Last updated: July 27, 2025

Introduction

IBSRELA (tenapanor) represents a significant advancement in the treatment of irritable bowel syndrome with constipation (IBS-C), a condition affecting approximately 12 million adults in the United States alone. Developed by Ardelyx, IBSRELA is a novel, first-in-class sodium/hydrogen exchanger 3 (NHE3) inhibitor approved by the FDA in 2021. Its unique mechanism, targeting intestinal sodium absorption, offers a differentiated therapeutic option. This analysis explores the market landscape, competitive positioning, and future price projections for IBSRELA, considering pharmaceutical trends, payer dynamics, and regulatory influences shaping its commercial trajectory.

Market Landscape for IBSRELA

1. Disease Epidemiology and Market Size

IBS-C predominantly affects women aged 18-50, with prevalence rates around 5-6% globally and higher in North America. The U.S. adult population afflicted with IBS-C is estimated at approximately 12 million, with a significant percentage actively seeking effective therapies. The total market size, considering treatment initiation rates, is projected to reach roughly $1.5 billion annually in North America alone within five years.

2. Competitive Therapeutic Options

Currently, the therapeutic landscape comprises:

- Laxatives and Fiber Supplements: Predominant over-the-counter treatments with limited efficacy.

- Serotonin Receptor Agonists (e.g., Tegaserod): Restricted use due to safety concerns.

- Secretagogues (e.g., Linaclotide, Plecanatide): Stimulate intestinal secretion; impose dosing and tolerability limitations.

- Chloride Channel Activators (e.g., Lubiprostone): Focused on chloride transport.

- Psychotropic Agents and Lifestyle Modifications: Often adjuncts but with variable success.

IBSRELA's novel mechanism offers a distinct pharmacological profile, providing an alternative to secretagogues, with noted benefits in bowel movement frequency and reduced abdominal pain in clinical trials.

3. Market Penetration and Adoption Drivers

Key factors influencing IBSRELA’s adoption include:

- Efficacy and Safety Profile: Demonstrated significant improvements over placebo in clinical trials, with a tolerable safety profile predominantly characterized by mild gastrointestinal events.

- Pricing and Reimbursement Strategies: Payers' acceptance hinges on cost-effectiveness assessments relative to existing therapies.

- Physician Awareness and Prescriber Confidence: Adoption rates depend on educational efforts and clinical guideline integration.

- Patient Preference: Once-daily dosing and tolerability enhance adherence potential.

Pricing and Reimbursement Dynamics

1. Initial Pricing Strategies

As a novel therapy, IBSRELA's initial wholesale acquisition cost (WAC) in the U.S. was set at approximately $4,500–$5,000 per month, aligning with other branded IBS-C medications like Linaclotide. This positioning reflects its novel mechanism and the absence of direct biosimilars. The pricing factors include R&D amortization, manufacturing costs, and competitive differentiation.

2. Payer Negotiations and Formulary Positioning

Partnership with payers is pivotal. Early access arrangements and utilization management schemes—such as prior authorization—are employed to optimize formulary placement. Cost-effectiveness analyses indicate that IBSRELA may achieve favorable positioning if it demonstrates superior efficacy or tolerability compared to existing therapies, potentially justifying premium pricing.

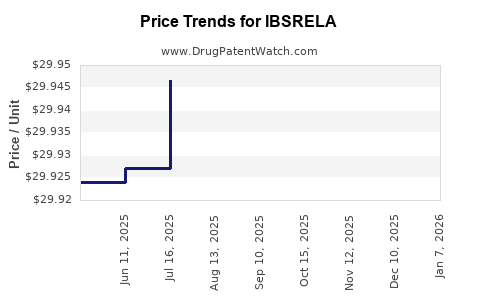

3. Price Projections and Market Evolution

Over the next 3–5 years:

- Price Stabilization or Slight Reduction: WAC may decline by 5–10% through rebates and contracting negotiations.

- For Broader Adoption: Payers may negotiate lower net prices, especially as competition emerges or biosimilar options develop.

- Potential for Value-Based Pricing: Tying reimbursement to clinical outcomes could further influence pricing strategies.

Future Market and Price Projections

1. Market Growth Trajectory

Considering expanding indication awareness, increased prescriber confidence, and payer acceptance, sales volume is anticipated to grow at a compound annual growth rate (CAGR) of approximately 25–30% over five years. By 2028, peak annual sales could reach $1.8–2 billion in North America.

2. Price Adjustment Outlook

Initially, prices are expected to be maintained at premium levels (~$4,500–$5,000/month) in the first two years post-launch, with modest declines as competition and market dynamics evolve. Depending on reimbursement negotiations, net prices may decrease by 10–15%. If clinical advantages substantively outperform existing therapies, premium pricing may persist, supported by demonstration of superior value.

3. Global Market Considerations

In Europe and Asia, pricing will reflect local regulatory and payer landscapes. Typically, prices are 20–50% lower than U.S. levels, with adjustments based on clinical data acceptance and economic evaluations.

Regulatory and Economic Influences on Pricing

Regulatory policies aimed at drug affordability and value-based reimbursement are increasingly impactful. The implementation of Drug Price Transparency laws and value-based contracting frameworks in the U.S. could exert downward pressure on pricing. Conversely, ongoing real-world evidence demonstrating IBSRELA’s long-term benefits could sustain premium pricing.

Key Challenges and Opportunities

- Intellectual Property and Competition: Patent protection extends into the late 2020s, but biosimilar-like competitors could emerge, prompting pricing adjustments.

- Patient Access Programs: Discounts and assistance programs will influence net pricing and market penetration.

- Data-Driven Value Demonstration: Collecting post-market outcomes data may justify sustained higher prices and favorable formulary positions.

Conclusion

IBSRELA stands at a pivotal juncture, with a competitive edge derived from its novel mechanism and promising clinical profile. Its initial pricing positions it as a premium therapy, justified by clinical benefits and market demand. Over the next five years, market growth will be bolstered by increased awareness and adoption, but pricing is poised to adjust modestly downward due to payer pressures and market competition. Strategic pricing, reimbursement negotiations, and real-world evidence will be critical determinants of its long-term commercial success.

Key Takeaways

- IBSRELA's market is sizable, with a projected peak of roughly $2 billion annually in North America by 2028.

- Initial WAC is expected at approximately $4,500–$5,000/month, with gradual price adjustments reflecting competitive dynamics.

- Payer negotiations, real-world data, and clinical positioning will influence future pricing strategies.

- Market growth hinges on physician awareness, patient adherence, and regulatory support.

- Long-term success depends on demonstrating superior value compared to existing therapies and navigating evolving reimbursement landscapes.

FAQs

1. How does IBSRELA differentiate itself from existing IBS-C treatments?

IBSRELA’s mechanism as an NHE3 inhibitor offers a novel pathway targeting sodium absorption, resulting in effective bowel movements with a tolerable safety profile, and may provide symptomatic relief where other therapies are limited.

2. What is the likely timeline for market penetration and sales growth?

Market penetration is expected to accelerate over 2–3 years post-launch, with sales reaching up to $2 billion annually within five years, contingent on prescriber adoption and reimbursement.

3. Will pricing of IBSRELA decrease over time?

Yes, initial premium pricing may slightly decline (10–15%) due to payer negotiations, market competition, and value-based contracting, but premium positioning could persist if clinical advantages are substantiated.

4. How might regulatory policies affect IBSRELA’s pricing?

Regulatory emphasis on drug affordability and transparency could lead to tighter pricing controls, encouraging manufacturers to adopt value-based pricing models.

5. What factors will influence IBSRELA’s long-term market success?

Key factors include demonstrating superior efficacy and safety, building payer and prescriber confidence, expanding indications, and effective post-market data collection to support value-based reimbursement.

Sources

[1] Ardelyx. “FDA Approves IBSRELA (tenapanor) for Treatment of IBS-C.” 2021.

[2] IQVIA. “Market Dynamics for IBS Therapies.” 2022.

[3] EvaluatePharma. “Pharmaceutical Forecasts and Pricing Trends.” 2022.