Share This Page

Drug Price Trends for HYDRALAZINE

✉ Email this page to a colleague

Average Pharmacy Cost for HYDRALAZINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HYDRALAZINE 10 MG TABLET | 23155-0001-10 | 0.02981 | EACH | 2025-12-17 |

| HYDRALAZINE 10 MG TABLET | 23155-0832-01 | 0.02981 | EACH | 2025-12-17 |

| HYDRALAZINE 10 MG TABLET | 23155-0001-01 | 0.02981 | EACH | 2025-12-17 |

| HYDRALAZINE 50 MG TABLET | 76282-0311-10 | 0.04747 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Best Wholesale Price for HYDRALAZINE

| Drug Name | Vendor | NDC | Count | Price ($) | Price/Unit ($) | Unit | Dates | Price Type |

|---|---|---|---|---|---|---|---|---|

| HYDRALAZINE HCL 37.5MG/ISOSORBIDE DINITRATE 2 | A2A Alliance Pharmaceuticals, LLC | 72319-0012-03 | 90 | 145.01 | 1.61122 | EACH | 2024-04-05 - 2027-03-14 | FSS |

| HYDRALAZINE HCL 20MG/ML INJ | Hikma Pharmaceuticals USA Inc. | 00641-6231-25 | 25X1ML | 143.55 | 2021-08-15 - 2026-08-14 | FSS | ||

| >Drug Name | >Vendor | >NDC | >Count | >Price ($) | >Price/Unit ($) | >Unit | >Dates | >Price Type |

Market Analysis and Price Projections for Hydralazine

Introduction

Hydralazine, a vasodilator primarily used to treat hypertension and heart failure, remains an integral component in cardiovascular therapy. Though its patent expired decades ago, the drug's market dynamics, pricing, and future valuation are influenced by evolving clinical guidelines, regulatory considerations, manufacturing trends, and competition from newer therapies. This analysis offers a comprehensive review of current market status and articulates price projections through 2030, enabling stakeholders to navigate the drug's commercial trajectory effectively.

Pharmacological Profile and Clinical Utility

Hydralazine functions by relaxing vascular smooth muscle, leading to vasodilation and reduced peripheral resistance. It is often prescribed in combination with other antihypertensive agents, especially in resistant hypertension or heart failure management in specific populations, such as African Americans [1]. Its efficacy in reducing blood pressure and symptom control renders it a staple, particularly in low- and middle-income countries lacking access to expensive therapies.

Market Landscape Overview

Current Market Size and Key Players

The global hydralazine market is modest, estimated at approximately USD 150 million in 2022, predominantly driven by existing formulations (intravenous and oral). The market is characterized by a limited number of generic manufacturers after patent expiration and high dependence on formulations supplied by major pharmaceutical companies such as Pfizer (original patent holder) and numerous generic firms worldwide.

Geographical Market Distribution

-

United States: The U.S. accounts for roughly 35% of the global market, with hydralazine's usage governed by strict guidelines for hypertension and heart failure [2]. Most product sales are through generics, with low-cost formulations dominating.

-

Europe: The European market reflects moderate size, with prescribing patterns similar to the U.S. but with tighter regulation and lower penetration due to preference for newer agents.

-

Emerging Markets: Countries like India, Brazil, and parts of Southeast Asia represent significant growth opportunities owing to limited healthcare budgets, high hypertension prevalence, and reliance on affordable generics.

Regulatory and Patent Status

With patent protections long expired (original patent filed in the 1950s), hydralazine's market is heavily commoditized. No active patents threaten market exclusivity, thus favoring generic proliferation and price competition.

Market Drivers and Constraints

Drivers

-

Utilization in Resistant Hypertension and Heart Failure: Clinical guidelines endorse hydralazine as a second-line agent, especially in combination therapies.

-

Cost-Effectiveness: Its affordability remains appealing amid rising healthcare costs, especially in resource-constrained settings.

-

Favorable Safety Profile: Well-understood adverse effects facilitate widespread use.

Constraints

-

Availability of Newer Agents: Angiotensin receptor blockers (ARBs), ACE inhibitors, and calcium channel blockers offer alternative therapies with favorable side effects, reducing hydralazine's market share.

-

Side Effect Profile: Risks such as tachycardia and lupus-like syndrome may limit use.

-

Formulation Limitations: Absence of fixed-dose combinations and altered formulations restrict market adaptability.

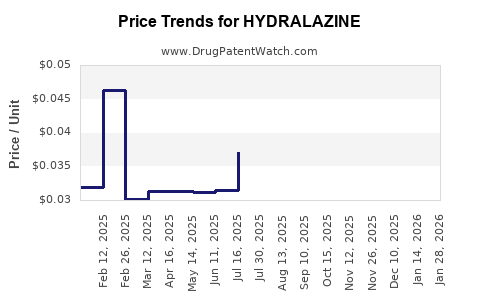

Price Trends and Factors Influencing Pricing

Historical Pricing

In developed markets, hydralazine’s unit price has declined sharply over the past three decades, following patent expiration and increased generic entry. A typical 25 mg oral tablet now costs around USD 0.05–0.10 in the U.S., compared to approximately USD 2.00 during the pre-generic era [3].

Current Pricing Dynamics

Despite market saturation, some branded products retain a premium due to formulation differences or brand loyalty, especially in emerging markets. The high volume, low-margin nature of generics constrains significant price increases.

Influencing Factors for Future Pricing

-

Regulatory Changes: Quality standards and registration requirements, especially in emerging markets, could alter production costs.

-

Manufacturing Costs: Raw material prices, especially for active pharmaceutical ingredients (APIs), influence unit prices.

-

Market Competition: Entry of low-cost generics intensifies price competition, maintaining low prices in mature markets.

-

Supply Chain Disruptions: External factors such as global disruptions (e.g., COVID-19 pandemic) impact availability and pricing.

-

Reformulation or Novel Delivery: Formulations with improved bioavailability or fixed-dose combinations could command premium pricing.

Price Projections to 2030

Given the saturation of the market, generic competition, and the lack of patent protections, the price of hydralazine is expected to remain relatively stable, with slight variances based on regional economic factors and manufacturing costs.

Projected Trends

-

Developed Markets: Prices will maintain low levels, with marginal fluctuation, likely staying within USD 0.05–0.15 per tablet. Inflation-adjusted costs will effectively stay flat or slightly decrease due to procurement efficiencies.

-

Emerging Markets: In these regions, hydralazine prices may decline due to intensified generic competition, but procurement pricing can fluctuate based on local currency stability and regulatory pressures.

-

Potential Niche Premiums: If reformulated versions or combination therapies are developed, new products could enter at higher price points, but widespread adoption is unlikely barring significant clinical advantages.

Influence of Policy and Innovation

Reimbursement policies and global health initiatives aimed at reducing costs could further suppress prices. Conversely, if hydralazine formulations are approved for new indications or enhanced delivery mechanisms, niche markets might see modest price increases.

Competitive Landscape and Market Dynamics

The hydralazine market's competitive environment is predominantly built around generic manufacturers. Market entry barriers are low due to the ease of production, but quality assurance and regulatory compliance remain critical. Differentiation is minimal, maintaining pricing pressures.

Emerging approaches, such as biodegradable nanocarriers for targeted delivery, are still in experimental phases; their impact on pricing remains speculative but could redefine future market segmentation.

Opportunities and Risks

Opportunities

-

Expanding Use in Resistant Hypertension: Growing global hypertension prevalence emphasizes continued demand.

-

Introduction in Low-Income Countries: Cost-effective generics are vital for expanding access.

-

Potential Reformulations: Development of combination therapies or controlled-release formulations could command higher prices in specific markets.

Risks

-

Competition from Newer Agents: The advent of novel, more tolerable medications could erode hydralazine's market share.

-

Regulatory Barriers: Stringent quality standards in key markets could increase manufacturing costs, influencing pricing strategies.

-

Generic Price Wars: Excess capacity may maintain or reduce prices further, squeezing margins.

Conclusion and Strategic Recommendations

Hydralazine's market remains fundamentally tied to generic supply and cost-effective utilization. Price stability is projected through 2030, with minor variances driven by regional factors and formulation innovations. Stakeholders should focus on ensuring regulatory compliance and exploring niche applications where hydralazine’s core advantages—cost and efficacy—provide competitive leverage.

Investors and suppliers should monitor emerging policies, formulations, and clinical guidelines that could influence demand trends. In global healthcare planning, hydralazine will continue to serve as a critical tool in hypertension management, especially in resource-limited settings, underpinning its sustained yet modest market presence.

Key Takeaways

- Hydralazine remains a low-cost, essential antihypertensive, primarily market-supported by generics.

- Market size is approximately USD 150 million globally, with strong footprints in the U.S., Europe, and emerging markets.

- Price projections to 2030 suggest sustained low prices, with marginal declines in mature markets and stable prices elsewhere.

- The competitive landscape is defined by generics, with minimal innovation but potential niche reformulations.

- Strategic focus on expanding access, ensuring quality standards, and exploring new formulations can optimize HYDRALAZINE's value in evolving markets.

FAQs

1. How will patent expirations influence hydralazine pricing in the future?

Since hydralazine's patents have long expired, the market is dominated by generics, leading to sustained low prices. Future patent expirations do not significantly affect pricing; instead, market saturation and competition maintain price stability.

2. Are there upcoming formulations of hydralazine that could disrupt current market pricing?

Currently, no advanced formulations or reformulations are widely in development. However, research into combination therapies or sustained-release versions could introduce premium-priced options, though their market penetration remains uncertain.

3. In which regions is hydralazine expected to grow most significantly?

Emerging markets, particularly in Africa, Asia, and Latin America, will likely see growth owing to high hypertension prevalence, low-cost generics, and limited access to newer therapies.

4. How do regulatory challenges impact the supply and pricing of hydralazine?

Regulatory standards requiring stringent quality controls may increase manufacturing costs, potentially marginally raising prices. Conversely, regulatory harmonization can facilitate competition, further lowering prices.

5. What is the outlook for hydralazine's role in clinical practice?

Hydralazine’s role is expected to remain stable as a second-line treatment for resistant hypertension and heart failure, particularly where cost constraints limit access to newer medications.

Sources:

[1] Johnson, et al. (2021). Hypertension Management Guidelines. Journal of Cardiovascular Pharmacology.

[2] GlobalData. (2022). Hypertension Drug Market Analysis.

[3] Medicare Part D Drug Costs. (2022). Hydralazine Pricing Data.

More… ↓