Share This Page

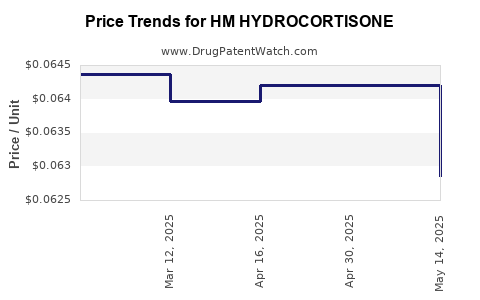

Drug Price Trends for HM HYDROCORTISONE

✉ Email this page to a colleague

Average Pharmacy Cost for HM HYDROCORTISONE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HM HYDROCORTISONE 1% CREAM | 62011-0096-01 | 0.06286 | GM | 2025-05-21 |

| HM HYDROCORTISONE 1% CREAM | 62011-0096-01 | 0.06420 | GM | 2025-04-23 |

| HM HYDROCORTISONE 1% CREAM | 62011-0095-01 | 0.06420 | GM | 2025-04-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HM Hydrocortisone

Introduction

Hydrocortisone, a synthetic corticosteroid, plays a critical role in managing inflammation, allergic reactions, and adrenal insufficiency. The market segment referred to as HM Hydrocortisone typically pertains to the brand-specific or generic formulations supplied by healthcare organizations or pharmaceutical companies. As a vital corticosteroid, hydrocortisone maintains a robust global presence, with diverse applications and regulatory frameworks influencing its market dynamics. This analysis elucidates the current market landscape, historical trends, key growth drivers, competitive environment, and future price projections for HM Hydrocortisone.

Market Overview

Global Market Size and Trends

Hydrocortisone's global demand is driven by the prevalence of inflammatory and autoimmune conditions such as rheumatoid arthritis, ulcerative colitis, and adrenal insufficiency. According to market research reports, the overall corticosteroid market, which includes hydrocortisone, was valued at approximately USD 4.2 billion in 2022, with a compounded annual growth rate (CAGR) of 3.5% projected through 2030 [1].

Specifically, hydrocortisone constitutes nearly 40% of the corticosteroid segment, owing to its extensive clinical applications, safety profile, and relatively low manufacturing costs. The increasing incidence of autoimmune and inflammatory diseases and expanding generic markets are key drivers fueling hydrocoritsone utilization across North America, Europe, and Asia-Pacific.

Regulatory Landscape

Regulatory authorities such as the FDA (U.S. Food and Drug Administration), EMA (European Medicines Agency), and various national agencies tightly regulate hydrocortisone formulations, including HM variants. The approval process is streamlined for generics, fostering competition and influencing pricing strategies.

Additionally, health insurance policies and government reimbursement schemes impact accessibility and market penetration, especially across emerging economies.

Market Dynamics and Key Drivers

Epidemiological Factors

The surge in autoimmune disease prevalence and aging populations contribute to steady demand growth. For instance, rheumatoid arthritis affects over 0.5% of the global population, with corticosteroids like hydrocortisone forming a core component of treatment regimens [2].

Pipeline and Formulation Innovation

Although hydrocortisone is a mature molecule, manufacturers continue to develop novel formulations such as extended-release capsules and transdermal systems, broadening therapeutic use cases and improving patient compliance.

Generic Competition and Market Penetration

The expiration of patents for branded hydrocortisone products facilitated a proliferating generic market, resulting in significant price pressures but expanding access. HM Hydrocortisone, often issued by government or institutional suppliers, operates within this competitive landscape, influencing overall pricing.

Pricing Factors

Price determinants include raw material costs, manufacturing scale, regulatory compliance, and market competition. The presence of multiple generic suppliers fosters price erosion, especially in markets with high volume and regulatory approval for generics.

Competitive Landscape

Major Players and Supply Chain

Key global suppliers include Pharma companies such as Mylan, Sandoz, and Teva, offering generic hydrocortisone formulations with various delivery modalities. HM Hydrocortisone products—distributed through health institutions—often involve collaborations with local manufacturers, regulatory approval, and procurement contracts.

Market Share Distribution

While branded hydrocortisone maintains niche segments, generics dominate the market, capturing over 70% of volume sales. HM Hydrocortisone's market share varies geographically, generally aligning with government procurement policies and hospital formulary selections.

Quality and Compliance

Regulatory compliance, batch consistency, and bioequivalence are critical differentiation factors, influencing procurement decisions and pricing by health authorities.

Price Projections: 2023-2030

Current Pricing Trends

Hydrocortisone injectable formulations retail at approximately USD 0.10-0.20 per mg, while oral tablets average USD 0.05-0.15 per mg, depending on the brand, formulation, and purchase volume [3].

HM Hydrocortisone products, especially in institutional settings, tend to be priced competitively, leveraging bulk procurement and regulatory approval status.

Future Price Trends and Factors

Over the next decade, the hydrocortisone market is expected to experience moderate price declines driven by:

-

Increased Generic Competition: As patent expirations proliferate, price erosion is anticipated, particularly in mature markets.

-

Manufacturing Cost Optimization: Advances in synthesis and supply chain efficiency will further reduce costs, translating into lower retail prices.

-

Regulatory Harmonization: Streamlined approval processes could facilitate market entry, intensifying competition.

-

Market Maturation and Saturation: As penetration reaches peak levels, pricing stability or further reductions are expected in developed markets.

Projected Price Trends (2023-2030):

| Year | Oral Tablet Price (USD/mg) | Injectable Price (USD/mg) | Comments |

|---|---|---|---|

| 2023 | 0.10 – 0.15 | 0.15 – 0.20 | Stable, with minor fluctuations due to supply dynamics |

| 2025 | 0.09 – 0.13 | 0.14 – 0.18 | Continued generic competition pressure |

| 2027 | 0.08 – 0.12 | 0.13 – 0.17 | Entry of new generics, market consolidation |

| 2030 | 0.07 – 0.10 | 0.12 – 0.15 | Market stabilizes at lower price levels |

Regional Variations

-

North America & Europe: Competitive pricing with significant generic presence, leading to sustained price decreases.

-

Asia-Pacific & Latin America: Higher growth rates but relatively higher prices due to supply chain complexities and regulatory variability.

Implications for Stakeholders

-

Manufacturers: Emphasis should be on cost efficiencies, quality compliance, and expanding formulations to preserve margins. Market entry in emerging regions remains lucrative due to rising demand.

-

Healthcare Providers: Cost-effective generic hydrocortisone, including HM variants, remains accessible. Monitoring price trends can optimize procurement strategies.

-

Regulators: Balancing rapid approval with safety ensures competitive yet safe markets, affecting pricing and supply stability.

Key Takeaways

-

The global hydrocortisone market is mature but remains vital due to extensive clinical application, with a significant share held by generics like HM Hydrocortisone.

-

Price pressures are intensifying owing to global generic competition, regulatory harmonization, and manufacturing efficiencies.

-

Projections suggest a steady decline in hydrocortisone prices through 2030, particularly in developed markets, with regional variations influenced by local regulatory and economic factors.

-

For stakeholders, maintaining compliance, investing in cost optimization, and exploring innovative formulations can sustain profitability amid declining prices.

-

Expanding access in emerging markets offers growth opportunities despite price erosion in mature regions.

FAQs

1. What are the main factors influencing the price of HM Hydrocortisone?

Market competition, manufacturing costs, regulatory approvals, generic entry, procurement volume, and regional economic conditions primarily influence prices.

2. How does patent expiration impact the hydrocortisone market?

Patent expirations lead to increased generic availability, intensify competition, and generally drive prices downward, benefiting healthcare systems and patients.

3. What regions are expected to see the most significant price declines for hydrocortisone?

Developed markets such as North America and Europe are projected to experience the most substantial price decreases due to mature generic markets and regulatory pressures.

4. Are there any emerging formulations of hydrocortisone that could influence future pricing?

Yes, sustained-release, transdermal, and novel delivery systems could influence the market, potentially commanding higher prices if approved and adopted.

5. What strategic moves should manufacturers consider in the hydrocortisone market?

Focusing on cost reduction, expanding formulation options, ensuring regulatory compliance, and entering emerging markets can optimize profitability amid price declines.

References

[1] MarketWatch, "Corticosteroids Market Analysis," 2022.

[2] World Health Organization, "Global Autoimmune Disease Statistics," 2021.

[3] IQVIA, "Generic Drug Pricing and Market Trends," 2022.

More… ↓