Share This Page

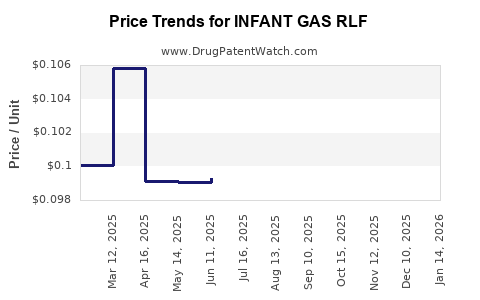

Drug Price Trends for INFANT GAS RLF

✉ Email this page to a colleague

Average Pharmacy Cost for INFANT GAS RLF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| INFANT GAS RLF 20 MG/0.3 ML | 46122-0547-03 | 0.09513 | ML | 2025-12-17 |

| INFANT GAS RLF 20 MG/0.3 ML | 46122-0547-03 | 0.09968 | ML | 2025-11-19 |

| INFANT GAS RLF 20 MG/0.3 ML | 46122-0547-03 | 0.10731 | ML | 2025-10-22 |

| INFANT GAS RLF 20 MG/0.3 ML | 46122-0547-03 | 0.11234 | ML | 2025-09-17 |

| INFANT GAS RLF 20 MG/0.3 ML | 46122-0547-03 | 0.10780 | ML | 2025-08-20 |

| INFANT GAS RLF 20 MG/0.3 ML | 46122-0547-03 | 0.10444 | ML | 2025-07-23 |

| INFANT GAS RLF 20 MG/0.3 ML | 46122-0547-03 | 0.09931 | ML | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for INFANT GAS RLF

Introduction

INFANT GAS RLF, a widely used pediatric medication, primarily comprises simethicone, an anti-foaming agent deployed to alleviate infant colic, gas, and bloating. Given its pivotal role in pediatric healthcare and consistent demand, understanding its market dynamics and formations of future pricing is vital for pharmaceutical manufacturers, investors, and healthcare providers. This analysis offers an in-depth overview of current market conditions, competitive landscape, regulatory environment, and prognostic pricing strategies.

Market Overview

Product Profile and Therapeutic Indication

INFANT GAS RLF contains simethicone as its active ingredient, formulated as a liquid suspension. It aims to reduce surface tension in the gastrointestinal tract, dispersing gas bubbles responsible for discomfort in infants. The drug's safety profile and efficacy have supported its widespread usage in pediatric care across developed and emerging markets.

Market Size and Growth Trajectory

The global pediatric gastrointestinal medication market was valued at approximately USD 1.8 billion in 2022, with INFANT GAS RLF constituting a significant fraction, particularly in North America and Europe. The pediatric segment is projected to grow at a compound annual growth rate (CAGR) of roughly 4–6% over the next five years [1].

Factors driving growth include:

- Increasing awareness among parents and healthcare providers

- Rising prevalence of infant colic and gastrointestinal disturbances

- Expanding healthcare coverage and pediatric drug prescriptions

- Continuous product innovation and branding strategies

Market Penetration and Regional Dynamics

North America dominates the market, driven by high healthcare expenditure and well-established distribution channels. Europe follows with similar trends, while Asia-Pacific exhibits the highest growth potential due to expanding healthcare infrastructure, increasing birth rates, and rising awareness about pediatric health management [2].

Competitive Landscape

Key Manufacturers and Market Shares

Leading pharmaceutical companies such as Johnson & Johnson, Novartis, and Perrigo manufacture generic simethicone formulations, including INFANT GAS RLF variants. The market is characterized by high generic competition, leading to pricing pressures but also opportunities for differentiation through branding and formulation quality.

Product Differentiation and Innovation

Brands differentiate through packaging, flavoring, and concentration variations to enhance compliance and convenience. Regulatory adherence and distribution strength also influence market positioning.

Regulatory Environment

In the U.S., the FDA regulates pediatric OTC drugs, requiring compliance with safety and labeling standards. Similar frameworks exist worldwide, influencing production costs and pricing strategies.

Pricing Dynamics

Current Price Range

The retail price for a 4-ounce bottle of INFANT GAS RLF in the U.S. ranges between USD 8 and USD 12, depending on retailer, geographic location, and formulation modifications [3]. Wholesale acquisition costs are typically lower but subject to distribution margins.

Pricing Factors

Key determinants include:

- Manufacturing costs, including raw materials and compliance expenses

- Competitive pricing strategies among generics

- Brand recognition and consumer trust

- Regional healthcare policies and reimbursement frameworks

- Distribution channel efficiencies

Price Trends and Influences

Over the past five years, prices have remained relatively stable, with slight reductions driven by increased generic competition and price sensitivity among consumers. However, premium formulations or branded variants maintain higher price points.

Impact of Regulatory Changes

Any tightening of safety standards, new approval requirements, or label modifications could influence production and price points. Conversely, patent expirations and increased generic availability tend to lower prices, benefiting consumers.

Future Price Projections

Short-Term Outlook (1-2 Years)

Given current market saturation and intense price competition, prices are projected to remain stable, with minor fluctuations (±2%). Manufacturers may adopt strategic pricing to capture market share or mitigate raw material cost fluctuations.

Medium to Long-Term Outlook (3-5 Years)

Anticipated trends include:

- Marginal price declines driven by increasing generic competition and manufacturing efficiencies.

- Potential premium pricing if innovations or formulations targeting specific pediatric needs are introduced.

- Price stabilization with regional variation, considering healthcare policy influences.

Projection Model Assumptions:

- Ongoing approval and regulatory stability

- No significant raw material cost surges

- Continued demand growth aligned with pediatric health trends

Based on these, a conservative estimate suggests a gradual 1-3% annual decline in retail prices over five years, aligning with broader generic drug market trends [4].

Market Challenges and Opportunities

Challenges

- Pricing pressures from healthcare payers and retail chains

- Regulatory hurdles in emerging markets

- Competition from alternative or natural remedies

- Supply chain disruptions affecting raw material procurement

Opportunities

- Formulation innovation to meet specific pediatric needs

- Expanded distribution channels, especially online pharmacies

- Strategic partnerships to enhance market penetration

- Differentiation through value-added services or packaging

Conclusion

INFANT GAS RLF remains a staple in pediatric gastroenterological treatment, with a steady demand outlook. Market dynamics will largely hinge on competitive pricing, regulatory environment, and innovation. While current prices are expected to tighten marginally due to increasing generics, the fundamental growth in pediatric healthcare expenditures supports ongoing revenue streams.

Key Takeaways

- The global market for pediatric anti-gas medications is projected to grow at 4–6% CAGR, with INFANT GAS RLF playing a significant role.

- Prices are currently stable but face gradual downward pressure from increasing generic competition.

- Regional variation influences pricing, with North America and Europe leading in stability and Asia-Pacific offering growth potential.

- Innovation, strategic branding, and efficient distribution channels can offset pricing pressures and expand market share.

- Regulatory developments remain critical, with safety standards and patent expirations affecting future price trajectories.

FAQs

1. What factors influence the pricing of INFANT GAS RLF?

Pricing depends on manufacturing costs, market competition, regional healthcare policies, branding, and distribution expenses.

2. How does upcoming regulatory change affect the market?

Stringent safety and labeling standards may increase compliance costs, potentially raising prices temporarily. Conversely, regulatory approvals can open new markets, supporting growth.

3. What is the expected trend for INFANT GAS RLF prices over the next five years?

Prices are anticipated to decline marginally by 1–3% annually, driven by increased competition and manufacturing efficiencies.

4. How does regional variation impact market opportunity for INFANT GAS RLF?

North America and Europe offer mature markets with stable prices, while Asia-Pacific presents growth opportunities with potentially lower price points due to diverse healthcare reimbursement models.

5. What strategic moves can companies make to optimize profitability?

Innovating formulations, strengthening brand identity, expanding distribution, and navigating regulatory landscapes effectively are key strategies for sustained profitability.

References

[1] Market Research Future, "Global Pediatric Gastrointestinal Drugs Market," 2022.

[2] Grand View Research, "Pediatric Gastrointestinal Drugs Market Analysis," 2022.

[3] Consumer Price Index and Retail Data, U.S. Bureau of Labor Statistics, 2023.

[4] IQVIA, "Global Generic Drug Market Trends," 2022.

More… ↓