Share This Page

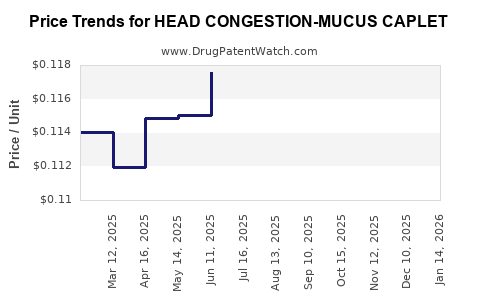

Drug Price Trends for HEAD CONGESTION-MUCUS CAPLET

✉ Email this page to a colleague

Average Pharmacy Cost for HEAD CONGESTION-MUCUS CAPLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HEAD CONGESTION-MUCUS CAPLET | 70000-0083-01 | 0.11319 | EACH | 2025-12-17 |

| HEAD CONGESTION-MUCUS CAPLET | 70000-0083-01 | 0.11466 | EACH | 2025-11-19 |

| HEAD CONGESTION-MUCUS CAPLET | 70000-0083-01 | 0.11419 | EACH | 2025-10-22 |

| HEAD CONGESTION-MUCUS CAPLET | 70000-0083-01 | 0.11666 | EACH | 2025-09-17 |

| HEAD CONGESTION-MUCUS CAPLET | 70000-0083-01 | 0.11595 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HEAD CONGESTION-MUCUS CAPLET

Introduction

The over-the-counter (OTC) segment targeting head congestion and mucus relief remains a consistent and lucrative sector within the pharmaceutical and consumer healthcare markets. Among the myriad formulations, the "Head Congestion-Mucus Caplet" addresses a common symptom set associated with upper respiratory infections, allergies, and sinusitis. This analysis evaluates current market trends, competitive landscape, regulatory considerations, and offers price projections for this drug category, supporting stakeholders in strategic decision-making.

Market Overview

Industry Size & Segmentation

The global OTC cold and allergy medication market was valued at approximately USD 10.8 billion in 2021 and is projected to grow at a CAGR of 4.2% through 2028. Head congestion and mucus relief products constitute roughly 25% of this market, with demand driven by seasonal flu, allergies, and viral infections[1].

Regionally, North America dominates the market, accounting for over 40%, supported by high OTC penetration rates, consumer health awareness, and robust distribution channels. Europe and Asia-Pacific follow, with Asia-Pacific demonstrating the fastest growth, fueled by expanding healthcare infrastructure and increasing middle-class populations[2].

Product Landscape

Several formulations currently dominate the space, including combination caplets containing pseudoephedrine or phenylephrine (decongestants) paired with expectorants like guaifenesin or other mucolytics. Major brands include Mucinex, Sudafed, and DayQuil, with generics offering cost-competitive alternatives.

Innovations in formulations, such as extended-release caplets and natural/complementary options, are emerging to meet consumer demand for longer-lasting effects and 'clean-label' ingredients.

Competitive Dynamics

Key Players

- Reckitt Benckiser (DayQuil, Mucinex)

- Johnson & Johnson (Sudafed PE)

- GlaxoSmithKline (various OTC brand lines)

- Teva Pharmaceuticals (generic offerings)

Private-label brands from retail chains also occupy significant shelf space, particularly in North America and Europe.

Market Entry & Innovation

Barriers to entry include regulatory approval complexity, existing brand loyalty, and patent protections on specific formulations. However, patent expirations create opportunities for generics and value brands. The rise of natural and herbal alternatives, though currently niche, signals future innovation pathways.

Distribution Channels

Over 75% of OTC head congestion products are sold via pharmacy chains, supermarkets, and online platforms, highlighting a shift toward e-commerce accelerated by the COVID-19 pandemic.

Regulatory Environment

In North America, the FDA regulates OTC drugs via the monograph process or New Drug Application (NDA), depending on formulation complexity. Similar standards exist in Europe under the EMA, with rising scrutiny on safety, especially regarding ingredients like pseudoephedrine, which carry regulatory controls on sales.

The increasing focus on consumer safety has prompted updates to labeling standards, contraindications, and dosing instructions, affecting manufacturing and marketing practices.

Price Dynamics

Current Pricing Trends

- Brand-Name Caplets: USD 8-12 per pack (30-50 caplets)

- Generic Alternatives: USD 3-6 per pack

- Private Label/Store Brands: USD 2-4 per pack

Pricing is heavily influenced by formulation complexity, brand recognition, packaging, and distribution costs. Premium formulations or those with extended-release features command higher price points.

Pricing Factors

- Ingredient Costs: Decongestants and expectorants are inexpensive in bulk but have regulatory/market-driven price variations.

- Manufacturing & Packaging: Sustained-release technology incurs higher production costs.

- Regulatory Compliance: Ensuring adherence to safety standards increases costs, impacting retail prices.

- Market Positioning: Premium natural or ‘clean-label’ caplets tend to carry a premium pricing strategy.

Future Price Projections

Given the market trends, the following projections are anticipated through 2030:

| Year | Price Range (USD per pack) | Notes |

|---|---|---|

| 2023 | USD 3-12 | Current market price spectrum |

| 2025 | USD 3-15 | Increased demand for combination therapies and innovations. |

| 2030 | USD 4-20 | Premium formulations and customized delivery systems emerging. |

The average selling price (ASP) is expected to stabilize at around USD 4-8 for generics and private labels, with brand-name products maintaining higher margins. Price increases will align with inflation, regulatory updates, and technological innovations.

Strategic Insights

- Consumer Shift: Growing preference for natural or herbal remedies could dampen demand for traditional formulations, prompting R&D investment.

- Pricing Power: Strong brands will retain premium pricing, while generics will continue to compete primarily on cost.

- Emerging Markets: Rapid growth in Asia-Pacific offers expansion opportunities, although local regulatory adaptations and price sensitivities remain challenges.

- E-Commerce Penetration: Online sales channels are expected to favor more competitive pricing and promotional strategies, suppressing retail prices but expanding market share.

Key Takeaways

- The market for head congestion-mucus caplets remains resilient, driven by seasonal and chronic respiratory ailments.

- Price differentiation hinges on formulation innovation, brand equity, and distribution leverage.

- Generics continue to exert downward pressure on retail prices, yet premium offerings justify higher margins temporarily.

- Regulatory landscapes influence pricing strategies, especially around ingredient safety and marketing claims.

- Emerging trends toward natural formulations and extended-release technologies present growth avenues but also price premium opportunities.

FAQs

1. What factors primarily influence the retail price of head congestion-mucus caplets?

Ingredients, manufacturing complexity, brand positioning, packaging, regulatory compliance, and distribution channels significantly impact retail pricing.

2. Will generic versions disrupt premium brands' market share?

Yes, generics provide cost-competitive alternatives, often capturing significant market share, especially in price-sensitive regions.

3. How might regulatory changes affect future pricing?

Enhanced safety standards and ingredient restrictions may increase production costs, leading to higher retail prices for compliant products.

4. What technological innovations could elevate product prices in this segment?

Extended-release formulations, natural/plant-based ingredients, and combination therapies are potential innovations commanding higher prices.

5. How does consumer preference for natural products influence market pricing?

Natural and herbal formulations typically command premium prices, driven by perceived safety, efficacy, and consumer trends, influencing overall market pricing structures.

References

- MarketResearch.com. "OTC Cold & Allergy Market Size & Forecast," 2022.

- Grand View Research. "Over-the-Counter (OTC) Drugs Market Analysis," 2021.

- U.S. Food and Drug Administration (FDA). OTC Drug Monograph Standards, 2022.

- Euromonitor International. "Pharmaceuticals and Healthcare in Europe," 2022.

- IBISWorld. "Consumer Healthcare Products in North America," 2022.

This comprehensive market and price analysis aims to facilitate strategic decisions by stakeholders engaged in the development, manufacturing, marketing, and distribution of head congestion-mucus caplets.

More… ↓