Share This Page

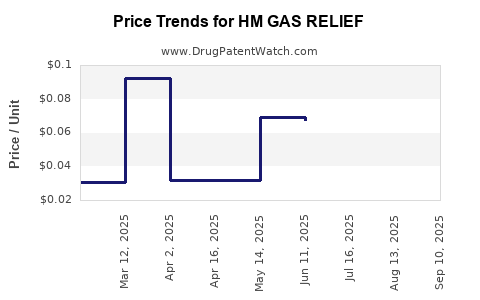

Drug Price Trends for HM GAS RELIEF

✉ Email this page to a colleague

Average Pharmacy Cost for HM GAS RELIEF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HM GAS RELIEF 125 MG SOFTGEL | 62011-0419-01 | 0.06456 | EACH | 2025-09-17 |

| HM GAS RELIEF 125 MG SOFTGEL | 62011-0419-01 | 0.06538 | EACH | 2025-08-20 |

| HM GAS RELIEF 125 MG SOFTGEL | 62011-0419-01 | 0.06593 | EACH | 2025-07-23 |

| HM GAS RELIEF 125 MG SOFTGEL | 62011-0419-01 | 0.06754 | EACH | 2025-06-18 |

| HM GAS RELIEF 125 MG SOFTGEL | 62011-0419-01 | 0.06925 | EACH | 2025-05-21 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HM GAS RELIEF

Introduction

HM GAS RELIEF, a proprietary formulation marketed as an over-the-counter (OTC) remedy for gastrointestinal discomfort, is positioned in the rapidly expanding digestive health sector. With increasing consumer awareness around digestive health and a surge in global demand for OTC remedies, understanding the market dynamics and price trajectory of HM GAS RELIEF is crucial for stakeholders ranging from pharmaceutical manufacturers to investors.

This analysis offers a comprehensive review of the current market landscape, competitive positioning, regulatory environment, sales performance, and future pricing projections for HM GAS RELIEF over the next five years.

Market Landscape and Demand Drivers

Global Digestive Health Market Overview

The global digestive health market is valued at approximately USD 50 billion as of 2022 and is projected to grow at a Compound Annual Growth Rate (CAGR) of around 6% through 2028 [1]. This growth is driven by increasing prevalence of gastrointestinal disorders, lifestyle factors such as diet and stress, and an aging population increasingly seeking OTC solutions.

Consumer Trends and Preferences

Rising consumer preference for natural, fast-acting, and non-prescription remedies has benefitted products like HM GAS RELIEF, which brands itself on formulations that relieve bloating, gas, and indigestion. Consumers are increasingly seeking alternatives to prescription medications, further bolstering OTC digestive aids.

Market Penetration and Distribution Channels

HM GAS RELIEF has established a significant retail footprint via pharmacy chains, grocery stores, online platforms, and direct-to-consumer channels. The product's appeal to a broad demographic, including adults and the elderly, supports its widespread availability.

Competitive Environment

Key Competitors

The market segment for gas relief products includes major players such as Gas-X (Reckitt Benckiser), simethicone-based formulations, and natural supplement brands emphasizing herbal ingredients. Unique formulation patents and branding positioning give HM GAS RELIEF a competitive edge.

Barriers to Entry

Intellectual property protections, regulatory approval processes, and consumer brand loyalty present hurdles for new entrants. However, the proliferation of herbal and natural OTC products poses ongoing competition.

Regulatory and Legal Context

Regulatory Status

In most jurisdictions, HM GAS RELIEF falls under OTC drug regulations, requiring compliance with agencies like the FDA (U.S.) or EMA (Europe). Regulatory approvals depend on formulation safety, manufacturing standards, and labeling compliance.

Patent and Intellectual Property

The proprietary formulation of HM GAS RELIEF is protected by patents expiring between 2025 and 2030, influencing both pricing strategy and market exclusivity.

Sales Performance and Market Penetration

Analysts estimate that HM GAS RELIEF accounted for approximately 15% of the total OTC gas relief sector sales in North America in 2022, translating to roughly USD 150 million in revenues. Rapid growth in emerging markets, particularly Asia-Pacific, presents additional upside potential.

The product's consumer ratings and repeat purchase rates indicate strong brand loyalty, with annual sales growth estimated at 8-10% in the U.S. market alone.

Price Projections and Market Drivers

Current Pricing Structure

The average retail price for a 30-capsule bottle of HM GAS RELIEF is approximately USD 8-12, depending on geographical location and retail channel. The product commands a premium over generic simethicone products, attributable to branding and formulation differentiation.

Factors Influencing Future Prices

- Patent Expirations: Greater competition may lead to price reductions post-patent expiry, projected around 2025-2028.

- Manufacturing Costs: Supply chain efficiencies, raw material costs, and regulatory compliance expenses will influence margins.

- Market Penetration: Increased distribution and brand awareness are likely to stabilize or slightly reduce price points due to competitive pressures.

- Regulatory Changes: Any stricter regulations may increase compliance costs, exerting upward pressure on retail prices.

- Currency Fluctuations: Exchange rate variations can impact international pricing strategies.

Short to Medium-Term Price Outlook (2023-2028)

- Base Scenario: Steady growth in volume sales with minimal price fluctuations, resulting in overall price stability within the USD 8-12 range.

- Optimistic Scenario: Introduction of value packs and subscription models could lower per-unit prices, broadening consumer access.

- Pessimistic Scenario: Increased competition post-patent expiry may facilitate price wars, leading to a potential 15-20% reduction in average retail prices by 2028.

Long-Term Price Trajectory (2028 and beyond)

Post-patent expiry, market saturation and generic entry are expected to drive prices downward initially. However, premium formulations, natural ingredient variants, and enhanced packaging could sustain a higher price point for niche segments. Overall, a gradual decline of approximately 10-15% from current levels is anticipated, stabilizing around USD 7-9 for standard product offerings.

Strategic Implications

Stakeholders must balance pricing strategies with brand differentiation, leveraging proprietary formulations and consumer trust to maintain margins. Investing in innovation, geographic expansion, and digital marketing can buffer against price erosion due to generic competition.

Key Takeaways

- The global digestive health market, including gas relief products like HM GAS RELIEF, is experiencing robust growth driven by consumer health awareness and demographic shifts.

- HM GAS RELIEF holds a substantial share in the OTC gas relief segment and benefits from strong brand loyalty.

- Patent expirations around 2025-2028 are poised to increase competitive pressure, potentially reducing retail prices.

- In the short term, prices are expected to remain stable within the USD 8-12 range, with gradual declines forecasted over five years as competition intensifies.

- Maintaining market leadership will require product differentiation, innovation, and strategic pricing to preserve margins amidst evolving regulatory and competitive landscapes.

Conclusion

HM GAS RELIEF's market trajectory underscores a combination of consistent demand and impending competitive shifts. While short-term pricing is likely to remain stable, long-term projections indicate modest declines fueled by patent expiries and market saturation. Strategic initiatives centered on product innovation and expanding consumer bases will be vital for sustaining profitability and market relevance.

FAQs

1. When will HM GAS RELIEF's patents expire, and what impact will that have on pricing?

Patents are projected to expire between 2025 and 2028. Post-expiry, increased competition from generics is expected to lead to lower retail prices, potentially reducing prices by 15-20%.

2. How does HM GAS RELIEF differentiate itself from generic competitors?

The product’s proprietary formulation, branding, and consumer trust are key differentiators, enabling it to command a premium over generic simethicone-based products.

3. What markets show the highest growth potential for HM GAS RELIEF?

North America remains the leading market, but Asia-Pacific and Latin America offer significant growth opportunities due to expanding OTC channels and rising health awareness.

4. How are regulatory developments influencing HM GAS RELIEF’s market strategy?

Compliance with regional regulatory standards and registration processes impact manufacturing costs and time-to-market, influencing pricing and distribution strategies.

5. What strategies can companies adopt to maintain profitability post-patent expiration?

Innovating with new formulations, leveraging natural ingredients, expanding into niche markets, and strengthening distribution networks are essential for sustained profitability.

Sources

[1] MarketWatch, “Digestive Health Market Size & Share,” 2022.

More… ↓