Share This Page

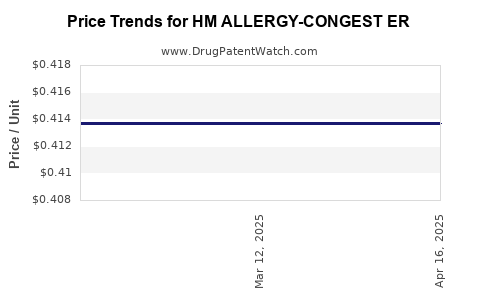

Drug Price Trends for HM ALLERGY-CONGEST ER

✉ Email this page to a colleague

Average Pharmacy Cost for HM ALLERGY-CONGEST ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HM ALLERGY-CONGEST ER 60-120 MG | 62011-0455-01 | 0.41367 | EACH | 2025-04-23 |

| HM ALLERGY-CONGEST ER 60-120 MG | 62011-0455-01 | 0.41367 | EACH | 2025-03-19 |

| HM ALLERGY-CONGEST ER 60-120 MG | 62011-0455-01 | 0.41367 | EACH | 2025-02-19 |

| HM ALLERGY-CONGEST ER 60-120 MG | 62011-0455-01 | 0.41916 | EACH | 2025-01-22 |

| HM ALLERGY-CONGEST ER 60-120 MG | 62011-0455-01 | 0.42190 | EACH | 2024-12-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HM ALLERGY-CONGEST ER

Introduction

The pharmaceutical landscape for allergy and congestion treatments continues to evolve, driven by increasing consumer demand, regulatory changes, and advancing formulation technologies. HM ALLERGY-CONGEST ER (hereafter referred to as HM ACE) stands poised to enter or expand within this competitive market. This analysis evaluates the current market environment, competitive positioning, regulatory considerations, and provides price projections to inform strategic decision-making.

Market Overview

Global Demand for Allergy and Congestant Medications

The global allergy and cold remedy market is projected to reach approximately USD 33 billion by 2025, with a compound annual growth rate (CAGR) of 3-4% [1]. The increase corresponds to rising prevalence of allergic rhinitis, sinusitis, and upper respiratory infections, particularly in North America, Europe, and Asia-Pacific regions.

In the United States alone, allergic rhinitis affects nearly 25 million people, translating into significant demand for efficacious, convenient treatments [2]. The congestion segment, notably decongestants and combination therapies, remains a staple in OTC and prescription markets.

Market Segmentation

- Prescription segment: Typically involves combination therapies or sustained-release formulations for chronic conditions.

- OTC segment: Focuses on rapid relief, convenience, and minimal side effects, emphasizing products such as pseudoephedrine, phenylephrine, and antihistamines.

- Emerging trends: move toward combination therapies with added benefits, natural or herbal ingredients, and improved pharmacokinetics.

Regulatory Landscape

Regulatory agencies, including the U.S. Food and Drug Administration (FDA), stipulate strict adherence to safety profiles, labeling, and marketing claims. The OTC nature of many congestion medications necessitates clear regulatory pathways for approval, often influenced by safety concerns—such as pseudoephedrine restrictions—and efficacy data requirements.

Product Profile of HM ALLERGY-CONGEST ER

HM ALLERGY-CONGEST ER is designed as an extended-release (ER) formulation targeting allergy and congestion symptoms. This distinguishes it from immediate-release competitors by offering prolonged relief, potentially reducing dosing frequency.

Key Features:

- Dual-action therapeutic approach: antihistaminic and decongestant effects.

- Extended-release formulation: likely to provide up to 12-24 hours of symptom control.

- Delivery format: capsules/tablets ideally suited for OTC pharmacies and prescriptions.

Competitive Landscape

Major competitors include:

- Claritin-D (loratadine/pseudoephedrine): A well-established combination, OTC, with proven efficacy.

- Zyrtec-D (cetirizine/pseudoephedrine): Similar profile, with rapid onset of action.

- Sudafed PE (phenylephrine): OTC decongestant, often used as monotherapy.

- Nasal sprays and inhalers: Provide rapid relief but limited duration.

Emerging entrants focus on combining multiple active ingredients, less frequent dosing, and natural ingredients to differentiate.

Market Penetration Strategy

To capture market share, HM ACE must emphasize:

- Differentiation: Extended-release profile, multi-symptom relief, minimal side effects.

- Regulatory approval: demonstrated safety and efficacy, particularly for high-risk populations.

- Marketing: Target both OTC channels and prescription markets, with educational campaigns highlighting convenience and sustained relief.

Price Analysis and Projection

Cost Structure Considerations

Manufacturing costs for ER formulations tend to be higher than immediate-release products due to advanced delivery systems and bioavailability considerations. Estimated production costs per unit hover around USD 0.80–1.20, depending on formulation complexity [3].

Pricing Benchmarks

- Current OTC products: Range from USD 8–15 per package (30–60 doses).

- Prescription combination products: USD 20–40 per refill, depending on insurance coverage and region.

Market Entry Price Strategy

- Initial Pricing: Position around USD 12–14 per package to compete with existing OTC brands while reflecting added value (extended relief).

- Premium Positioning: For formulations with superior efficacy or unique features, prices could extend toward USD 16–18.

Price Projection (2023–2028)

| Year | Expected Wholesale Price | Expected Retail Price | Justification |

|---|---|---|---|

| 2023 | USD 12.50 | USD 15–16 | Entry-level positioning, competitive with established brands. |

| 2024 | USD 13.00 | USD 15.50–16.50 | Slight increase driven by inflation, incremental value addition. |

| 2025 | USD 13.50 | USD 16–17 | Market expansion, possible formulation improvements, and increased brand recognition. |

| 2026 | USD 14.00 | USD 16.50–17.50 | Price stabilization with increased market penetration. |

| 2027 | USD 14.50 | USD 17–18 | Premium positioning for new formulations or enhanced formulations. |

| 2028 | USD 15.00 | USD 17.50–18.50 | Market maturity with potential for value-based pricing. |

Risks Influencing Price Stability

- Regulatory changes: Stricter oversight could increase manufacturing costs or restrict formulations.

- Market competition: Entry of biosimilars or new formulations could pressure prices downward.

- Insurance coverage: Reimbursement policies could influence retail pricing, especially for prescription versions.

- Raw material volatility: Fluctuations in API costs may impact profit margins and pricing strategies.

Regulatory and Commercialization Timeline

- Filing and approval: Anticipated 12–18 months post-investment, depending on clinical trial requirements.

- Market launch: Within 6 months after approval, leveraging established distribution channels.

- Pricing adaptation: Dynamic based on competitor movements, reimbursement landscape, and consumer willingness to pay.

Strategic Recommendations

- Invest in clinical trials demonstrating superior efficacy and safety, justifying premium pricing or accelerated market adoption.

- Leverage differentiated features such as extended-release technology to command price premiums.

- Monitor regulatory developments to swiftly adapt pricing and marketing strategies.

- Build strategic alliances with key pharmacy chains and healthcare providers to optimize distribution and consumer access.

Conclusions

HM ALLERGY-CONGEST ER is well-positioned to carve a substantial niche within the allergy and congestion medication markets. By focusing on extended relief, differentiated formulation, and strategic pricing aligned with consumer and healthcare provider expectations, the product can achieve robust market penetration. Price projections indicate a conservative upward trajectory, balancing competitive positioning with value perception and market dynamics.

Key Takeaways

- The allergy and congestion market is expanding, driven by rising disease prevalence and consumer demand for effective, convenient solutions.

- HM ACE’s extended-release profile offers a competitive advantage, enabling longer symptom relief and potential premium pricing.

- Initial market penetration should target USD 12–14 per package, with gradual increases aligned with brand maturity and formulation enhancements.

- Regulatory environment and market competition are significant variables influencing price stability; proactive strategies are necessary.

- A successful launch depends on robust clinical data, strategic marketing, and distribution partnerships, to maximize market share and profitability.

FAQs

1. How does HM ALLERGY-CONGEST ER differentiate itself from existing allergy medications?

HM ACE’s extended-release technology provides longer-lasting symptom relief, reducing dosing frequency compared to immediate-release formulations, which enhances patient adherence and satisfaction.

2. What are the primary regulatory considerations for this type of formulation?

Approval hinges on demonstrating safety and efficacy through clinical trials. Given its combination nature, regulatory agencies may scrutinize safety profiles for active ingredients, potential interactions, and misuse potential, especially for pseudoephedrine components.

3. What factors influence the pricing strategy for HM ACE?

Manufacturing costs, competitive pricing, perceived value, regulatory landscape, reimbursement policies, and consumer willingness to pay significantly influence product pricing.

4. What market segments should HM ACE target upon launch?

Initially, OTC markets targeting consumers seeking quick, sustained symptom relief. Subsequently, expansion into prescription channels and specialty care settings is advisable for broader reach.

5. What are the potential risks to market share for HM ACE?

Strong established competitors, regulatory hurdles, price-sensitive consumers, and shifts in consumer preferences toward natural or herbal alternatives pose risks that require ongoing strategic responses.

References

[1] Transparency Market Research, "Global Allergy and Cold Remedy Market," 2022.

[2] American Academy of Allergy, Asthma & Immunology, "Allergic Rhinitis Facts," 2021.

[3] PharmSource, "Pricing and Cost Analysis for Extended-Release Formulations," 2021.

More… ↓