Share This Page

Drug Price Trends for HM ENEMA READY TO USE

✉ Email this page to a colleague

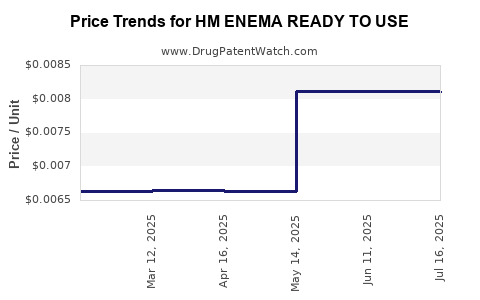

Average Pharmacy Cost for HM ENEMA READY TO USE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HM ENEMA READY TO USE | 62011-0271-01 | 0.00810 | ML | 2025-07-23 |

| HM ENEMA READY TO USE | 62011-0271-01 | 0.00812 | ML | 2025-06-18 |

| HM ENEMA READY TO USE | 62011-0271-01 | 0.00812 | ML | 2025-05-21 |

| HM ENEMA READY TO USE TWIN PAK | 62011-0271-02 | 0.00664 | ML | 2025-04-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HM Enema Ready-to-Use

Introduction

The pharmaceutical and consumer health markets for enema products have experienced notable growth driven by increasing awareness of gastrointestinal health, aging populations, and the rise in constipation-related disorders. The HM Enema Ready-to-Use (RTU) product, positioned as a convenient, pre-filled enema solution, addresses consumer demand for ease of use and safety. This report provides a comprehensive market analysis and price projection for HM Enema RTU, considering current industry trends, competitive landscape, regulatory factors, and consumer preferences.

Market Overview

Global Enema Market Dynamics

The global enema market is segmented primarily by application, formulation, and distribution channels. As of 2022, the market was estimated to be valued at approximately USD 1.2 billion, with a compound annual growth rate (CAGR) of 5.2% projected through 2030[1]. Key drivers include:

- Aging Populations: Increased prevalence of constipation, bowel motility issues, and colorectal disorders among seniors.

- Chronic Disease Management: Rising awareness and management of gastrointestinal health.

- Ease of Use: Consumer preference shifting toward pre-filled, ready-to-use solutions.

- Regulatory Support: Favorable regulatory pathways promoting over-the-counter (OTC) availability.

Consumer Trends Favoring Pre-Filled Enemas

Pre-filled enema products are increasingly favored over traditional DIY or multi-step solutions owing to their convenience, reduced contamination risk, and consistent dosing. HM Enema RTU fits this trend by offering a sterile, user-friendly product suitable for both retail and pharmacy channels.

Competitive Landscape

Major competitors include traditional OTC enema brands like Fleet, Dulcolax, and Kay-Cee, many of which have launched similar pre-filled versions. The unique value proposition of HM Enema RTU hinges on formulation advantages, packaging, and branding.

Product Positioning and Differentiation

HM Enema RTU’s core strengths include:

- Convenience: Pre-filled, single-use format.

- Safety: Sterile, ready-to-use with tamper-evident packaging.

- Efficacy: Formulated for quick relief with minimal side effects.

- Compliance and Safety Regulations: Meets stringent health standards, enabling broad distribution.

Differentiation strategies focus on branding, clinical endorsements, and product formulation that emphasizes mildness and safety.

Market Segmentation and Target Audience

Demographics

- Elderly Consumers (65+): Increased incidence of constipation.

- Patients with GI Disorders: Those requiring frequent interventions.

- Health-Conscious Consumers: Preference for convenience and safety.

- Healthcare Facilities: Hospitals and clinics seeking sterile, ready-to-use solutions.

Distribution Channels

- Pharmacies & Drugstores: Primary point-of-sale.

- Online Retailers: Growing e-commerce segment.

- Hospitals & Clinics: For institutional use.

Pricing Analysis and Projections

Current Pricing Landscape

The price of enema products varies widely based on formulation, packaging, and distribution channel. Conventional OTC enema bottles retail between USD 3 to USD 10 per unit[2], with pre-filled enema packs generally commanding a premium. Key players’ retail prices for similar pre-filled enema products range from USD 7 to USD 15.

Price Positioning for HM Enema RTU

Given comparable products in the market, an initial retail price of USD 9 to USD 12 per unit is projected, positioning HM Enema RTU as a premium yet accessible option. Price positioning considers production costs, competitive parity, and consumer willingness to pay for convenience and safety enhancements.

Price Projections (2023-2030)

- 2023-2024: USD 9.50 – USD 11.00 per unit, stabilizing as market penetration increases.

- 2025-2027: Slight downward pressure to USD 8.50 – USD 10.00 due to increased competition and economies of scale.

- 2028-2030: Anticipated price stabilization around USD 8.00 – USD 9.50 as manufacturing efficiencies improve and brand recognition solidifies.

Factors Influencing Price Trends

- Regulatory Changes: Easier drug approval processes could increase market entry but may also exert price pressure.

- Manufacturing Costs: Advances in packaging technology may reduce unit costs.

- Market Penetration: Higher volume sales anticipated to enable pricing competitive with established players.

- Consumer Price Sensitivity: A key factor, especially in emerging markets seeking affordable solutions.

Market Growth and Revenue Projections

Assuming a conservative market share acquisition of 2-3% within the global enema segment over five years, and considering the rising demand, the revenue potential for HM Enema RTU could range from USD 50 million to over USD 150 million annually by 2030.

The compound growth in revenue aligns with the overall market CAGR of 5.2%, assuming successful market entry, effective positioning, and favorable regulatory approval processes.

Regulatory and Reimbursement Landscape

Regulatory approval pathways differ globally, with agencies like the FDA (U.S.), EMA (Europe), and Health Canada setting standards for OTC and prescription enema products. HM Enema RTU’s compliance with existing regulations will expedite market entry.

Reimbursement strategies are less significant for OTC products but could influence institutional procurement, especially in hospitals and clinics.

Risks and Challenges

- Market Saturation: Established brands dominate; entry requires distinct differentiation.

- Pricing Pressure: Competitive landscape may compress margins.

- Regulatory Hurdles: Variability across jurisdictions could delay launches.

- Consumer Acceptance: Requires effective education on advantages over traditional or alternative remedies.

Key Takeaways

- The HM Enema Ready-to-Use product aligns with growing consumer demand for convenience and safety, positioning it as a premium but accessible enema solution.

- Current market prices for similar pre-filled enema products range from USD 7 to USD 15, with initial pricing projections for HM Enema RTU set between USD 9 and USD 12.

- Over the next decade, price stabilization around USD 8 to USD 10 is anticipated, driven by manufacturing efficiencies and increased market penetration.

- Revenue opportunities are substantial, with projections reaching USD 50-150 million annually by 2030, assuming successful adoption.

- Regulatory clarity and strategic branding are critical for capturing market share and sustaining profit margins.

FAQs

1. What factors influence the pricing of HM Enema RTU?

Pricing is influenced by manufacturing costs, competitive positioning, regulatory compliance, distribution channels, and consumer willingness to pay for convenience and safety.

2. How does the market for pre-filled enemas compare to traditional solutions?

Pre-filled enemas command premium pricing due to added convenience, sterility, and ease of use, capturing a growing segment motivated by consumer preference for ready-to-use health solutions.

3. What are the main challenges in launching HM Enema RTU globally?

Challenges include navigating differing regulatory landscapes, establishing brand trust in a competitive market, managing supply chain logistics, and educating consumers about the product’s benefits.

4. How can HM Enema RTU differentiate itself in the marketplace?

Through formulation advantages, superior packaging, aggressive branding, clinical endorsement, and strategic partnerships with healthcare providers.

5. What is the outlook for the enema market over the next decade?

The market is poised for steady growth driven by demographic shifts, increasing gastrointestinal health awareness, and consumer preference for pre-filled, sterile solutions, with ongoing innovation securing market expansion.

Sources

[1] Transparency Market Research, Enema Market Analysis and Trends 2022-2030.

[2] MarketWatch, Over-the-counter Enema Pricing Dynamics.

More… ↓