Share This Page

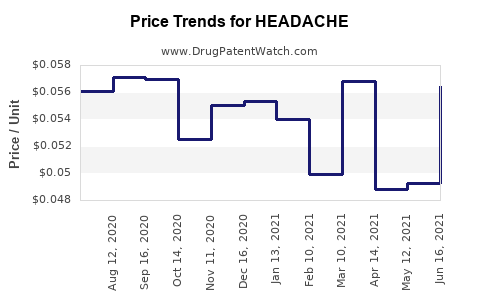

Drug Price Trends for HEADACHE

✉ Email this page to a colleague

Average Pharmacy Cost for HEADACHE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HEADACHE RELIEF CAPLET | 70000-0146-01 | 0.06462 | EACH | 2025-12-17 |

| HEADACHE RLF 250-250-65 MG CPLT | 70000-0066-01 | 0.06462 | EACH | 2025-12-17 |

| HEADACHE RELIEF CAPLET | 70000-0146-01 | 0.06557 | EACH | 2025-11-19 |

| HEADACHE RLF 250-250-65 MG CPLT | 70000-0066-01 | 0.06557 | EACH | 2025-11-19 |

| HEADACHE RELIEF CAPLET | 70000-0146-01 | 0.06779 | EACH | 2025-10-22 |

| HEADACHE RLF 250-250-65 MG CPLT | 70000-0066-01 | 0.06779 | EACH | 2025-10-22 |

| HEADACHE RELIEF CAPLET | 70000-0146-01 | 0.06907 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Headache Medication

Introduction

Headache medication encompasses a broad segment of the pharmaceutical market, driven by the high prevalence of headache disorders, particularly migraine and tension-type headaches. As one of the most common neurological conditions globally, headaches affect approximately 50% of adults worldwide, with migraines estimated to impact over 1 billion people, representing a significant market opportunity for pharma companies[1]. This article provides a comprehensive market analysis and detailed price projections for headache pharmaceuticals, emphasizing current trends, competitive landscapes, and future pricing strategies.

Market Overview

Global Headache Medication Market Size

The global headache medication market was valued at approximately USD 4.2 billion in 2022 and is projected to reach USD 6.1 billion by 2030, growing at a compound annual growth rate (CAGR) of around 5%[2]. Growth is driven by increasing awareness, better diagnostic protocols, and evolving treatment options, including innovative therapies like biologics and CGRP (calcitonin gene-related peptide) inhibitors.

Key Market Drivers

- Rising Prevalence: Increasing migraine and tension headache incidences, especially in aging populations.

- Technological Advancements: Development of targeted biologics and neuromodulation devices.

- Healthcare Accessibility: Improved healthcare infrastructure in emerging markets.

- Consumer Awareness: Campaigns highlighting migraine and headache management.

Market Segmentation

The market segmentation is twofold:

-

Drug Class:

- Analgesics: OTC (e.g., acetaminophen, NSAIDs).

- Triptans: Prescription-only, e.g., sumatriptan.

- CGRP Inhibitors: Erenumab, fremanezumab.

- Other Preventatives: Beta-blockers, antidepressants, antiseizure medications.

-

Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Competitive Landscape

The landscape includes established pharmaceutical giants like Teva, Lilly, and Novartis, along with emerging biotech firms introducing novel biologics. Patent expirations of blockbuster triptans, such as sumatriptan (generics available since 2004), have intensified pricing pressures, whereas innovative therapies like CGRP inhibitors command premium pricing.

Current Pricing Strategies

Over-the-Counter (OTC) Analgesics

OTC migraine remedies such as acetaminophen and NSAIDs are priced nominally, typically between USD 0.05–0.20 per tablet, emphasizing affordability.

Prescription Triptans

Brand-name triptans like sumatriptan typically retail for USD 15–USD 25 per box (6–9 doses). Generic versions have reduced prices by approximately 50–70%, making them more accessible.

CGRP Monoclonal Antibodies

CGRP inhibitors (e.g., erenumab) are premium-priced drugs, with average wholesale prices (AWP) around USD 600–USD 700 per month. Patent exclusivity and the high cost of biologics justify these prices, although biosimilars may influence future pricing strategies.

Pricing Influences

Pricing strategies are affected by:

- Regulatory approval status

- Patent protection duration

- Manufacturing costs

- Competitive dynamics

- Payer negotiation leverage

- Market demand growth

Future Price Projections (2023-2030)

Trends Influencing Future Pricing

- Biosimilars and Generics: Increased competition from biosimilars and generics is expected to reduce biologic drug prices by up to 30% within the next five years[3].

- Market Penetration of Cost-effective Therapies: As awareness and insurance coverage improve, more patients will access affordable generic medications, pressuring branded drug prices downward.

- Technological Innovations: Personalized treatment approaches and neuromodulation devices may command premium pricing; however, their integration into standard care will depend on cost-effectiveness.

Predicted Price Trajectory

| Drug Category | 2023 Average Price Range | 2027 Projection | 2030 Projection |

|---|---|---|---|

| OTC Analgesics | USD 0.05–USD 0.20 per tablet | Stable | Slight decrease (USD 0.04–USD 0.18) |

| Prescription Triptans | USD 15– USD 25 per box | USD 10–USD 20 | USD 8–USD 18 |

| CGRP Inhibitors | USD 600–USD 700/month | USD 400–USD 600 | USD 300–USD 500 |

| Neuromodulation Devices | USD 2,000–USD 5,000/device | USD 1,500–USD 4,000 | USD 1,200–USD 3,500 |

Price Drivers and Challenges

- Patent Expiry & Biosimilar Entry: The expiration of key patents will catalyze price decreases for biologics.

- Insurance Coverage: Increased coverage and reimbursement policies will make medications more affordable, influencing market prices.

- Manufacturing & R&D Costs: Innovations driving high costs might sustain elevated prices for novel therapies.

Market Growth Opportunities and Challenges

Opportunities

- Expansion into emerging markets offers significant growth potential due to rising healthcare access.

- Development and commercialization of novel biologics and personalized medicine.

- Integration of digital health tools and neuromodulation devices.

Challenges

- Price sensitivity in developing regions.

- Stringent regulatory frameworks delaying drug approvals.

- Patent expirations increasing generic competition.

- Reimbursement constraints impacting pricing strategies.

Regulatory and Policy Impacts

Regulatory agencies like the FDA and EMA are prioritizing innovative migraine therapies, influencing market competitiveness and pricing. Governments and insurers are increasingly advocating for cost-effective therapeutics, pressuring pharma companies to balance premium pricing with affordability.

Conclusion

The headache medication market is poised for steady growth, driven by technological innovation, demographic shifts, and expanding healthcare coverage. While current prices for premium biologics remain high, mounting biosimilar entrants, patent expiries, and market competition are set to drive down costs over the next decade. Companies embracing cost-effective manufacturing, strategic pricing, and market expansion can optimize profitability while improving patient access.

Key Takeaways

- The global headache medication market is projected to reach USD 6.1 billion by 2030, with a CAGR of 5%.

- Price reductions are expected for biologics due to biosimilars, patent expiries, and increased competition.

- Generic and OTC medications will maintain affordability, although premium therapies like CGRP inhibitors will see gradual price declines.

- Emerging markets represent significant growth opportunities given rising prevalence and improving healthcare infrastructure.

- Strategic pricing, patent management, and innovation will determine competitive positioning and profitability.

FAQs

1. How will biosimilars impact the price of biologic headache treatments?

Biosimilars are expected to reduce biologic prices by up to 30% within five years, increasing affordability and market competition.

2. What factors influence the pricing of new headache medications?

Regulatory approval, patent status, manufacturing costs, market competition, reimbursement policies, and perceived clinical value primarily influence pricing.

3. Are OTC headache remedies likely to see price reductions?

OTC analgesic prices are relatively stable but may experience slight downward pressure as generic versions proliferate.

4. How significant is geographical expansion in shaping future market prices?

Expanding into emerging markets will drive volume growth but may also necessitate lower prices due to differing purchasing powers and reimbursement landscapes.

5. What role will digital health and neuromodulation devices play in the headache market?

These innovative modalities will create premium-priced options and diversify treatment paradigms, potentially commanding higher market prices as they gain acceptance.

Sources

[1] World Health Organization. "Migraine Fact Sheet." 2022.

[2] Grand View Research. "Headache Medication Market Size, Share & Trends Analysis Report." 2022.

[3] IQVIA. "Biosimilar Market Trends." 2021.

More… ↓