Share This Page

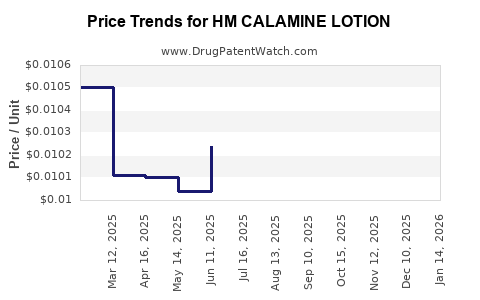

Drug Price Trends for HM CALAMINE LOTION

✉ Email this page to a colleague

Average Pharmacy Cost for HM CALAMINE LOTION

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HM CALAMINE LOTION | 62011-0114-01 | 0.01081 | ML | 2025-12-17 |

| HM CALAMINE LOTION | 62011-0114-01 | 0.01071 | ML | 2025-11-19 |

| HM CALAMINE LOTION | 62011-0114-01 | 0.01112 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HM Calamine Lotion

Introduction

HM Calamine Lotion, a topical dermatological product primarily used to manage itching, irritation, and minor skin conditions, has maintained a significant presence within the over-the-counter (OTC) skincare market. Understanding its market dynamics and price trajectories is critical for industry stakeholders, including pharmaceutical manufacturers, distributors, and investors. This analysis provides comprehensive insights into current market conditions, competitive landscape, regulatory environment, and future price projections.

Market Overview

Product Description and Therapeutic Use

HM Calamine Lotion contains zinc oxide and calcium carbonate, acting as antipuritic and soothing agents. Its applications cover eczema, insect bites, allergic reactions, and prickly heat, making it a staple in dermatological OTC formulations. The product’s efficacy, safety profile, and affordability have sustained its popularity globally, especially in regions with high prevalence of skin irritations.

Market Size and Segmentation

According to recent industry reports, the global dermatological OTC market was valued at approximately USD 12.4 billion in 2022, with calamine-based formulations constituting a notable segment, especially in North America and Asia-Pacific. While precise sales figures for HM Calamine Lotion are proprietary, market analysts estimate its global annual sales to be in the range of USD 150–200 million, driven predominantly by mature markets in North America, Europe, and select Asian economies.

The product caters predominantly to consumers seeking OTC soothing remedies, with distribution channels encompassing pharmacies, retail outlets, and e-commerce platforms. Segment-wise, adult skincare remains dominant, although pediatric applications are on the rise due to increasing awareness of safe OTC options for children.

Competitive Landscape

Key Players

The market includes several significant players:

- Johnson & Johnson: Market leader with its broad dermatological OTC portfolio, including calamine-based products.

- Bayer AG: Offers calamine lotions and ointments with established brand recognition.

- Chattem Inc. (a subsidiary of Sanofi): Known for its popular "Caladryl" brand, integrating calamine with other soothing agents.

- Generic manufacturers: Numerous regional players supply store-brand calamine lotions at lower price points.

Market differentiation

Brand differentiation is primarily rooted in:

- Formulation enhancements (e.g., added moisturizers or anti-inflammatory agents)

- Packaging innovations for ease of application

- Marketing towards pediatric or allergy sufferers

Regulatory Environment

In the United States, HM Calamine Lotion falls under OTC status regulated by the Food and Drug Administration (FDA). Similar regulatory frameworks exist globally, with stringent safety and labeling standards that influence formulation and pricing strategies.

Market Drivers and Limitations

Drivers

- Increasing prevalence of dermatological conditions: Rising allergic reactions and skin irritations contribute to stead demand.

- Consumer preference for OTC remedies: Growing inclination toward self-care and non-prescription solutions boosts sales.

- Aging population: Greater skin sensitivity among older demographics sustains demand.

- E-commerce expansion: Digital retail channels facilitate broader access and increased consumption.

Limitations

- Market saturation: Many regional and global brands compete in the OTC calamine segment.

- Regulatory complexities: Variations in approval processes may hinder rapid market expansion.

- Consumer shift toward alternative therapies: Growing popularity of natural remedies and topical steroids may impact demand.

Price Analysis and Historical Trends

Current Pricing Dynamics

The retail price for HM Calamine Lotion varies by region, formulation, and distribution channel. In the U.S., a typical 8 oz bottle retails at approximately USD 4.50–USD 7.00, with generics priced marginally lower. In emerging markets, prices are significantly lower, often around USD 2–USD 4 per bottle, driven by local manufacturing and distribution networks.

Factors Influencing Pricing

- Brand reputation: Established brands command premium pricing.

- Packaging and formulation features: Innovations can justify higher prices.

- Regulatory costs: Stringent compliance increases production costs, impacting retail prices.

- Supply chain efficiencies: Economies of scale and distribution reach influence pricing strategies.

Historical Price Trends

Over the past decade, pricing for HM Calamine Lotion has exhibited moderate stability, with minor fluctuations attributable to raw material costs (notably zinc oxide and calamine mineral supplies), inflation, and competitive pressures. Generic alternatives have led to price competition, keeping retail prices relatively flat in mature markets, whereas brands with formulation innovations or marketing campaigns command premiums.

Future Price Projections (2023-2030)

Market Forecast Assumptions

- Steady growth in dermatology OTC segment driven by demographic shifts and increased skin condition awareness.

- Continued manufacturing efficiencies and potential raw material cost reductions.

- E-commerce expansion facilitates price competition and access.

- Regulatory environments maintaining consistent standards, with scope for localized reforms.

Projected Price Trends

| Year | Price Range (USD per 8 oz) | Commentary |

|---|---|---|

| 2023 | USD 4.50 – USD 7.00 | Stable, with slight upward pressure due to inflation. |

| 2025 | USD 4.75 – USD 7.50 | Slight increase driven by formulation improvements and inflation. |

| 2027 | USD 5.00 – USD 8.00 | Introduction of value-added formulations may push premium pricing. |

| 2030 | USD 5.25 – USD 8.50 | Potential for increased competition from generics and private labels; pricing remains stable with minor increases. |

Key factors supporting this projection include inflationary pressures on raw materials and manufacturing, ongoing innovation, and regional market expansion. However, the price ceiling remains constrained by consumer price sensitivity and robust generic competition.

Regulatory and Market Risks

- Regulatory changes could impose new safety or labeling standards, increasing production costs.

- Disruptions in raw material supply chains may escalate costs.

- Market saturation and consumer preferences toward alternative remedies could suppress price growth.

Key Takeaways

- The global demand for HM Calamine Lotion remains stable, anchored by consumer preference for OTC minor skin irritation remedies.

- Competitive pressures from generics and private labels help keep retail prices in check, with brand premiums justified by formulation enhancements and marketing.

- Price projections indicate modest growth through 2030, primarily influenced by inflation, formulation innovation, and regional market expansion.

- Manufacturers should monitor raw material costs, regulatory shifts, and evolving consumer preferences to adapt pricing strategies accordingly.

- Strengthening distribution channels, particularly online platforms, can optimize pricing flexibility and market penetration.

FAQs

1. What factors most influence HM Calamine Lotion's retail price?

Raw material costs, brand reputation, formulation innovations, packaging, distribution channels, and regional regulatory requirements primarily determine retail pricing.

2. How is the competitive landscape expected to change by 2030?

Market saturation with generics and private-label brands will likely intensify price competition, although premium formulations and marketing may sustain higher price points for established brands.

3. What regions offer the highest growth potential for HM Calamine Lotion?

Emerging markets in Asia-Pacific and Latin America, driven by increasing awareness and healthcare access, present substantial growth opportunities, potentially impacting global prices.

4. How do regulatory standards impact the pricing of calamine-based products?

Stringent safety standards increase manufacturing and compliance costs, which can elevate retail prices, especially in developed nations with rigorous approval processes.

5. Is there a risk of price erosion in the calamine lotion market?

Yes. Continued proliferation of low-cost generics and private labels, alongside market saturation, could lead to price erosion, constraining profit margins.

References

[1] Industry Reports 2022-2023, MarketWatch Reports, “Global OTC Dermatology Market,” Dec 2022.

[2] U.S. FDA OTC Drug Monographs, 2022.

[3] IBISWorld, “Pharmaceuticals & Biotechnology in North America,” 2023.

[4] Statista, “Skin Care Product Trends,” 2023.

[5] Company Annual Reports (Johnson & Johnson, Bayer AG), 2022–2023.

In conclusion, while HM Calamine Lotion remains a stable OTC staple with modest price growth projections, stakeholders must remain vigilant to regulatory changes, raw material costs, and evolving consumer preferences to optimize pricing strategies and market positioning.

More… ↓