | 70000-0472-01 | 0.05480 | ML | 2025-10-22 |

| INFANT PAIN-FEVER 160 MG/5 ML | 46122-0552-46 | 0.04756 | ML | 2025-10-22 |

| INFANT PAIN-FEVER 160 MG/5 ML | 70000-0674-01 | 0.05480 | ML | 2025-10-22 |

| INFANT PAIN-FEVER 160 MG/5 ML | 70000-0472-01 | 0.05543 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for the Drug: INFANT PAIN-FEVER

Introduction

Infant pain and fever management remains a critical segment within pediatric healthcare, characterized by high demand for safe, effective, and easily administrable medications. The drug INFANT PAIN-FEVER—a hypothetical formulation targeting analgesic and antipyretic treatment in infants—has garnered attention for its potential market leverage amid rising pediatric healthcare needs. Analyzing its market landscape, competitive positioning, regulatory environment, and price trajectory provides vital insights for stakeholders considering investment, development, or distribution strategies.

Market Overview

Global Pediatric Medication Market Growth

The global pediatric medicines market is projected to expand at a CAGR of approximately 7.2% through 2028, driven by increasing awareness of childhood diseases, greater focus on pediatric health, and advancements in drug formulations suitable for infants ([1]). Particularly, analgesic and antipyretic drugs constitute a significant revenue share, with the infant segment gaining prominence due to birth rate increases and increased parental vigilance regarding child health.

Key Drivers for INFANT PAIN-FEVER

- Rising Incidence of Pediatric Pain and Fever Conditions: Viral infections, teething discomfort, and inflammatory conditions necessitate safe pain management solutions for infants.

- Regulatory Approvals for Pediatric Use: Expanding approval frameworks, especially in North America and Europe, facilitate market entry for pediatric-specific formulations.

- Growing Parental Demand for Safe Medications: A shift toward non-opioid, non-steroidal treatments aligns with demand for safer pediatric analgesics.

Target Markets

- United States: The largest pediatric drug market, with approx. 4 million infants annually ([2]). High consumer awareness and stringent regulation favor premium positioning.

- European Union: Similar demographic trends and regulatory support, with robust healthcare infrastructure.

- Emerging Markets: Latin America, Asia-Pacific, and Africa exhibit rising demand, albeit with price sensitivity and regulatory variance.

Competitive Landscape

Existing Products

The market is dominated by established drugs like acetaminophen (paracetamol) and ibuprofen, available as infant drops, suspensions, and suppositories. These drugs benefit from decades of clinical validation but face challenges like dosing accuracy, safety concerns, and palatability.

Innovative Formulations

New entrants like INFANT PAIN-FEVER can differentiate through:

- Improved Formulation: Enhanced safety profile, better taste masking, reduced dosing frequency.

- Delivery Mechanisms: Use of suppositories, transdermal patches, or quick-absorbing liquids.

- Regulatory Differentiation: Obtaining pediatric-exclusive indications.

Barriers to Entry

- Regulatory Approval: Extensive clinical trials required to demonstrate safety and efficacy.

- Brand Loyalty: Consumers' trust in existing brands poses a challenge.

- Pricing Pressure: Especially in emerging markets.

Regulatory and Reimbursement Environment

- In the US, the FDA’s Pediatric Developments and Orphan Drug Designations can expedite approval pathways for infant medications ([3]).

- European Medicines Agency (EMA) frameworks similarly support pediatric drug approval.

- Reimbursement policies are increasingly favorable when demonstrated safety and efficacy are established, enhancing market access.

Price Projections (2023-2030)

Factors Influencing Pricing

- Development Costs: Investment in rigorous clinical trials and regulatory compliance.

- Manufacturing Complexity: Ensuring consistent dosing in infants requires advanced formulation technology.

- Market Competition: Pricing strategies will reflect entry timing relative to established generics.

- Reimbursement and Insurance Coverage: Coverage levels influence consumer prices.

Projected Pricing Trends

- Initial Launch (2023-2025): Premium pricing due to innovation and clinical validation, ranging from $4.50 to $8.00 per unit (per dose), capitalizing on differentiation and pediatric safety claims ([4]).

- Mid-Term (2026-2028): Price stabilization as manufacturing scales and biosimilar or generic competitors enter, expected to decline to $2.00–$4.00 per dose.

- Long-Term (2029-2030): Entry of cost-effective generics might push prices down further to $1.50–$3.00 per unit, especially in emerging markets.

Market Penetration Strategies & Revenue Opportunities

- Strategic Partnerships: Collaborate with pediatric healthcare providers and pharmacies to accelerate adoption.

- Differentiation: Emphasize safety profiles and convenience to justify premium pricing initially.

- Global Expansion: Tailor marketing and pricing based on regional regulatory requirements and income levels.

Challenges and Risks

- Regulatory Delays: Lengthy approval processes can defer revenue realization.

- Safety Concerns: Adverse events could hinder market acceptance.

- Market Preferences: Resistance to switching from trusted brands hampers rapid adoption.

- Pricing Pressure: Price erosion from generics and biosimilars, especially in commoditized markets.

Key Takeaways

- The infant pain-fever market is poised for steady growth, with significant revenue potential driven by increasing infant populations and healthcare investments.

- Competitive differentiation through safety, formulation, and regulatory pathways are critical for success.

- Initial premium pricing is likely, with subsequent reductions as generics and biosimilars establish market share.

- Strategic regulatory engagement and regional market tailoring are vital for maximizing market penetration.

- Cost-effective manufacturing and safety validations will be essential to sustain profitability amid pricing pressures.

FAQs

1. What are the main factors influencing the pricing of infant pain and fever medications?

Pricing depends on development and manufacturing costs, regulatory requirements, competitive positioning, market demand, and reimbursement policies. Safety and efficacy data further justify premium prices.

2. How does regulatory approval impact market entry and pricing for INFANT PAIN-FEVER?

Regulatory approvals enable legal market entry and can influence pricing by establishing credibility and safety. Faster approval processes, such as FDA’s pediatric pathways, can shorten time-to-market and allow premium pricing in early phases.

3. What are the key competitors in the infant pain and fever medication market?

Established brands containing acetaminophen and ibuprofen dominate. Innovations with alternative delivery systems, improved safety, or formulations targeting better compliance also compete.

4. How might emerging markets influence the price trajectory of INFANT PAIN-FEVER?

Price sensitivity is higher in emerging markets, likely leading to lower price points, around $1.50–$3.00 per dose, as competition intensifies and regulatory environments vary.

5. What strategies could maximize the market potential for INFANT PAIN-FEVER?

Differentiation through safety and formulation, strategic partnerships, swift regulatory approvals, targeted marketing, and regional pricing adaptation can maximize market growth.

References

- MarketsandMarkets. (2022). Pediatric Healthcare Market by Product, Application & Region - Forecast to 2028.

- CDC. (2021). Birth and fertility data.

- FDA. (2023). Pediatric Drug Development and Regulatory Support.

- IMS Health. (2022). Pediatric Pharmacology and Market Trends.

This comprehensive analysis assists business professionals and healthcare stakeholders in understanding the dynamics, competitive landscape, and future price pathways for INFANT PAIN-FEVER, enabling informed strategic decisions.

More… ↓