Last updated: July 27, 2025

Introduction

Hydrocortisone butyrate, a semi-synthetic corticosteroid, plays a significant role in dermatology treatment for conditions such as eczema, dermatitis, and psoriasis, owing to its potent anti-inflammatory properties. As a topical corticosteroid, it stands out for its efficiency and safety profile, especially in pediatric and sensitive skin applications. Understanding the current market trends, competitive landscape, and future pricing trajectories for hydrocortisone butyrate is crucial for stakeholders, including pharmaceutical companies, investors, and healthcare professionals.

Market Overview

Global Market Size and Growth Trends

The global corticosteroids market, encompassing various formulations including topical, oral, and injectable drugs, was valued at approximately USD 5.2 billion in 2022, with a compound annual growth rate (CAGR) of around 4.3% projected through 2030 [1]. Within this market, topical corticosteroids like hydrocortisone butyrate hold a significant share due to their widespread dermatological use. The rising prevalence of skin disorders combined with increasing dermatologist prescribing rates propels the market expansion.

Key Regional Markets

-

North America: Dominates the corticosteroids market owing to high prevalence of skin conditions and advanced healthcare infrastructure. The U.S. represents a substantial segment, with an estimated CAGR of 4.2% from 2023 to 2030 [2].

-

Europe: Demonstrates steady growth, bolstered by high healthcare expenditure and awareness campaigns. Germany, France, and the UK are front-runners.

-

Asia-Pacific: Exhibits rapid expansion driven by increasing urbanization, healthcare modernization, and population growth. China and India are key markets with a CAGR approaching 6% [3].

Market Drivers

- Increasing incidence of dermatological diseases.

- Growing geriatric population with chronic skin conditions.

- Rising awareness and adoption of topical corticosteroids.

- Patent expirations leading to generic proliferation.

- Enhancements in drug formulations improving safety and compliance.

Market Challenges

- Concerns over corticosteroid side effects, such as skin atrophy and systemic absorption.

- Regulatory scrutiny regarding safety and labeling.

- Competition from newer biologics and alternative therapies.

Competitive Landscape

Major pharmaceutical players active in hydrocortisone butyrate formulations include Pfizer, Meda Pharma, Bausch Health, and Teva Pharmaceuticals. Many companies offer both branded and generic versions, with pricing strategies influenced by market positioning and regulatory requirements.

Generic versions dominate due to patent expirations, intensifying price competition. The generic segment accounts for approximately 80% of hydrocortisone butyrate prescriptions, driving down prices and increasing accessibility.

Pricing Dynamics

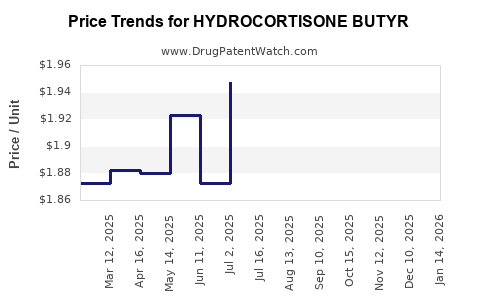

Current Price Points

In North America, average retail prices for hydrocortisone butyrate ointments (dose: 0.1%) range between USD 10 to USD 20 per tube (30g), with variations based on brand, formulation, and insurance coverage [4]. Generic products tend to be priced 20-30% lower than branded counterparts.

In Europe, prices fluctuate from EUR 8 to EUR 15 per tube, contingent on country-specific healthcare policies and reimbursement schemes.

Factors Affecting Pricing

- Regulatory Approval and Market Exclusivity: Effective patent life influences initial pricing. Once expiration occurs, generic competition drives prices down sharply.

- Manufacturing Costs: Raw material procurement, especially for corticosteroids, impacts production costs.

- Distribution and Logistics Costs: Regional factors, including import tariffs and supply chain efficiency.

- Market Penetration and Competition: High generic competition compresses margins but expands market volume.

- Reimbursement Policies: Payers’ negotiation power can limit prices, especially in publicly funded healthcare systems.

Price Projections (2023-2030)

Given current trends, compounded with anticipated patent expiries and increasing generic presence, prices for hydrocortisone butyrate are expected to trend downward, with an annual decline of approximately 3-5% in mature markets.

However, in emerging markets, where regulation, distribution channels, and affordability are evolving, prices may stabilize or even slightly increase due to market entry barriers and import costs.

Projected Price Range (2023-2030):

- North America: From USD 10-20 per tube down to USD 8-15.

- Europe: From EUR 8-15 to EUR 6-12.

- Asia-Pacific: From USD 5-10 to USD 4-8, reflecting increasing local manufacturing and market dynamics.

Note: These projections assume no significant regulatory changes or disruptive innovations. The trend favors lower prices driven by generic proliferation, which is consistent across dermatological corticosteroid segments.

Regulatory Landscape and Impact

Regulatory agencies such as the FDA (U.S.) and EMA (Europe) impose strict safety standards on corticosteroids, affecting drug approval and labeling—a factor that can influence market entry and pricing. Recent trends favoring conservative prescribing and lower-potency corticosteroids may influence demand and pricing strategies.

Market Entry and Future Outlook

Emerging pharmaceutical companies may leverage biosimilar or value-added topical formulations to capture market share. Innovations targeting enhanced safety, reduced systemic absorption, or combination therapies could help sustain higher price points.

The increasing use of teledermatology and home-based treatment models could further influence pricing, distribution, and accessibility, especially in remote areas.

Key Takeaways

- The hydrocortisone butyrate market is robust, with steady growth driven by dermatological prevalence and generic competition.

- Prices are expected to decline gradually, in the range of 3-5% annually, as patent expiries facilitate widespread generic adoption.

- Regional differences in pricing reflect regulatory, economic, and healthcare infrastructure factors, with emerging markets offering potential growth for affordable formulations.

- Innovation in formulation safety profiles and delivery mechanisms may influence future pricing strategies and market positioning.

- Stakeholders should monitor patent cliffs, regulatory trends, and regional market developments to optimize pricing and market penetration.

FAQs

1. What factors most influence the pricing of hydrocortisone butyrate?

Pricing is primarily impacted by patent status, manufacturing costs, competition from generics, regulatory environment, and regional healthcare policies.

2. How will patent expirations affect hydrocortisone butyrate prices?

Patent expiries lead to increased generic competition, exerting downward pressure on prices and expanding access.

3. Are there significant regional differences in hydrocortisone butyrate pricing?

Yes. Developed markets tend to have higher prices due to healthcare system structures, while emerging markets often have more affordable formulations.

4. What future trends could impact the hydrocortisone butyrate market?

Emerging formulations with improved safety, biosimilar versions, and changes in prescribing practices could influence market dynamics and pricing.

5. How does competition from other corticosteroids affect hydrocortisone butyrate pricing?

Intense competition among corticosteroids can lead to price suppression but also drives innovation and formulary inclusion strategies.

References

- MarketsandMarkets, "Corticosteroids Market—Global Forecast to 2030," 2022.

- Grand View Research, "Dermatology Drugs Market Size & Trends," 2022.

- Research and Markets, "Asia-Pacific Dermatology Market Outlook," 2022.

- GoodRx Research, "Topical Corticosteroid Pricing Data," 2023.