Last updated: July 28, 2025

Introduction

Heparin sodium is a widely used anticoagulant primarily employed to prevent and treat thromboembolic disorders. As a critical component in surgical procedures, dialysis, and other medical interventions, its market dynamics significantly influence healthcare costs and treatment outcomes worldwide. This analysis provides a comprehensive assessment of the current market landscape, key drivers, challenges, and a five-year price projection for Heparin sodium, offering actionable insights for stakeholders.

Market Overview

Regulatory Status and Formulations

Heparin sodium is approved and extensively utilized in various formulations, including injectable parenteral forms, primarily heparin sodium injections. The drug's regulatory approval spans global markets, with major approvals in the US (by the FDA), Europe (EMA), and other regions, adhering to stringent safety and efficacy standards.

Market Size and Growth Trends

The global heparin market was valued at approximately USD 4.2 billion in 2022, with a compound annual growth rate (CAGR) estimated at about 6% from 2023 to 2028.[1] Factors underpinning this growth include rising prevalence of cardiovascular diseases, increasing surgical procedures, and expanding use in intensive care units—especially amidst COVID-19 related complications requiring anticoagulation management.

Major Suppliers

Key manufacturers include Sanofi, Baxter International, Pfizer, and Appleton, who dominate the supply chain with proven expertise in manufacturing pharmaceutical grade heparin, predominantly derived from porcine intestinal mucosa. Supply chain stability is crucial given the drug’s biological origin and regulatory scrutiny for purity and safety.

Market Drivers

Rising Prevalence of Coagulopathies

An aging global population correlates with increased incidence of atrial fibrillation, deep vein thrombosis (DVT), pulmonary embolism (PE), and heart surgeries, bolstering demand for anticoagulants like heparin.[2]

Expansion of Surgical Procedures and Critical Care

Surgeons and intensivists increasingly rely on heparin for anticoagulation during procedures, including cardiopulmonary bypass and dialysis, intensifying market need.

Growing Adoption in Emerging Markets

Emerging regions such as Asia-Pacific and Latin America are witnessing exponential growth in healthcare infrastructure and surgical volume, expanding access to heparin therapy.

Impact of the COVID-19 Pandemic

The pandemic underscored heparin's role in managing coagulopathies in COVID-19 patients, temporarily boosting demand. While the pandemic's peak effects diminish, ongoing research maintains its relevance in critical care.

Market Challenges

Supply Chain Disruptions

Heparin production involves complex biological processes. Variability in raw material quality, especially porcine intestinal tissues, affects supply stability and cost.

Regulatory and Quality Concerns

Membrane and extract purity concerns, revealed in past contamination scandals, led to enhanced regulatory oversight, impacting production costs and market confidence.

Market Competition from Alternatives

Synthetic anticoagulants like enoxaparin and novel oral anticoagulants (NOACs) pose competitive pressure, especially in outpatient settings, potentially limiting scope for heparin growth.

Price Dynamics and Projections

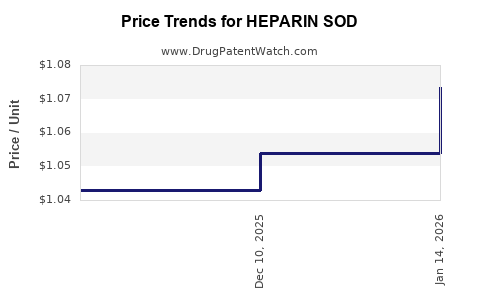

Current Pricing Landscape

The average wholesale price (AWP) for a 10,000-unit vial of heparin sodium injection hovers around USD 15–20, depending on region and supplier.[3] Prices are subject to raw material costs, manufacturing expenses, regulatory compliance, and market competition.

Factors Influencing Future Prices

- Raw Material Costs: Fluctuations in porcine mucosa availability and quality directly affect production costs.

- Regulatory Costs: Heightened regulatory scrutiny and quality assurance protocols increment operational expenses.

- Competitive Landscape: Adoption of alternative anticoagulants may compress prices, especially in markets where newer agents are preferred.

Price Projection (2023-2028)

Considering current trends, raw material stability, regulatory landscape, and market expansion in emerging economies, we project a compounded annual decrease of 1–2% in wholesale prices for heparin sodium, with some regional variations. Overall, prices are expected to stabilize or decline modestly due to increased competition and supply chain optimization, with regional disparities influenced by regulatory environments and raw material costs.

Regional Market Insights

- North America: Market dominated by established suppliers with relatively stable prices; regulatory updates may influence costs.

- Europe: Stringent regulations and quality standards could maintain higher prices than other regions.

- Asia-Pacific: Rapidly expanding markets, lower regulatory costs, and raw material advantages may drive prices downward over time.

- Emerging Markets: Growing demand, but price sensitivity and supply limitations could cause variability.

Strategic Considerations for Stakeholders

- Manufacturers: Focus on securing raw material supply chains and advancing purification technologies to maintain cost efficiency.

- Distributors: Monitor regional regulatory and market shifts to optimize pricing strategies.

- Healthcare Providers: Evaluate cost-benefit profiles of heparin relative to emerging alternatives, especially in outpatient and low-risk settings.

- Regulators: Balance safety standards with market access and supply stability.

Key Takeaways

- The global heparin sodium market is experiencing steady growth driven by demographic trends and procedural volume increases.

- Supply chain complexities and regulatory pressures influence pricing stability.

- Price projections suggest minimal declines (1–2% CAGR) over the next five years, with regional variations.

- Emerging markets present significant growth opportunities but require strategic sourcing and cost management.

- Competition from synthetic and oral anticoagulants may influence future demand and pricing structures.

Conclusion

Heparin sodium remains an essential anticoagulant with stable global demand, reinforced by its critical role in various medical interventions. Market participants should prioritize supply chain resilience, regulatory compliance, and cost efficiency to capitalize on growth opportunities while navigating competitive pressures. Continued innovations in manufacturing and sourcing, along with strategic regional expansion, will be vital to sustaining market positioning and optimizing price stability.

FAQs

1. How are raw material costs affecting heparin sodium prices?

Raw materials, primarily porcine intestinal tissues, are susceptible to supply fluctuations and quality concerns, directly influencing manufacturing costs and subsequently, regional pricing strategies.

2. What is the impact of regulatory standards on heparin pricing?

Enhanced safety and purity standards increase compliance costs for producers, potentially raising prices initially; however, regulatory clarity can streamline approvals and stabilize costs long-term.

3. How do emerging alternative anticoagulants affect heparin market prices?

The advent of synthetic agents like enoxaparin and oral anticoagulants introduces competition, particularly in outpatient settings, exerting downward pressure on heparin prices.

4. What regional factors influence future heparin sodium prices?

Regions with growing healthcare infrastructure, demographic shifts, and raw material advantages—such as Asia-Pacific—may see prices decline, whereas regions with strict regulations, like Europe, may maintain higher prices.

5. Is the COVID-19 pandemic likely to cause long-term changes in heparin prices?

While pandemic-driven demand boosted reliance on heparin temporarily, the long-term effect on prices is tempered by supply chain adjustments and the availability of alternative therapies.

Sources:

[1] Markets and Markets. Heparin Market by Type, Application, Region - Global Forecast to 2028.

[2] World Health Organization. Cardiovascular Diseases Fact Sheet.

[3] Pharmaceutical Pricing Index. Heparin Sodium Injection Wholesale Prices (2023).