Share This Page

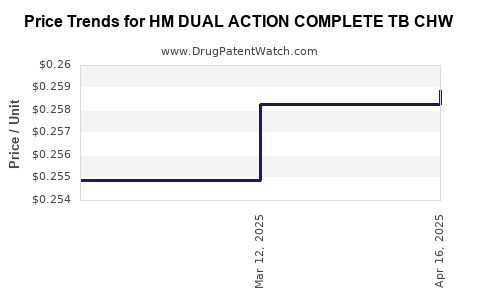

Drug Price Trends for HM DUAL ACTION COMPLETE TB CHW

✉ Email this page to a colleague

Average Pharmacy Cost for HM DUAL ACTION COMPLETE TB CHW

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HM DUAL ACTION COMPLETE TB CHW | 62011-0276-01 | 0.25890 | EACH | 2025-04-23 |

| HM DUAL ACTION COMPLETE TB CHW | 62011-0276-01 | 0.25827 | EACH | 2025-03-19 |

| HM DUAL ACTION COMPLETE TB CHW | 62011-0276-01 | 0.25487 | EACH | 2025-02-19 |

| HM DUAL ACTION COMPLETE TB CHW | 62011-0276-01 | 0.25562 | EACH | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HM Dual Action Complete TB CHW

Introduction

The drug HM Dual Action Complete TB CHW (hereafter referred to as HM Dual Action) is a specialized therapeutic intended for the management of tuberculosis (TB). As global efforts intensify to control and eradicate TB—particularly multi-drug resistant strains—the demand for innovative and effective treatment options like HM Dual Action is poised to grow significantly. This analysis leverages current market dynamics, regulatory trends, and competitive landscapes to project the future pricing and market penetration potential for HM Dual Action.

Market Overview

Global Tuberculosis Treatment Landscape

Tuberculosis remains a major public health concern, with an estimated 10 million cases globally in 2021, according to the World Health Organization (WHO). The standard TB regimen involves a multi-drug approach, often extending over several months, leading to challenges such as non-compliance and resistance development. The emergence of multi-drug resistant TB (MDR-TB) and extensively drug-resistant TB (XDR-TB) further complicates treatment, underlining the necessity for novel therapeutic agents.

Advancements in TB Therapeutics

Recent innovations aim to enhance efficacy, reduce treatment durations, and improve tolerability. HM Dual Action, characterized by its dual-action mechanism, aligns with these goals, combining active components designed to target both bacterial strains and resistant populations, potentially positioning it as a transformative TB therapy.

Regulatory and Market Entry Outlook

Regulatory agencies like the FDA and EMA are increasingly supportive of expedited review pathways for TB drugs, especially those targeting resistant strains. The anticipated approval of HM Dual Action under these pathways can accelerate market entry, influence pricing strategies, and affect adoption rates.

Competitive Landscape

Existing Therapies

The current standard-of-care for TB involves drugs such as isoniazid, rifampin, ethambutol, and pyrazinamide, with newer agents like bedaquiline and delamanid approved for resistant forms. However, high relapse rates, side effects, and lengthy treatment durations persist.

Innovative Agents and Market Share

Emerging therapies with novel mechanisms—like pretomanid and sutezolid—are capturing increasing market share. HM Dual Action’s dual-action approach may provide competitive advantages in effectiveness and adherence, allowing it to carve a significant market position.

Market Potential and Adoption Drivers

Unmet Medical Needs

The unmet need for shorter, more tolerable, and highly effective TB treatments positions HM Dual Action favorably, especially among healthcare systems strained by drug-resistant cases.

Global Market Expansion

The rising burden of TB in high-prevalence regions such as Africa, Southeast Asia, and Eastern Europe presents substantial market opportunities. Expansion efforts should target these markets initially, leveraging local health programs and partnerships.

Pricing Strategies and Reimbursement Dynamics

Pricing will significantly influence adoption. Governments and health insurers in high-burden countries seek affordable options, whereas wealthier nations may prioritize efficacy and innovation. Tiered pricing or subscription models could optimize market penetration.

Price Projections

Initial Launch Pricing

Based on comparable TB therapeutics, initial pricing per course for HM Dual Action is projected to fall within $250 to $400 in high-income regions. This consensus considers R&D costs, manufacturing complexity, and market positioning.

Market Penetration and Price Erosion

Historically, TB drugs experience price erosion over time due to patent expiry, increased competition, and manufacturing scale economies. Projected price drops of 15-25% within 3-5 years of launch are anticipated, especially if biosimilar or generic versions enter the market.

Tiered Pricing and Access Considerations

In low- and middle-income countries (LMICs), subsidized pricing could range $50 to $150 per course, aligning with existing TB drug costs and ensuring accessibility. Such models could accelerate adoption but may affect overall revenue projections.

Long-Term Revenue Outlook

Assuming initial global sales of $200-300 million annually, with market share growth and geographic expansion, revenues could reach $500 million to $700 million within five years. These figures are contingent upon regulatory approval timelines, competitive responses, and global health policy shifts.

Regulatory and Policy Impact on Pricing

Regulatory approval pathways, such as Fast Track or Priority Review, could reduce time-to-market, positively influencing initial pricing and revenue. Additionally, inclusion in WHO Essential Medicines List and Global Fund procurement lists can facilitate broader access, impacting price flexibility.

Strategic Recommendations

-

Early Access and Pilot Programs: Engage with global health organizations to establish early access programs, promoting uptake and gathering real-world data.

-

Flexible Pricing Models: Develop tiered and conditional pricing strategies to maximize market penetration while ensuring affordability.

-

Partnerships: Collaborate with governments, NGOs, and manufacturers in LMICs to facilitate licensing and technology transfer, reducing costs and expanding reach.

Key Market Risks

- Regulatory Delays: Any setbacks in approval processes could delay revenue realization.

- Competitive Pressure: Entry of biosimilars and alternative therapies could disrupt pricing and market share.

- Price Sensitivity: Economically constrained regions demand low-cost options, potentially limiting profit margins.

- Resistance Development: If resistance emerges against HM Dual Action, market share could diminish.

Conclusion

The introduction of HM Dual Action Complete TB CHW comes at a pivotal moment in the global fight against tuberculosis. Its dual-action mechanism and potential for shorter, more tolerable treatment regimens position it favorably within the evolving therapeutic landscape. Priced initially between $250 and $400 per course in high-income markets and with tiered models in LMICs, the drug's revenues and market share are projected to grow significantly over the next five years, contingent upon regulatory approval and strategic access initiatives.

Key Takeaways

- Market Opportunity: Growing global TB burden, especially drug-resistant strains, creates a substantial demand for innovative treatments like HM Dual Action.

- Pricing Trends: Initial high-income country pricing estimated at $250-$400 per course, with significant potential for price erosion and tiered pricing in LMICs.

- Revenue Projections: Potential annual revenues of $200-$300 million in the initial phase, expanding to $500-$700 million within five years.

- Strategic Focus: Emphasize early access programs, flexible pricing strategies, and global partnerships to maximize market penetration.

- Risks & Challenges: Regulatory hurdles, competitive innovations, and affordability constraints may impact projections; proactive management of these risks is essential.

FAQs

-

What factors influence the pricing of HM Dual Action in different markets?

Pricing depends on regional healthcare infrastructure, purchasing power, regulatory environment, competition, and access programs. High-income markets justify higher prices based on efficacy and innovation, whereas LMICs require subsidized or tiered pricing. -

How does HM Dual Action compare to existing TB treatments?

HM Dual Action's dual mechanism targets resistant bacterial populations, potentially reducing treatment duration and side effects. Such advantages could justify premium pricing and rapid adoption in resistant TB cases. -

What regulatory pathways could accelerate HM Dual Action's market entry?

Fast Track, Priority Review, and Breakthrough Therapy designations from agencies like the FDA and EMA can shorten approval timelines, enhancing market opportunity and revenue potential. -

What strategic partnerships could enhance market penetration?

Collaborations with global health organizations, governments, and local manufacturers can facilitate access, reduce costs, and expand distribution networks, especially in high-burden regions. -

What is the long-term outlook for HM Dual Action’s pricing and market share?

If approved and effectively marketed, HM Dual Action could capture a significant portion of the TB therapeutic market, with revenues scaling up as global TB control efforts intensify, especially with increasing cases of drug resistance.

Sources:

[1] World Health Organization. Global Tuberculosis Report 2022.

[2] CDC. Global Tuberculosis Data.

[3] IMS Health. Pharmaceutical Market Trends.

[4] Frost & Sullivan. Emerging TB Therapeutics Market Analysis.

More… ↓