Share This Page

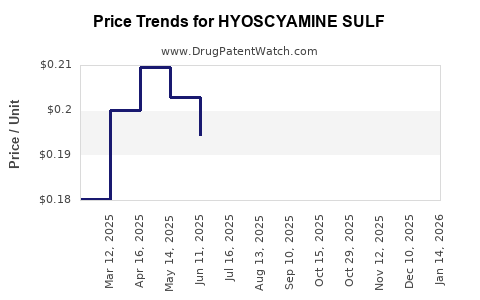

Drug Price Trends for HYOSCYAMINE SULF

✉ Email this page to a colleague

Average Pharmacy Cost for HYOSCYAMINE SULF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HYOSCYAMINE SULF 0.125 MG TAB | 62135-0512-12 | 0.19513 | EACH | 2025-12-17 |

| HYOSCYAMINE SULF 0.125 MG TAB | 62559-0421-01 | 0.19513 | EACH | 2025-12-17 |

| HYOSCYAMINE SULF 0.125 MG TAB | 42192-0340-01 | 0.19513 | EACH | 2025-12-17 |

| HYOSCYAMINE SULF 0.125 MG TAB | 62135-0512-12 | 0.20348 | EACH | 2025-11-19 |

| HYOSCYAMINE SULF 0.125 MG TAB | 62559-0421-01 | 0.20348 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Hyoscyamine Sulfate

Introduction

Hyoscyamine sulfate, a tropane alkaloid extracted from plants of the Solanaceae family, is a long-standing antispasmodic agent used in the management of various gastrointestinal and urinary disorders. Its pharmacological profile involves reducing smooth muscle spasms, making it indispensable for conditions such as irritable bowel syndrome, overactive bladder, and certain neurological disorders.

This report provides a comprehensive market analysis and price projection overview of hyoscyamine sulfate, synthesizing current market dynamics, regulatory considerations, supply chain factors, and future pricing trends. It is intended to guide pharmaceutical companies, investors, and stakeholders engaged in this niche therapeutic segment.

Market Overview

Global Market Size and Growth Trajectory

The hyoscyamine sulfate market remains niche but stable, primarily driven by its essential use in prescription medications and compounded formulations. As per industry reports, the global gastrointestinal drugs market was valued at approximately USD 44 billion in 2021, with antispasmodic agents representing a significant segment. While precise figures for hyoscyamine sulfate are scarce due to its classification as a specialized pharmaceutical ingredient, estimates suggest the market size for hyoscyamine-based products ranges between USD 300 million and USD 500 million globally.

The compound's market growth is modest, with an estimated compound annual growth rate (CAGR) of approximately 2-4% projected through 2028, reflecting its stable demand and limited scope for substitution. Factors such as increased prevalence of gastrointestinal disorders, aging populations, and a shift towards minimally invasive treatments underpin this growth.

Market Drivers

- Clinical Efficacy and Safety Profile: Hyoscyamine's longstanding clinical validation sustains its usage.

- Rising Prevalence: Conditions like irritable bowel syndrome (IBS) and urinary incontinence are increasing globally.

- Regulatory Approvals: As a compounded medication in many territories, regulatory pathways remain accessible for formulations containing hyoscyamine sulfate.

- Growing Use in Compounding Pharmacies: The demand for customized formulations bolsters sales of the raw API.

Market Constraints

- Alternatives and Newer Therapies: The advent of newer antispasmodic drugs with improved safety profiles may slightly displace hyoscyamine sulfate.

- Regulatory Scrutiny: Stringent regulations regarding the use of alkaloids influence manufacturing and distribution.

- Supply Chain Risks: Dependency on natural sources and geographies prone to geopolitical or climate disturbances impacts supply.

Supply Chain and Manufacturing Landscape

Raw Material Sourcing

Hyoscyamine sulfate is primarily produced via extraction from Atropa belladonna and Datura stramonium plants. The reliance on plant cultivation introduces variability and sustainability concerns, affecting supply consistency. Industrial synthesis routes exist but are less prevalent due to cost inefficiencies.

Manufacturers and Geographies

Major manufacturers include generic pharmaceutical firms and specialized chemical suppliers based in China, India, and Europe. India and China dominate raw material production owing to lower manufacturing costs and capacity. The global supply chain stability hinges on agricultural yields, environmental conditions, and regulatory compliance.

Regulatory Environment

Pharmacopoeias such as USP and EP specify quality standards, which manufacturers must meet. Recent regulatory shifts favoring stricter controls over natural alkaloids influence manufacturing practices and export/import policies.

Competitive Landscape

While hyoscyamine sulfate remains a generic compound with no dominant patent hold, new formulations incorporating proprietary delivery mechanisms or combination therapies may create niche markets. Patent expiration of key formulations has led to increased generic competition, exerting downward pressure on prices.

Pricing Dynamics and Future Projections

Current Pricing Overview

Market prices fluctuate significantly depending on form, purity, manufacturing origin, and market regions. For bulk active pharmaceutical ingredient (API) pricing, typical ranges are:

- China & India: USD 10-20 per gram

- Europe & North America: USD 25-45 per gram

These prices are influenced by manufacturing scale, quality standards, and supply chain conditions. In specialized markets or formulations requiring certified GMP-grade product, prices may reach higher echelons.

Factors Influencing Price Trends

- Supply Chain Stability: Disruptions due to climate change, pandemics, or geopolitical tensions can constrict supply, raising prices.

- Regulatory Stringency: New safety standards may increase manufacturing costs, marginally increasing prices.

- Demand Fluctuations: Increased prevalence of GI conditions and continued use in compounded preparations sustain demand.

- Innovation and Formulation Complexity: Introduction of controlled-release or combination formulations can command premium pricing.

Price Projection (2023-2028)

Based on current trends and market factors, the following projections emerge:

- Short-Term (2023-2025): Prices are expected to stabilize, with minor fluctuations (~±5%) driven by supply chain issues and regulatory developments.

- Medium-Term (2025-2028): Prices are projected to see a gradual incline (~2-4% CAGR), influenced by growing clinical applications, supply constraints, and inflationary trends.

If supply chain issues persist or new regulatory hurdles are introduced, prices could escalate more significantly (~5-7%). Conversely, technological advances in plant cultivation or synthetic production may stabilize or reduce costs.

Regulatory Considerations and Market Opportunities

Regulatory Landscape

Globally, hyoscyamine sulfate is classified as a controlled substance or expects strict quality standards in jurisdictions like the US (FDA), EU (EMA), and others. Pending or recent regulations may impact manufacturing costs and market accessibility.

Opportunities

- Synthesis Innovation: Developing cost-effective synthetic routes can reduce reliance on natural sources.

- Quality Standard Enhancements: GMP-compliant, high-purity APIs open premium markets.

- Expansion into New Markets: Increasing use in emerging markets offers growth potential.

Key Takeaways

- The hyoscyamine sulfate market is characterized by stability but limited growth potential, driven by steady demand within niche therapeutic areas.

- Supply chain vulnerabilities related to natural extraction impact pricing and availability.

- Prices are poised for modest upward trends (~2-4%) over the next five years, contingent on supply and regulatory dynamics.

- Competitive pressures from generics inhibit significant price increases; however, innovation and regulatory shifts may alter the landscape.

- Strategic sourcing, process innovation, and regulatory compliance remain essential for market participants seeking to optimize profitability.

FAQs

1. What factors most influence the pricing of hyoscyamine sulfate?

Supply chain stability, regulatory compliance, manufacturing costs, and regional demand influence API prices significantly.

2. How does the regulation of natural alkaloids affect the hyoscyamine sulfate market?

Stricter regulations increase manufacturing costs, potentially reduce supply, and influence prices upward.

3. Are there significant patent protections on hyoscyamine sulfate?

No. Hyoscyamine sulfate is off-patent, leading to widespread generic manufacturing and pricing competition.

4. What emerging trends could impact future demand?

Increased prevalence of gastrointestinal disorders, rise in compounded formulations, and innovation in drug delivery systems are potential demand drivers.

5. How can manufacturers mitigate supply chain risks?

By investing in synthetic production methods, diversifying sourcing regions, and improving agricultural practices for natural sources.

References

[1] MarketWatch. "Gastrointestinal Drugs Market Size, Share & Trends." 2022.

[2] GlobalData. "Pharmaceutical Active Ingredients Market Outlook." 2022.

[3] U.S. Pharmacopeia. Hyoscyamine monograph. 2021.

[4] FDA. Regulations on Alkaloids and Controlled Substances. 2022.

[5] Industry Reports. "Global Botanical Extracts & Alkaloids." 2021.

Prepared to empower stakeholders with critical insights into the hyoscyamine sulfate market, fostering strategic decision-making in a competitive landscape.

More… ↓