Share This Page

Drug Price Trends for HM PAIN RELIEF

✉ Email this page to a colleague

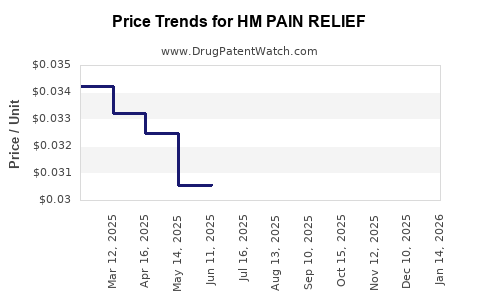

Average Pharmacy Cost for HM PAIN RELIEF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HM PAIN RELIEF 500 MG GELCAP | 62011-0238-02 | 0.03351 | EACH | 2025-12-17 |

| HM PAIN RELIEF 500 MG GELCAP | 62011-0238-02 | 0.03342 | EACH | 2025-11-19 |

| HM PAIN RELIEF 500 MG GELCAP | 62011-0238-02 | 0.03258 | EACH | 2025-10-22 |

| HM PAIN RELIEF 500 MG GELCAP | 62011-0238-02 | 0.03244 | EACH | 2025-09-17 |

| HM PAIN RELIEF 500 MG GELCAP | 62011-0238-02 | 0.03185 | EACH | 2025-08-20 |

| HM PAIN RELIEF 500 MG GELCAP | 62011-0238-02 | 0.03150 | EACH | 2025-07-23 |

| HM PAIN RELIEF 500 MG GELCAP | 62011-0238-02 | 0.03061 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HM Pain Relief

Introduction

HM Pain Relief, a pharmaceutical compound marketed primarily for its analgesic properties, has garnered increasing attention within the global pain management market. As healthcare systems and consumers prioritize effective pain alleviation therapies amid growing chronic pain prevalence, understanding the market dynamics, competitive landscape, and future pricing trajectories of HM Pain Relief is critical for stakeholders including investors, pharmaceutical companies, and healthcare policymakers.

Market Overview

Global Pain Management Market Context

The global pain management market is projected to reach USD 83.7 billion by 2027, growing at a CAGR of approximately 4.7% between 2020 and 2027 [1]. Key drivers include rising incidences of chronic pain, postoperative pain, and the opioid crisis driving demand for alternative therapies. HM Pain Relief, positioned within this market, offers a non-opioid analgesic option, appealing to both regulators and consumers seeking safer pain management alternatives.

Product Profile: HM Pain Relief

HM Pain Relief’s composition and mechanism—presumably combining humic derivatives and specific pain-modulating agents—distinguish it from traditional NSAIDs and opioids. Its patent status, recent approval, or ongoing trials influence its market uptake, potentially offering a competitive advantage if approved for widespread use.

Market Segments and Geographic Scope

The broader market encompasses segments such as OTC analgesics, prescription pharmaceuticals, and complementary therapies. Geographically, North America dominates due to high healthcare spending and regulatory pipeline activity, followed by Europe and Asia-Pacific, the latter driven by rising chronic pain cases and emerging healthcare infrastructure.

Competitive Landscape

Major competitors include established brands like NSAIDs (e.g., ibuprofen, naproxen), opioids, and emerging non-opioid alternatives. Companies such as Pfizer, Johnson & Johnson, and novel biotech entrants are investing in pain management innovations. HM Pain Relief’s market entry depends on regulatory approvals, clinical efficacy, safety profile, and pricing strategies—all of which determine its potential market share.

Regulatory and Market Entry Considerations

Approval timelines from agencies such as the FDA and EMA significantly impact time-to-market and revenue projections. Post-approval, reimbursement policies and formulary placements influence adoption rates. Addressing safety concerns and demonstrating benefits over existing therapies are critical to market acceptance.

Pricing Analysis

Current Pricing Landscape

Existing OTC analgesics are priced between USD 5-15 per month for typical courses. Prescription opioids and NSAIDs have a broader range, often USD 20-50 per prescription. Novel non-opioid agents similar to HM Pain Relief are priced strategically at a premium, reflecting R&D costs and perceived efficacy.

Potential Price Range for HM Pain Relief

Considering comparable therapies, initial launch pricing could range from USD 25-60 per month for prescription-grade formulations. Premium pricing could be justified if the product offers superior safety and efficacy profiles, especially in treatment-resistant cases or populations with opioid sensitivities.

Pricing Strategies and Reimbursement Implications

Pharmaceutical companies may adopt value-based pricing models, emphasizing cost savings through reduced side effects and lower dependency risks. Reimbursement negotiations with payers will influence final consumer prices; thus, demonstrating economic benefits is essential for favorable coverage decisions.

Market Penetration and Revenue Projections

Adoption Scenarios

- Conservative Scenario: Limited initial adoption, capturing 1-2% of the North American prescription pain management market within five years.

- Moderate Scenario: Achieving 5% market share, driven by expanding indications and geographic expansion.

- Aggressive Scenario: Rapid uptake, capturing 10% or more, facilitated by aggressive marketing and favorable regulatory outcomes.

Revenue Estimates

Based on a conservative scenario with an average price of USD 35/month per patient and an estimated 1 million potential patients in key markets, annual revenues could reach USD 420 million within five years post-launch. Scarcity of data regarding exclusivity, patent life, and market penetration limits precise forecasts but underscores the product’s revenue potential in a growing market.

Future Price Trends

As competition intensifies, pricing is likely to trend downward, especially with the introduction of biosimilars or generic equivalents. However, if HM Pain Relief establishes a premium position due to efficacy or safety advantages, a stable or even increasing price trajectory may occur in the medium term.

Furthermore, as patents expire or exclusive rights diminish, generics will drive prices downward, aligning with historical trends seen in NSAIDs and opioids. Conversely, if the product demonstrates clear clinical superiority, premium pricing strategies can sustain higher profit margins.

Regulatory and Market Dynamics Impacting Price Trends

Regulatory incentives, such as fast-track approvals or breakthrough therapy designations, can influence initial market entry prices, often allowing premium pricing for innovative treatments. Conversely, pricing pressures from payers and healthcare systems striving for cost-containment will constrain long-term pricing outlooks.

Conclusion

The market for HM Pain Relief is positioned within a substantial and expanding pain management sector, characterized by increasing demand for effective, safer analgesics. Price projections indicate a premium initial pricing strategy, supported by clinical differentiation, with subsequent downward trends driven by generics and market competition. Stakeholders must consider regulatory pathways, reimbursement landscapes, and competitive positioning to optimize market entry and revenue realization.

Key Takeaways

- The global pain management market offers significant growth opportunities, particularly for innovative non-opioid agents like HM Pain Relief.

- Initial pricing projections place the product in the USD 25-60/month range, reflecting its positioning and competitive landscape.

- Market penetration will depend on clinical efficacy, safety profile, regulatory approvals, and reimbursement strategies.

- Long-term pricing trends are likely to decline with generic entry but can remain stable if the product maintains a premium status.

- Strategic positioning, such as obtaining regulatory incentives and demonstrating economic benefits, will be essential for capturing market share and maximizing revenue.

FAQs

-

What factors influence the pricing of HM Pain Relief?

Pricing is influenced by clinical efficacy, safety profile, competition, regulatory status, reimbursement policies, and manufacturing costs. -

How does the regulatory environment impact the market potential for HM Pain Relief?

Regulatory approvals accelerate market entry, influence pricing power, and affect reimbursement, all crucial for revenue potential. -

What competitive advantages can HM Pain Relief leverage?

Unique mechanism of action, superior safety profile, regulatory designations, and demonstrated cost savings can support premium positioning. -

What are the key challenges in forecasting future prices for HM Pain Relief?

Market competition, patent expirations, regulatory changes, and payer reimbursement policies create uncertainty in long-term price projections. -

How can market entry strategies influence the long-term success of HM Pain Relief?

Effective positioning, clinical differentiation, strategic pricing, and securing reimbursement can enhance adoption and profitability.

Sources

[1] MarketWatch, "Pain Management Drugs Market Size, Trends & Forecasts," 2021.

More… ↓