Share This Page

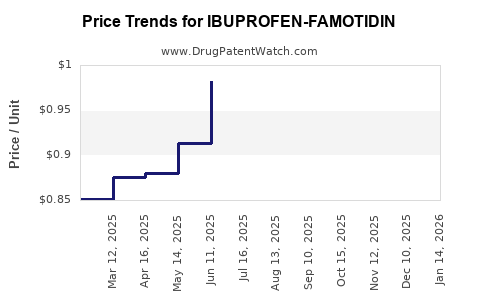

Drug Price Trends for IBUPROFEN-FAMOTIDIN

✉ Email this page to a colleague

Average Pharmacy Cost for IBUPROFEN-FAMOTIDIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| IBUPROFEN-FAMOTIDIN 800-26.6 MG | 31722-0315-90 | 0.68456 | EACH | 2025-12-17 |

| IBUPROFEN-FAMOTIDIN 800-26.6 MG | 49884-0366-09 | 0.68456 | EACH | 2025-12-17 |

| IBUPROFEN-FAMOTIDIN 800-26.6 MG | 67877-0626-90 | 0.68456 | EACH | 2025-12-17 |

| IBUPROFEN-FAMOTIDIN 800-26.6 MG | 31722-0315-90 | 0.71166 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for IBUPROFEN-FAMOTIDIN

Introduction

The combination of ibuprofen and famotidine represents a strategic merger of analgesic and antacid therapeutic actions, targeting pain management with concurrent gastrointestinal (GI) protection. As regulatory landscapes evolve and healthcare demands shift, understanding the market dynamics and potential pricing trajectories for ibuprofen-famotidine combinations is critical for pharmaceutical stakeholders, investors, and healthcare providers.

This analysis examines the current market environment, potential growth avenues, competitive landscape, regulatory considerations, and forecasted pricing trends, providing a comprehensive outlook for this unique pharmaceutical entity.

Market Overview

Therapeutic Positioning and Rationale

Ibuprofen, a widely used nonsteroidal anti-inflammatory drug (NSAID), is a staple for pain and inflammation relief across demographics. Famotidine, a potent H2-receptor antagonist, is extensively prescribed for acid-related disorders, notably gastroesophageal reflux disease (GERD). Co-formulation aims to mitigate NSAID-induced gastric damage, a significant adverse concern that often hampers NSAID utilization.

With the rising prevalence of chronic pain, osteoarthritis, and related inflammatory conditions, coupled with increased awareness of NSAID GI side effects, the combined ibuprofen-famotidine product appeals to both clinicians and consumers seeking safer analgesic options [1].

Market Size and Growth Drivers

According to IQVIA, NSAID sales globally surpass $15 billion annually, with a considerable share attributable to prescription and over-the-counter (OTC) segments. The rising incidence of GI complications among NSAID users underscores the demand for formulations that address these adverse effects.

The global acid-reducing agents market, estimated at over $20 billion, complements this outlook, with demand driven by GERD and peptic ulcer disease. The convergence of these markets via combination drugs positions ibuprofen-famotidine as an attractive product for both pain management and GI safety.

Regulatory Environment

The regulatory pathway for fixed-dose combination (FDC) drugs varies across jurisdictions. In the U.S., FDA approval hinges on demonstrating bioequivalence, safety, and efficacy of the combination over monotherapies. Successful regulatory pathways can fast-track market entry, especially if the combination addresses unmet medical needs or offers significant safety advantages [2].

Competitive Landscape

Existing Players

- Generic NSAIDs with Gastroprotective Agents: Several OTC products combine NSAIDs with misoprostol or other gastroprotectants, but fewer formulations integrate famotidine specifically with ibuprofen.

- Standalone Drugs: Ubuprofen and famotidine are widely available as OTC and prescription medications, with numerous generic options reducing pricing dynamics.

Potential Entrants

Pharmaceutical companies focusing on combination therapies targeting safe pain management are keen to expand portfolios. Patent expiration of existing NSAID formulations incentivizes R&D into combination products with improved safety profiles.

Differentiators

- Efficacy: Demonstrating superior GI safety without compromising analgesic efficacy.

- Formulation: Developing convenient, patient-friendly dose forms, such as tablets or suspensions.

- Regulatory Incentives: Securing fast-track designations or orphan drug status for niche indications.

Price Projections: Current Influences and Future Trends

Current Pricing Dynamics

The price of over-the-counter ibuprofen products remains highly competitive, often below $10 for a standard bottle. Famotidine’s OTC formulations are similarly inexpensive, with many generics priced under $5 per pack.

For combination FDCs, premium pricing typically ranges from 20% to 50% above monotherapies due to added formulation complexity and safety benefits. Initial price points are projected between $15 and $25 per pack, contingent on dosage and packaging.

Factors Influencing Future Price Trends

- Patent and Exclusivity Periods: Patent protection can support premium pricing for 5-7 years post-launch. Patent cliffs may lead to significant price reductions once generics enter the market.

- Manufacturing Costs: Advances in formulation technology reducing production expenses could enable more competitive pricing.

- Regulatory and Reimbursement Policies: Favorable reimbursement policies could support higher prices, whereas price controls and formulary restrictions may put downward pressure.

- Market Penetration and Volume: High-volume sales can offset lower margins, especially if the drug becomes standard care.

- Competitive Innovations: Introduction of similar or superior combination products could erode pricing advantages.

Forecasted Price Trajectory

- Short-term (1-2 years post-launch): Prices likely in the $20-$25 range, driven by initial exclusivity and novelty.

- Medium-term (3-5 years): With market penetration and potential biosimilar competition, prices may decline to $12-$15 per pack.

- Long-term (beyond 5 years): Market saturation, patent expiry, and increased generic availability could further reduce prices to below $10 per pack, aligning with standard NSAID and famotidine prices.

Market Penetration and Growth Projections

- Adoption Rate: Expected moderate growth initially, with rapid acceleration once safety benefits are demonstrated and regulatory approvals secured.

- Geographic Expansion: Markets in North America and Europe will lead, followed by emerging markets where GI safety concerns are rising.

- Prescribing Trends: Increased physician and consumer acceptance hinge on clinical evidence demonstrating improved safety profiles.

Regulatory and Market Entry Strategies

- Clinical Evidence: Robust trial data illustrating GI safety advantages are essential.

- Pricing Strategies: Tiered pricing to address different healthcare systems.

- Partnerships: Collaborations with insurers and pharmacy benefit managers to facilitate formulary inclusion.

Key Takeaways

- The ibuprofen-famotidine market is poised for growth, driven by rising demand for safer NSAID options and a fragmented competitive landscape.

- Early market entry, backed by robust clinical data, can command premium pricing in the short term, with prices likely to decline as generics emerge.

- Strategic positioning through regulatory milestones, manufacturing efficiency, and market expansion is vital for profitability.

- Pricing strategies should balance affordability, reimbursement potential, and competitive differentiation.

FAQs

Q1: What are the primary advantages of ibuprofen-famotidine combination therapy?

A: It offers effective pain relief with reduced risk of NSAID-induced gastric injuries, addressing a significant safety concern that limits NSAID use.

Q2: How does the patent landscape influence pricing for ibuprofen-famotidine products?

A: Patent protection enables premium pricing during exclusivity periods. Once patents expire and generics enter, prices tend to decrease substantially.

Q3: Which markets are most likely to adopt ibuprofen-famotidine formulations first?

A: North America and Europe, owing to advanced healthcare infrastructure, regulatory support, and high awareness of NSAID-related GI risks.

Q4: What challenges might affect the market penetration of ibuprofen-famotidine?

A: Clinical acceptance, regulatory approval timelines, competition from existing NSAIDs and gastroprotective agents, and payer reimbursement policies.

Q5: Can over-the-counter availability impact the pricing strategies of ibuprofen-famotidine?

A: Yes; OTC formulations typically have lower prices driven by competition and consumer demand, influencing prescription drug pricing and market perceptions.

References

- IQVIA. Global NSAID Market Insights, 2022.

- U.S. Food and Drug Administration. Guidance on Fixed-Dose Combination Drugs, 2021.

More… ↓