Share This Page

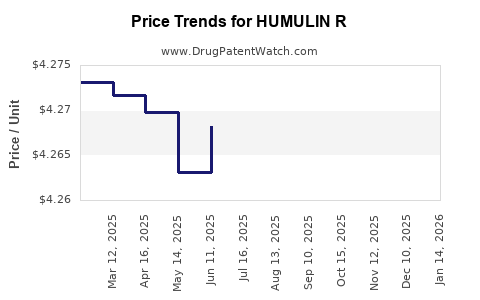

Drug Price Trends for HUMULIN R

✉ Email this page to a colleague

Average Pharmacy Cost for HUMULIN R

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HUMULIN R 500 UNIT/ML KWIKPEN | 00002-8824-27 | 91.67554 | ML | 2025-12-17 |

| HUMULIN R 100 UNIT/ML VIAL | 00002-8215-01 | 4.26729 | ML | 2025-12-17 |

| HUMULIN R 500 UNIT/ML KWIKPEN | 00002-8824-27 | 91.68292 | ML | 2025-11-19 |

| HUMULIN R 100 UNIT/ML VIAL | 00002-8215-01 | 4.26821 | ML | 2025-11-19 |

| HUMULIN R 500 UNIT/ML VIAL | 00002-8501-01 | 71.17416 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HUMULIN R

Introduction

HUMULIN R, a rapid-acting insulin analog produced by Eli Lilly and Company, is a cornerstone in diabetes management, particularly for type 1 and insulin-dependent type 2 diabetes mellitus. As a recombinant human insulin, HUMULIN R is used to control blood glucose levels during meals and daily routines. This analysis explores the current market landscape, competitive positioning, regulatory environment, manufacturing considerations, and forecasts future pricing trends.

Market Landscape

Global Diabetes Drug Market Overview

The global diabetes therapeutics market was valued at approximately USD 61 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 8% through 2030 [1]. The rise in diabetes prevalence—estimated at 537 million adults in 2021—and advancements in insulin formulations bolster demand.

HUMULIN R Positioning

HUMULIN R holds a significant share within the rapid-acting insulin segment, which includes competitors such as Novo Nordisk's NovoLog (insulin aspart) and Sanofi’s Apidra (insulin glulisine). Its long-standing presence and established efficacy sustain its market position, especially in the U.S. and European markets.

Target Demographics and Sales Drivers

-

Type 1 Diabetes Patients: Reliant on insulin therapy for survival and blood glucose regulation.

-

Type 2 Diabetes Patients: Increasing insulin use due to delayed disease progression and rising obesity levels.

-

Healthcare Providers' Preferences: Preference for rapid-onset insulins facilitating flexible dosing schedules.

Note: The global shift towards biosimilar insulins and new-generation insulins exerts pressure on HUMULIN R's market share, yet its entrenched reputation and clinical familiarity sustain demand.

Regulatory and Patent Dynamics

Patent Status and Market Exclusivity

Eli Lilly's patent protection for HUMULIN R expired in many jurisdictions, leading to the entry of biosimilars and generics, which have intensified price competition [2]. The expiration timeline varies by region, with notable biosimilar entries in the U.S. occurring post-2022.

Regulatory Approvals

HUMULIN R is approved by agencies such as the FDA and EMA, with ongoing post-market surveillance ensuring safety and efficacy. Regulatory hurdles for biosimiar approval influence pricing and market dynamics.

Manufacturing and Supply Chain Considerations

-

Production Costs: The complex recombinant DNA technology underpinning insulin synthesis entails significant R&D and manufacturing expenses, impacting initial pricing.

-

Supply Chain Factors: Global supply chain disruptions, particularly during the COVID-19 pandemic, have influenced inventory levels and pricing stability.

-

Biologic Complexity: As a biologic, HUMULIN R's manufacturing intricacies limit rapid scale-up of biosimilar competitors, offering some pricing power to Lilly.

Pricing Analysis and Trends

Historical Price Trends

-

United States: The list price of HUMULIN R (per 10 mL vial) historically ranged from USD 130 to USD 170, with actual patient costs depending on insurance negotiations and rebates [3].

-

Europe & Other Markets: Prices tend to be lower due to different healthcare systems and negotiated reimbursement rates.

Current Price Dynamics

-

Biosimilar Entry Impact: As biosimilars gain approval, retail prices typically decline by 15-30%, with some regions experiencing more substantial reductions.

-

Rebate and Contract Negotiations: Insurers and pharmacy benefit managers (PBMs) leverage rebates and formulary placement to influence net prices, often resulting in substantial discounts from list prices.

-

Healthcare Policy Influence: Policies favoring biosimilar adoption, cost containment, and value-based reimbursement pressure HUMULIN R's retail and wholesale prices downward.

Future Price Projections

-

Short-term (1-3 years): Anticipated modest price declines of 10-20% due to increasing biosimilar competition and policy-driven cost-containment.

-

Long-term (4-10 years): Potential stabilization or further reduction (~20-40%) as biosimilars and insulin analogs penetrate broader markets, driven by patient affordability needs and healthcare reforms.

-

Influence of Innovations: Advances in insulin delivery systems, such as closed-loop pumps and ultra-long-acting insulins, may reshape the demand for traditional HUMULIN R, influencing pricing strategies.

Market Challenges and Opportunities

Challenges

-

Intellectual Property Expiry: Accelerates biosimilar competition, pressuring prices.

-

Pricing Reforms: Government and insurer policies to reduce drug costs may cap reimbursements.

-

Competition from New Formulations: Ultra-rapid-acting insulins and insulin analogs with improved pharmacokinetics threaten market share.

Opportunities

-

Emerging Markets: Growing diabetes prevalence offers expansion prospects, albeit at lower price points due to pricing sensitivities.

-

Combination Therapies: Integration with GLP-1 receptor agonists and delivery innovations can enhance patient adherence and loyalty.

-

Partnerships and Licensing: Collaborations with biosimilar manufacturers could expand access and stabilize revenues.

Conclusion

HUMULIN R remains a vital insulin therapy within the diabetes market, with its long-standing clinical reputation and manufacturing complexities underpinning its value. However, patent expirations and biosimilar entries forecast downward pressure on pricing, especially over the next decade. Eli Lilly's strategic response must balance maintaining market share with pricing agility, navigating the evolving regulatory landscape, and innovating in delivery platforms. Overall, while short-term price declines are inevitable, HUMULIN R's entrenched position sustains its relevance in diabetes care.

Key Takeaways

-

The global insulin market is expanding rapidly due to increasing diabetes prevalence, but intense competition from biosimilars pressures traditional insulin pricing.

-

HUMULIN R’s market share faces significant headwinds from patent expirations, biosimilar entrants, and policy shifts aimed at cost containment.

-

Short-term forecasts predict a 10-20% decline in HUMULIN R prices, with longer-term reductions driven by biosimilar proliferation and healthcare reforms.

-

Strategic initiatives such as innovation in delivery systems and regional expansion are critical for maintaining profitability.

-

Monitoring regulatory developments and biosimilar market entry timelines is essential for accurate pricing and market penetration strategies.

FAQs

1. How will biosimilar insulin products impact the pricing of HUMULIN R?

Biosimilar insulins are expected to exert significant downward pressure on HUMULIN R prices, potentially reducing list prices by up to 30%. Increased biosimilar competition will incentivize Eli Lilly to optimize pricing strategies to sustain market share.

2. Are there new formulations of HUMULIN R in development?

Currently, Eli Lilly continues to focus on delivery innovations and combination therapies. No publicly announced new formulations of HUMULIN R are in advanced development, but the company invests in next-generation insulin research.

3. How do regional healthcare policies influence HUMULIN R pricing?

Policies promoting biosimilar substitution, price caps, and reimbursement negotiations vary globally. In regions with aggressive biosimilar adoption, HUMULIN R prices are likely to decrease faster compared to markets with protected proprietary pricing.

4. What role does monopolistic manufacturing complexity play in HUMULIN R’s pricing?

As a biologic, the complex manufacturing process limits rapid biosimilar scale-up, giving Lilly some pricing power. This complexity creates entry barriers that temporarily stabilize HUMULIN R’s prices even amid patent expiry.

5. What strategies should healthcare providers consider regarding HUMULIN R?

Providers should evaluate cost-effective biosimilar options, monitor regulatory approvals, and incorporate newer delivery platforms for optimal patient outcomes, while considering formularies and payer agreements to manage costs.

References

[1] ReportLinker. "Global Diabetes Therapeutics Market Report 2022." 2022.

[2] U.S. Patent and Trademark Office. "Patent Expiry and Biosimilar Entry in Insulin Market." 2022.

[3] Healthcare Cost and Utilization Project (HCUP). "Insulin Pricing Data." 2022.

More… ↓