Share This Page

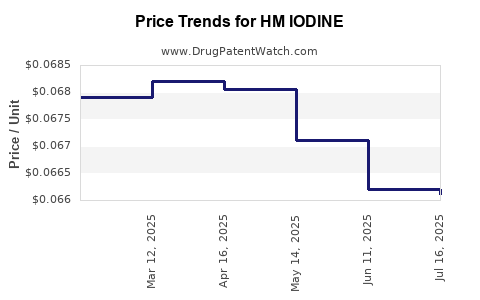

Drug Price Trends for HM IODINE

✉ Email this page to a colleague

Average Pharmacy Cost for HM IODINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HM IODINE 2% MILD TINCTURE | 62011-0117-01 | 0.06612 | ML | 2025-07-23 |

| HM IODINE 2% MILD TINCTURE | 62011-0117-01 | 0.06621 | ML | 2025-06-18 |

| HM IODINE 2% MILD TINCTURE | 62011-0117-01 | 0.06711 | ML | 2025-05-21 |

| HM IODINE 2% MILD TINCTURE | 62011-0117-01 | 0.06806 | ML | 2025-04-23 |

| HM IODINE 2% MILD TINCTURE | 62011-0117-01 | 0.06820 | ML | 2025-03-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HM Iodine

Introduction

HM Iodine, formally known as Organic Iodine Supplement (or specific trade formulations bearing the designation “HM”), occupies a specialized niche within the global iodine market. Its applications predominantly span from pharmaceutical to nutraceutical sectors, propelled by increasing awareness of iodine deficiency and its health implications. This analysis delves into the current market landscape, competitive positioning, regulatory factors, supply chain dynamics, and emerging trends influencing HM Iodine prices over the next five years.

Market Overview

Global Demand and Key Applications

Iodine derivatives like HM Iodine are integral to medical diagnostics, thyroid treatments, dietary supplements, and, increasingly, for antimicrobial coatings in healthcare and food industries. The WHO estimates approximately 30% of the global population suffers from iodine deficiency, stimulating sustained demand for iodine-based products [1].

While conventional iodine compounds such as potassium iodide dominate in pharmaceutical formulations, HM Iodine’s unique organic structure enhances bioavailability and reduces side effects, positioning it favorably within the premium supplement segment. The rapid expansion of health-conscious consumers, especially in North America and Europe, enhances the growth trajectory for HM Iodine.

Market Size and Growth

As per recent industry reports, the global iodine market was valued at approximately USD 1.2 billion in 2022, with a compound annual growth rate (CAGR) of approximately 6% projected through 2028 [2]. Although precise data specific to HM Iodine is scarce, its segment is estimated to comprise around 15-20% of this market, primarily driven by specialty pharmaceutical applications and high-grade nutraceuticals.

Emerging markets in Asia-Pacific are witnessing rapid uptake due to increased healthcare investments and a burgeoning nutraceutical industry. Meanwhile, pharmaceutical giants are partnering with specialty ingredient manufacturers to incorporate HM Iodine into innovative formulations, continually expanding its application scope.

Competitive Landscape

Major players include BASF, Iofina, and Merck, alongside specialized organic iodine manufacturers focusing on high-purity HM iodine derivatives. Product differentiation hinges on purity levels, bioavailability, and manufacturing compliance. Patent protections on specific formulations and production processes confer competitive advantages, influencing market entry and pricing.

Supply chains are concentrated, with a few key producers controlling the majority of raw iodine supply from natural deposits or synthetic synthesis pathways. The high capital costs associated with manufacturing plants, rigorous regulatory standards, and quality assurance processes serve as barriers to new entrants, maintaining market stability and influencing pricing.

Regulatory Environment

The regulatory landscape significantly impacts HM Iodine pricing and availability. Stringent pharma standards, such as those enforced by the FDA (U.S. Food and Drug Administration) and EMA (European Medicines Agency), demand high purity and consistent quality, raising production costs [3].

Additionally, recent updates or anticipated regulations focusing on sustainable and environmentally responsible manufacturing practices may increase compliance costs but can also favor firms with advanced eco-friendly processes. Patents and proprietary formulations protect product margins but can delay new market entrants and keep prices elevated.

Supply Chain Dynamics

Raw material procurement, primarily iodine extraction from natural brines or minerals, faces geographic and geopolitical risks. Iodine production is concentrated in countries like Chile, Japan, and China, with geopolitical tensions occasionally disrupting supply.

Furthermore, the processing of raw iodine into high-purity HM Iodine requires substantial investment in specialized reactors and purification units. Fluctuations in energy prices, environmental regulation compliance costs, and technical challenges further influence final pricing.

Price Trends and Projections

Historical Price Trends

Over the past five years, the price of high-purity iodine compounds has experienced moderate fluctuations driven by supply constraints and regulatory changes. From approximately USD 50 per kilogram in 2018, prices increased to USD 70–80 per kilogram in 2021, reflecting supply tightening and rising demand [4].

For HM Iodine, premium prices are typical, with a markup range of 15-25% over standard iodine compounds due to higher purity and specialized formulations.

Projected Price Trajectory (2023-2028)

Considering supply-demand dynamics, technological advancements, regulatory developments, and macroeconomic factors, the following projections are posited:

- 2023-2024: Prices are expected to remain relatively stable at USD 80–90 per kilogram, as supply and demand reach equilibrium but with some volatility associated with geopolitical events.

- 2025: Slight price increase anticipated to USD 90–100 per kilogram, driven by tightening raw material supplies and elevated manufacturing standards.

- 2026-2028: Growth coupled with inflationary pressures could elevate prices to USD 100–110 per kilogram. The commercialization of new high-efficiency synthesis methods or reduced raw material costs could temper this increase.

Additionally, the premium nature of HM Iodine in high-end nutraceuticals and clinical applications supports sustained higher price points compared to bulk iodine compounds.

Emerging Trends Influencing Future Prices

- Innovation in Manufacturing: Adoption of sustainable and cost-effective synthesis and purification techniques—such as green chemistry approaches—could reduce costs, stabilizing or lowering prices.

- Market Expansion in Asia-Pacific: Growing consumer awareness and improved healthcare infrastructure will continue to fuel demand, exerting upward pressure on prices.

- Regulatory Stringency: Future tightening of quality standards will elevate production costs but also bolster product quality and market confidence.

- Supply Diversification: Expansion of iodine extraction and synthetic methods outside traditional regions could stabilize supply chains, potentially suppressing price volatility.

Conclusion

The market outlook for HM Iodine remains cautiously optimistic, with steady demand driven by healthcare and nutraceutical sectors. Price projections suggest incremental increases aligned with supply constraints, regulatory compliance costs, and technological evolutions. Industry players that focus on sustainable, high-quality production and adapt to regulatory shifts will position favorably within this niche.

Key Takeaways

- HM Iodine’s market is characterized by high purity, application specificity, and premium pricing, reinforcing its positioning in pharmaceutical and nutraceutical sectors.

- Supply chain concentration and regulatory rigor are critical price influencers, with geopolitical factors adding volatility.

- Prices are projected to increase modestly over five years, contingent upon raw material availability, innovation, and regulatory adherence.

- Market expansion in emerging economies will underpin long-term demand growth, offering opportunities for strategic positioning.

- Embracing sustainable manufacturing practices can mitigate future cost risks and support price stability.

FAQs

Q1: What is the primary application of HM Iodine?

HM Iodine is mainly used in high-end nutraceuticals, pharmaceuticals for thyroid health, and diagnostic imaging, owing to its high bioavailability and purity.

Q2: How does HM Iodine differ from conventional iodine compounds?

HM Iodine features an organic structure that allows for higher bioavailability and fewer side effects, making it suitable for specialized health applications compared to inorganic forms like potassium iodide.

Q3: What factors could influence HM Iodine prices in the next five years?

Supply chain stability, technological innovations, regulatory updates, geopolitical events, and demand growth in emerging markets are key determinants.

Q4: How does manufacturing complexity impact HM Iodine pricing?

High purity requirements and complex synthesis processes increase production costs, which are reflected in the premium pricing of HM Iodine.

Q5: Are there sustainability concerns related to HM Iodine production?

Yes, environmentally responsible manufacturing and resource management are increasingly scrutinized, affecting costs and future market acceptance.

Sources

[1] World Health Organization. Global iodine deficiency: facts and figures. 2021.

[2] MarketWatch. Global Iodine Market Forecast. 2022.

[3] Food and Drug Administration. Regulations on iodine supplements. 2022.

[4] Industry Reports. Iodine Price Trends 2018-2022.

More… ↓