Share This Page

Drug Price Trends for INF ACETAMINOPHEN

✉ Email this page to a colleague

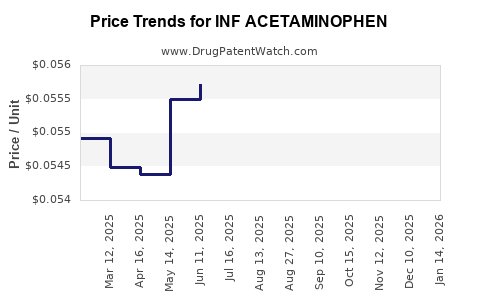

Average Pharmacy Cost for INF ACETAMINOPHEN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| INF ACETAMINOPHEN 160 MG/5 ML | 00536-1426-77 | 0.05653 | ML | 2025-12-17 |

| INF ACETAMINOPHEN 160 MG/5 ML | 00536-1426-77 | 0.05576 | ML | 2025-11-19 |

| INF ACETAMINOPHEN 160 MG/5 ML | 00536-1426-77 | 0.05480 | ML | 2025-10-22 |

| INF ACETAMINOPHEN 160 MG/5 ML | 00536-1426-77 | 0.05543 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Acetaminophen (Paracetamol)

Introduction

Acetaminophen, also known as paracetamol, remains one of the most widely used over-the-counter (OTC) analgesic and antipyretic agents globally. Despite its long-standing history, shifts in regulatory landscapes, production costs, and competitive dynamics influence its market stability and future pricing projections. This report provides a comprehensive market overview, analyzes current conditions, assesses key drivers and barriers, and projects pricing trends for the coming years.

Market Overview and Global Demand

Historical Context and Market Size

Acetaminophen has been a staple in pain management for over a century, with the global market estimated to reach approximately USD 20 billion in 2022, reflecting consistent demand driven by its affordability and safety profile when used appropriately [1].

Geographical Markets

North America and Europe dominate the market, accounting for over 60% of global consumption, primarily due to high OTC drug utilization and established regulatory frameworks. Emerging markets in Asia-Pacific and Latin America exhibit rapid growth, driven by increasing healthcare access and urbanization.

Therapeutic and Consumer Trends

The demand for acetaminophen remains stable, although recent concerns over hepatotoxicity at high doses have led to stricter regulation and public awareness campaigns. Moreover, the shift towards combination products and formulations with other active ingredients sustains its market relevance.

Market Drivers

1. Cost-effectiveness and Accessibility

As an inexpensive, widely available OTC drug, acetaminophen offers healthcare providers and consumers an accessible option for mild to moderate pain relief and fever reduction.

2. Regulatory Environment

Regulators in several jurisdictions, including the U.S. FDA and EMA, have maintained its status as a safe alternative when used within recommended doses, encouraging continued usage.

3. New Formulations and Delivery Systems

Innovations such as rapid-release formulations, liquid gels, and combination products with cold remedies expand its usage scope and consumer appeal.

4. Growing Awareness of Safer Alternatives

Compared to NSAIDs, acetaminophen’s gastrointestinal safety profile supports its preference among certain patient groups, especially those contraindicated for NSAID use.

Market Barriers and Challenges

1. Safety Concerns and Regulatory Restrictions

High-profile reports of hepatotoxicity have prompted dosage restrictions and enhanced labeling, potentially constraining sales volumes and impacting pricing.

2. Competition from Alternatives

Other analgesics, including NSAIDs and opioids, threaten market share, especially as some formulations are marketed as more effective or safer.

3. Manufacturing and Raw Material Costs

Although largely generic, raw material prices for key synthesis intermediates can fluctuate, influencing production costs and pricing strategies.

Competitive Landscape

The acetaminophen market is predominantly fragmented, with leading generic manufacturers globally competing on price and supply reliability. Major players include McNeil Consumer Healthcare, Johnson & Johnson, and Teva Pharmaceuticals. The entry of low-cost manufacturing regions further intensifies competitive pressures.

Pricing Analysis

Past and Present Pricing Trends

In developed countries, the retail price of OTC acetaminophen tablets averages USD 0.01–0.03 per tablet. Prices have remained relatively stable over the last five years, with minor fluctuations driven primarily by inflation and manufacturing costs.

Factors Influencing Price Stability

- Regulatory constraints limiting maximum allowable doses and labeling changes.

- Widespread generic competition maintaining low prices.

- Supply chain stability for raw materials.

Future Price Projections (2023-2028)

1. Short-term Outlook (2023-2025)

Pricing is expected to remain stable in mature markets, with a slight downward trend due to intense generic competition and overcapacity. Regulatory measures to reduce overdosing could marginally increase production costs but are unlikely to significantly impact retail prices.

2. Medium to Long-term Outlook (2026-2028)

Potential increases could arise from raw material price hikes or new regulatory restrictions. However, global manufacturing capacity expansions, especially in low-cost regions like India and China, should sustain low price levels. Also, innovations enabling lower dosing or new delivery methods could introduce premium pricing segments.

3. Impact of Emerging Markets

Growing demand in Asia-Pacific and Latin America may lead to a gradual increase in prices driven by limited local manufacturing capacity and rising consumer incomes. Entry of local generic manufacturers will likely sustain competitive pricing.

4. Regulatory Impact on Pricing

Any movement towards stricter regulation restricting dosages or mandating new labeling could marginally increase manufacturing and compliance costs, ultimately affecting retail prices modestly.

Regulatory Trends and Implications

Regulatory agencies globally continue to monitor acetaminophen safety. Recent initiatives include limiting maximum doses per single dose or per day and mandating clearer labeling about hepatotoxicity risks. The implementation of such measures may temporarily elevate regulatory compliance costs, but their long-term effect on prices is likely negligible due to the commoditized nature of acetaminophen.

Potential Market Disruptors

- Novel Delivery Platforms: Development of transdermal patches or injectable formulations could command premium prices but will initially face regulatory hurdles.

- Regulatory Restrictions: Stricter dose limits or bans on high-dose formulations could reduce per-unit revenues.

- Patent Expirations and Generics: As patents expire worldwide, increased generic manufacturing will depress prices further.

- Emerging Alternatives: Advances in pain management or the development of safer, more effective compounds could erode acetaminophen’s market share.

Conclusion

The global acetaminophen market exhibits long-term stability driven by its cost-effectiveness, safety profile, and widespread acceptance. Short-term price trends will likely remain flat or decline marginally due to intense generic competition and overcapacity. Medium to long-term projections suggest minor price increases may occur in emerging markets, driven by rising demand and localized manufacturing constraints. Ongoing regulatory vigilance and innovation are expected to influence future pricing dynamics modestly.

Key Takeaways

- Market is mature and price-sensitive with persistent low prices due to high generic competition.

- Regulatory developments focus on safety, likely maintaining stable pricing with minor adjustments.

- Emerging markets present opportunities for modest price increases owing to growing demand and limited local manufacturing.

- Innovation in formulations may create premium segments but won't drastically alter overall market prices.

- Raw material costs and policy changes remain the most significant factors influencing future pricing trends.

FAQs

1. What are the primary factors influencing acetaminophen price stability?

Market saturation, high generic competition, and the commodity-like nature of the drug underpin stable, low retail prices. Regulatory controls also constrain significant price swings.

2. How might regulatory restrictions impact future acetaminophen prices?

Stricter dose limits and packaging regulations could increase manufacturing and compliance costs, potentially leading to slight price increases, especially in markets with tight regulations.

3. Are there any emerging markets with potential for higher acetaminophen prices?

Yes, rapid growth in Asia-Pacific and Latin America, coupled with limited local manufacturing capacity, could lead to modest price increases.

4. Will innovations in delivery systems significantly affect the price of acetaminophen?

Initially, novel delivery mechanisms like patches or injectables may command higher prices, but widespread adoption will depend on regulatory approval and consumer acceptance.

5. What are the key risks to acetaminophen market stability?

Regulatory crackdowns on high doses, safety concerns, and competition from alternative pain management drugs pose the primary risks to market stability and pricing.

References

[1] MarketResearch.com, "Global Acetaminophen Market Size & Share Analysis," 2022.

More… ↓