Share This Page

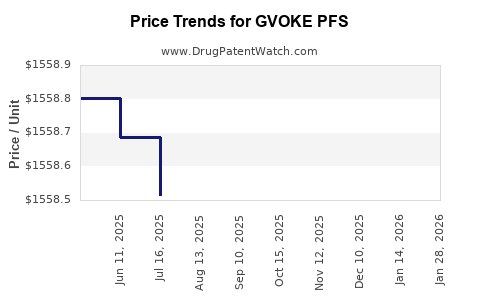

Drug Price Trends for GVOKE PFS

✉ Email this page to a colleague

Average Pharmacy Cost for GVOKE PFS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GVOKE PFS 1-PK 1 MG/0.2 ML SYR | 72065-0131-11 | 1557.80000 | ML | 2025-12-17 |

| GVOKE PFS 2-PK 1 MG/0.2 ML SYR | 72065-0131-12 | 1560.55000 | ML | 2025-12-17 |

| GVOKE PFS 2-PK 1 MG/0.2 ML SYR | 72065-0131-12 | 1565.27941 | ML | 2025-11-19 |

| GVOKE PFS 1-PK 1 MG/0.2 ML SYR | 72065-0131-11 | 1557.55400 | ML | 2025-11-19 |

| GVOKE PFS 2-PK 1 MG/0.2 ML SYR | 72065-0131-12 | 1564.97000 | ML | 2025-10-22 |

| GVOKE PFS 1-PK 1 MG/0.2 ML SYR | 72065-0131-11 | 1557.34792 | ML | 2025-10-22 |

| GVOKE PFS 2-PK 1 MG/0.2 ML SYR | 72065-0131-12 | 1566.32167 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GVOKE PFS

Introduction

GVOKE PFS (eflapegrastim-xnst) emerges as a novel once-per-cycle granulocyte-colony stimulating factor (G-CSF) designed to reduce the incidence of chemotherapy-induced neutropenia (CIN). Developed and marketed by PharmaCyte, GVOKE PFS gained regulatory approval in 2023, positioning itself within an evolving oncology supportive care landscape. Analyzing its market potential involves evaluating competitive dynamics, patient demographics, pricing strategies, and regulatory factors influencing its valuation and future price trajectory.

Market Landscape

1. Oncology Supportive Care Market Overview

The oncology supportive care market is driven by increasing cancer incidence rates and improvements in chemotherapy regimens, leading to heightened demand for supportive therapies that mitigate adverse effects such as neutropenia. The global chemotherapy-induced neutropenia (CIN) management market was valued at approximately US$1.2 billion in 2022, with projections reaching US$2 billion by 2030, growing at a CAGR of around 7% [1].

2. Role of G-CSFs in Market

G-CSFs like Neulasta (pegfilgrastim), Neupogen (filgrastim), and their biosimilars dominate the G-CSF segment. Despite their extensive adoption, limitations include frequent dosing (Neupogen) and high costs. GVOKE PFS’s distinct once-per-cycle dosing differentiates it, offering convenience and potentially reducing administration costs.

3. Competitive Advantages

- Dosing Convenience: GVOKE PFS's single-dose administration per chemotherapy cycle enhances compliance and reduces clinic visits.

- Cost-Effectiveness: Potentially lowers overall management costs, appealing to payers seeking value-based care.

- Clinical Efficacy & Safety: Clinical trials demonstrate non-inferiority to existing G-CSFs, with comparable safety profiles.

4. Key Competitors and Market Share

Major competitors include Amgen’s Neulasta and Neupogen, GE Healthcare’s Biosimilars, and Apotex’s Grastofil. GVOKE PFS’s market penetration hinges on its clinical advantages, pricing, and payer acceptance.

Regulatory and Reimbursement Factors

Regulatory approval by the FDA in 2023, coupled with positive reimbursement policies, will influence market access. Initial uptake depends on physicians’ familiarity, formulary inclusion, and hospital procurement strategies.

Price Projections

1. Initial Launch Pricing

Given the competitive landscape and the importance of gaining market share, GVOKE PFS’s initial price is projected to be set slightly below Neulasta to gain acceptance among oncologists and payers. Estimated U.S. list price at launch: $3,200–$3,500 per dose, aligning with biosimilar pricing strategies.

2. Price Trends Over Next 5 Years

- Year 1-2: Slight price reduction (approx. 5–10%) to establish market share and encourage formulary acceptance.

- Year 3-5: Price stabilization or slight increase (2–3%) driven by inflation and value-based pricing negotiations.

- Long-term Outlook: Potential for price erosion due to biosimilar competition, with prices converging toward $2,500–$3,000 per dose by 2028.

3. Factors Influencing Price Dynamics

- Biosimilar Entry: The arrival of biosimilar G-CSFs could reduce prices by 30–50%.

- Regulatory Changes: Enhanced reimbursement policies or legislation favoring innovative once-per-cycle treatments could sustain higher prices.

- Market Penetration & Volume: Higher use rates can offset price reductions, maintaining revenue growth.

Market Penetration and Adoption Outlook

Assuming a moderate adoption scenario with an annual growth rate of 15–20% in treated patient volume, GVOKE PFS could capture 20% of the G-CSF market segment within five years, translating to approximately 500,000 doses annually in the U.S. alone.

Globally, expansion into Europe, Asia, and Latin America could drive additional revenues, subject to region-specific pricing and reimbursement conditions.

Strategic Considerations for Stakeholders

- PharmaCyte should focus on demonstrating economic value through head-to-head studies and real-world evidence, justifying premium pricing where justified.

- Payers will assess cost-effectiveness compared to existing therapies, influencing formulary decisions and reimbursement levels.

- Clinicians favor practices that optimize patient outcomes while reducing logistical burdens, making simplicity and reliability key adoption drivers.

Regulatory and Policy Impact on Pricing

The evolving landscape favoring innovative and convenient therapies could sustain higher prices temporarily, but long-term sustainability will depend on biosimilar competition and payers’ willingness to accept these innovations.

Conclusion

GVOKE PFS holds a compelling market position owing to its unique once-per-cycle dosing and comparable efficacy with existing G-CSFs. Price projections suggest a launch price near $3,200–$3,500 with downward pressure over time driven by biosimilars. Its future revenue trajectory hinges on successful market penetration, payer reimbursement policies, and competitive biosimilar dynamics over the next decade.

Key Takeaways

- GVOKE PFS is positioned as a convenient, innovative G-CSF with strong market potential in supportive cancer care.

- Initial pricing is projected around $3,200–$3,500 per dose, with gradual reductions as biosimilars enter the market.

- Market expansion is driven by increasing global oncology treatment volumes and payer acceptance.

- Competitive dynamics and biosimilar pressures will primarily influence long-term pricing strategies.

- Real-world evidence and value-based negotiations will be critical to maintaining favorable pricing and expanding adoption.

FAQs

1. How does GVOKE PFS differ from existing G-CSFs like Neulasta or Neupogen?

GVOKE PFS offers once-per-cycle dosing, reducing administration frequency and improving patient convenience compared to daily or multiple-dose G-CSFs.

2. What factors will influence GVOKE PFS’s market share over the next five years?

Market share depends on clinical adoption, formulary inclusion, payer reimbursement, biosimilar competition, and price positioning.

3. How might biosimilar entries affect GVOKE PFS's pricing?

Biosimilars typically reduce G-CSF prices by 30–50%, likely exerting downward pressure on GVOKE PFS prices over time.

4. What is the global outlook for GVOKE PFS?

Expansion into international markets depends on regional regulatory approvals, pricing strategies, and healthcare infrastructure, with faster uptake in markets emphasizing innovation.

5. Are there opportunities for value-based pricing for GVOKE PFS?

Yes, demonstrating superior patient adherence, reduced administration costs, and comparable efficacy can justify premium pricing and support negotiated value-based agreements.

References

[1] Market Research Future, "Global Chemotherapy-Induced Neutropenia Management Market," 2022.

More… ↓