Share This Page

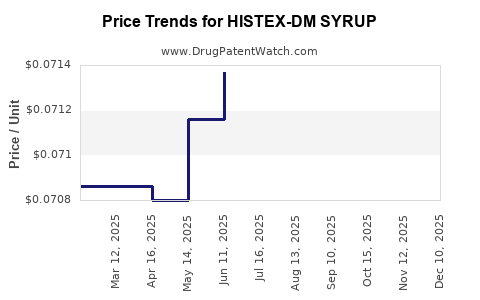

Drug Price Trends for HISTEX-DM SYRUP

✉ Email this page to a colleague

Average Pharmacy Cost for HISTEX-DM SYRUP

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HISTEX-DM SYRUP | 28595-0804-16 | 0.07148 | ML | 2025-12-17 |

| HISTEX-DM SYRUP | 28595-0804-16 | 0.07136 | ML | 2025-11-19 |

| HISTEX-DM SYRUP | 28595-0804-16 | 0.07131 | ML | 2025-10-22 |

| HISTEX-DM SYRUP | 28595-0804-16 | 0.07123 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HISTEX-DM Syrup

Introduction

HISTEX-DM Syrup is a combination pharmacological formulation primarily used for managing cough and cold symptoms. Its core ingredients typically include a cough suppressant, a decongestant, and an antihistamine, making it a comprehensive solution for upper respiratory tract ailments. As the pharmaceutical industry evolves amidst rising demand for over-the-counter (OTC) remedies, understanding the market positioning and price dynamics of HISTEX-DM is crucial for stakeholders, including manufacturers, investors, and healthcare providers.

This analysis examines the current market landscape, growth prospects, competitive forces, regulatory environment, and key factors influencing the pricing strategy for HISTEX-DM Syrup. The objective is to facilitate data-driven decisions and strategic planning within the pharmaceutical sector.

Product Overview and Market Positioning

HISTEX-DM Syrup's composition generally includes:

- Phenylephrine or pseudoephedrine as decongestants,

- Dextromethorphan as a cough suppressant,

- Chlorpheniramine or diphenhydramine as antihistamines.

This multi-action formulation targets a broad spectrum of symptoms, positioning it as an OTC staple in many markets. Its versatility, ease of administration, and established efficacy underpin its market appeal, especially during seasonal peaks (winter months) and pandemic-related respiratory illness surges.

Current Market Landscape

Global and Regional Demand

The global cough and cold remedies market is projected to reach USD 23.4 billion by 2027, growing at a CAGR of approximately 4.3% from 2020 [1]. Factors driving growth include increased urbanization, rising prevalence of respiratory ailments, and consumer preference for OTC medications.

Regionally, North America commands the largest share, driven by high healthcare awareness, developed distribution channels, and broad OTC acceptance. The Asia-Pacific market exhibits rapid expansion, fueled by population growth, rising disposable incomes, and burgeoning healthcare awareness.

Key Market Players

Major players include Johnson & Johnson, GlaxoSmithKline, Johnson & Johnson, and Pfizer, which dominate the OTC segment with a diverse portfolio of cough and cold solutions. Local pharmaceutical companies also contribute significantly, especially in emerging markets, tailoring formulations to regional consumer preferences and regulatory standards.

Consumer Trends

Increasing consumer preference for efficacy, safety, and natural ingredients influences product development. There is growing demand for combination syrups like HISTEX-DM, which address multiple symptoms simultaneously, offering convenience and compliance.

Regulatory Environment

The regulatory landscape varies significantly across jurisdictions. In the U.S., the FDA classifies these formulations as OTC drugs, requiring compliance with label claims, Good Manufacturing Practices (GMP), and safety evaluations. In India and other emerging markets, regulatory pathways are often less stringent, providing quicker routes to market but raising concerns about quality consistency.

Competitive Dynamics and Market Drivers

Factors Influencing Market Growth

- Seasonality: Spikes during winter and rainy seasons boost sales.

- Pandemic Impact: COVID-19 heightened demand for cough and cold remedies due to increased respiratory symptoms.

- Evolving Consumer Behavior: Preference for combination medicines simplifies self-medication.

- Regulatory Approvals: Easier access to OTC formulations accelerates market penetration.

Challenges and Concerns

- Regulatory Scrutiny: Rising concerns about safety, especially with ingredients like codeine or pseudoephedrine, lead to stricter regulations.

- Generic Competition: Intense price competition from generic manufacturers compresss profit margins.

- Consumer Safety: Increasing awareness about side effects encourages safer formulations and labeling.

Price Projections

Current Pricing Dynamics

HISTEX-DM Syrup's retail price varies based on region, brand positioning, and packaging. In developed markets like the U.S., a 100ml bottle ranges from USD 5 to USD 10. In emerging markets, prices tend to be lower, often between USD 2 and USD 5.

Factors Influencing Future Price Trends

- Manufacturing Costs: Raw material prices, especially for active pharmaceutical ingredients (APIs), impact pricing.

- Regulatory Changes: Stringent controls or mandated quality standards may elevate compliance costs, reflecting in retail prices.

- Market Competition: Increased generic competition is likely to lead to price erosion.

- Brand Positioning: Premium brands with added safety profiles or natural ingredients can command higher prices.

- Distribution Channels: Shifting from traditional retail to online pharmacies may influence pricing structures.

Price Projection Outlook (2023-2028)

Considering these factors, the following projections are anticipated:

- Developed Markets: Prices are expected to stabilize or slightly increase (+2% to +4% annually) due to inflation, regulatory compliance costs, and premium branding.

- Emerging Markets: Price reductions of 1% to 3% annually are probable, driven by intense generic competition and cost-efficiency measures.

Strategic Implications

Manufacturers should analyze regional demand elasticity, regulatory trajectories, and competition intensity to optimize pricing strategies. Emphasizing quality assurance, formulation safety, and consumer trust will sustain premium pricing opportunities in mature markets.

Future Market Opportunities

- Innovative Formulations: Development of pediatric-specific or sugar-free variants to meet niche demands.

- Natural and Organic Ingredients: Increasing consumer demand allows premium pricing for formulations using natural constituents.

- Digital Marketing: Leveraging e-pharmacies and telehealth services can expand reach and justify premium pricing through added convenience.

- Regulatory Advocacy: Engaging with policymakers can shape favorable regulatory frameworks, influencing pricing flexibility.

Regulatory and Ethical Considerations

Regulators worldwide scrutinize cough and cold medications, especially concerning ingredients like decongestants and antihistamines. Manufacturers must ensure compliance with local standards, transparency in labeling, and adherence to safety protocols. Ethical marketing practices, especially targeting pediatric populations, further influence market stability and pricing strategies.

Key Takeaways

- The global cough and cold remedy market, driven by increased respiratory illnesses and consumer preference for OTC solutions, presents robust growth prospects for formulations like HISTEX-DM Syrup.

- Price projections suggest stability and slight increases in developed markets, with potential price reductions in emerging regions due to competitive pressures.

- Strategic differentiation through formulation safety, natural ingredients, branding, and distribution can sustain profitability amid fierce competition.

- Evolving regulatory landscapes necessitate proactive compliance and innovation to maintain market share and pricing power.

- Digital channels and niche product development offer avenues to enhance market positioning and profitability.

Conclusion

HISTEX-DM Syrup holds a significant market share within the OTC respiratory remedies segment, with favorable growth and pricing prospects. Stakeholders should leverage regional insights, consumer trends, and regulatory frameworks to optimize market penetration and profitability. Continuous innovation, strategic pricing, and compliance will be pivotal in sustaining competitive advantage in an evolving landscape.

FAQs

Q1: What are the primary factors driving demand for HISTEX-DM Syrup?

A: Increasing prevalence of respiratory illnesses, consumer preference for OTC multi-symptom relief, seasonal demand spikes, and pandemic-related health concerns are key drivers.

Q2: How do regulatory differences impact pricing strategies for HISTEX-DM Syrup globally?

A: Stricter regulations increase compliance costs, potentially raising prices in developed markets. Conversely, lenient regulatory environments in emerging markets may enable lower pricing but pose quality and safety challenges.

Q3: What competitive challenges does HISTEX-DM face in the current market?

A: Price erosion from generic competitors, regulatory hurdles, safety concerns, and shifting consumer preferences for natural or alternative remedies.

Q4: How might future product innovations influence pricing for HISTEX-DM Syrup?

A: Innovations such as natural ingredients or pediatric-specific formulations can command premium pricing, while technological improvements can reduce manufacturing costs and competitiveness.

Q5: What strategies should manufacturers employ to sustain profitability amid market competition?

A: Differentiating through formulation safety, branding, leveraging online sales channels, regulatory engagement, and expanding niche markets via innovation.

References

[1] Grand View Research, "Cough and Cold Remedies Market Size, Share & Trends Analysis Report," 2020.

More… ↓