Share This Page

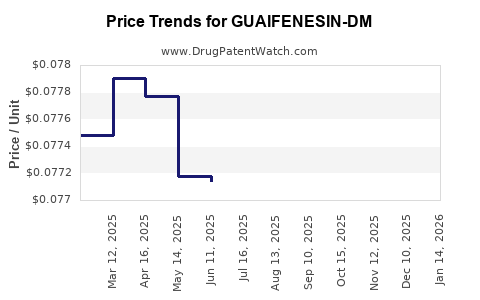

Drug Price Trends for GUAIFENESIN-DM

✉ Email this page to a colleague

Average Pharmacy Cost for GUAIFENESIN-DM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GUAIFENESIN-DM 400-20 MG TAB | 24689-0123-01 | 0.07864 | EACH | 2025-12-17 |

| GUAIFENESIN-DM 400-20 MG TAB | 24689-0123-02 | 0.07864 | EACH | 2025-12-17 |

| GUAIFENESIN-DM 400-20 MG TAB | 24689-0123-01 | 0.07902 | EACH | 2025-11-19 |

| GUAIFENESIN-DM 400-20 MG TAB | 24689-0123-02 | 0.07902 | EACH | 2025-11-19 |

| GUAIFENESIN-DM 400-20 MG TAB | 24689-0123-01 | 0.07884 | EACH | 2025-10-22 |

| GUAIFENESIN-DM 400-20 MG TAB | 24689-0123-02 | 0.07884 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Guaifenesin-DM

Introduction

Guaifenesin-DM, a combination drug comprising guaifenesin and dextromethorphan, remains a pivotal therapy in managing cough and cold symptoms, primarily impacting the over-the-counter (OTC) and prescription markets. Its widespread usage across various demographics — including pediatric, adult, and elderly populations — underscores its market significance. Understanding the current market landscape, competitive positioning, regulatory environment, and future price trajectories is essential for stakeholders ranging from pharmaceutical companies and investors to healthcare providers and policymakers.

Market Overview

Product Profile and Therapeutic Use

Guaifenesin acts as an expectorant, facilitating mucus clearance in respiratory pathways, whereas dextromethorphan functions as an antitussive, suppressing dry cough. The synergistic combination provides comprehensive symptomatic relief for upper respiratory illnesses, particularly in cold and flu formulations. OTC formulations dominate the global market, with prescription formulations constituting a smaller fraction primarily for pediatric use.

Market Size and Dynamics

The global expectorant-cough suppressant market, inclusive of Guaifenesin-DM, was valued at approximately USD 2.4 billion in 2021, with projections estimating a compound annual growth rate (CAGR) of around 4.2% through 2028 [1]. The COVID-19 pandemic temporarily disrupted supply chains but simultaneously increased demand due to respiratory symptom prevalence. Post-pandemic, increased consumer awareness and expanding aging populations sustain steady growth.

Regional Market Distribution

- North America: Dominates with approximately 45% market share, driven by high OTC OTC sales, extensive healthcare infrastructure, and robust marketing.

- Asia-Pacific: Exhibits rapid growth potential due to rising disposable income, urbanization, and increasing access to healthcare.

- Europe: Stable market with mature OTC sales, regulations favoring consumer access.

- Latin America and Africa: Emerging markets with expanding distribution channels and increasing disease burden.

Competitive Landscape

Major players include Johnson & Johnson, Reckitt Benckiser, GlaxoSmithKline, and Perrigo. The market is characterized by:

- Strong OTC presence, with formulations available in syrups, tablets, and lozenges.

- Increasing R&D investments targeting improved formulations and combination therapies.

- Patent expirations leading to a market shift towards generics, constraining pricing power of branded products.

Regulatory and Patent Environment

Regulatory Framework

Most countries govern Guaifenesin-DM under OTC regulations, with varying degree of safety and efficacy assessments. Stringent labeling and manufacturing standards are enforced by agencies like the FDA (U.S.) and EMA (Europe).

Patent Landscape

While Guaifenesin itself is off-patent, certain combination formulations have patent protections, influencing market exclusivity. The expiration of key patents has facilitated the influx of generics, exerting downward pressure on prices and revenues.

Market Drivers and Challenges

Drivers

- Persistent consumer demand for effective cold remedies.

- Growing global prevalence of respiratory illnesses.

- Expansion of OTC availability in developing regions.

- Product innovation, including flavored and sugar-free variants.

Challenges

- Intense price competition among generics.

- Regulatory constraints on combination medications.

- Potential safety concerns regarding misuse, especially of dextromethorphan.

- Market saturation in developed regions.

Price Trends and Projections

Historical Price Patterns

Prices for Guaifenesin-DM products have exhibited a downward trend over the past decade, primarily driven by generic entry. A typical store-brand product might retail at USD 3-5 per 100 ml syrup or USD 2-4 per tablet, compared to premium branded options costing up to 20% more.

Future Price Trajectories

Projected price declines are expected to continue, with some nuances:

- Increased generics: Price erosion is anticipated as more manufacturers enter the market, reducing profit margins for branded products.

- Formulation innovation: New delivery formats and combination products may command premium pricing temporarily but are likely to face competition eventually.

- Regional disparities: Developing markets may experience sharper price declines due to commoditization, whereas established markets might maintain higher prices due to brand loyalty and regulatory barriers.

By 2028, average retail prices for Guaifenesin-DM formulations could decrease by an additional 15-25%, assuming continued generic penetration, unless premium niche segments emerge.

Price Regulation and Impact

In some jurisdictions, governments are contemplating or enacting measures to regulate OTC drug prices, which could further depress retail prices. Conversely, in markets with limited generic competition or patents, prices may stabilize or increase.

Strategic Considerations for Stakeholders

- Pharmaceutical companies should focus on innovation, including sustained-release formulations, combination therapies, and targeted pediatric or elderly formulations.

- Manufacturers and distributors need to optimize supply chains and negotiate favorable procurement to sustain margins amid pricing pressures.

- Policy makers must balance affordability with incentives for R&D investments.

Conclusion

Guaifenesin-DM remains a vital component in respiratory therapy with a sizable and mature market. The outlook indicates continued price declines driven by increased generic competition, with regional variations influencing trends. Stakeholders should adapt by innovating product offerings, optimizing supply chains, and navigating regulatory changes to maintain competitiveness.

Key Takeaways

- The global Guaifenesin-DM market was valued at USD 2.4 billion in 2021 and is forecasted to grow at a CAGR of 4.2% through 2028.

- Price decline trends, driven by generics, are expected to persist, with retail prices decreasing by 15-25% over the next five years.

- Regional variations are significant: North America and Europe tend to sustain higher prices due to brand loyalty, whereas emerging markets experience sharper price declines.

- Patent expirations have facilitated market entry for generics, intensifying competition and further compressing margins.

- Innovation in formulations and delivery methods can enable premium pricing and differentiation amidst commoditization pressures.

FAQs

1. How does patent expiration affect Guaifenesin-DM pricing?

Patent expirations open the market to generic competitors, increasing supply and driving prices downward. Branded products may see price erosion unless they differentiate through innovation or brand loyalty.

2. What are the key drivers behind the projected decline in Guaifenesin-DM prices?

Increased generic competition, regulatory approvals for OTC sales, and market saturation in developed regions contribute significantly to downward pricing trends.

3. Are premium formulations or delivery methods likely to maintain higher prices?

Yes, formulations such as sustained-release tablets, for pediatric use, or combination products with additional active ingredients can command higher prices, at least temporarily.

4. What role do regional regulations play in Guaifenesin-DM pricing?

Regulatory authorities influence pricing via OTC status regulations, safety guidelines, and potential drug price controls, impacting regional market prices.

5. What strategies can pharmaceutical companies adopt to remain competitive in this market?

Focus on product differentiation through innovation, proactively managing patent portfolios, expanding regional presence, and engaging in strategic partnerships to maximize market share.

Sources

[1] MarketResearch.com, "Expectorant and Cough Suppressant Market Forecast," 2022.

More… ↓