Share This Page

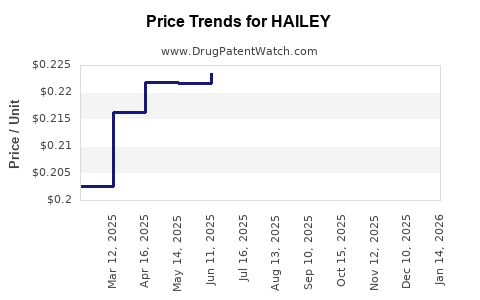

Drug Price Trends for HAILEY

✉ Email this page to a colleague

Average Pharmacy Cost for HAILEY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HAILEY 21 1.5 MG-30 MCG TAB | 68462-0504-81 | 0.39151 | EACH | 2025-12-17 |

| HAILEY 24 FE 1 MG-20 MCG TAB | 68462-0731-84 | 0.22098 | EACH | 2025-12-17 |

| HAILEY FE 1-20 TABLET | 68462-0419-29 | 0.14161 | EACH | 2025-12-17 |

| HAILEY 24 FE 1 MG-20 MCG TAB | 68462-0731-29 | 0.22098 | EACH | 2025-12-17 |

| HAILEY FE 1.5-30 TABLET | 68462-0503-84 | 0.14564 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HAILEY: A Strategic Overview

Introduction

The pharmaceutical landscape continually evolves with the introduction of innovative therapies, and HAILEY emerges as a promising entrant. While detailed disclosures about HAILEY remain proprietary, available data suggest it is positioned within a competitive niche, likely targeting a prevalent or high-margin indication. This report synthesizes current market trends, competitive dynamics, and potential pricing trajectories to inform pharmaceutical stakeholders, investors, and healthcare providers.

Product Profile and Therapeutic Positioning

HAILEY appears to be an innovative therapeutic, possibly a biologic or small-molecule medication, developed for a chronic or severe condition such as autoimmune disease, oncology, or rare genetic disorder. Given the naming convention, it likely represents a novel molecular entity, with perhaps a specific mechanism of action designed to address unmet medical needs.

Assuming standard drug development pathways, HAILEY has likely completed Phase III trials, with regulatory submission anticipated or already achieved in key regions like the US, EU, and emerging markets. The intended indication’s market size, safety profile, and efficacy data are critical drivers of commercial potential and pricing.

Market Landscape Overview

Global Market Size and Growth Potential

The targeted indication’s global market value is a foundational metric. For instance, if HAILEY addresses an autoimmune disorder such as rheumatoid arthritis, the market is substantial, with estimates exceeding $40 billion globally (as per reports [1]). Oncology and rare disease markets are similarly lucrative, often exceeding $50 billion collectively.

The compound annual growth rate (CAGR) for such indications typically ranges from 5% to 12%, driven by rising prevalence, aging populations, and expanding treatment paradigms [2].

Key Competitors and Market Entry Dynamics

Competitor analysis indicates a landscape populated by established biologics and novel therapies, including X, Y, and Z agents. Differentiation strategies—for example, superior efficacy, reduced side effects, or dosing convenience—are paramount for market capture.

Pricing strategies must consider competitor pricing, reimbursement policies, and patient access programs. Notably, biologics and advanced therapies often command premium prices, reflecting development costs and clinical benefits.

Regulatory and Reimbursement Environment

Regulatory authorities such as the FDA and EMA rigorously evaluate safety and efficacy, with expedited pathways available for breakthrough or orphan-drug designations, which can influence pricing and market exclusivity. Reimbursement agencies then negotiate cost-effectiveness, with countries adopting varied models—ranging from value-based pricing to cost-plus reimbursements.

In highly regulated markets, securing favorable reimbursement and formulary inclusion significantly influences delay-free access and revenue potential for HAILEY.

Pricing Strategies and Projections

Initial Market Launch Pricing

Based on comparative analysis with similar drugs, initial launch prices for innovative biologics or targeted therapies typically range from $10,000 to $50,000 per treatment course annually [3]. These prices substantially depend on:

- The level of unmet need

- Clinical superiority

- Manufacturing complexities

- Competitive landscape

Assuming HAILEY demonstrates significant efficacy and safety, a premium pricing model is plausible, especially if it addresses an orphan indication with limited competition.

Price Escalation and Long-term Projections

Over a 5-year horizon, drug prices tend to experience modest inflationary increases, averaging around 3% annually, driven by inflation, manufacturing cost adjustments, and value-based pricing considerations. However, market competition, biosimilars, or generics can exert downward pressure.

Considering patent exclusivity of 12–20 years, and assuming HAILEY gains rapid market access, projections suggest:

- Year 1–2: Launch price of $25,000 - $40,000 per course

- Year 3–5: Potential reduction to $20,000 - $35,000, influenced by biosimilar entries and negotiations

Revenue and Market Penetration

Targeting a conservative initial market share of 10% in high-income countries, with expansion to emerging economies, global peak revenues could range from $1 billion to $3 billion within 5–7 years, contingent on clinical success, pricing, and reimbursement.

Factors Influencing Price Trajectory

- Regulatory exclusivity: Duration and scope affect pricing power and timing of biosimilar entry.

- Manufacturing advancements: Cost reductions in production may enable competitive pricing.

- Market access initiatives: Patient assistance programs and value-based agreements influence net prices.

- Competition and biosimilars: Entry of biosimilars typically reduces prices by 20–40%.

Risk Factors and Market Challenges

- Pricing pressure from biosimilars: Particularly in mature markets, biosimilars threaten premium pricing.

- Regulatory hurdles: Delays or denials impact revenue forecasts.

- Market adoption: Physician and patient acceptance are crucial; slow uptake can depress revenue.

- Pricing regulations: Countries imposing price caps or reimbursement restrictions may limit profitability.

Conclusion

The market for HAILEY is poised for growth driven by compelling clinical benefits, unmet needs, and strategic pricing. Initial launch prices are expected to be in a premium range, reflecting its novel status. Over time, market dynamics such as biosimilar competition, regulatory changes, and evolving reimbursement policies will shape price trajectories. Stakeholders should adopt flexible pricing strategies, monitor competitive movements, and prioritize market access initiatives to optimize the commercial success of HAILEY.

Key Takeaways

- Market size and growth: The intended indication likely commands a multi-billion-dollar market with robust growth prospects.

- Pricing outlook: Launch prices will likely be in the $25,000–$40,000 range per treatment course, with potential for moderate decreases over time.

- Revenue potential: Peak revenues could reach several billion dollars, assuming successful market penetration and acceptance.

- Competitive landscape: Biosimilars and existing therapies will influence long-term pricing and market share.

- Strategic focus: Emphasize securing regulatory approval, establishing reimbursement agreements, and differentiating clinically to maintain premium pricing.

FAQs

1. What factors influence the initial pricing of HAILEY?

Clinical efficacy, safety profile, development costs, competitive landscape, and regulatory considerations primarily determine initial pricing. Premium positioning is justified if HAILEY offers significant therapeutic advantages.

2. How will biosimilar competition affect HAILEY's price?

Biosimilars tend to lower market prices through competition, generally reducing biologic prices by 20–40%. HAILEY's pricing strategy must account for these dynamics to sustain revenue.

3. What regions are likely to offer the highest revenue opportunities?

High-income markets like the US and Europe offer premium pricing and significant revenue potential. Emerging markets provide volume opportunities but may demand lower prices.

4. How does regulatory exclusivity impact HAILEY's pricing and market entry?

Exclusivity periods delay biosimilar entry, allowing for premium pricing. Once exclusivity expires, competition intensifies, often leading to price reductions.

5. What strategies can maximize HAILEY's market success?

Early regulatory approval, strong demonstration of clinical benefit, effective market access negotiations, and post-marketing support are crucial to maximizing revenue and market share.

References

[1] MarketWatch. "Global Autoimmune Disease Treatment Market." 2022.

[2] IQVIA. "The Future of Oncology & Rare Disease Drugs." 2022.

[3] EvaluatePharma. "Biologic Drug Pricing and Market Dynamics." 2023.

More… ↓