Last updated: July 29, 2025

Introduction

Guanfacine, a selective alpha-2A adrenergic receptor agonist, has established itself as a vital therapeutic agent for conditions including attention deficit hyperactivity disorder (ADHD), hypertension, and off-label uses such as opioid withdrawal management. Its unique mechanism targeting prefrontal cortex receptor activity positions it as a differentiated product in the neuropsychiatric pharmacology space. This market analysis delineates current demand, competitive landscape, pricing strategies, and future price projections for guanfacine, providing critical insights for stakeholders across pharmaceutical R&D, manufacturing, and investment sectors.

Market Overview

Therapeutic Applications and Market Drivers

Guanfacine’s primary indications—ADHD and hypertension—continue to underpin its market presence. The ADHD segment dominates, given the condition’s prevalence, especially among children and adolescents, with estimates suggesting over 6 million children in the United States diagnosed as of 2022 [1]. Increasing recognition of non-stimulant options like guanfacine offers growth opportunities amidst concerns about stimulant misuse and side effects.

In hypertension, guanfacine is often prescribed as an adjunct or secondary therapy, especially for patients intolerant to first-line medications. The broader acceptance of personalized medicine, coupled with heightened cardiovascular health awareness, sustains demand.

Market Size and Growth Trends

The global ADHD therapeutics market was valued at approximately USD 16 billion in 2021, with a compound annual growth rate (CAGR) projected at 7% through 2030 [2]. Guanfacine’s share within this market is expanding, particularly with the rising approval of formulations tailored for specific age groups and delivery modalities.

The hypertension segment is also witnessing growth, with the global hypertensive drugs market expected to reach USD 64 billion by 2027, growing at a CAGR of about 5.8% [3]. Guanfacine’s niche positioning as a non-stimulant and centrally acting agent sustains its relevance.

Competitive Landscape

Brand-name formulations, such as Tenex and Intuniv, dominate the guanfacine market. These are produced primarily by specialty pharma and large pharmaceutical companies. Generic versions have entered markets worldwide, intensifying price competition. Notable competitors include clonidine, another centrally acting agent with broader indications, and newer non-stimulant therapeutics like viloxazine and guanfacine XR formulations.

Patent protections have historically limited generic penetration, but as patents expire, market prices are subject to downward pressure. Ongoing R&D aims to develop extended-release (XR) formulations, improving adherence, and expanding market penetration.

Pricing Dynamics

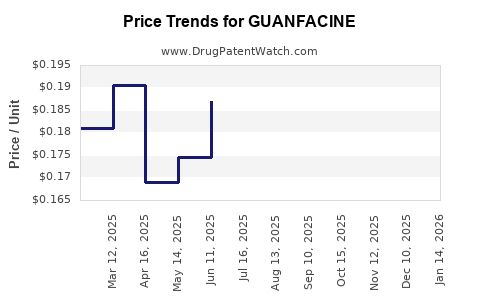

Current Pricing Landscape

At present, the average retail price for branded immediate-release guanfacine (Tenex) ranges between USD 4.50 and USD 8 per tablet in the United States, depending on dosage and pharmacy discounts [4]. The extended-release formulations, such as Intuniv, command higher prices—approximately USD 20–USD 30 per tablet, reflecting convenience and formulation costs.

Generics significantly reduce consumer prices; a typical generic guanfacine XR drops prices to approximately USD 10–USD 15 per tablet. Wholesale acquisition costs (WAC) and insurance reimbursements influence actual prices paid, with significant variation across regions.

Factors Influencing Pricing

- Patent Status: The expiration of patents for branded formulations catalyzes generic entry, exerting downward pressure on prices.

- Regulatory Approvals: New formulations, including transdermal patches or novel extended-release systems, can command premium prices due to improvements in adherence and efficacy.

- Market Penetration: Increased adoption in pediatric and adult populations amplifies sales volume, affecting per-unit pricing strategies.

- Pricing Strategies: Pharmaceutical companies leverage bundling, formulary positioning, and patient assistance programs to maximize profitability.

Price Projections (2023–2030)

Short-term (2023–2025)

In the immediate future, the market will experience price stability, with generic competition for immediate-release guanfacine continuing to suppress prices in developed markets. However, branded extended-release formulations will attract premiums, especially if formulated with sustained-release technology or novel delivery methods. Expect retail prices for XR formulations to hover around USD 20–USD 35 per tablet, aligning with current trends.

Medium-term (2025–2027)

As patents for leading-brand drugs expire and biosimilar or similar formulations enter the market, a gradual price reduction—estimated at 10–20%—is anticipated. Additionally, emergence of biosimilars or interchangeable generics could further pressure prices, especially in mature markets like North America and Europe.

Long-term (2027–2030)

By this horizon, widespread generic penetration is projected. Prices for guanfacine XR could decline by an additional 25–30% from peak branded prices, reaching approximately USD 10–USD 15 per tablet. Introduction of innovative formulations—such as once-daily transdermal patches—may sustain higher prices for specialized products. Market segmentation and differentiated delivery systems will play crucial roles in maintaining value propositions.

Emerging Markets and Regional Variations

In low- and middle-income countries (LMICs), generic versions dominate, with prices often less than USD 2 per tablet due to lower regulatory and manufacturing costs. Rapid access and affordability considerations could influence pricing strategies globally, leading to regional disparities.

Future Market Dynamics

Innovation and Digital Health Integration

The trajectory of guanfacine pricing will depend heavily on product innovation—such as extended-release and transdermal systems—and associated patent protections. Digital health integration, including adherence monitoring, could justify premium pricing. Additionally, personalized medicine approaches targeting specific patient subgroups may influence pricing strategies.

Regulatory Environment and Patent Landscape

Patent expirations in the next decade will catalyze generic competition, significantly narrowing price differentials. Conversely, patent extensions through new formulations or combination therapies could sustain higher prices longer.

Market Penetration and Adoption Trends

Increased awareness, clinician education, and formulary inclusion will expand guanfacine access. Adoption of once-daily XR formulations enhances compliance, providing an opportunity for premium pricing for such formulations, especially in developed markets.

Key Takeaways

- Market Size & Growth: The global ADHD and hypertension markets underpin guanfacine’s enduring relevance; projected CAGR of approximately 6% through 2030 underpins sustained demand.

- Pricing Trends: Current prices range from USD 4.50 to USD 30 per tablet, with generics exerting downward pressure, especially post-patent expiry.

- Price Projections: Branded formulations may see prices decline by 10–20% through 2027, with long-term prices stabilizing around USD 10–USD 15 per tablet due to generics and market competition.

- Strategic Opportunities: Innovations in delivery systems and formulations, along with targeted patient populations, could support premium pricing segments.

- Regional Variations: LMIC markets will continue to offer lower prices, while high-income nations will experience gradual price declines aligned with patent expirations and market saturation.

Conclusion

Guanfacine’s market dynamics are marked by steady demand, evolving competition, and pricing pressures driven by patent landscapes and technological innovation. Stakeholders should monitor regulatory developments, patent statuses, and emerging formulations to optimize pricing strategies. As advanced delivery platforms and personalized medicine become more prevalent, guanfacine’s pricing trajectory is poised for moderation but with potential premium segments preserved through innovation.

FAQs

1. What factors influence the pricing of guanfacine in different markets?

Pricing is primarily influenced by patent status, formulation type (immediate vs. extended-release), regional regulatory costs, generic competition, and payer reimbursement policies.

2. How will patent expirations affect guanfacine prices?

Patent expirations typically lead to increased generic entry, exerting downward pressure on prices. In the U.S., imminent patent expiry of branded formulations is expected to reduce prices by approximately 20–30% within three years.

3. Are there upcoming formulations that could command premium prices?

Yes, novel delivery systems such as transdermal patches, longer-acting formulations, or combination therapies can justify higher pricing due to improved adherence and clinical outcomes.

4. What is the outlook for guanfacine in emerging markets?

Generics dominate these markets, resulting in significantly lower prices (less than USD 2 per tablet). Market access is influenced by regulatory landscape and economic factors.

5. How might digital health technologies influence guanfacine pricing?

Digital adherence tools and remote monitoring can create value added offerings, enabling companies to maintain premium pricing for integrated or enhanced formulations.

References

[1] American Psychiatric Association. Diagnostic and Statistical Manual of Mental Disorders, Fifth Edition (DSM-5). 2013.

[2] MarketsandMarkets. ADHD Therapeutics Market Size, Share & Trends Analysis. 2022.

[3] Fortune Business Insights. Hypertensive Drugs Market Forecast, 2022–2027.

[4] GoodRx. Guanfacine Prices & Cost Comparisons. 2023.