Share This Page

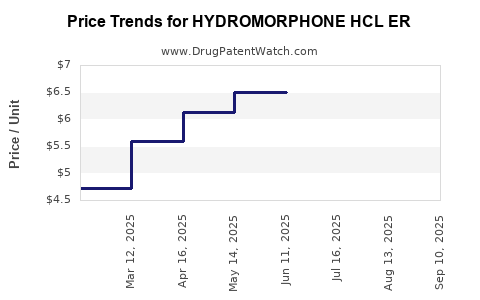

Drug Price Trends for HYDROMORPHONE HCL ER

✉ Email this page to a colleague

Average Pharmacy Cost for HYDROMORPHONE HCL ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HYDROMORPHONE HCL ER 8 MG TAB | 13811-0701-10 | 6.40026 | EACH | 2025-09-17 |

| HYDROMORPHONE HCL ER 8 MG TAB | 31722-0119-01 | 6.40026 | EACH | 2025-09-17 |

| HYDROMORPHONE HCL ER 8 MG TAB | 00574-0293-01 | 6.40026 | EACH | 2025-09-17 |

| HYDROMORPHONE HCL ER 16 MG TAB | 00574-0295-01 | 9.57500 | EACH | 2025-09-03 |

| HYDROMORPHONE HCL ER 8 MG TAB | 00574-0293-01 | 6.45457 | EACH | 2025-09-03 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Hydromorphone HCl ER

Introduction

Hydromorphone HCl ER (Extended Release) is a potent opioid analgesic used primarily for managing severe pain in chronic conditions when around-the-clock treatment is necessary. As an extended-release formulation, it provides sustained pain relief, reducing dosing frequency. Given its critical role in pain management and the ongoing opioid market dynamics, understanding its market landscape and future pricing is essential for stakeholders, including pharmaceutical manufacturers, healthcare providers, policymakers, and investors.

This analysis explores the current market environment of Hydromorphone HCl ER, evaluates competitive forces, regulatory considerations, and projects pricing trends for the upcoming period.

Current Market Environment

Market Size and Demand Drivers

Hydromorphone is classified as a Schedule II controlled substance in the United States, reflecting its high potential for abuse. Nonetheless, the global opioid analgesics market remains robust, driven by an aging population, rising prevalence of chronic pain conditions, and advancements in pain management protocols.

In 2022, the U.S. opioid analgesics market was valued at approximately $12 billion, with opioids accounting for around 65% of all analgesics prescriptions. Hydromorphone's share comprises a significant fraction of this segment, particularly within inpatient and hospice care settings.

Demand for Hydromorphone HCl ER is largely confined to developed markets, notably North America and Europe, where regulatory stringency necessitates controlled prescription and distribution channels.

Market Participants and Supply Chain

Major manufacturers include Purdue Pharma, Hikma Pharmaceuticals, Teva Pharmaceutical Industries, and Pfizer. These firms market both generic and branded formulations, with generics capturing a substantial market share due to their lower price points.

Supply chains extend from active pharmaceutical ingredient (API) production—primarily sourced from India and China—to formulation and distribution networks. Regulatory compliance, manufacturing quality, and patent protections influence market accessibility.

Pricing Factors and Regulatory Landscape

Pricing of Hydromorphone HCl ER varies significantly by region, driven by factors such as regulatory policies, reimbursement schemes, competition, and patient access programs.

In the U.S., the Average Wholesale Price (AWP) for Hydromorphone HCl ER ranges from $8 to $12 per 8 mg tablet, with trend variations influenced by payer negotiations and formulary placements. Generic formulations dominate due to patent expirations, exerting downward pressure on prices.

Globally, pricing is affected by national drug reimbursement policies, opioid regulation, and the extent of controlled substance oversight.

Market Challenges and Regulatory Considerations

Opioid Crisis and Regulatory Tightening

The opioid epidemic has led to increased regulation, prescriber restrictions, and monitoring programs, notably the CDC guidelines that limit opioid prescribing. Such measures have curtailed overprescription, inadvertently reducing demand for hydromorphone and other high-potency opioids, especially in outpatient settings.

Legal and Reimbursement Dynamics

Legal actions against opioid manufacturers, both federal and state, have prompted manufacturers to implement strict compliance measures, limiting unnecessary dispensation. Reimbursement policies further influence utilization: insurers' efforts to control costs have often favored alternative pain management options, such as non-opioid analgesics.

Market Access and Abuse Deterrence

Efforts to mitigate abuse potential include reformulating products with abuse-deterrent technologies. These innovations tend to increase manufacturing costs but potentially stabilize or elevate prices by adding value.

Future Price Projections (2023–2028)

Assumptions

- Continued patent expirations of branded formulations by 2024 will escalate generic market penetration.

- Regulatory pressures may remain stringent, impacting prescribing trends.

- Growing awareness of opioid misuse may dampen demand growth but could stimulate innovation, including abuse-deterrent formulations.

- Healthcare reimbursement will increasingly favor cost-effective, non-opioid alternatives.

Projected Pricing Trends

| Year | Price Range per 8 mg Tablet | Key Drivers |

|---|---|---|

| 2023 | $8.00 – $12.00 | Stable demand, ongoing generic competition |

| 2024 | $6.50 – $10.00 | Patent expirations, increased generic supply |

| 2025 | $6.00 – $9.00 | Continued market penetration, regulatory impacts |

| 2026 | $5.50 – $8.50 | Generic consolidation, pressure for price reductions |

| 2027 | $5.00 – $8.00 | Evolution of pain management therapies, abuse deterrent formulations |

| 2028 | $4.50 – $7.50 | Further regulatory restrictions, shift toward non-opioid analgesics |

Implication of Price Trends

The predominant trend indicates a gradual decline in the per-unit price of Hydromorphone HCl ER, driven mainly by increased generic competition and regulatory pressures. Nonetheless, niche markets—such as palliative and hospice care—may maintain relatively stable prices due to the critical nature of pain management.

Inclusion of abuse-deterrent formulations could temporarily stabilize or raise prices owing to added development and manufacturing costs. Investors and manufacturers should anticipate further differentiation strategies to sustain profitability.

Strategic Recommendations

- Diversify Portfolio: Companies should explore developing abuse-deterrent formulations or alternative non-opioid analgesics to counteract declining prices.

- Monitor Regulatory Changes: Proactive adaptation to evolving regulations is essential to maintain market access and compliance.

- Expand in Non-U.S. Markets: Emerging markets with less stringent opioid regulation may present growth opportunities, though at lower current price points.

- Engage in Value-Based Pricing: Demonstrating clinical value, especially in the context of opioid misuse mitigation, can justify premium pricing for innovative formulations.

Key Takeaways

- The Hydromorphone HCl ER market is characterized by intense generic competition, regulatory scrutiny, and demand limitations driven by the opioid crisis.

- Pricing is projected to decline steadily over the next five years, with 8 mg tablets expected to decrease from approximately $8–$12 in 2023 to around $4.50–$7.50 by 2028.

- Future profitability hinges on innovation, including abuse-deterrent technologies, and strategic market positioning in emerging geographies.

- Manufacturers should prepare for a highly competitive environment, emphasizing compliance, cost management, and differentiation.

- Stakeholders must balance the need for pain management solutions with regulatory and societal concerns about opioid misuse.

FAQs

1. How will the opioid epidemic affect the future market for Hydromorphone HCl ER?

Regulatory measures aimed at curbing misuse have led to tighter prescribing restrictions. This environment may suppress overall demand, particularly in outpatient settings, but essential applications in hospice and inpatient care will sustain a baseline demand. Innovation in abuse-deterrent formulations could also influence future market dynamics.

2. What is the impact of patent expirations on Hydromorphone HCl ER pricing?

Patent expirations typically catalyze price declines as generic manufacturers enter the market, increasing competition and reducing per-unit prices. This trend is expected to continue, exerting downward pressure on the retail and wholesale prices.

3. Are there opportunities for premium pricing in the Hydromorphone market?

Yes. Developing abuse-deterrent formulations or formulations with improved safety profiles could command higher prices due to their added value. Demonstrating superior technology and safety can justify premium pricing in a competitive market.

4. Which regions offer potential growth opportunities for Hydromorphone HCl ER?

Emerging markets with less regulatory strictness and growing healthcare infrastructure may offer growth opportunities. However, price levels in these regions are generally lower, and products must meet local regulatory standards.

5. How are alternative pain management options influencing Hydromorphone pricing?

The availability of non-opioid analgesics and multimodal pain management strategies reduces reliance on high-potency opioids, contributing to price declines and market saturation in some segments. Companies must innovate and diversify to sustain profitability.

References

[1] IQVIA. "Opioid Market Trends," 2022.

[2] CDC. "Guidelines for Prescribing Opioids," 2016.

[3] MarketWatch. "Global Opioid Analgesics Market Size, Share & Trends," 2022.

[4] FDA. "Abuse-Deterrent Opioid Analgesics," 2021.

[5] IMS Health. "Pharmaceutical Pricing and Market Access," 2022.

More… ↓