Share This Page

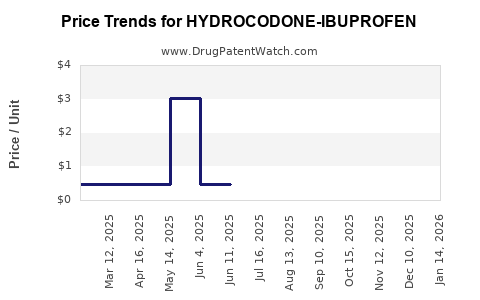

Drug Price Trends for HYDROCODONE-IBUPROFEN

✉ Email this page to a colleague

Average Pharmacy Cost for HYDROCODONE-IBUPROFEN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HYDROCODONE-IBUPROFEN 7.5-200 | 13107-0004-01 | 0.47863 | EACH | 2025-12-17 |

| HYDROCODONE-IBUPROFEN 7.5-200 | 53746-0145-01 | 0.47863 | EACH | 2025-12-17 |

| HYDROCODONE-IBUPROFEN 10-200 | 53746-0117-01 | 3.36064 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Hydrocodone-Ibuprofen

Introduction

Hydrocodone-ibuprofen, a combination analgesic, integrates the opioid hydrocodone with the nonsteroidal anti-inflammatory drug (NSAID) ibuprofen. Approved for managing moderate to severe pain, this drug is positioned in a competitive analgesic segment emphasizing efficacy and safety profiles. As the landscape of pain management evolves amid regulatory changes and opioid scrutiny, understanding the market dynamics and pricing forecasts for hydrocodone-ibuprofen is crucial for pharmaceutical stakeholders, healthcare providers, and investors.

Market Overview

Current Market Landscape

Hydrocodone-ibuprofen entered a segment characterized by longstanding formulations like acetaminophen-hydrocodone and oxycodone-based combinations. The recent trend emphasizes combination drugs that reduce opioid dosages and mitigate risks associated with abuse and side effects while providing potent pain relief.

According to IQVIA data (2022), combination opioids with NSAIDs account for approximately 15% of the US analgesic prescriptions, with hydrocodone products dominating the segment. The demand is driven by the increasing prevalence of chronic pain conditions, postoperative procedures, and acute injury management.

Regulatory Environment

Regulatory agencies, particularly the U.S. Food and Drug Administration (FDA), have intensified scrutiny on opioid-containing medicines, emphasizing misuse prevention. The FDA's recent initiatives include scheduling reevaluations, stricter prescribing guidelines, and potential rescheduling of hydrocodone products from Schedule III to Schedule II, impacting market accessibility.

Moreover, the opioid epidemic has prompted widespread reformulation efforts, including abuse-deterrent formulations and innovative delivery systems, which influence market offerings and growth opportunities for hydrocodone-ibuprofen.

Competitive Landscape

Hydrocodone-ibuprofen faces competition from several fronts:

- Generic formulations: Established products like acetaminophen-hydrocodone (Vicodin, Norco) dominate the prescriptions, exerting downward pricing pressure.

- Non-opioid alternatives: NSAIDs and acetaminophen, along with neuropathic pain agents and non-pharmacologic therapies, offer safer profiles, challenging opioid combination efficacy claims.

- New formulations: Abuse-deterrent formulations and transdermal patches are gaining traction, offering differentiated value propositions.

Market Drivers and Challenges

Drivers:

- Rising chronic pain incidences and aging population.

- Preference for combination analgesics to reduce pill burden.

- Demand for rapid-acting opioid-NSAID therapies.

Challenges:

- Tightened regulatory controls.

- Increased focus on opioid misuse and addiction prevention.

- Competition from non-opioid pain management options.

Price Analysis and Projections

Current Pricing Landscape

As of 2023, the average wholesale acquisition cost (WAC) for hydrocodone-ibuprofen combination drugs ranges from $20 to $35 per pharmacy unit, depending on formulation strength, dosage, and manufacturer. Generic availability exerts significant downward pressure; branded formulations typically command premiums up to 30–50%.

A case example is the generic hydrocodone-ibuprofen 5mg/200mg tablets, which retail around $15 to $25 for a 30-day supply (30 tablets). Brand-name equivalents, if available, can reach $35 to $50 for comparable quantities.

Price Trends and Future Projections

Short-term Outlook (Next 1–2 Years):

- Slight decline in prices driven by increased generic competition and healthcare system cost-control initiatives.

- Anticipated stabilization owing to supply chain dynamics and regulatory uncertainties.

Medium to Long-term Outlook (3–5 Years):

- Possible marginal price increases around 3–5% annually, aligned with inflation and R&D costs.

- Price variations influenced by reformulation efforts, abuse-deterrent technologies, and regulatory developments.

Impact of Regulatory and Market Changes:

- Stricter opioid prescription guidelines could limit overall volume, reducing market prices.

- Introduction of reformulated, abuse-deterrent versions might command higher prices, balancing volume constraints with perceived added safety.

Economic Considerations

The cost of hydrocodone-ibuprofen remains competitive relative to other opioid-NSAID combinations and combination drugs incorporating acetaminophen. Manufacturers' strategic pricing, especially for generic manufacturers seeking market share, will predominantly influence the average market price.

Financial Outlook and Strategic Implications

For pharmaceutical companies, projecting revenues involves balancing pressure from generics, regulatory constraints, and evolving prescribing practices. Pricing strategies should emphasize differentiation via safety profiles, convenient formulations, or combination innovations. Investment in abuse-deterrent technologies could offer premium pricing opportunities, especially if regulatory pressure on opioids intensifies.

Healthcare payers are increasingly favoring non-opioid alternatives, advocating for formulary restrictions and value-based reimbursement models. Consequently, market penetration for hydrocodone-ibuprofen might face headwinds unless new data demonstrate clear safety advantages or cost-effectiveness.

Concluding Remarks

Hydrocodone-ibuprofen occupies a niche within pain management, poised for cautious growth amidst a landscape of regulatory risks and competitive pressures. Its pricing trajectory will likely trend downward initially due to generic flooding, with potential stabilization if reformulation efforts and abuse-deterrent features add value.

Stakeholders must monitor regulatory updates, prescriber preferences, and patient safety developments to capitalize on opportunities and mitigate risks in this evolving market.

Key Takeaways

- Hydrocodone-ibuprofen's market is influenced heavily by opioid regulation, with a current price range of $15 to $50 per supply unit, depending on formulation and branding.

- Competition from generics and alternative therapies constrains pricing power, but abuse-deterrent formulations could command premium pricing if regulatory demands favor such innovations.

- Short-term prices are expected to decline slightly due to increased generic competition, with a potential modest rise over the medium term driven by reformulation and safety features.

- Evolving prescriber behavior increasingly favors non-opioid analgesics, potentially limiting hydrocodone-ibuprofen's market growth.

- Companies should focus on differentiating their formulations via safety, delivery, and formulation innovations to sustain pricing and market share.

FAQs

1. How does regulatory policy impact the pricing of hydrocodone-ibuprofen?

Regulatory policies, especially opioid scheduling and prescribing guidelines, can influence supply and demand, affecting pricing. Stricter regulations may reduce prescriptions, leading to supply constraints and potential price increases for reformulated or abuse-deterrent versions, but generally exert downward pressure due to market contraction.

2. What are the primary competitors to hydrocodone-ibuprofen in the pain management market?

Main competitors include other opioid combinations like acetaminophen-hydrocodone, non-opioid NSAIDs, neuropathic pain agents, and non-pharmacologic therapies such as physical therapy and nerve blocks.

3. Will the introduction of abuse-deterrent formulations significantly affect pricing?

Yes, abuse-deterrent formulations often command higher prices due to their safety advantages, appealing to prescribers, payers, and regulators aiming to mitigate misuse, thereby presenting opportunities for premium pricing.

4. How does the shift towards non-opioid pain medications influence the market?

The trend limits growth and reduces overall market share for opioid-NSAID combinations, potentially leading to price declines and market consolidation focused on niche segments or specialized formulations.

5. What factors should pharmaceutical companies consider for future pricing strategies?

Considerations include regulatory trends, safety and efficacy differentiation, patent and exclusivity periods, manufacturing costs, competitive pressures, and shifting prescriber and patient preferences.

References:

[1] IQVIA, “Pharmaceutical Market Data,” 2022.

[2] FDA, “Opioid Policy Updates,” 2023.

[3] Market Research Future, “Analgesic Market Forecasts,” 2023.

More… ↓