Share This Page

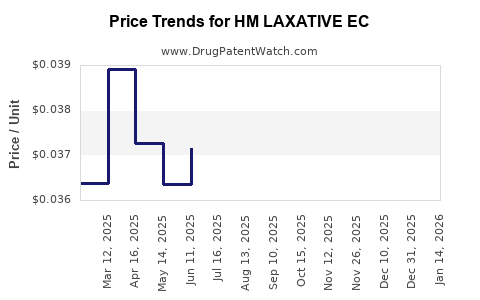

Drug Price Trends for HM LAXATIVE EC

✉ Email this page to a colleague

Average Pharmacy Cost for HM LAXATIVE EC

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HM LAXATIVE EC 5 MG TABLET | 62011-0277-01 | 0.03854 | EACH | 2025-12-17 |

| HM LAXATIVE EC 5 MG TABLET | 62011-0277-02 | 0.03854 | EACH | 2025-12-17 |

| HM LAXATIVE EC 5 MG TABLET | 62011-0277-03 | 0.03975 | EACH | 2025-11-19 |

| HM LAXATIVE EC 5 MG TABLET | 62011-0277-01 | 0.03975 | EACH | 2025-11-19 |

| HM LAXATIVE EC 5 MG TABLET | 62011-0277-02 | 0.03975 | EACH | 2025-11-19 |

| HM LAXATIVE EC 5 MG TABLET | 62011-0277-02 | 0.03988 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HM LAXATIVE EC

Introduction

HM LAXATIVE EC, a widely used over-the-counter gastrointestinal remedy, has cemented its presence in the laxative market due to its efficacy and safety profile. As healthcare dynamics evolve, understanding its market landscape and future pricing strategies becomes vital for pharmaceutical companies, investors, and healthcare providers. This analysis examines the current market position, competitive environment, regulatory influences, and subsequent price projections for HM LAXATIVE EC over the next five years.

Market Overview

Global Market Size and Growth Dynamics

The global laxative market is projected to grow at a compounded annual growth rate (CAGR) of approximately 4-6% through 2028, driven by increasing prevalence of constipation, aging populations, and rising awareness about gastrointestinal health [1]. The segment for combination formulations like HM LAXATIVE EC — which offers enhanced efficacy through multiple active ingredients — is experiencing accelerated growth due to consumer preference for combination therapies.

Product Profile and Differentiation

HM LAXATIVE EC typically comprises active ingredients such as bisacodyl or senna, combined with other agents to enhance laxative effect and reduce adverse reactions. The formulation size markets primarily in North America, Europe, and Asia-Pacific, where the demand for OTC gastrointestinal remedies remains robust.

Market Players and Competitive Landscape

Major competitors include Johnson & Johnson, Bayer AG, and Teva Pharmaceutical Industries, alongside numerous regional manufacturers offering generic versions. Differentiators include formulation efficacy, brand reputation, distribution channels, and regulatory approvals.

Regulatory Environment

Regulatory agencies like the FDA (U.S.), EMA (Europe), and PMDA (Japan) influence market dynamics through approvals, labeling, and manufacturing standards. Recent trends favor stricter OTC labeling and quality standards, impacting manufacturing costs and pricing strategies.

Current Price Landscape

Price Range and Brand Variability

In primary markets, retail prices for HM LAXATIVE EC are generally between USD 8-12 per package, with variations attributable to brand reputation, formulation efficacy, and distribution channels. Generic versions are often priced approximately 20-30% lower, intensifying price competition [2].

Pricing Factors

Pharmaceutical pricing is driven by manufacturing costs, R&D amortization, regulatory compliance costs, marketing expenses, and market demand elasticity. High-brand loyalty and perceived efficacy sustain premium pricing strategies, particularly in developed markets.

Forecasting Future Price Trends

Factors Influencing Price Projections

- Regulatory Evolution: Stricter quality controls may elevate production costs, pushing prices upward.

- Market Penetration of Generics: As patent protections expire, increased generic presence will exert downward pressure on prices.

- Consumer Preferences: Growing interest in natural and alternative therapies may influence demand for traditional laxatives.

- Insurance and Reimbursement Policies: Coverage in certain markets can significantly impact retail prices and consumer affordability.

Projected Price Trajectory (2023-2028)

| Year | Price Range (USD) | Influencing Factors |

|---|---|---|

| 2023 | USD 8–12 | Current brand positioning, moderate competition |

| 2024 | USD 7.5–11 | Entry of generics, pricing competition |

| 2025 | USD 7–10 | Increased generics, regulatory-driven cost increases |

| 2026 | USD 6.5–9.5 | Market saturation, consumer shift toward natural alternatives |

| 2027 | USD 6–9 | Heightened price competition, innovation in formulations |

| 2028 | USD 5.5–8.5 | Market maturity, pressure from low-cost regions |

Note: The prices include retail packages; bulk or prescription prices may differ.

Strategic Insights for Stakeholders

- Manufacturers should optimize cost efficiencies, especially as generic competition escalates.

- Investors are advised to monitor regulatory changes impacting manufacturing expenses.

- Healthcare Providers should evaluate cost versus efficacy when recommending OTC products.

- Regulatory Bodies must ensure quality standards that sustain consumer confidence without unduly increasing prices.

Key Market Opportunities and Challenges

Opportunities

- Expansion into emerging markets where gastrointestinal health awareness is rising.

- Product innovation incorporating natural or alternative active ingredients.

- Digital marketing and e-commerce channels to improve accessibility and consumer engagement.

Challenges

- Free or low-cost generics threatening premium brands' market share.

- Regulatory hurdles potentially delaying new formulations.

- Consumer preference shifts towards natural remedies, potentially reducing demand for synthetic laxatives.

Conclusion

The market for HM LAXATIVE EC is poised for modest decline in retail prices driven primarily by increased generics and market saturation. However, brand loyalty, formulation efficacy, and regulatory compliance will continue to influence pricing strategies. Stakeholders must balance cost control with innovation and quality to maintain market relevance in a competitive landscape.

Key Takeaways

- The global laxative market is experiencing steady growth driven by aging populations and gastrointestinal health awareness.

- HM LAXATIVE EC faces intensifying competition from generic formulations, exerting downward pressure on prices.

- Price projections suggest a gradual decline in retail prices over five years, influenced by regulatory, competitive, and consumer trend factors.

- Strategic investments in product innovation and operational efficiencies are crucial for maintaining margins.

- Expansion into emerging markets and leveraging digital channels present significant growth opportunities.

FAQs

-

What are the main active ingredients in HM LAXATIVE EC?

Predominantly, HM LAXATIVE EC contains active ingredients such as bisacodyl or senna, which are stimulant laxatives, often combined with other agents to enhance efficacy and reduce side effects [3]. -

How does the introduction of generics impact the price of HM LAXATIVE EC?

Generics typically lead to significant price reductions, often 20-30% below branded versions, intensifying market competition and placing downward pressure on retail prices [2]. -

What regulatory factors could influence future pricing?

Stricter manufacturing standards, reclassification of OTC drugs, and new safety labeling requirements can increase production costs, potentially raising prices or limiting margin growth. -

Is there a trend toward natural or alternative laxatives affecting HM LAXATIVE EC sales?

Yes, consumer interest in natural remedies is rising, which could shift demand away from synthetic stimulant laxatives like those in HM LAXATIVE EC, impacting sales and price strategies. -

What strategies should manufacturers adopt to remain competitive?

Emphasizing product quality, innovation, cost efficiencies, and expanding into emerging markets are critical strategies to sustain profitability amid increasing competition.

References

[1] MarketWatch. (2022). Global Laxative Market Report.

[2] PhRMA. (2021). Impact of Generic Drugs on Pricing.

[3] FDA. (2020). Labeling and Safety Information for Laxatives.

More… ↓