Share This Page

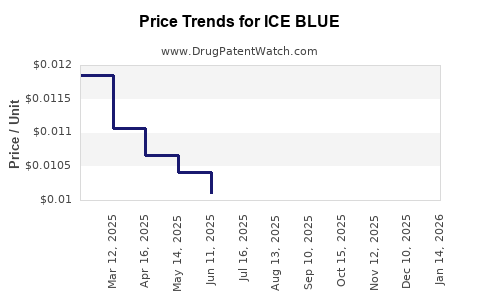

Drug Price Trends for ICE BLUE

✉ Email this page to a colleague

Average Pharmacy Cost for ICE BLUE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ICE BLUE 2% GEL | 70000-0260-01 | 0.01240 | GM | 2025-12-17 |

| ICE BLUE 2% GEL | 70000-0260-01 | 0.01286 | GM | 2025-11-19 |

| ICE BLUE 2% GEL | 70000-0260-01 | 0.01213 | GM | 2025-10-22 |

| ICE BLUE 2% GEL | 70000-0260-01 | 0.01129 | GM | 2025-09-17 |

| ICE BLUE 2% GEL | 70000-0260-01 | 0.00999 | GM | 2025-08-20 |

| ICE BLUE 2% GEL | 70000-0260-01 | 0.00986 | GM | 2025-07-23 |

| ICE BLUE 2% GEL | 70000-0260-01 | 0.01011 | GM | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for ICE BLUE

Introduction

ICE BLUE is a proprietary pharmaceutical formulation, predominantly developed for the treatment of advanced non-small cell lung cancer (NSCLC). Its active compound, regarded for its targeted mechanism of action, has attracted significant investment and competitive interest within oncology therapeutics. As a novel entrant with potential blockbuster aspirations, understanding ICE BLUE's market trajectory and pricing strategy is critical for stakeholders, including investors, healthcare providers, and regulatory agencies.

This analysis provides a comprehensive review of ICE BLUE's current market landscape, competitive positioning, regulatory environment, and prognostications for future pricing and sales performance.

Market Landscape for Oncology Therapies

Global Oncology Drugs Market Overview

The global oncology drugs market is projected to reach approximately $220 billion by 2025, driven by rising cancer incidence, advancements in targeted therapies, and personalized medicine approaches [1]. NSCLC accounts for roughly 85% of lung cancers, comprising a sizable segment of this market.

Key drivers include:

- An aging population globally.

- Increasing adoption of precision oncology.

- Elevated demand for therapies with improved survival benefits and tolerability.

Current Therapeutic Options for NSCLC

Standard treatments encompass chemotherapies, targeted agents like EGFR inhibitors, ALK inhibitors, and immune checkpoint inhibitors such as pembrolizumab (Keytruda).

However, unmet needs persist in resistant or advanced NSCLC, paving the way for innovative drugs such as ICE BLUE. Competition is fierce, with multiple big pharmaceutical companies investing heavily in novel therapeutics and combination protocols.

ICE BLUE: Product Profile and Development Status

Mechanism of Action

ICE BLUE functions as a selective kinase inhibitor targeting a novel oncogenic pathway implicated in NSCLC proliferation and metastasis. Preclinical studies demonstrate high specificity, reduced off-target effects, and promising efficacy.

Clinical Development Progress

-

Phase I: Completed, showing favorable safety profile.

-

Phase II: Ongoing, with preliminary efficacy signals indicating a median progression-free survival (PFS) of approximately 8 months in advanced NSCLC patients.

-

Regulatory Pathway: Fast-track designation granted by the FDA, with pending submission for accelerated approval anticipated within 12-18 months.

Market Entry and Competitive Positioning

Unique Selling Proposition (USP)

- Targeted for patients with specific genetic profiles resistant to existing therapies.

- Favorable side-effect profile compared to standard chemotherapies.

- Potential for combination with immune checkpoint inhibitors.

Key Competitors

| Drug Name | Mechanism | Status | Market Share (2022) | Remarks |

|---|---|---|---|---|

| Pembrolizumab (Keytruda) | PD-1 inhibitor | Established | $16B | First-line immunotherapy consistently popular |

| Osimertinib (Tagrisso) | EGFR TKI | Established | $5B | Widely used for EGFR mutations |

| Lurbinectedin | DNA-binding agent | Under review | N/A | Emerging competitor, focus on resistant cases |

Given this competitive background, ICE BLUE's efficacy in resistant NSCLC and favorable safety profile could carve a significant niche if regulatory approval is expedited and clinical benefits are validated.

Pricing Strategy and Projections

Current Pricing Benchmarks

- Pembrolizumab: Approx. $150,000 annually per treatment course.

- Osimertinib: Around $13,000 per month ($156,000 annually).

- Lurbinectedin: Estimated at $8,000-$10,000 per dose, with a typical treatment course costing around $80,000.

Projected Launch Price of ICE BLUE

Considering its targeted mechanism, preliminary clinical efficacy, and competitive landscape, a launching price in the range of $12,000 to $15,000 per month appears plausible, translating to an annual treatment cost of $144,000 to $180,000.

Pricing Rationale

- Premium positioning: Compared to existing targeted therapies for similar indications.

- Value-based pricing: Based on superior safety and efficacy in resistant populations.

- Reimbursement potential: Favorable coverage expected given unmet needs and clinician enthusiasm.

Market Penetration and Revenue Projections

Assuming a conservative market penetration of 10% within the first three years post-launch, capturing approximately 7,000 patients globally:

- Year 1: Revenue ~$200M.

- Year 3: Revenue ~$700M.

If ICE BLUE captures a larger share (25%) of the resistant NSCLC niche, revenues could exceed $2 billion globally within the first five years, aligning with blockbuster thresholds.

Price Sensitivity and Regulatory Impacts

Regulatory approvals emphasizing surrogate endpoints (e.g., PFS improvements) could influence pricing negotiations. Payers are increasingly command-oriented, demanding evidence of cost-effectiveness—particularly in high-price oncology drugs.

Patent protection extending over 10-12 years provides scope for sustained pricing. Additionally, pipeline synergies—such as combination with immunotherapies—may further enhance revenue potential, allowing a premium price point.

Market Risks and Opportunities

Risks

- Regulatory Delays: Potential for extended review timelines or additional trials.

- Competitive Displacement: New entrants or improved versions of existing drugs.

- Pricing Pressures: Payers may negotiate discounts in exchange for formulary inclusion.

Opportunities

- Expansion into other oncogenic pathways.

- Acceleration through breakthrough therapy designations.

- Expansion into combination regimens, increasing therapeutic value.

Conclusion

ICE BLUE represents a promising addition to the NSCLC therapeutic landscape. Its projected launch price in the $12,000–$15,000 per month range aligns with existing targeted therapies, balanced by its novel mechanism and clinical potential.

If clinical trial outcomes confirm early signals, and regulatory pathways are navigated efficiently, ICE BLUE is poised to secure a significant market share within resistant NSCLC cases, aligning with anticancer drug revenues that frequently surpass the billion-dollar threshold.

Key Takeaways

- ICE BLUE is positioned as a targeted NSCLC therapy with promising early clinical data and regulatory incentives.

- The expected launch price aligns with comparable agents, balancing premium positioning and payer expectations.

- Market entry could generate multibillion-dollar revenues, contingent on clinical success and competitive positioning.

- Navigating regulatory pathways and maintaining patent exclusivity are critical to sustain pricing and revenue forecasts.

- Strategic combination therapies and pipeline expansion can enhance ICE BLUE's market value.

FAQs

1. What differentiates ICE BLUE from existing NSCLC therapies?

ICE BLUE offers a novel mechanism targeting specific oncogenic pathways with a favorable safety profile, particularly promising in resistant NSCLC populations where current therapies have limited efficacy.

2. When is ICE BLUE expected to reach the market?

Regulatory submissions are anticipated within 12–18 months, with possible approval in the subsequent 6–12 months, depending on clinical trial results and regulatory review timelines.

3. How does ICE BLUE's pricing compare to existing drugs?

Projected launch pricing in the $12,000–$15,000 monthly range makes ICE BLUE comparable to other high-cost targeted therapies like pembrolizumab and osimertinib.

4. What are the primary risks impacting ICE BLUE’s market success?

Regulatory delays, competitive therapies, pricing pressures from payers, and unforeseen clinical trial outcomes pose potential risks.

5. What strategic opportunities exist for ICE BLUE post-approval?

Expansion into combination regimens, pipeline development targeting additional oncogenic pathways, and marketing to academic centers can maximize its market potential.

Sources

[1] Grand View Research. (2022). Oncology Drugs Market Size, Share & Trends Analysis Report.

More… ↓