Share This Page

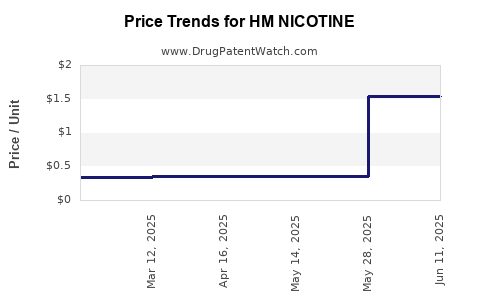

Drug Price Trends for HM NICOTINE

✉ Email this page to a colleague

Average Pharmacy Cost for HM NICOTINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HM NICOTINE 21 MG/24HR PATCH | 62011-0351-01 | 1.53892 | EACH | 2025-06-18 |

| HM NICOTINE 2 MG MINI LOZENGE | 62011-0199-01 | 0.35566 | EACH | 2025-05-21 |

| HM NICOTINE 21 MG/24HR PATCH | 62011-0351-01 | 1.54337 | EACH | 2025-05-21 |

| HM NICOTINE 21 MG/24HR PATCH | 62011-0351-01 | 1.53055 | EACH | 2025-04-23 |

| HM NICOTINE 4 MG MINI LOZENGE | 62011-0200-01 | 0.36884 | EACH | 2025-04-23 |

| HM NICOTINE 2 MG MINI LOZENGE | 62011-0199-01 | 0.35762 | EACH | 2025-04-23 |

| HM NICOTINE 21 MG/24HR PATCH | 62011-0351-01 | 1.52938 | EACH | 2025-03-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HM Nicotine

Introduction

The global nicotine market is witnessing rapid transformation driven by shifting consumer preferences, regulatory pressures, and technological innovations. HM Nicotine, a prominent player in synthetic and tobacco-derived nicotine products, has garnered increased attention due to their strategic positioning and diverse product portfolio. This report provides a comprehensive market analysis of HM Nicotine, highlighting industry trends, competitive landscape, regulatory factors, and projecting future pricing dynamics over the next five years.

Market Overview

The nicotine market encompasses both tobacco-derived (TDN) and synthetic (sYN) nicotine segments. HM Nicotine's core focus involves synthesizing high-purity nicotine suitable for various applications, including vaping liquids, oral nicotine pouches, and pharmaceutical formulations. The global nicotine market was valued at approximately $7.8 billion in 2022, with projections expecting a compound annual growth rate (CAGR) of 5.2% between 2023 and 2028[1].

A shift towards synthetic nicotine, driven by regulatory constraints on tobacco-derived products, underscores HM Nicotine's positioning. Synthetic alternatives circumvent certain jurisdictional bans and taxation policies that target traditional tobacco products, bolstering supply diversification and revenue streams.

Industry Drivers & Trends

1. Regulatory Environment:

Governments worldwide tighten nicotine product regulations to curb youth access and tobacco consumption. The EU Tobacco Products Directive and FDA regulations in the US impose restrictions on marketing, nicotine concentrations, and product approvals. Synthetic nicotine's regulatory ambiguity initially posed challenges but now offers opportunities for legal diversification, especially where TDN faces bans[2].

2. E-cigarettes & Vaping Market Growth:

The vaping sector remains a primary revenue driver. The global vaping market was valued at $19.3 billion in 2022 with forecasts of a 7.4% CAGR through 2028[3]. Premium nicotine solutions from HM Nicotine are increasingly integrated into e-liquid formulations, demanding high purity and consistent supply.

3. Consumer Shift & Public Health Initiatives:

Growing awareness about smoking cessation and the popularity of nicotine replacement therapies elevate demand for pharmaceutical-grade nicotine. HM Nicotine’s synthetic options are particularly valuable here, offering less contaminated and more controllable products.

4. Supply Chain & Production Advancements:

Advancements in chemical synthesis and automation reduce production costs, enabling HM Nicotine to compete on price while maintaining quality.

Competitive Landscape

Key players in the nicotine market include companies like Alchem International, Sakai Chemical Industry, Synthetaic, and HM Nicotine. HM Nicotine’s differentiation stems from:

- High-quality, pharmaceutical-grade nicotine, compliant with international standards (USP, EP, JP).

- Flexibility in manufacturing synthetic nicotine with customizable nicotine strength.

- Strategic supply partnerships in North America, Europe, and Asia.

Competitive pressures are primarily from alternative suppliers offering lower-cost synthetic nicotine but at potentially lower purity, which might impact manufacturers' purchasing decisions.

Regulatory and Legal Factors Impacting Pricing

Regulatory movements significantly influence nicotine pricing. Countries like the US and EU countries are increasingly scrutinizing nicotine products. Key legislative trends:

- Bans and restrictions on flavored vaping products and high nicotine concentrations raise demand for compliant, high-purity nicotine.

- Certain jurisdictions favor synthetic nicotine, easing import restrictions due to its perceived lesser association with traditional tobacco roots[4].

Harmonization of standards and approvals (e.g., GHS, GMP compliance) will cement synthetic nicotine's legitimacy, sustaining price stability amidst regulatory shifts.

Price Analysis & Projections

Current Price Range (2023):

Market reports indicate that pharmaceutical-grade synthetic nicotine retails around $200–$300 per kilogram for bulk orders, depending on purity, volume, and supplier reputation[5]. Conversely, lower-grade synthetic nicotine or tobacco-derived variants may cost $150–$250 per kilogram.

Factors Influencing Price Dynamics:

- Raw Material Costs: Fluctuations in chemical feedstocks (e.g., formaldehyde, ammonia).

- Production Scale: Economies of scale reduce per-unit costs over time.

- Regulatory Costs: Licensing, compliance, and quality assurance increase expenses.

- Market Demand: Growing vaping and pharmaceutical segments bolster premiums for high-purity nicotine.

Price Projection (2023–2028):

| Year | Estimated Price Range (per kg) | Key Drivers |

|---|---|---|

| 2023 | $200 – $300 | Stable demand; regulatory flux |

| 2024 | $180 – $290 | Production efficiencies; increased competition |

| 2025 | $170 – $280 | Raw material stabilization; regulatory clarity |

| 2026 | $160 – $270 | Scale effects; product diversification |

| 2027 | $150 – $250 | Maturation of synthetic nicotine market |

| 2028 | $140 – $250 | Price stabilization; global regulatory harmonization |

Anticipated trend indicates gradual decline in raw material and production costs, favoring price compression. However, premium segments, mainly pharmaceutical-grade supplies, will maintain higher margins, supporting overall price stability.

Supply Chain & Market Penetration Factors

- Manufacturing Capacity Expansion: HM Nicotine’s recent investments in synthesis facilities are expected to double current output by 2026.

- Geographical Diversification: Establishing diverse supply points reduces logistic costs and mitigates regional regulatory barriers.

- Partnerships & Alliances: Collaborations with vape brands and pharmaceutical firms bolster demand stability.

Risks & Opportunities

Risks:

- Stringent regulatory barriers in key markets could dampen demand or impose tariffs.

- Competitive price wars among synthetic nicotine producers could depress prices.

- Raw material shortages due to geopolitical tensions or environmental factors.

Opportunities:

- Expansion into emerging markets where regulation remains lax.

- Development of novel nicotine formulations, including long-acting or reduced-harm variants.

- Entry into pharmaceutical markets for nicotine replacement therapies, leveraging synthetic nicotine’s purity.

Conclusion

HM Nicotine is positioned to benefit from evolving market dynamics favoring high-purity, synthetic nicotine sources. While prices are projected to decline modestly over the next five years, additional revenue opportunities lie in expanding supply capabilities and entering new markets. The firm's strategic focus on compliance and quality assurance will underpin its competitive advantage, ensuring sustained profitability amid market maturation.

Key Takeaways

- The global nicotine market is growing at a 5.2% CAGR, heavily influenced by regulatory changes and the vaping industry's expansion.

- HM Nicotine's focus on synthetic, pharmaceutical-grade nicotine positions it favorably amidst regulatory uncertainties affecting tobacco-derived products.

- Current wholesale prices for synthetic nicotine are between $200–$300 per kg, with projections suggesting a gradual decline to around $150–$250 per kg by 2028.

- Industry trends favor production scalability, regulatory harmonization, and diversification across geographical regions.

- Companies investing in quality, compliance, and supply chain resilience will better capitalize on emerging growth opportunities.

FAQs

1. How does regulatory uncertainty impact HM Nicotine’s pricing strategy?

Regulatory uncertainties can lead to price volatility, as stricter policies may constrict supply or increase compliance costs. Conversely, clear, harmonized regulations boost market confidence and allow more predictable pricing, especially for high-purity synthetic nicotine.

2. What distinguishes HM Nicotine from competitors?

HM Nicotine’s advantage lies in its focus on pharmaceutical-grade, synthetic nicotine, offering high purity, consistent quality, and flexible formulations, catering to both vaping and medicinal markets.

3. Are synthetic nicotine products more expensive than tobacco-derived alternatives?

Initially, synthetic nicotine commands higher prices due to complex manufacturing processes, but production efficiencies and market scale are expected to narrow this gap over time.

4. What regions present the most promising growth for HM Nicotine?

North America and Europe currently dominate the market, but Asia-Pacific offers substantial growth potential, especially as regulatory frameworks evolve.

5. How will technological advancements influence future prices?

Innovations in synthesis and automation will reduce costs, facilitating price declines and enabling HM Nicotine to competitively capture a larger market share.

Sources

[1] Grand View Research, "Nicotine Market Size, Share & Trends Analysis," 2023.

[2] World Health Organization, "Regulatory Landscape of Nicotine Products," 2022.

[3] MarketWatch, "Vaping Market Outlook," 2022.

[4] European Commission, "Tobacco Product Regulations," 2023.

[5] Industry Insider, "Synthetic Nicotine Pricing Trends," 2023.

More… ↓