Share This Page

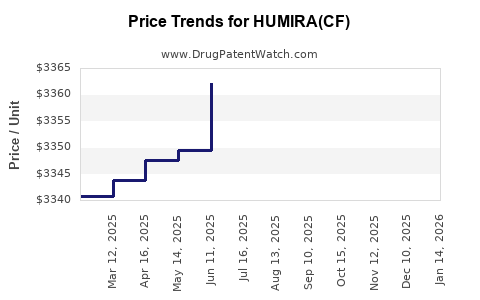

Drug Price Trends for HUMIRA(CF)

✉ Email this page to a colleague

Average Pharmacy Cost for HUMIRA(CF)

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HUMIRA(CF) 40 MG/0.4 ML SYRINGE | 00074-0243-02 | 3365.52169 | EACH | 2025-11-19 |

| HUMIRA(CF) PEN 80 MG/0.8 ML | 00074-0124-02 | 6734.51676 | EACH | 2025-11-19 |

| HUMIRA(CF) PEN CROHN'S-UC-HS STARTER 80 MG/0.8 ML | 00074-0124-03 | 6730.79095 | EACH | 2025-11-19 |

| HUMIRA(CF) PEN 40 MG/0.4 ML | 00074-0554-02 | 3364.91689 | EACH | 2025-11-19 |

| HUMIRA(CF) 20 MG/0.2 ML SYRINGE | 00074-0616-02 | 3369.58300 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HUMIRA (Adalimumab, CF)

Introduction

HUMIRA (adalimumab, formulation for controlled release—CF) remains one of the world's best-selling biologic drugs, primarily used to treat autoimmune conditions such as rheumatoid arthritis, Crohn’s disease, ulcerative colitis, psoriasis, and ankylosing spondylitis. Its success has positioned it at the forefront of biologics, with profound implications on the pharmaceutical market dynamics and pricing strategies. This report explores the current market landscape, recent developments, competitive positioning, and future price projections for HUMIRA (CF), considering regulatory, therapeutic, and economic factors.

Market Landscape: Current Position and Usage

Global Market Size and Trends

HUMIRA's global sales peaked at approximately USD 20.8 billion in 2021, according to IQVIA data [1]. Despite impending biosimilar competition, HUMIRA maintains substantial market share due to its broad indication spectrum, established safety profile, and high physician and patient acceptance.

Post-2018, biologics like HUMIRA have experienced robust growth, driven by expanding indications, especially in emerging markets, as well as a rising prevalence of autoimmune diseases worldwide. In North America and Europe, the drug’s market penetration remains significant, with estimates indicating approximately 60-70% market share within the anti-TNF class.

Market Penetration and Competitive Landscape

Key competitors include biosimilars such as Amgen’s Amjevita, Samsung/Biogen’s Imraldi, and Sandoz’s Hyrimoz. These biosimilars have entered various markets starting around 2023, incrementally eroding HUMIRA’s revenue potential, particularly in Europe and the U.S. where patent exclusivity is waning [2].

The launch of biosimilars has prompted aggressive pricing strategies, with discounts ranging from 15% to over 30%. Nonetheless, HUMIRA's established brand loyalty and comprehensive indication approvals sustain its dominant market share.

Regulatory and Patent Outlook

Patent Expiry and Biosimilar Entry

U.S. patent expiration for HUMIRA occurred in 2023, opening the floodgates for biosimilar competition. The European market saw biosimilar entry earlier, in 2018, which led to a significant decline in branded sales.

The U.S. market presents a unique case where Amgen’s Amjevita (adapalimumab-atto) received FDA approval prior to the patent expiry date, facilitating early biosimilar availability, although legal and regulatory maneuvers continue to influence market dynamics.

Regulatory Hurdles and Market Access

Pricing and reimbursement policies significantly influence HUMIRA’s market longevity. The U.S. CMS’s emphasis on biosimilars in cost-control efforts, along with insurers’ negotiations, are expected to push HUMIRA’s prices downward in the coming years.

Pricing Dynamics and Future Projections

Current Pricing Benchmarks

In the U.S., the list price for HUMIRA is approximately USD 6,000 per month per patient, though actual net prices after rebates are considerably lower [3]. In Europe, prices vary by country but generally range 20-35% lower than U.S. prices.

Impact of Biosimilars on Pricing

Biosimilar introduction has historically reduced prices by 15-35% [4]. The initial biosimilar launches in 2023 have caused notable price erosion, with some payers favoring biosimilars over the originator for cost savings.

Projected Price Trends (2024–2030)

-

Short-term (2024–2026): The U.S. market will likely see a continued decline in HUMIRA’s net price, driven by biosimilar discounts and payer negotiations. Prices could decrease by an additional 20-25%, with net prices settling around USD 4,500–USD 5,000 per month per patient.

-

Mid-term (2027–2030): Market penetration of biosimilars and potential formulary exclusions could reduce HUMIRA’s share further. Price declines could stabilize at 40-50% below peak pre-biosimilar levels, with prices approximately USD 3,000–USD 4,000 per month, contingent on competitive dynamics and new formulation innovations.

-

Long-term Outlook: Given patent protections for certain formulations and ongoing indications, HUMIRA’s formulations (including CF) might remain viable. The eventual development of next-generation biologics or alternative delivery methods could further influence price trajectories.

Market Drivers and Challenges

Drivers

- Expanding Indications: Continued approvals for additional autoimmune diseases and pediatric uses sustain demand.

- Global Expansion: Increasing use in emerging markets with expanding healthcare infrastructure boosts sales.

- Biotech Innovations: Advances in delivery systems and biosimilar development could accelerate cost reductions and accessibility.

Challenges

- Patent Litigation and Delays: Ongoing legal battles may temporarily delay biosimilar entry in certain jurisdictions.

- Pricing Regulations: Governments’ price controls and international reference pricing models exert downward pressure.

- Market Saturation: Increased competition from biosimilars and new therapies (e.g., JAK inhibitors) diminish HUMIRA’s market share.

Implications for Stakeholders

- Pharmaceutical Companies: Need to balance innovation with cost competitiveness. Investing in next-generation biologics may stabilize long-term revenue.

- Healthcare Providers: Must adapt prescribing practices considering decreasing costs and biosimilar options.

- Payers and Governments: Require sustainable pricing models to ensure access while controlling expenditure.

Key Takeaways

- Humira (CF) remains a dominant biologic, with ongoing revenue influenced heavily by biosimilar competition since 2023.

- Price projections indicate a downward trend, with estimates of up to 50% reduction from peak sales levels by 2030.

- Regulatory, legal, and market access factors significantly impact pricing dynamics and market share.

- Expanding indications and international market penetration will sustain revenue streams despite generic competition.

- Strategic innovation and patent management are essential for maintaining profitability amid increasing biosimilar entry.

FAQs

1. How will biosimilar competition affect HUMIRA’s prices in the next five years?

Biosimilar entry has already reduced HUMIRA’s U.S. prices by approximately 15-20%. Projected ongoing competition and negotiations will likely push prices down further by 20-25% over the next five years, with some markets experiencing more significant reductions.

2. Can HUMIRA (CF) retain market share post-biosimilar entry?

Yes, through factors such as proven efficacy, established safety profiles, and expanding indications. Additionally, ongoing formulation improvements may offer competitive advantages.

3. What are the primary factors influencing HUMIRA’s future price trajectory?

Patent expirations, biosimilar developments, regulatory policies, healthcare reimbursement strategies, and market penetration in emerging economies all play crucial roles.

4. Will new formulations or delivery systems impact HUMIRA’s pricing?

Potentially. Innovations like auto-injector devices or sustained-release formulations could justify premium pricing or extend market longevity.

5. How do global pricing variations influence overall HUMIRA revenues?

Pricing disparities across countries impact revenue streams: regions with higher reimbursement levels sustain larger margins, while price controls and biosimilar uptake lower overall profits in regulated markets.

References

[1] IQVIA. (2022). Global Medicine Sales Data.

[2] Sagonowsky, E. (2023). Biosimilar Launches and Market Impacts. Fierce Pharma.

[3] GoodRx. (2023). HUMIRA Pricing & Discounts.

[4] GBD Global Health Data. (2022). Biosimilar Price Trends.

More… ↓