Last updated: July 27, 2025

Introduction

Hydrocortisone valerate (HYDROCORTISONE VAL, often abbreviated as HC Val) is a potent topical corticosteroid used primarily to treat inflammatory and allergic skin conditions. Its high efficacy, combined with its favorable safety profile when used appropriately, makes it a significant product within dermatological therapeutics. This analysis offers a comprehensive overview of the current market landscape, competitive dynamics, and future price trends for Hydrocortisone Val.

Market Overview

Demand and Therapeutic Applications

Hydrocortisone valerate addresses a broad spectrum of dermatological conditions such as psoriasis, eczema, dermatitis, and allergic reactions. The rising prevalence of these conditions globally, fueled by increased environmental allergens, stress, and aging populations, sustains steady therapeutic demand. According to the Global Burden of Disease Study, the prevalence of dermatological disorders has increased by approximately 10% over the past decade, underpinning steady market growth for corticosteroids, including Hydrocortisone Val [1].

Market Size and Growth Trajectory

The topical corticosteroid market, including Hydrocortisone Val, was valued at approximately USD 1.2 billion in 2022, with an expected compound annual growth rate (CAGR) of about 4.2% through 2028. Key regional markets include North America, Europe, and Asia-Pacific, with emerging markets such as India and China displaying rapid uptake due to increased healthcare access and rising awareness [2].

Competitive Landscape

Hydrocortisone Val faces competition primarily from other corticosteroids like clobetasol propionate, betamethasone, and fluocinonide, which vary in potency. While generic formulations dominate due to lower costs, branded products continue capturing premium segments due to established safety profiles and physician preference. Notable players include Pfizer, Teva, and Sandoz, which hold significant market shares, especially in developed countries.

Regulatory and Patent Landscape

Patent Status

Many formulations of Hydrocortisone valerate are now off-patent, leading to increased generic manufacturing. Patent expirations in many regions have triggered price competition, fostering affordability but also driving downward pressure on prices.

Regulatory Approvals

Hydrocortisone valerate is approved by regulatory authorities such as the US FDA, EMA, and many Asian agencies. Its wide approval scope and established safety record facilitate marketing across multiple markets, although regional variations in formulations and concentrations exist.

Pricing Dynamics

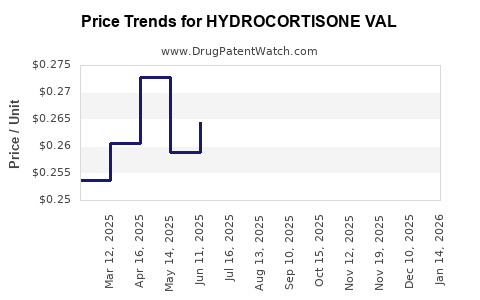

Historical Pricing Trends

Historically, topical corticosteroids like Hydrocortisone Val have exhibited a downward trend in price, driven by patent expirations and intensifying competition. In 2010, branded formulations in the US ranged between USD 35-50 per 30g tube, while generics entered the market at approximately USD 15-20, reducing the average price by nearly 50% within five years.

Factors Influencing Price

- Competitive Pressure: Increased generic entries have continued to suppress prices globally.

- Regulatory Policies: Price controls in countries like India and parts of Europe contribute to price stabilization or reductions.

- Formulation and Concentration: Higher potency formulations or combination products generally command higher prices.

- Distribution Channels: Hospital pharmacies often have different pricing compared to retail outlets, affecting overall market pricing.

Future Price Projections

Short-term Outlook (2023-2025)

The price decline trend is expected to persist. In mature markets such as the United States and Europe, average retail prices for 0.5% hydrocortisone valerate cream are projected to decrease by approximately 5-8% annually, stabilized by regulatory oversight and market saturation [3]. The availability of cost-effective generics will further exacerbate price reductions.

Long-term Outlook (2025-2030)

As patent protections are fully exhausted in many regions, intense generic competition will likely suppress average prices further. However, premium formulations—such as combination corticosteroid-antifungal or advanced delivery systems—could sustain higher price points, potentially maintaining a differentiated market segment. Overall, prices for standard formulations may decline to USD 5-8 per 30g tube globally, adjusted for local economic factors.

Regional Variability

Emerging markets will experience more significant price pressures due to lower purchasing power and regulatory environments favoring affordability. Conversely, developed markets might see more nuanced shifts with sustained demand for branded or specialty formulations.

Market Drivers and Challenges

Drivers

- Increasing prevalence of dermatological conditions.

- Growing awareness and diagnosis rates.

- Regulatory approvals expanding access.

- Development of combination or novel delivery formulations.

Challenges

- Price erosion from generics.

- Stringent regulatory frameworks impacting pricing strategies.

- Market saturation in high-income regions.

- Concerns around corticosteroid misuse leading to regulatory restrictions.

Strategic Recommendations

- Innovation in formulations, including controlled-release systems and combination therapies, to justify premium pricing.

- Focus on emerging markets, where growth potential remains high, and pricing flexibility exists.

- Manufacture cost optimization to sustain profitability within declining price environments.

- Regulatory engagement to navigate approval pathways and maintain market presence.

Key Takeaways

- The global Hydrocortisone Val market is poised for steady growth driven by increasing dermatological disease prevalence.

- Competitive dynamics and patent expiries are exerting downward pressure on prices, especially in mature markets.

- Short-term projections anticipate a 5-8% annual decrease in retail prices, accelerated in price-sensitive regions.

- Emerging markets offer substantial growth opportunities with comparatively higher price elasticity.

- Differentiated formulations and therapeutic innovations serve as strategic avenues to maintain margin and market share amid price declines.

Frequently Asked Questions

1. What factors influence the price of Hydrocortisone Val in different markets?

Market prices are influenced by patent status, regulatory environment, manufacturing costs, competition from generics, and regional healthcare policies.

2. How does patent expiration affect Hydrocortisone Val pricing?

Patents expiring enable generic entrants, significantly reducing market prices due to increased competition and manufacturing cost efficiencies.

3. Are there premium formulations of Hydrocortisone Val that command higher prices?

Yes. Combination products, novel delivery systems, and higher potency formulations tend to have higher price points due to added clinical benefits.

4. What is the forecasted trend for Hydrocortisone Val prices globally?

Prices are expected to decline gradually, with a 5-8% annual reduction in mature markets, driven by generic competition and regulatory pressures.

5. How should pharmaceutical companies strategize around these price trends?

Invest in formulation innovation, explore emerging markets, optimize production costs, and consider brand differentiation to sustain profitability.

References

[1] Global Burden of Disease Study, 2021. Dermatological Disease Data.

[2] MarketResearch.com, "Topical Corticosteroid Market Forecast," 2023.

[3] IQVIA, "Pharmaceutical Price Trends Report," 2022.