Last updated: July 27, 2025

Introduction

Imipramine hydrochloride (HCl) is a tricyclic antidepressant (TCA) initially marketed in the 1950s for the treatment of depression. Over decades, its application has expanded to include enuresis and certain anxiety disorders. Despite newer antidepressants entering pharmaceutical markets, Imipramine HCl persists due to its proven efficacy, cost-effectiveness, and established safety profile. This analysis assesses current market dynamics and provides price projections grounded in evolving demand, competitive landscape, regulatory factors, and manufacturing trends.

Market Overview

Historical Context

Imipramine HCl held a dominant position in depression therapy until the early 2000s. Its patent expiration in most jurisdictions transitioned its status to a generic drug, leading to significant price reductions. Despite the advent of selective serotonin reuptake inhibitors (SSRIs) and other novel agents, Imipramine maintains niche applications, such as treatment-resistant depression, certain enuresis cases, and off-label uses in specific demographics.

Current Market Size

The global antidepressant market valuation stood at approximately USD 16 billion in 2021, with tricyclics accounting for a declining but steady segment, estimated at roughly USD 0.3-0.5 billion. Imipramine, as a generic, accounts for an estimated 15-20% of this segment, equating to USD 45-100 million annually. Its primary markets include North America, Europe, and select Asian countries, where healthcare protocols and prescribing behaviors influence utilization rates.

Market Drivers

- Cost-effectiveness: Imipramine remains a low-cost alternative, especially pertinent in low- and middle-income countries (LMICs).

- Clinical efficacy: Proven track record for treatment-resistant depression and enuresis.

- Formulation stability: Availability in multiple forms (capsules, tablets).

- Off-label uses: Management of certain neuropathic pain conditions.

- Generic proliferation: Facilitates affordable access, bolstering steady demand.

Market Constraints

- Side-effect profile: Anticholinergic and cardiovascular risks limit widespread adoption.

- Competition: Dominance of SSRIs (e.g., sertraline, fluoxetine), SNRIs, and atypical agents reduces prescribing frequency.

- Regulatory shifts: Stringent regulatory requirements for old drugs influence manufacturing and distribution.

- Patient and clinician preferences: Favor newer agents with improved safety profiles and side-effect tolerability.

Competitive Landscape

The global Imipramine HCl market comprises a multitude of generic manufacturers across Asia (India, China, Pakistan), Europe, and America. Major players include Sun Pharmaceutical Industries, Teva Pharmaceuticals, Mylan, and local generics producers. Price competition is intense, driven by manufacturing efficiencies, patent expiry, and regulatory cost frameworks.

Patent Status and Regulatory Environment

With patent expiry, market entry costs are reduced, increasing generics competition. Regulatory agencies such as the FDA and EMA require bioavailability and bioequivalence data for approval, which are generally straightforward for established drugs like Imipramine.

Supply Chain and Manufacturing

Regional manufacturing, especially in India and China, sustains low-cost production. Supply chain disruptions, e.g., during the COVID-19 pandemic, underscore dependency risks, influencing availability and price stability.

Price Trend Analysis

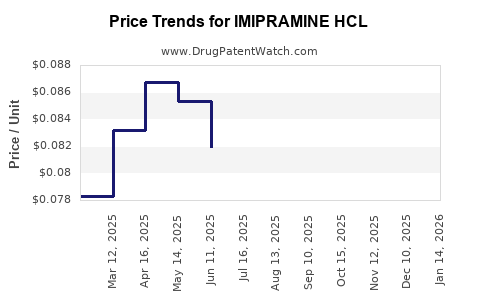

Historical Price Trends

Historically, Imipramine HCl bulk APIs experienced a significant price decline—from approximately USD 300-500 per kilogram at the peak in the early 2000s to USD 50-100 per kilogram in recent years. Tablet prices for a typical 25 mg dose (per tablet) have correspondingly decreased from USD 0.50-1.00 to USD 0.05-0.20, reflecting generics competition.

Current Pricing Dynamics

- API Level: USD 50-100/kg, highly variable depending on purity and supplier (as per Global Data, 2022).

- Finished Dosage Forms: Retail prices fluctuate based on market, patent status, and healthcare system policies; outpatient prescriptions may cost USD 0.10-0.30 per tablet.

Price Projections (2023-2033)

Short-term (2023-2025):

Stable prices with minor fluctuations driven by supply chain stabilization, regulation, and manufacturing efficiencies. API prices may slightly oscillate within USD 50-70/kg due to competition and raw material costs.

Medium-term (2026-2030):

Potential slight price decline for APIs (USD 40-60/kg) due to increasing manufacturing efficiencies, raw material abundance, and market saturation. Finished dosage costs might stabilize or decline modestly, maintaining affordability. Prescribing rates could increase marginally in LMICs, driven by healthcare strengthening initiatives.

Long-term (2031-2033):

Prices may plateau or slightly increase if supply chain disruptions occur or regulatory policies tighten. Additionally, if new formulations or delivery methods emerge (e.g., sustained-release formulations), existing prices could be affected.

Market Opportunities and Risks

-

Opportunities:

- Growing demand in LMICs due to affordability.

- Off-label applications expanding clinical use cases.

- Potential formulations with improved side-effect tolerability.

-

Risks:

- Competitive pressure from newer antidepressants.

- Stringent regulations impacting manufacturing or marketing.

- Changes in clinical guidelines favoring safer agents.

- Supply chain disruptions affecting pricing stability.

Conclusion

Imipramine HCl maintains a niche but resilient position within the antidepressant market. Its price trajectory is expected to remain stable or slightly decline over the next decade, primarily influenced by generics competition, manufacturing efficiencies, and regional market dynamics. While demand may diminish in high-income markets favoring newer drugs, its role in cost-sensitive healthcare systems continues to underpin its economic importance.

Key Takeaways

- The global Imipramine HCl market is characterized by low-cost, high-volume generic production, with steady supply and demand primarily in LMICs and specific niche applications.

- API prices are projected to stabilize within USD 40-70/kg through 2033, with finished dosage form prices remaining low and potentially declining slightly.

- Competitive pressures from newer antidepressants could limit growth in high-income nations but sustain demand in cost-sensitive regions.

- Regulatory and supply chain factors remain critical, with potential fluctuations affecting pricing and availability.

- Opportunities exist for developing formulations with improved safety profiles and optimized delivery mechanisms to expand clinical utility.

FAQs

1. What factors influence the pricing of Imipramine HCl?

Pricing is mainly affected by manufacturing efficiency, raw material costs, competition among generic producers, regulatory requirements, and regional healthcare policies.

2. How does the patent status impact the market for Imipramine?

Patent expiry has facilitated a surge in generic manufacturing, significantly reducing prices and increasing accessibility.

3. Are there regional differences in Imipramine's market demand?

Yes, demand is higher in LMICs due to affordability and established clinical protocols, while high-income markets prefer newer agents with better safety profiles.

4. What future developments could affect Imipramine's market?

Introduction of new formulations, off-label indications, regulatory changes, and supply chain disruptions are potential influences.

5. Is Imipramine still relevant given newer antidepressants?

Yes, particularly in resource-limited settings and specific clinical indications where cost and long-term experience favor its continued use.

References

[1] Grand View Research, "Antidepressant Market Size, Share & Trends Analysis Report," 2022.

[2] IQVIA, "Global Drug Pricing and Market Trends," 2022.

[3] U.S. Food and Drug Administration (FDA), Orange Book, 2022.

[4] GlobalData Healthcare, "Pharmaceutical Price Trends," 2022.

[5] World Health Organization (WHO), "Essential Medicines List," 2021.