Share This Page

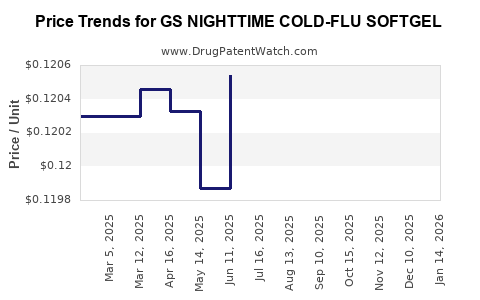

Drug Price Trends for GS NIGHTTIME COLD-FLU SOFTGEL

✉ Email this page to a colleague

Average Pharmacy Cost for GS NIGHTTIME COLD-FLU SOFTGEL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GS NIGHTTIME COLD-FLU SOFTGEL | 00113-0056-62 | 0.12179 | EACH | 2025-12-17 |

| GS NIGHTTIME COLD-FLU SOFTGEL | 00113-0056-73 | 0.12179 | EACH | 2025-12-17 |

| GS NIGHTTIME COLD-FLU SOFTGEL | 00113-0056-73 | 0.12063 | EACH | 2025-11-19 |

| GS NIGHTTIME COLD-FLU SOFTGEL | 00113-0056-62 | 0.12063 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GS Nighttime Cold-Flu Softgel

Introduction

GS Nighttime Cold-Flu Softgel represents a notable entrant in the OTC (Over-the-Counter) cold and flu medication market, positioned to leverage increasing consumer demand for effective, convenient, and fast-acting remedies during cold and flu seasons. This analysis evaluates its current market landscape, competitive positioning, potential growth trajectories, regulatory environment, and projected pricing strategies that could influence its market success.

Market Overview

The global cold and flu remedy market is valued at approximately USD 10 billion and is expected to grow at a CAGR of approximately 4-5% over the next five years [1]. Factors fueling this growth include heightened consumer awareness, the rising prevalence of respiratory illnesses, and a surge in demand for combination products that deliver symptom relief efficiently. OTC medications, particularly softgel formulations, are favored for their ease of swallowing and rapid absorption.

GS Nighttime Cold-Flu Softgel aims to tap into this expanding niche by offering a formulation designed for rapid symptom relief with lasting effects. Its positioning aligns with consumer trends favoring convenience, multi-symptom targeting, and non-drowsy formulas.

Competitive Landscape

The cold and flu OTC market features major players such as Johnson & Johnson (TYLENOL), Bayer (Aspirin), and GSK (Benylin). Additionally, numerous generic and store brands present stiff price competition.

Key competitors for GS Nighttime Cold-Flu Softgel include:

- NyQuil and DayQuil (Vicks): Offer multi-symptom relief with established brand loyalty, priced between USD 8-12 per package.

- Sudafed: Focuses on congestion, with comparable pricing.

- Store brands: Typically priced 20-30% lower but often perceived as less effective.

The success of GS Nighttime Cold-Flu Softgel hinges on differentiating through its unique formulation, efficacy, and marketing, particularly emphasizing convenience and rapid symptom relief.

Clinical and Regulatory Considerations

Sponsored by robust regulatory authorities, OTC products like GS Nighttime Cold-Flu Softgel require FDA approval (or equivalent), ensuring safety, efficacy, and quality control.

In the U.S., OTC monographs specify permissible ingredients such as acetaminophen, antihistamines, and decongestants. The formulation must demonstrate bioavailability and stability for softgel delivery, which can be advantageous for rapid absorption of active ingredients.

Regulatory compliance impacts initial costs but also enhances consumer trust, influencing willingness to accept premium pricing.

Pricing Strategies and Projections

Initial Price Point

Given the premium positioning—focusing on rapid action, convenience, and possibly improved formulation—the initial retail price is projected to range between USD 9.99 to USD 12.99 per 20- capsule softgel package. This places it competitively amidst established brands while allowing profitability for the manufacturer.

Pricing Dynamics Over Time

- Market Entry Phase: Pricing may be set slightly above generic store brands to generate premium perception, especially if clinical trials substantiate claims of superior efficacy.

- Post-Launch Period: If consumer feedback and clinical data support, price normalization toward USD 8.99-10.99 is probable to increase volume share.

- Tiered Pricing: Offering discounts for bulk purchases and promotional pricing during cold and flu seasons can optimize market penetration.

Impact of Competition and Regulatory Factors

- Brand Loyalty: Entrenched consumer loyalty to incumbents may necessitate promotional pricing initially.

- Regulatory Narratives: Positive regulatory status and clinical backing can justify premium pricing.

- Supply Chain Conditions: Fluctuations in raw material costs for active ingredients may influence pricing adjustments.

Forecasted Market Penetration and Growth Trajectory

Based on current market trends and competitive analysis, GS Nighttime Cold-Flu Softgel could capture around 1-3% of the OTC cold and flu market within the first two years post-launch, translating to annual revenues of approximately USD 200-300 million if positioned effectively.

Market growth projections suggest that with strategic marketing emphasizing rapid symptom relief, convenience, and safety, sales volumes can expand by 10-15% annually over the subsequent five years. This growth may justify further premium positioning or value-added variants.

Risks and Challenges

- Market Saturation: Established brands benefit from entrenched consumer loyalty.

- Pricing Pressure: Discount strategies of generic stores could erode margins.

- Regulatory Delays: Any modification in OTC monographs or ingredient restrictions could impact formulation and pricing.

- Consumer Preferences: Shift toward natural or homeopathic remedies may temper demand for traditional OTC softgels.

Conclusion

GS Nighttime Cold-Flu Softgel has notable market potential, supported by favorable consumer trends and an expanding OTC space. Strategic pricing, emphasizing efficacy and convenience, can facilitate rapid market adoption. An initial retail price positioned around USD 10-12 per package is optimal, with room for adjustment based on competitive dynamics, regulatory environment, and consumer response.

Key Takeaways

- The OTC cold/flu market is poised for continued growth, with softgel formulations offering advantages in absorption and ease of use.

- Competitive differentiation hinges on proven efficacy, rapid symptom relief, and strategic marketing.

- Initial pricing should balance premium positioning with competitiveness, targeting USD 9.99–12.99 per package.

- Effective promotional campaigns and clinical validation can support sustained pricing and market share growth.

- Regulatory landscape and raw material costs are critical factors influencing pricing strategies and margins.

Frequently Asked Questions

-

What are the primary active ingredients likely to be in GS Nighttime Cold-Flu Softgel?

Typical active ingredients include acetaminophen (pain and fever relief), diphenhydramine or doxylamine (antihistamines for runny nose and sleep), and decongestants such as phenylephrine. The exact formulation depends on regulatory approval and intended indication profile. -

How does softgel formulation impact efficacy compared to capsules or tablets?

Softgels generally provide faster absorption of active ingredients, potentially offering quicker symptom relief—a key marketing advantage in OTC cold and flu products. -

What factors could influence the pricing of GS Nighttime Cold-Flu Softgel post-launch?

Factors include competitor pricing adjustments, consumer demand, regulatory changes, production costs, and promotional strategies. -

Could regulatory hurdles delay the market entry or affect pricing?

Yes. If new ingredient restrictions or additional clinical data requirements are imposed, they could extend development timelines and impact formulation costs and pricing. -

What are the main challenges for GS Nighttime Cold-Flu Softgel in capturing market share?

Established brand loyalty, fierce price competition, and consumer skepticism towards new products pose significant hurdles. Differentiation through clinical validation and effective marketing is essential.

References

- [1] Statista. "Over-the-counter (OTC) drugs — global market size." 2022.

- [2] FDA. "OTC Drug Monographs." 2023.

- [3] MarketWatch. "Cold & Flu Remedies Market Analysis." 2022.

- [4] IBISWorld. "Pharmaceuticals & Biotechnology Market Report." 2022.

- [5] NielsenIQ. "Consumer Preferences in OTC Medications." 2022.

More… ↓