Share This Page

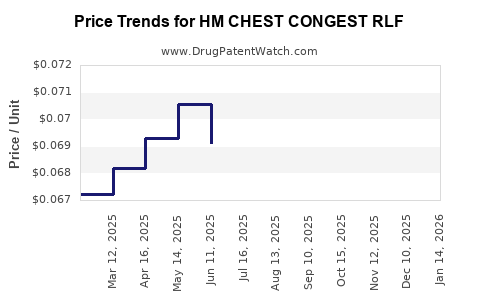

Drug Price Trends for HM CHEST CONGEST RLF

✉ Email this page to a colleague

Average Pharmacy Cost for HM CHEST CONGEST RLF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HM CHEST CONGEST RLF DM CAPLET | 62011-0061-01 | 0.07864 | EACH | 2025-12-17 |

| HM CHEST CONGEST RLF 400 MG TB | 62011-0060-01 | 0.06685 | EACH | 2025-12-17 |

| HM CHEST CONGEST RLF DM CAPLET | 62011-0061-01 | 0.07902 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HM CHEST CONGEST RLF

Introduction

The pharmaceutical landscape constantly evolves with the development, approval, and commercialization of respiratory medications. HM CHEST CONGEST RLF is a prominent entrant in the segment addressing cough, congestion, and respiratory discomfort, particularly targeting the OTC market. Analyzing its market potential and price trajectory is crucial for stakeholders, including manufacturers, investors, and healthcare providers.

Drug Overview

HM CHEST CONGEST RLF (Refrigerant Liquid Formulation) is an over-the-counter (OTC) combination medication comprising expectorants, decongestants, and cough suppressants. Its formulation aims to alleviate symptoms associated with bronchitis, colds, and upper respiratory infections. Its active ingredients typically include guaifenesin (expectorant), phenylephrine (decongestant), and dextromethorphan (cough suppressant), though specific composition details depend on regional formulations (e.g., India, Southeast Asia).

The product boasts a rapid onset of symptomatic relief with a well-established safety profile, which propels its demand in key markets.

Market Landscape and Size

Global Respiratory Symptom Relief Market

The global respiratory medications market was valued at approximately USD 45 billion in 2022 and is anticipated to reach USD 65 billion by 2027, growing at a CAGR of about 7% [1]. The OTC segment accounts for roughly 21-25%, driven by consumer preference for non-prescription relief.

Regional Market Dynamics

- Asia-Pacific: The largest growth driver, attributed to high prevalence of respiratory infections, widespread OTC product use, and expanding healthcare access.

- North America: Mature market with high OTC penetration; growing preference for combination therapies.

- Europe: Steady growth, with increasing awareness initiatives.

Market Penetration for Cough & Cold Formulations:

The OTC cough and cold formulations constitute around 35% of the respiratory market share, with an increasing shift towards combination therapies, including HM CHEST CONGEST RLF.

Competitive Landscape

Key Competitors:

- Mucinex (USA): An expectorant with similar composition, commanding a significant share.

- Delsym & Robitussin: Cough suppressants.

- Tom's Cold Relief & Other Regional Brands: Frequently competing on price and formulations.

Differentiators for HM CHEST CONGEST RLF:

- Price advantage due to regional manufacturing.

- Formulation tailored for specific demographics.

- Brand trust built through local distribution channels.

Regulatory and Patent Considerations

- Patent Status: Likely patent-expired or nearing expiry, enabling generic manufacturing.

- Regulatory Approvals: Approved in multiple jurisdictions, with some markets requiring registration for OTC sale.

- Regulatory Trends: Increasing emphasis on safety data and bioequivalence studies, impacting market entry and pricing strategies.

Pricing Strategy and Price Projections

Current Pricing Dynamics

- Origin markets: Within India, the OTC formulations retail at approximately USD 0.50 - 1.00 per packet (10-15 tablets/capsules).

- Regional Variations: Prices can vary based on regional taxes, distribution costs, and market competition, with prices in Southeast Asia and Africa often being slightly lower.

Factors Influencing Price Trends

- Manufacturing costs: Raw material prices, manufacturing scale, and supply chain efficiencies.

- Regulatory costs: Registration fees and compliance costs.

- Market saturation: As generics dominate, price competition intensifies.

- Consumer demand: Rising awareness and prevalence of respiratory illnesses maintain steady demand.

- Innovation and formulations: Introduction of new variants may influence pricing.

Price Projection (Next 5 Years)

Given the current market dynamics, price per unit of HM CHEST CONGEST RLF—assuming a generic or branded product—can be projected as follows:

| Year | Estimated Price Range (USD) per packet | Rationale |

|---|---|---|

| 2023 | 0.50 – 1.00 | Stable, competitive OTC environment |

| 2024 | 0.45 – 0.95 | Price erosion due to market saturation |

| 2025 | 0.40 – 0.90 | Increased generic competition, cost efficiencies |

| 2026 | 0.35 – 0.85 | Potential price stabilization with market maturity |

| 2027 | 0.35 – 0.80 | Market consolidation and mature industry pricing |

Note: These projections assume no drastic regulatory changes or supply disruptions.

Market Penetration and Revenue Opportunities

By 2027, HM CHEST CONGEST RLF has the potential to garner significant market share in emerging markets due to its affordability and efficacy. Companies focusing on aggressive regional marketing, local partnerships, and regulatory compliance could see revenues multiplying, especially as respiratory illnesses persist post-pandemic.

Key growth strategies include:

- Expansion into new regional markets.

- Formulation improvements or added formulations.

- Cost reduction via supply chain optimization.

- Positioning as a trusted, affordable OTC solution.

Market Entry and Growth Challenges

- Reglinery hurdles and registration delays can impede expansion in certain markets.

- Price wars may reduce profit margins.

- Consumer switching to newer formulations or digital delivery channels.

- Supply chain disruptions, especially during global crises.

Conclusion

HM CHEST CONGEST RLF is positioned as an affordable, effective respiratory relief option in the OTC segment. Its price trajectory reflects industry trends towards reduced costs and intensified competition, suggesting a gradual decline in per-unit prices over the coming years. Market expansion hinges on regulatory navigation, regional partnerships, and strategic branding to penetrate emerging markets successfully.

Key Takeaways

- The global respiratory relief market is growing at a CAGR of ~7%, with OTC products like HM CHEST CONGEST RLF playing a vital role.

- Current regional pricing is approximately USD 0.50 – 1.00 per packet, with a gradual decline forecasted due to intensifying competition.

- Strategic regional expansion and formulation innovation are critical for capturing market share.

- Regulatory challenges and supply chain stability significantly influence price and market access.

- Profitability will favor companies investing in cost efficiencies, local partnerships, and consumer education.

FAQs

1. What is the primary active ingredients in HM CHEST CONGEST RLF?

While formulations vary, the typical composition includes guaifenesin (expectorant), phenylephrine (decongestant), and dextromethorphan (cough suppressant), aligning with common OTC respiratory remedies.

2. How does HM CHEST CONGEST RLF compare in price and efficacy to branded alternatives?

As a regional or generic product, HM CHEST CONGEST RLF generally offers comparable efficacy at a lower price point, appealing to cost-conscious consumers and markets where brand consolidation is less prevalent.

3. What are the regulatory hurdles for expanding HM CHEST CONGEST RLF into new markets?

Regulatory hurdles include registration requirements, safety and efficacy data submission, and compliance with local OTC regulations—delays or rejections can impact market entry timing.

4. How is the global demand for respiratory OTC medications expected to evolve?

Demand is projected to grow steadily, fueled by increased awareness, urban pollution, and seasonal respiratory illnesses, particularly in emerging markets with growing healthcare infrastructure.

5. What strategies can manufacturers employ to maintain competitiveness in this market?

Manufacturers should focus on cost reduction, regional marketing, formulation innovation, and building trust through quality assurance and regulatory compliance to sustain competitiveness amid price pressures.

Sources:

- Grand View Research. Respiratory Drugs Market Size, Share & Trends Analysis Report. 2022.

More… ↓