Share This Page

Drug Price Trends for GS TUSSIN CF LIQUID

✉ Email this page to a colleague

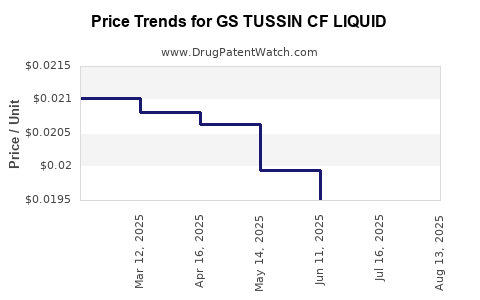

Average Pharmacy Cost for GS TUSSIN CF LIQUID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GS TUSSIN CF LIQUID | 00113-0703-26 | 0.01925 | ML | 2025-08-20 |

| GS TUSSIN CF LIQUID | 00113-0703-26 | 0.01922 | ML | 2025-07-23 |

| GS TUSSIN CF LIQUID | 00113-0703-26 | 0.01950 | ML | 2025-06-18 |

| GS TUSSIN CF LIQUID | 00113-0703-26 | 0.01995 | ML | 2025-05-21 |

| GS TUSSIN CF LIQUID | 00113-0703-26 | 0.02063 | ML | 2025-04-23 |

| GS TUSSIN CF LIQUID | 00113-0703-26 | 0.02082 | ML | 2025-03-19 |

| GS TUSSIN CF LIQUID | 00113-0703-26 | 0.02102 | ML | 2025-02-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GS TUSSIN CF LIQUID

Introduction

GS TUSSIN CF LIQUID is a combination over-the-counter (OTC) cough and cold remedy primarily containing guaifenesin and dextromethorphan. As part of the broader respiratory medication market, its sales performance, regulatory landscape, competitive positioning, and prospective pricing strategies warrant careful analysis to inform stakeholders—from pharmaceutical companies to retailers and investors.

Market Overview

Global Respiratory Medication Market

The respiratory therapeutic segment encompasses a broad array of products, including OTC cough suppressants, expectorants, nasal decongestants, and prescription inhalers. The global market size for OTC cough and cold remedies reached approximately USD 11 billion in 2022, with a compound annual growth rate (CAGR) of 4.2% forecasted through 2030 ([1]).

Product Positioning of GS TUSSIN CF LIQUID

GS TUSSIN CF LIQUID specifically targets consumers seeking symptomatic relief of cough and chest congestion. Its formulation combines guaifenesin (expectorant) with dextromethorphan (cough suppressant), aligning with typical consumer preferences for multi-symptom relief. The product competes mainly within the OTC segment, where consumer choice heavily depends on perceived efficacy, brand trust, price, and regulatory approvals.

Market Penetration and Consumer Demographics

The typical consumer demographic includes adults and adolescents with mild to moderate respiratory infections. Consumer loyalty is often brand-driven, with healthcare consumers favoring trusted brands and formulations backed by clinical efficacy and safety data. Pharmacists and healthcare professionals also influence purchase decisions through recommendations.

Regulatory and Patent Landscape

Regulatory Environment

As an OTC medication, GS TUSSIN CF LIQUID is regulated by the U.S. Food and Drug Administration (FDA) under OTC monograph rules. This regulatory pathway simplifies market entry but constrains labeling and formulation changes. Periodic updates to the monograph, particularly around safety concerns—for example, potential misuse of dextromethorphan—impact marketing and formulation strategies ([2]).

Patent Considerations

While brand-specific patents may protect proprietary formulations or delivery mechanisms, the active ingredients—guaifenesin and dextromethorphan—are generic. Patent expirations typically lead to increased competition, compelling pricing reconsiderations.

Competitive Landscape

Major players include Johnson & Johnson (Robitussin products), Procter & Gamble (Vicks), and GlaxoSmithKline (Pax) as well as store brands. These brands compete primarily on efficacy, brand trust, marketing, and pricing. Generic formulations and private labels also exert downward price pressure, especially in retail settings.

Key Differentiators and Market Drivers

- Efficacy: Consumer reviews and clinical data influence purchasing; formulations with proven symptom relief tend to command premium pricing.

- Safety Profile: Regulatory concerns around misuse (notably dextromethorphan) lead to age restrictions and labeling requirements, affecting market access.

- Convenience and Packaging: Liquid formulations appealing to children and those preferring liquids can command a premium.

- Seasonality: Demand boosts during flu season (October through March), affecting sales volumes.

Pricing Dynamics and Forecasts

Current Pricing Trends

The retail price of GS TUSSIN CF LIQUID generally ranges from USD 8 to USD 12 for a 4 oz bottle, depending on retailer, geographic location, promotions, and whether it’s a branded or generic product ([3]).

Generic OTC expectorants and cough suppressants often retail slightly lower, around USD 6 to USD 10, exerting competitive pressure on branded formulations. Store-brand equivalents are typically priced 10-20% lower than branded counterparts.

Market Factors Influencing Price

- Regulatory Pressures: Increased oversight and ingredient safety concerns may limit formulations, impacting cost structures.

- Supply Chain Dynamics: Raw material costs (e.g., active pharmaceutical ingredients) influence pricing, especially amidst global disruptions.

- Efficacy and Consumer Perception: Mature markets with high brand loyalty tend to sustain premium pricing.

- Competitive Entry: Patent expirations and increasing generics decrease prices via competition.

Projected Price Trajectory (2023–2030)

Short-term (2023-2025):

- Expect minimal price increases (~1-2% annually), primarily driven by inflation, supply chain costs, and regulatory compliance.

- Branded GS TUSSIN CF LIQUID may maintain a slight premium (~USD 1-2) over generic counterparts, supported by brand loyalty and perceived efficacy.

Medium to Long-term (2026–2030):

- As patent protections fade and generics flood the market, prices could decline substantially—up to 10-15% from current levels.

- Price stabilization around USD 5 to USD 8 for a similar product might occur, especially if new formulations or non-inferior generics expand market share.

- Premium pricing could persist for formulations with unique delivery mechanisms or added benefits, but mainstream products will likely see significant price erosion.

Market Growth and Opportunities

Innovations and Differentiation

- Formulation Enhancements: Improved taste, dosing accuracy, and natural ingredient integrations could justify slight premiums.

- Regulatory Advances: Simplified labeling, child-resistant packaging, and evidence-based claims enhance consumer trust, supporting pricing power.

- E-commerce and Direct-to-Consumer Channels: Expansion through online pharmacies offers opportunities to reach larger markets at potentially reduced marketing costs.

Strategic Recommendations

- Price Positioning: Maintaining a slight premium through branding and formulation differentiation can preserve margins.

- Market Expansion: Targeting pediatric or elderly markets with specialized formulations can unlock additional revenue.

- Regulatory Vigilance: Staying ahead of safety concerns ensures fewer market restrictions, sustaining pricing stability.

Key Takeaways

- The OTC cough and cold segment, especially products like GS TUSSIN CF LIQUID, remains competitive, with prices influenced by active ingredient costs, brand strength, regulatory considerations, and competition from generics.

- In the short term, pricing is expected to remain stable with marginal increases; over the longer term, increased generic penetration will pressure prices downward.

- Formulation innovations and regulatory compliance will be key to maintaining or commanding premium pricing.

- Growth prospects are solid during peak seasons, with year-round demand driven by allergy, cold, and flu prevalence.

FAQs

1. What factors influence the pricing of GS TUSSIN CF LIQUID?

Market dynamics such as brand strength, formulation innovation, regulatory environment, raw material costs, competitive pressures, and consumer perception heavily influence pricing strategies.

2. How does patent expiration impact GS TUSSIN CF LIQUID prices?

Patent expiration opens the market to generic competitors, leading to increased competition and downward pricing pressure—a trend observed historically in OTC medications.

3. What are the growth prospects for GS TUSSIN CF LIQUID over the next decade?

While traditional seasonal demand will persist, long-term growth hinges on formulation improvements, expanding consumer segments (pediatrics, seniors), and effective regulatory navigation.

4. Can formulation modifications preserve premium pricing?

Yes. Introducing differentiated features, such as natural ingredients, improved taste, or child-friendly formats, can help justify higher prices amid competitive pressures.

5. How do regulatory changes influence market pricing?

Enhanced safety regulations and labeling requirements can increase compliance costs but may also build consumer trust, enabling slight price premiums or market share gains.

References

[1] Statista. (2022). Global OTC cough and cold market size.

[2] U.S. Food and Drug Administration. OTC Drug Review and Monograph Updates.

[3] Retail pharmacy and online retailer pricing data, 2023.

More… ↓