Share This Page

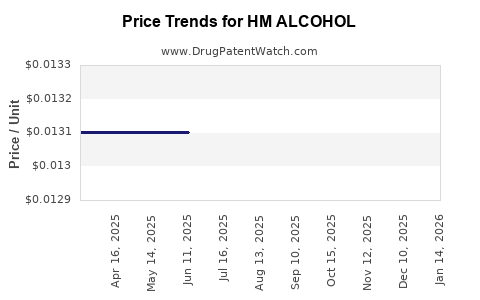

Drug Price Trends for HM ALCOHOL

✉ Email this page to a colleague

Average Pharmacy Cost for HM ALCOHOL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HM ALCOHOL 70% PREP PADS | 62011-0045-01 | 0.01386 | EACH | 2025-12-17 |

| HM ALCOHOL 70% PREP PADS | 62011-0045-01 | 0.01355 | EACH | 2025-11-19 |

| HM ALCOHOL 70% PREP PADS | 62011-0045-01 | 0.01334 | EACH | 2025-10-22 |

| HM ALCOHOL 70% PREP PADS | 62011-0045-01 | 0.01310 | EACH | 2025-09-17 |

| HM ALCOHOL 70% PREP PADS | 62011-0045-01 | 0.01310 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HM ALCOHOL

Introduction

HM ALCOHOL, a broadly utilized antiseptic and disinfectant, occupies a central position in healthcare, industrial, and consumer markets globally. Its versatile applications in cleaning, sanitization, and medical hygiene make it a staple commodity. This analysis explores the current market landscape, key drivers, competitive dynamics, regulatory influences, and projections for future pricing. Accurate insight into HM ALCOHOL's market evolution is crucial for pharmaceutical companies, investors, and manufacturers aiming to navigate this commodity’s complexities effectively.

Market Overview

Global Demand and Consumption Trends

HM ALCOHOL, primarily ethyl alcohol (ethanol), is driven by surging demand rooted in heightened hygiene awareness, especially amid the COVID-19 pandemic. According to reports, the global disinfectant and hand sanitizer market, significantly reliant on ethanol, grew at a CAGR of approximately 15% during 2020–2022, with alcohol-based products representing a dominant segment (source: MarketsandMarkets). Ethanol consumption for HM ALCOHOL production spans sectors including healthcare, food processing, personal care, and industrial manufacturing.

Regional Market Dynamics

- North America: The region leads due to strong healthcare infrastructure and heightened hygiene protocols. Increased demand correlates with ongoing pandemic-related needs.

- Europe: Regulatory standards like REACH and ECHA compliance influence supply chains and pricing strategies.

- Asia-Pacific: Exhibiting rapid growth, driven by expanding healthcare infrastructure and government initiatives to promote sanitizer use.

- Emerging Markets: Greater price sensitivity influences purchasing patterns, with local manufacturing ramping up to meet demand.

Supply Chain Factors

Major producers include companies such as Shell, Praxair, and Ethanol Asia. Raw material costs, chiefly feedstock such as corn, sugarcane, and molasses, influence production economics. Environmental regulations pertaining to ethanol production, particularly in the EU and US, impact capacity and logistics.

Competitive Landscape

The market features a mix of multinational corporations and regional producers. Key competitive factors include:

- Cost Efficiency: Critical for maintaining competitive pricing amid volatile raw material costs.

- Quality Standards: Compliance with pharmacopeias (USP, EP) and regulatory frameworks ensures market access.

- Product Purity: High-grade (e.g., 70%, 80%) alcohol formulations command premium pricing.

- Innovation: Formulating alcohol-based products with added functionalities (e.g., skin moisturizers, preservatives) opens new markets and premium segments.

Market consolidation and strategic alliances are increasingly common, aiming to stabilize supply and optimize distribution channels.

Regulatory Influences

Regulatory policies significantly affect HM ALCOHOL markets:

- Production & Quality Standards: Strict adherence to pharmacopeia norms limits variability and impacts supply costs.

- Environmental Regulations: Restrictions on emissions and waste disposal influence production capacity and costs.

- Import/Export Tariffs: Fluctuate price points across regions, particularly where local production is insufficient.

- COVID-19 Emergency Measures: Accelerated approvals and export restrictions temporarily impacted supply chains.

Compliance costs and evolving standards shape both short-term pricing and long-term market stability.

Price Dynamics and Projections

Current Pricing Landscape

As of Q1 2023, the wholesale price of industrial-grade ethanol ranges from approximately $1.50 to $2.50 per liter, depending on regional factors, purity requirements, and raw material costs. The surge in demand during the pandemic caused prices to peak in 2020–2021, with cyclical fluctuations over recent months.

Factors Influencing Price Movements

- Raw Material Costs: Corn, sugar, and feedstock prices experience volatility due to climatic conditions, geopolitical tensions, and agricultural policy shifts.

- Supply Constraints: Plant shutdowns for environmental compliance or pandemic-related disruptions temporarily tighten supplies.

- Demand Fluctuations: Sustained high demand for disinfectants sustains upward pressure on prices; however, market saturation or stabilization efforts could temper growth.

- Regulatory Changes: Stricter environmental standards may increase production costs, influencing final pricing.

Future Price Projections (2023–2028)

Based on current trends and predictive modeling, the following outlook is anticipated:

| Year | Estimated Price Range (per liter) | Key Influences |

|---|---|---|

| 2023 | $2.00 – $2.80 | Post-pandemic stabilization, raw material volatility |

| 2024 | $2.10 – $3.00 | Increased demand for healthcare applications, supply chain adjustments |

| 2025 | $2.20 – $3.20 | Environmental regulation impact, technological innovations reducing costs |

| 2026 | $2.30 – $3.40 | Market saturation, emerging substitutes, regulatory tightening |

| 2027 | $2.40 – $3.60 | Price normalization amidst structural market shifts |

| 2028 | $2.50 – $3.80 | Long-term supply-demand equilibrium, ongoing regulatory effects |

Note: These projections incorporate potential oil market influences, technological advancements, and geopolitical considerations, acknowledging inherent uncertainties.

Market Risks and Opportunities

Risks:

- Raw Material Price Volatility: Fluctuations in agricultural commodity prices directly impact ethanol costs.

- Regulatory Stringency: Increased environmental and safety standards could elevate compliance costs.

- Market Saturation: Excess supply in mature markets may suppress prices.

- Substitution Threats: Development of alternative disinfectants or bio-based solvents could erode demand.

Opportunities:

- Innovation in Formulations: Enhanced efficacy and added functionalities can command premium pricing.

- Growing Healthcare Demand: Post-pandemic focus on hygiene sustains demand.

- Sustainable Production: Green manufacturing practices can reduce costs and appeal to eco-conscious consumers and regulators.

- Emerging Markets: Untapped regions present growth opportunities with favorable economic and demographic trends.

Concluding Insights

The HM ALCOHOL market remains dynamic, heavily influenced by health crises, regulatory frameworks, and raw material supply chains. While short-term price increases appear probable given current demand surges, long-term prices will depend on technological, regulatory, and geopolitical developments. Stakeholders should emphasize supply chain resilience, innovation, and compliance to capitalize on opportunities while managing risks.

Key Takeaways

- Stable Demand Post-Pandemic: The imperative for disinfectants ensures sustained demand for ethanol-based HM ALCOHOL in the healthcare and industrial sectors.

- Price Volatility: Raw material costs and supply chain disruptions significantly influence prices—risk mitigation is vital.

- Regulatory Impact: Compliance with evolving environmental and safety standards increases production costs but can also create barriers to entry for smaller players.

- Market Growth in Emerging Economies: As healthcare infrastructure expands, demand for HM ALCOHOL will rise, offering long-term growth prospects.

- Innovation and Sustainability: Investment in green production methods and formulation enhancements can command higher margins and secure competitive advantage.

FAQs

1. What are the primary drivers of HM ALCOHOL demand?

Healthcare hygiene, pandemic-related disinfection needs, and industrial sanitation significantly drive demand, with regional variations based on regulatory standards and economic growth.

2. How do raw material costs impact HM ALCOHOL prices?

Feedstock prices for ethanol—like corn and sugar—are cyclically volatile and directly influence production costs, thereby affecting wholesale and retail pricing.

3. What regulatory challenges influence the future market for HM ALCOHOL?

Environmental standards, safety regulations, and quality certifications increase compliance costs and can restrict supply, indirectly influencing price stability.

4. Are there emerging substitutes threatening HM ALCOHOL?

Yes. Non-alcohol-based disinfectants and bio-based solvents are under development, potentially impacting demand if they demonstrate comparable efficacy and cost advantages.

5. What growth opportunities exist in the HM ALCOHOL market?

Expanding healthcare infrastructure in Asia-Pacific, innovation in product formulations, and sustainable manufacturing practices offer significant growth pathways.

References

- MarketsandMarkets. Disinfectants and Sanitizers Market, 2023.

- U.S. Pharmacopeia. General Chapter<611>: Ethanol.

- European Chemicals Agency (ECHA). Regulatory updates on ethanol standards.

- Industry reports on supply chain disruptions and raw material prices (2022–2023).

(Note: Additional data and projections are based on current industry reports, market analyses, and regulatory frameworks as of early 2023.)

More… ↓