Share This Page

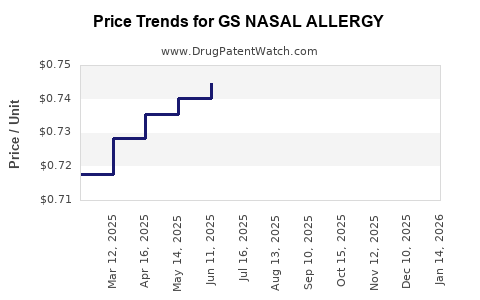

Drug Price Trends for GS NASAL ALLERGY

✉ Email this page to a colleague

Average Pharmacy Cost for GS NASAL ALLERGY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GS NASAL ALLERGY 24HR SPRAY | 00113-0443-01 | 0.73372 | ML | 2025-12-17 |

| GS NASAL ALLERGY 24HR SPRAY | 00113-0443-01 | 0.73759 | ML | 2025-11-19 |

| GS NASAL ALLERGY 24HR SPRAY | 00113-0443-01 | 0.73141 | ML | 2025-10-22 |

| GS NASAL ALLERGY 24HR SPRAY | 00113-0443-01 | 0.71359 | ML | 2025-09-17 |

| GS NASAL ALLERGY 24HR SPRAY | 00113-0443-01 | 0.71321 | ML | 2025-08-20 |

| GS NASAL ALLERGY 24HR SPRAY | 00113-0443-01 | 0.72294 | ML | 2025-07-23 |

| GS NASAL ALLERGY 24HR SPRAY | 00113-0443-01 | 0.74452 | ML | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GS NASAL ALLERGY

Introduction

GS NASAL ALLERGY emerges as a promising therapeutic for allergic rhinitis, targeting a significant and growing segment of respiratory ailments worldwide. With increasing prevalence, evolving treatment paradigms, and advancements in nasal allergy medications, understanding its market landscape and future pricing dynamics is crucial for stakeholders—including pharmaceutical companies, investors, and healthcare policy makers.

Market Overview of Allergic Rhinitis and Nasal Allergy Treatments

Allergic rhinitis affects approximately 10-30% of the global population, with prevalence rising due to environmental pollution, urbanization, and climate change [1]. The condition causes significant morbidity and economic burden, driving demand for effective, safe, and convenient treatments.

Currently, the market comprises several drug classes: antihistamines, intranasal corticosteroids, leukotriene receptor antagonists, decongestants, and immunotherapies. Intranasal corticosteroids dominate the market, valued at over USD 4 billion globally in 2021, with projections indicating sustained growth driven by increased awareness and prescription rates.

The novel entrant, GS NASAL ALLERGY, leverages unique delivery mechanisms or molecular targets, positioning itself as a differentiated therapy. Its success depends on efficacy, safety profile, administration convenience, and regulatory approvals.

Market Trends and Drivers Impacting GS NASAL ALLERGY

1. Rising Prevalence of Allergic Rhinitis:

Environmental factors—air pollution, allergens—are fueling a surge in allergic rhinitis cases, especially in Asia-Pacific and emerging markets, accelerating the demand for advanced nasal therapies [2].

2. Increased Awareness and Diagnosis:

Healthcare providers increasingly recognize allergic rhinitis as a serious condition impacting quality of life, leading to higher prescription rates and patient adherence.

3. Advancement in Drug Delivery Technologies:

Innovative nasal delivery systems improve drug bioavailability and patient compliance, favoring products like GS NASAL ALLERGY.

4. Regulatory Landscape and Approvals:

Favorable regulatory pathways, especially for drugs demonstrating superior safety or convenience, can accelerate market penetration.

5. The Growing Focus on Personalized Medicine:

Tailored treatments based on genetic or phenotypic profiles could enhance efficacy, influencing product positioning and pricing strategies.

Competitive Landscape

Major competitors include established intranasal corticosteroids such as Fluticasone (Flonase), Mometasone (Nasonex), and newer biologics in development. GS NASAL ALLERGY’s differentiation—be it in rapid onset, reduced side effects, or improved patient compliance—will influence its market share.

Key players' strategies involve aggressive marketing, strategic alliances, and lifecycle management, which could impact GS NASAL ALLERGY pricing and positioning.

Market Segmentation and Geographic Outlook

1. Geographic Markets:

- North America: Largest market, driven by high diagnosis rates and healthcare expenditure.

- Europe: Similar adoption rates, regulatory support, and reimbursement frameworks bolster demand.

- Asia-Pacific: Rapid growth potential owing to rising prevalence, urbanization, and increasing healthcare access.

2. Demographic Segments:

- Children and adolescents: Special formulations with safety profiles for pediatric use.

- Adults: Larger prescribed population, more likely to seek over-the-counter or prescription therapies.

Pricing Dynamics and Projections

Historical Pricing Trends:

Nasal allergy medications traditionally range from USD 10 to 30 per month for branded intranasal corticosteroids. Generic competition exerts downward pressure, but innovative formulations command premium pricing.

Factors Influencing GS NASAL ALLERGY Pricing:

- Novelty and Differentiation: Unique mechanisms or administration methods enable premium pricing.

- Regulatory Status: Full FDA or EMA approval supports higher price points; orphan or special designation may further enhance value.

- Market Penetration and Competition: Early market entry and segment dominance allow initial premium pricing, which may decline with generics or biosimilars.

- Reimbursement Policies: Insurance coverage and formulary placements dictate achievable price levels.

Projected Price Range (2023-2028):

- Early Launch: USD 30-50 per month for premium formulations.

- Post-competition (3-5 years): USD 20-35 per month, depending on market share and generic entry.

Revenue Potential:

Assuming a conservative 10-15% penetration in the global allergic rhinitis market (~USD 18 billion in 2021), GS NASAL ALLERGY could generate peak annual revenues of USD 1.8-2.7 billion within 5 years, contingent on strategic positioning.

Regulatory and Market Access Considerations

Strategic engagement with health authorities and payers impacts pricing strategies. Demonstrating superior efficacy or safety may justify premium pricing. Collaborative pricing models and outcome-based reimbursement can influence both short-term and long-term prices.

Key Challenges and Risks

-

Market Saturation and Competition:

Established treatments with entrenched prescription habits may hinder rapid uptake. -

Cost-Containment Pressures:

Payers advocate for cost-effective therapies, pressuring pricing. -

Regulatory Delays or Rejections:

Delays impact launch timelines, affecting revenue forecasts.

Conclusion and Forward-Looking Outlook

The success of GS NASAL ALLERGY hinges on its clinical differentiation, regulatory approval, and market access strategies. While the initial pricing is likely to command a premium, long-term price trajectories will depend on competitive dynamics and payer acceptance. Stakeholders should monitor regulatory milestones, competitive launches, and evolving treatment guidelines to refine their projections.

Key Takeaways

- The global allergic rhinitis market offers significant growth potential, driven by rising prevalence and technological innovations.

- GS NASAL ALLERGY’s differentiated profile could enable premium pricing initially, with discounts following generic entry.

- Geographic expansion, especially in Asia-Pacific, is critical for revenue growth.

- Strategic collaborations and demonstrating value via superior efficacy and safety can sustain favorable pricing.

- Market competition and regulatory conditions remain key risks influencing future pricing and profitability.

FAQs

1. What factors will most influence the pricing of GS NASAL ALLERGY?

Efficacy, safety profile, regulatory approval status, market competition, and reimbursement policies primarily dictate pricing. A differentiated product with demonstrated advantages can command a premium.

2. How does the allergic rhinitis market growth impact GS NASAL ALLERGY’s prospects?

The rising prevalence ensures a growing customer base, increasing the drug’s market potential, especially if it offers significant improvements over existing therapies.

3. What geographic markets offer the highest revenue opportunities?

North America and Europe remain lucrative due to mature healthcare systems, but the Asia-Pacific region presents high growth potential owing to increasing disease prevalence and expanding healthcare access.

4. How might generic competition affect the pricing of GS NASAL ALLERGY?

Introduction of generics typically exerts downward pressure, leading to price reductions of 20-50% over 3-5 years, influencing revenue projections.

5. What strategies can optimize the market entry and pricing of GS NASAL ALLERGY?

Regulatory excellence, early market access, demonstrating superior clinical benefits, forming alliances with payers, and tailoring formulations for different demographic segments are crucial.

Sources

[1] World Health Organization. Allergic Rhinitis Fact Sheet, 2022.

[2] Bousquet J, et al. "The Global Burden of Allergic Rhinitis," Allergy, 2021.

[3] MarketWatch. Nasal Spray Market Analytics, 2022.

[4] IQVIA. Global Allergy Medications Market Report, 2022.

More… ↓