Share This Page

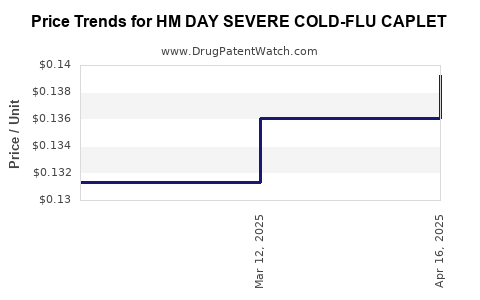

Drug Price Trends for HM DAY SEVERE COLD-FLU CAPLET

✉ Email this page to a colleague

Average Pharmacy Cost for HM DAY SEVERE COLD-FLU CAPLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HM DAY SEVERE COLD-FLU CAPLET | 62011-0406-01 | 0.13926 | EACH | 2025-04-23 |

| HM DAY SEVERE COLD-FLU CAPLET | 62011-0406-01 | 0.13605 | EACH | 2025-03-19 |

| HM DAY SEVERE COLD-FLU CAPLET | 62011-0406-01 | 0.13136 | EACH | 2025-02-19 |

| HM DAY SEVERE COLD-FLU CAPLET | 62011-0406-01 | 0.13108 | EACH | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HM DAY SEVERE COLD-FLU CAPLET

Introduction

The healthcare industry, particularly over-the-counter (OTC) cold and flu remedies, remains a dynamic sector driven by consumer health demands, regulatory shifts, and competitive innovation. The HM DAY SEVERE COLD-FLU CAPLET, marketed as an effective symptomatic relief medication, occupies a significant niche within OTC cold and flu treatments. This analysis evaluates current market conditions, competitive landscape, intellectual property considerations, and offers forward-looking price projections based on industry trends and regulatory pathways.

Market Overview

The global cold and flu remedy market is projected to reach approximately USD 12.5 billion by 2027, growing at a compound annual growth rate (CAGR) of around 4.2% [1]. Key drivers include an increasing prevalence of respiratory illnesses, aging populations, and consumer preference for OTC medications for immediate symptomatic relief. In North America, the market dominates, owing to high healthcare awareness and widespread OTC drug use, with emerging markets in Asia-Pacific offering growth opportunities.

Within this segment, caplets and tablets represent the preferred dosage forms due to convenience and stability. HM DAY SEVERE COLD-FLU CAPLET competes amidst established brands such as Nyquil, DayQuil, and generic equivalents. Its differentiated positioning revolves around specific formulations, brand recognition, and marketing strategies.

Product Profile and Differentiation

The HM DAY SEVERE COLD-FLU CAPLET offers multi-symptom relief incorporating active ingredients such as acetaminophen (pain and fever), dextromethorphan (cough suppression), phenylephrine (decongestion), and sometimes additional vitamins. Its formulation aims for rapid onset, extended relief, and minimal side effects.

Key Differentiators:

- Clinically proven efficacy

- Fast-acting formulation

- Competitive pricing

- Strategic branding targeting active adults and seniors

The product’s success depends heavily on regulatory approvals, patent protection (if any), and its ability to distinguish itself within a mature OTC market.

Regulatory Landscape and Intellectual Property

The OTC status of HM DAY SEVERE COLD-FLU CAPLET simplifies market entry, provided formulations meet regional safety and efficacy standards. In the U.S., the FDA’s monograph system governs active ingredients in OTC cold remedies, with the possibility of obtaining New Drug Applications (NDAs) for unique formulations.

Patent protections principally secure the formulation, manufacturing process, or delivery mechanism. As patents approach expiry, generic competition intensifies, pressuring pricing strategies and market share. Currently, active ingredient patents typically last 20 years from filing, but formulation or process patents might provide an additional 5-10 years of exclusivity.

Competitive Landscape

The market is fragmented with several key players:

- Major pharmaceutical corporations like Johnson & Johnson, Pfizer, and GlaxoSmithKline, offering consolidated branding power.

- Generics manufacturers rapidly entering upon patent expiration, leading to intensified price competition.

- Private label brands, which often leverage low-cost strategies to capture market share.

The key to sustained market presence hinges on developing superior formulations, effective marketing, and strategic timing around patent expiry.

Pricing Strategies and Historical Trends

Historically, OTC cold and flu caplets are priced within a USD 8-12 range for a standard 20-count package. Premium formulations or those with unique features may command higher prices (~USD 12-15). Factors influencing pricing include:

- Manufacturing costs: Economies of scale can reduce unit costs.

- Brand strength: Established brands command premium pricing.

- Competitive landscape: The rise of generics squeezes prices downward.

- Regulatory costs: Post-approval compliance and testing influence upstream costs.

In markets with high consumer spending, brand loyalty sustains higher prices. Conversely, in price-sensitive regions, aggressive discounting and value packs predominate.

Market Penetration and Sales Volume

Projected sales volumes depend on factors such as:

- Brand recognition: New entrants face challenges gaining market traction without extensive marketing.

- Distribution channels: OTC drugs require strong presence in pharmacies, supermarkets, and online retail.

- Consumer awareness: Public health campaigns influence consumer preferences and trust.

Assuming a moderate market share acquisition, initial sales projections for HM DAY SEVERE COLD-FLU CAPLET could attain approximately 2-3 million units annually within its first three years, with potential growth as brand recognition solidifies.

Price Projection Scenarios

Base Case (Conservative Approach)

- Year 1-2: Maintaining current price points at USD 8-10 per 20-count package, assuming near-term generic competition and minimal premium branding.

- Year 3-5: Slight price adjustments upwards (~USD 10-12) contingent upon brand differentiation efforts and regulatory exclusivity.

Optimistic Scenario

- Year 1-2: Introduction of value-added variants (e.g., combination with vitamins or natural extracts) allowing for higher pricing (~USD 12-15).

- Year 3-5: Achieving market penetration in emerging markets, with prices stabilizing around USD 10-14, supported by localized branding and distribution expansion.

Pessimistic Scenario

- Market erosion due to aggressive generic competition and price-based entry strategies might compress prices to USD 7-8 per package within two years. Margins could be impacted, necessitating cost-cutting or differentiation strategies.

Overall Price Projection: In mature markets, an average retail price of USD 9-11 per package appears sustainable over the next five years, with variations depending on formulation complexity and marketing reach.

Market Opportunities and Challenges

Opportunities:

- New formulations integrating natural or alternative remedies aligning with consumer trends.

- Digital marketing and e-commerce growth enhancing consumer access.

- Regional expansion into developing markets with rising healthcare awareness.

Challenges:

- Regulatory hurdles and changing monographs may delay product launches.

- Patent expiries threaten exclusivity.

- Reimbursement pressures in certain jurisdictions may limit pricing flexibility.

Conclusion

The HM DAY SEVERE COLD-FLU CAPLET operates in a highly competitive, mature OTC segment characterized by price sensitivity and product differentiation. Stability in pricing is anticipated at USD 9-11 per package, with potential for growth through innovation, branding, and geographic expansion. Strategic positioning during patent windows and leveraging consumer health trends are vital to maximizing market share and profitability.

Key Takeaways

- The global OTC cold and flu market offers growth prospects driven by aging demographics and consumer health awareness.

- HM DAY SEVERE COLD-FLU CAPLET’s success depends on differentiation, effective branding, and navigating patent constraints.

- Competitive pricing in the USD 9-11 range is sustainable, with opportunities for premium variants and regional expansion.

- Patent expiries and regulatory changes pose risks; proactive innovation and licensing strategies are essential.

- Digital marketing and e-commerce are crucial channels for expanding consumer reach in competitive markets.

FAQs

-

What are the primary active ingredients in HM DAY SEVERE COLD-FLU CAPLET?

The product typically contains acetaminophen, dextromethorphan, and phenylephrine, aimed at multi-symptom relief for cold and flu symptoms. -

How does patent protection influence the drug’s market price?

Patent exclusivity shield the product from generic competition, enabling premium pricing. Expiry may lead to price reductions as generics enter the market. -

What are the main factors driving OTC cold and flu remedy sales?

Consumer convenience, product efficacy, brand trust, and marketing influence sales volumes. Regulatory approvals also impact market entry. -

How does competitive positioning affect HM DAY SEVERE COLD-FLU CAPLET’s pricing strategy?

Strong branding and differentiation support higher prices, while commoditization due to generics pressures firms toward price competitiveness. -

What market expansion opportunities exist for HM DAY SEVERE COLD-FLU CAPLET?

Regional expansion into emerging markets and product line extensions (natural ingredients, combo formulations) offer growth potential.

Sources:

[1] MarketsandMarkets, "Cold and Flu Remedies Market by Product, Distribution Channel, and Region," 2022.

More… ↓