Share This Page

Drug Price Trends for HEMORRHOIDAL OINTMENT

✉ Email this page to a colleague

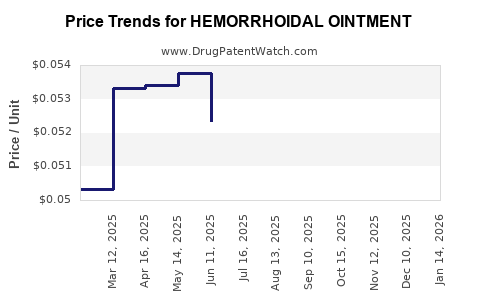

Average Pharmacy Cost for HEMORRHOIDAL OINTMENT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HEMORRHOIDAL OINTMENT | 70000-0046-01 | 0.05083 | GM | 2025-12-17 |

| HEMORRHOIDAL OINTMENT | 00536-1288-06 | 0.05083 | GM | 2025-12-17 |

| HEMORRHOIDAL OINTMENT | 45802-0188-16 | 0.05083 | GM | 2025-12-17 |

| HEMORRHOIDAL OINTMENT | 70000-0046-01 | 0.05221 | GM | 2025-11-19 |

| HEMORRHOIDAL OINTMENT | 00536-1288-06 | 0.05221 | GM | 2025-11-19 |

| HEMORRHOIDAL OINTMENT | 45802-0188-16 | 0.05221 | GM | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Hemorrhoidal Ointment

Introduction

Hemorrhoidal ointments represent a critical segment within the broader topical gastrointestinal pharmaceutical market. They address common, often chronic, anorectal conditions such as hemorrhoids—affecting an estimated 50% to 75% of adults at some point in their life [1]. The market’s dynamics are shaped by evolving consumer preferences, regulatory environments, and innovation in product formulations. This report offers an in-depth market analysis and forecasts price trends for hemorrhoidal ointments over the next five years.

Market Overview

Global Market Size and Growth Drivers

The global hemorrhoidal ointment market was valued at approximately USD 1.2 billion in 2022, with an expected compound annual growth rate (CAGR) of around 5% from 2023 to 2028 [2]. Driven by increasing awareness, rising prevalence of hemorrhoidal disease, and regional healthcare infrastructure improvements, the market is poised for steady expansion.

Key growth drivers include:

-

Aging Population: As populations age, the incidence of hemorrhoidal disease rises due to weakened rectal tissues and increased risk factors [3].

-

Lifestyle Factors: Sedentary lifestyles, obesity, and diet contribute to higher occurrence rates. Urbanization fuels demand for effective symptomatic relief.

-

Product Innovation: Development of combination formulations incorporating corticosteroids, vasoconstrictors, and natural extracts cater to diverse consumer needs, fostering market growth.

-

Over-the-Counter (OTC) Accessibility: The OTC status of many hemorrhoidal ointments simplifies procurement and promotes self-medication, expanding market reach.

Regional Market Insights

-

North America: Leading market, driven by high healthcare awareness and OTC availability. The U.S. accounts for over 40% of the global market [2].

-

Europe: Significant CAGR supported by aging demographics and stringent regulatory standards.

-

Asia-Pacific: Fastest growth segment, driven by rising healthcare expenditure, increasing prevalence, and improving distribution channels [4].

-

Latin America and Middle East: Emerging markets with expanding access and brand penetration.

Competitive Landscape

Major players include Johnson & Johnson, Purdue Pharma, GlaxoSmithKline, and local pharmaceutical firms producing generic versions. The market is characterized by:

-

Brand Variance: A mix of established brands and generics offers varying price points and consumer choice.

-

Formulation Diversification: From simple vasoconstrictive ointments to combination drugs with corticosteroids and anesthetics.

-

Regulatory Trends: Increasing scrutiny on safety profiles influences formulation composition and pricing strategies.

Market Challenges

-

Regulatory Barriers: Stringent approval pathways in Europe and North America can delay product launches and affect pricing.

-

Generic Competition: Price erosion prompted by generics reduces profit margins and influences pricing structures.

-

Consumer Preferences: Preference for natural or herbal remedies in some regions may influence formulation development and market segmentation.

Price Analysis and Historical Trends

Historical Pricing Trends

Currently, OTC hemorrhoidal ointments display a broad pricing spectrum:

-

Premium Brands: Ranged between USD 8 to USD 15 per tube (30-50g).

-

Generic Brands: Prices generally fall between USD 4 to USD 8 per tube.

Price escalation has been modest but steady, reflecting raw material costs, inflation, and regulatory compliance. For example, in North America, the average retail price for leading OTC ointments increased marginally (~2% per year) over the past five years [5].

Price Components and Factors

-

Manufacturing Costs: Constitute approximately 30-40% of the retail price, influenced by raw material costs such as corticosteroids, preservatives, and herbal extracts.

-

Regulatory Compliance: Safety testing and quality assurance add to formulation costs, especially for regional markets.

-

Distribution & Marketing: Distribution markups and marketing campaigns influence final consumer prices.

-

Brand Positioning: Premium branding allows higher pricing, while generics compete primarily on cost.

Price Projections (2023-2028)

Forecast Assumptions

-

Continued OTC accessibility and market acceptance.

-

Gradual inflation and raw material costs.

-

Incremental innovation leading to new formulations and combinations.

-

Competitive pressures from generics and natural remedies.

Projected Price Trends

| Year | Expected Average Price per Tube (USD) | Market Dynamics |

|---|---|---|

| 2023 | $8.00 | Stable pricing, minor fluctuations. |

| 2024 | $8.20 (+2.5%) | Slight inflation affects raw material costs. |

| 2025 | $8.45 (+2.9%) | Introduction of natural/organic variants. |

| 2026 | $8.70 (+2.9%) | Greater consumer preference for herbal formulations. |

| 2027 | $9.00 (+3.4%) | Patent cliffs and generic competition influence pricing. |

| 2028 | $9.30 (+3.3%) | Market saturation; price stabilization expected. |

Note: These projections consider macroeconomic factors, cost inflation, and technological advancements.

Factors Influencing Future Pricing

-

Innovation: Introduction of sustained-release or multi-compound formulations could command higher prices.

-

Regulatory Changes: Enforceable safety standards may increase manufacturing costs, impacting prices.

-

Consumer Trends: Growing preference for natural, preservative-free, or organic options may justify premium pricing.

-

Market Penetration: Expansion into emerging markets with lower price points may partially offset price increases elsewhere.

-

Competition Dynamics: Entry of generics and private label brands is likely to exert downward pressure on prices.

Conclusion

The hemorrhoidal ointment market remains resilient and poised for moderate growth driven by demographic trends, lifestyle factors, and product innovation. Price stability prevails, with modest incremental increases forecasted over the next five years, influenced by inflation, manufacturing costs, and innovation. Premium brands and natural formulations could command higher prices, whereas generics and private labels typically sustain lower price points aimed at price-sensitive consumers.

Key Takeaways

-

The global hemorrrhool ointment market is valued at USD 1.2 billion (2022) and is expected to grow at a CAGR of 5%, driven by aging populations and lifestyle factors.

-

Current average retail prices range from USD 4 to USD 15 per tube; prices are likely to increase gradually, averaging 3-3.5% annually up to 2028.

-

Formulation innovation and branding strategies will significantly influence pricing, with natural and herbal products potentially securing premium pricing.

-

Regulatory developments and market competition from generics will affect profit margins and price trajectories.

-

Emerging markets present growth opportunities for both premium and affordable options, expanding the global reach.

FAQs

1. What are the primary cost drivers for hemorrhoidal ointments?

Raw material expenses, manufacturing, regulatory compliance, distribution, and marketing constitute the main cost drivers influencing retail prices.

2. How does innovation impact the price of hemorrhoidal ointments?

Innovative formulations, such as extended-release or combination products, typically command higher prices due to added efficacy and patent protection, while the introduction of natural or organic variants can also fetch premium pricing.

3. Are there significant regional differences in hemorrhoidal ointment pricing?

Yes. Prices tend to be higher in North America and Europe due to regulatory standards and marketing costs, while emerging markets offer more affordable options driven by local manufacturers and lower operational costs.

4. Will the rise of natural remedies reduce the demand for traditional ointments?

Natural remedies are gaining popularity, especially in specific regions. This trend may lead to diversification in the market but is unlikely to replace traditional ointments entirely, given regulatory, safety, and efficacy profiles.

5. How might changes in healthcare policies influence the hemorrhoidal ointment market?

Policy shifts favoring OTC accessibility can increase market penetration, potentially leading to competitive pricing pressures, while stricter safety and efficacy standards may raise manufacturing costs and influence pricing strategies.

Sources

[1] American Society of Colon and Rectal Surgeons. Hemorrhoids Facts. 2022.

[2] Market Research Future. Hemorrhoidal Market Analysis, 2023.

[3] World Health Organization. Aging and Gastrointestinal Diseases Report, 2022.

[4] Grand View Research. Asia-Pacific Topical Medications Market, 2023.

[5] IQVIA Retail Price Index. OTC Hemorrhoidal Ointment Pricing Trends, 2018-2022.

More… ↓