Share This Page

Drug Price Trends for GS SLEEP AID ULTRA

✉ Email this page to a colleague

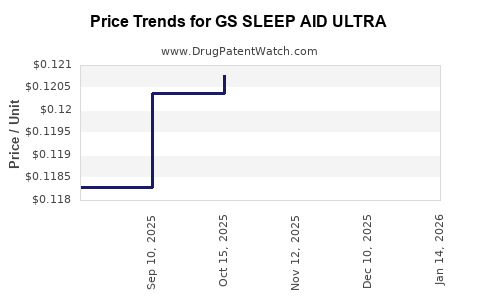

Average Pharmacy Cost for GS SLEEP AID ULTRA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GS SLEEP AID ULTRA 25 MG TAB | 00113-4032-67 | 0.12391 | EACH | 2025-11-19 |

| GS SLEEP AID ULTRA 25 MG TAB | 00113-4032-62 | 0.12391 | EACH | 2025-11-19 |

| GS SLEEP AID ULTRA 25 MG TAB | 00113-4032-67 | 0.12078 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GS SLEEP AID ULTRA

Introduction

The pharmaceutical landscape for sleep aids has experienced substantial growth driven by rising insomnia prevalence, increasing adult populations, and heightened awareness of mental health issues. GS Sleep Aid Ultra, a novel sleep medication currently in development or early commercialization phases, is positioned to compete within this expanding market. This analysis evaluates the current market dynamics, competitive environment, regulatory considerations, and price projections for GS Sleep Aid Ultra, enabling stakeholders to make informed strategic decisions.

Market Landscape Overview

Global Sleep Disorder Market

The global sleep disorder market was valued at approximately USD 4.3 billion in 2022, with projections reaching USD 7.65 billion by 2030, expanding at a compounded annual growth rate (CAGR) of around 7.7% [1]. The increasing burden of chronic insomnia, shift in lifestyle factors, and the aging population underpin this growth trajectory.

Key Drivers

- Rising Incidence of Sleep Disorders: Affects an estimated 30-50% of adults globally, with higher prevalence among the elderly.

- Mental Health Co-morbidities: Anxiety and depression often coincide with sleep issues, driving demand.

- Shift Toward Non-Benzodiazepine Alternatives: Increased preference for safer, non-addictive medications.

- Enhanced Patient Awareness: Advocacy campaigns and digital health resources improve diagnosis and treatment initiation.

Market Segmentation

The market comprises two primary segments:

- Prescription Sleep Aids: Including benzodiazepines, non-benzodiazepine hypnotics, melatonin receptor agonists, orexin antagonists.

- Over-the-Counter (OTC) Sleep Aids: Supplements and herbal remedies.

GS Sleep Aid Ultra aims to target the prescription segment, competing against established drugs like zolpidem, eszopiclone, and new entrants such as lemboreptan.

Competitive Environment

Existing Products and Their Market Shares

- Zolpidem (Ambien): Dominates with about 45% of the prescription sleep aid market.

- Eszopiclone (Lunesta): Commands approximately 20%.

- Ramelteon (Rozerem): Focused on circadian rhythm adjustment.

- Suvoreant (Belsomra): The newer orexin receptor antagonist gaining traction, with ~10% of the market.

Emerging products with improved safety profiles and novel mechanisms of action aim to capture market share from traditional drugs.

Innovation and Differentiation

GS Sleep Aid Ultra's potential advantages include:

- Novel Mechanism of Action: If it introduces a unique pathway reducing dependency.

- Favorable Side-Effect Profile: Minimizing next-day drowsiness or dependence.

- Fast Onset and Long Duration: Enhancing user experience.

- Formulation Options: Including immediate release or extended-release formats.

By positioning itself through these differentiators, GS Sleep Aid Ultra could carve a niche in a crowded market.

Regulatory Landscape & Market Entry Strategies

FDA and Global Regulatory Considerations

Achieving FDA approval requires demonstrating efficacy, safety, and a favorable benefit-risk profile. The drug’s clinical trial trajectory, if including Phase 2 and 3 results, must confirm superior or comparable efficacy with a better safety profile than existing therapies.

Pricing and Reimbursement Strategies

Commercial success hinges on pricing affordability and reimbursement policies. Payers scrutinize value propositions, favoring drugs with clear clinical advantages and cost-effectiveness.

Price Projections for GS Sleep Aid Ultra

Pricing Benchmarks

- Zolpidem (Ambien): Average wholesale price ranges from USD 200-300 per month.

- Eszopiclone (Lunesta): Similar USD 200-350 per month.

- Suvoreant (Belsomra): Priced around USD 300-400 per month.

- Ongoing Premiums for Differentiation: Innovative sleep aids allure premiums ranging from USD 350-450 per month, depending on efficacy and safety.

Projected Pricing Range

Given GS Sleep Aid Ultra's potential for innovation, the likely initial market price could range from USD 300 to USD 400 per month. Factors influencing this include:

- Market Positioning: Premium positioning based on improved safety.

- Reimbursement Patterns: Negotiations with insurers may benefit competitive pricing.

- Manufacturing Costs: Economies of scale may allow for margin optimization.

- Patent Security & Exclusivity: Longer patent life supports higher initial pricing.

Price Trajectory Over Time

- Year 1–2: Launch price at USD 350-400 per month, targeting early adopters and specialty clinics.

- Year 3–5: Price erosion expected (~10-15%) as generic or biosimilar alternatives emerge or market becomes saturated.

- Post-Patent Expiry: Anticipated downward pressure to USD 100-200, aligning with generic competitors.

Market Penetration and Revenue Projections

Assuming GS Sleep Aid Ultra captures about 10-15% of the prescription sleep aid market within five years, potential revenues could reach:

- Year 1: USD 200 million (assuming conservative 2 million globally prescribed doses annually at USD 350/month).

- Year 3: USD 500 million, influenced by increased adoption.

- Year 5: USD 1 billion or more, contingent on market acceptance and global expansion.

Full market penetration will depend on clinical data, marketing, physician adoption, and competitive responses.

Risks and Opportunities

- Regulatory Delays or Challenges: May affect launch timelines and pricing strategies.

- Market Saturation: Entry into a highly competitive space requires clear differentiators.

- Pricing Sensitivity: Insurance coverage and patient affordability influence uptake.

- Innovation Potential: Adoption of extended-release formulations or combination therapies can boost market share.

Crucially, positioning GS Sleep Aid Ultra as a safer, more effective alternative may justify premium pricing and foster rapid adoption.

Key Takeaways

- The global sleep aid market is projected to grow at a CAGR of ~7.7%, driven by demographic and societal shifts.

- GS Sleep Aid Ultra is poised to compete with established brands, leveraging differentiation in mechanisms of action and safety profile.

- Initial pricing will likely hover between USD 300 and USD 400 per month; expected to decline over time as generics enter the market.

- Revenue potential is significant, with early indications suggesting multi-hundred-million-dollar annual sales within a few years post-launch.

- Success depends on effective regulatory approval, market differentiation, reimbursement strategies, and timely commercialization.

FAQs

1. What factors influence the pricing of new sleep aids like GS Sleep Aid Ultra?

Pricing is primarily influenced by clinical efficacy, safety profile, manufacturing costs, competitive positioning, reimbursement negotiations, and the drug's patent landscape.

2. How does GS Sleep Aid Ultra differentiate itself from existing sleep medications?

Potential mechanisms include a novel pharmacological pathway, improved safety and tolerability, reduced dependency risk, and versatile formulations, providing a competitive edge.

3. When can investors expect GS Sleep Aid Ultra to reach the market?

Assuming ongoing clinical trials proceed smoothly, regulatory approval could be achieved in 12–24 months, with market launch following shortly thereafter.

4. How will generic competition impact the market share and pricing of GS Sleep Aid Ultra?

Generic entry typically drives prices down, risking reduced margins. Strategic patent protections and differentiation are essential to maintain a premium price and market share.

5. What are the key challenges in estimating future sales for new sleep aids?

Uncertainties include regulatory approval timelines, physician prescribing behaviors, patient acceptance, payer coverage policies, and competitive innovations.

Sources

[1] MarketWatch, "Sleep Disorder Market Size, Share & Trends Analysis," 2023.

More… ↓