Share This Page

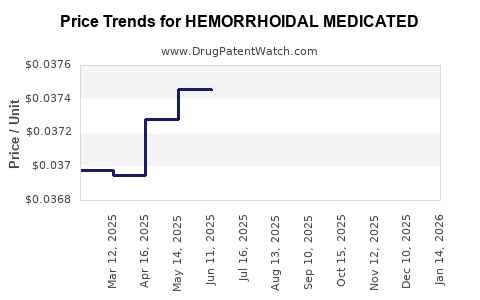

Drug Price Trends for HEMORRHOIDAL MEDICATED

✉ Email this page to a colleague

Average Pharmacy Cost for HEMORRHOIDAL MEDICATED

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HEMORRHOIDAL MEDICATED 50% PAD | 70000-0364-01 | 0.03935 | EACH | 2025-12-17 |

| HEMORRHOIDAL MEDICATED 50% PAD | 70000-0364-01 | 0.03867 | EACH | 2025-11-19 |

| HEMORRHOIDAL MEDICATED 50% PAD | 70000-0364-01 | 0.03843 | EACH | 2025-10-22 |

| HEMORRHOIDAL MEDICATED 50% PAD | 70000-0364-01 | 0.03840 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Hemorrhoidal Medicated Drugs

Introduction

Hemorrhoidal medicated drugs comprise a substantial segment within the gastrointestinal and topical drug markets. Given the global rise in hemorrhoidal conditions propelled by aging populations, lifestyle factors, and increased awareness, the demand for these medications shows promising growth potential. This analysis provides a comprehensive overview of the current market landscape, key drivers, competitive dynamics, regulatory factors, and future price projections for medicated hemorrhoidal treatments.

Market Overview

Global Market Size and Growth Trajectory

The global hemorrhoidal medicated drugs market, estimated to be valued at approximately USD 1.8 billion in 2022, is projected to reach USD 2.5 billion by 2030, expanding at a compound annual growth rate (CAGR) of around 4.2% (2023–2030). Market growth is driven by the increasing prevalence of hemorrhoidal disease, especially among aging populations in North America and Europe, alongside rising health awareness and OTC availability.

Key Product Segments

Main categories within the hemorrhoidal medicated market include:

- Topical creams and ointments: Comprise corticosteroids, anesthetics, vasoconstrictors, and protectants.

- Suppositories and enemas: Deliver targeted relief.

- Oral medications: Include analgesics and venotonics.

- Combination formulations: Combine multiple active ingredients for enhanced efficacy.

Geographical Landscape

North America accounts for approximately 40% of the market share, owing to higher healthcare spending and OTC accessibility. Europe contributes roughly 25%, while Asia-Pacific exhibits the fastest growth (CAGR ~6%) due to increasing urbanization and healthcare infrastructure development.

Market Drivers and Challenges

Driving Factors

- Aging population: Increased prevalence of hemorrhoids among seniors enhances market demand.

- Lifestyle factors: Sedentary lifestyles, obesity, and chronic constipation contribute to higher incidence rates.

- Rising awareness: Enhanced diagnosis and OTC drug accessibility promote self-medication.

- Product innovations: Development of more effective, targeted formulations boosts consumer confidence.

Challenges

- Regulatory hurdles: Stringent approval processes for new formulations can delay product launches.

- Competitive landscape: Presence of numerous OTC products leads to price competition.

- Efficacy concerns: Consumer skepticism due to variable clinical efficacy results for some OTC products.

Competitive Landscape

Major industry players include Johnson & Johnson, Bayer AG, Sanofi, GlaxoSmithKline, and Teva Pharmaceutical Industries. These companies focus on innovation, patent protection, and marketing strategies to maintain market share. Notably, many players are investing in combination products with both symptomatic relief and localized action, aiming to differentiate in a saturated market.

Emerging niche brands and generics also influence pricing dynamics, aiming to capture price-sensitive consumers.

Regulatory Environment

Regulations differ across regions, with agencies like the FDA (U.S.), EMA (Europe), and PMDA (Japan) governing product approvals. OTC designation facilitates market access but requires adherence to safety, efficacy, and labeling standards. Regulatory hurdles influence product development timelines and entry barriers, indirectly impacting prices and market competition.

Price Dynamics and Projections

Current Price Trends

The average retail price of hemorrhoidal medicated creams and ointments varies by formulation and region. In North America, OTC creams like hydrocortisone-based products retail between USD 8 to USD 15 per tube (30g–50g). Suppositories are priced similarly, often in the range of USD 10–20 for a pack of 10.

Pricing reflects formulation complexities, manufacturing costs, and branding strategies. Premium formulations with advanced delivery mechanisms command higher prices, whereas generics maintain competitive pricing.

Future Price Projections

By 2030, prices are expected to stabilize or slightly decline, averaging USD 7–13 per unit in North America and Europe, driven by increased competition. In emerging markets such as India and Southeast Asia, prices are projected to decrease further due to local manufacturing and regulatory incentives, reaching as low as USD 3–8 per unit.

The rise of generics and over-the-counter availability will sustain price erosion, but premium combination products incorporating novel ingredients or delivery systems may retain higher price points, ranging from USD 15–25.

Key Market Drivers Influencing Pricing

- Innovation and product differentiation: New formulations with enhanced efficacy and reduced side effects justify higher pricing.

- Patent protections: Limited patent periods lead to price stabilization for branded products. Post-expiry, generic competition drives prices down.

- Distribution channels: OTC accessibility reduces healthcare provider markup, maintaining affordable prices, but pharmacies and online channels may charge premiums.

- Regulatory incentivization: Regulatory approvals and reimbursement policies influence retail pricing structures.

Impact of Market Dynamics on Price Projections

- Competitive Entry: The burgeoning generic segment will exert downward pressure on prices.

- Innovation: Breakthrough formulations will command premium pricing and sustain higher revenue streams.

- Regional Market Variance: Developed markets will maintain relatively higher prices owing to brand loyalty and consumer trust; emerging markets will see more aggressive price decreases.

- Supply Chain Factors: Raw material costs, manufacturing efficiencies, and logistics will influence retail prices.

Conclusion

The hemorrhoidal medicated drugs market is poised for steady growth, driven by demographic and lifestyle factors, coupled with ongoing product innovation. Price projections suggest a trend towards stabilization and decline in mature markets, with premium products maintaining higher price points. Companies investing in R&D, strategic patent leveraging, and tailored regional approaches are well-positioned to capitalize on emerging opportunities.

Key Takeaways

- Market growth is sustainable with an expected CAGR of approximately 4.2% through 2030, driven by demographic changes and increasing awareness.

- Pricing is influenced by formulation complexity, brand positioning, regional economic factors, and regulatory environment.

- Generics and OTC products will exert downward pressure on prices, especially in developing countries.

- Innovative formulations with enhanced efficacy will command premium prices, especially in mature markets like North America and Europe.

- Strategic positioning—including patent management and regional customization—is critical for maximizing revenue.

FAQs

1. What are the main active ingredients used in medicated hemorrhoidal drugs?

Common active ingredients include hydrocortisone (anti-inflammatory), lidocaine (anesthetic), phenylephrine (vasoconstrictor), and protectants like zinc oxide and glycerin.

2. How does patent expiration affect pricing?

Patent expirations open the market to generic competitors, leading to significant price reductions. Branded products often maintain higher prices until patent expiry.

3. Are OTC hemorrhoidal medications safe for long-term use?

Typically, OTC medications are safe when used as directed. Long-term use should be under medical supervision, especially for products containing corticosteroids to prevent adverse effects.

4. What innovations are driving market growth?

Innovations include combined formulations, delivery systems improving drug bioavailability, and natural or herbal-based products appealing to wellness trends.

5. How do regional regulatory differences impact market entry?

Stringent regulatory standards in developed markets may delay product launches but ensure higher product safety and efficacy. Looser regulations in emerging markets facilitate faster entry but may impact product quality perceptions.

References

[1] MarketResearch.com, “Hemorrhoidal Medicated Drugs Market Report,” 2022.

[2] Grand View Research, “Gastrointestinal Drug Market Size & Share,” 2023.

[3] World Health Organization, “Global Burden of Hemorrhoidal Disease,” 2021.

[4] U.S. FDA, “Over-the-Counter Drugs Monograph,” 2022.

[5] IQVIA, “Pharmaceutical Market Data,” 2023.

More… ↓