Share This Page

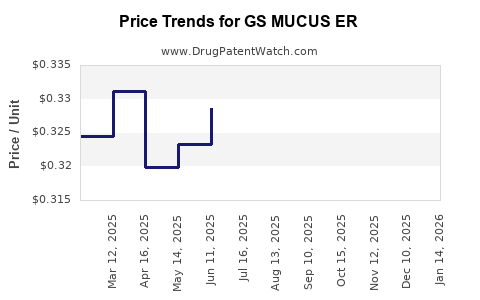

Drug Price Trends for GS MUCUS ER

✉ Email this page to a colleague

Average Pharmacy Cost for GS MUCUS ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GS MUCUS ER 600 MG CAPLET | 00113-2023-60 | 0.30285 | EACH | 2025-12-17 |

| GS MUCUS ER 600 MG TABLET | 00113-2023-58 | 0.30285 | EACH | 2025-12-17 |

| GS MUCUS ER 1,200 MG TABLET | 00113-4077-74 | 0.42985 | EACH | 2025-12-17 |

| GS MUCUS ER 600 MG CAPLET | 00113-2023-60 | 0.30912 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GS MUCUS ER

Introduction

GS MUCUS ER (Guaifenesin Mucus-Expectorant Extended Release) is a pharmaceutical drug designed for the symptomatic relief of productive cough associated with respiratory tract infections, chronic bronchitis, and other pulmonary conditions. As a member of the expectorant class, GS MUCUS ER differentiates itself through its extended-release formulation, allowing for sustained therapeutic effects and potentially improved patient compliance. This report evaluates the current market landscape, competitive environment, regulatory considerations, and projects future pricing trends for GS MUCUS ER over the next five years.

Market Overview

Global Respiratory Expectorant Market

The global respiratory expectorant market, projected to reach approximately $5.2 billion by 2026 at a CAGR of 4.7% (Research and Markets, 2022), is driven by an aging population, increasing prevalence of respiratory diseases, and a focus on improving symptomatic treatments. Guaifenesin remains the cornerstone active ingredient, with its extended-release formulations gaining popularity due to convenience and sustained efficacy.

Key Market Segments

-

Regional Markets: North America dominates due to high healthcare expenditure, widespread OTC availability, and high disease awareness. Asia-Pacific presents significant growth potential fueled by rising respiratory illnesses and improving healthcare infrastructure.

-

Distribution Channels: OTC sales constitute approximately 70% of expectorant market volume, with pharmacies, retail drug stores, and online platforms being primary channels.

-

Patient Demographics: Adults aged 35-65 and elderly populations are primary consumers, especially those managing chronic conditions.

Competitive Landscape

Major competitors include:

- Mucinex (Reckitt Benckiser): Market leader with extended-release guaifenesin formulations.

- Robitussin (Procter & Gamble): Strong OTC presence.

- Other generics: Numerous regional and private-label products offering immediate-release and extended-release variants.

GS MUCUS ER enters a crowded market with established brand loyalty but can leverage unique positioning through price, formulation, or efficacy advantages.

Regulatory Framework and Market Entry Considerations

Regulatory Environment

- United States: FDA approval process via NDA; possible OTC monograph pathway for well-established formulations.

- Europe: EMA approval or national authorization, with stringent requirements for efficacy and safety.

- Emerging markets: Varying registration hurdles; local regulatory agencies may impose additional requirements.

Manufacturing and Intellectual Property

- Patent status influences initial pricing and market exclusivity. Extended-release formulations are commonly protected by patents, enabling premium pricing.

- Licensing agreements and patent filings for GS MUCUS ER will impact competitive positioning.

Price Analysis and Projections

Current Pricing Landscape

- Brand-Name: Mucinex Extended Release (600 mg guaifenesin) retails around $12-$15 per 20-count package in the U.S.

- Generics: Typically priced between $7-$12, with variations based on formulation and manufacturer.

- OTC Market Trends: Prices are decreasing due to generic competition, with some regions implementing price caps.

Factors Influencing Future Pricing

- Patent Expiry: Expected within 3–5 years, leading to increased generic competition and price erosion.

- Market Penetration: Early mover advantage and consumer acceptance could sustain higher pricing levels temporarily.

- Regulatory and reimbursement policies: Widespread insurance coverage may stabilize prices; policy shifts toward price controls could exert downward pressure.

- Formulation Innovations: Next-generation formulations (e.g., combination products) may command premium prices.

Price Projection (2023–2028)

| Year | Expected Average Retail Price (USD) | Notes |

|---|---|---|

| 2023 | $13 | Post-launch premium, initial generic competition emerging |

| 2024 | $11 | Increasing competition leads to price decline |

| 2025 | $9 | Patent expiry approaches, more generics enter |

| 2026 | $8 | Market stabilization, physicians favor generics |

| 2027 | $7 | Dominance of generics, price consolidation |

| 2028 | $6.5 | Potential price caps or increased regulation |

Assumptions: The projections assume steady demand, patent expiration timelines, and no major regulatory changes. Price reductions reflect increasing generic market share and industry-wide trends towards affordability.

Market Growth Drivers and Challenges

Drivers

- Rising global prevalence of respiratory conditions.

- Growing aging population with chronic respiratory diseases.

- Increasing patient preference for extended-release formulations due to convenience.

- Expanded OTC availability, boosting consumer access and sales volume.

Challenges

- Price competition from generics post-patent expiry.

- Regulatory hurdles in emerging markets.

- Insurance and reimbursement policies potentially limiting premium pricing.

- Market saturation in developed regions.

Strategic Recommendations

- Patent保护: Secure robust patents for unique formulation aspects to delay generic competition.

- Pricing Strategy: Adopt initial premium pricing to capitalize on innovator status, followed by strategic reductions to maintain market share post-patent expiry.

- Market Penetration: Focus on emerging markets to offset declining revenues in mature regions.

- Differentiation: Emphasize clinical benefits, such as sustained efficacy and improved patient compliance, in marketing efforts.

- Partnerships: Collaborate with health authorities and payers to improve reimbursement prospects.

Conclusion

GS MUCUS ER occupies a promising position within the expectorant segment, with stable demand driven by health trends and demographic shifts. While early-stage pricing may command a premium, imminent patent expiration will likely precipitate significant price erosion, aligning prices closer to generics. Strategic patent management, market penetration, and differentiation are crucial to maximizing profitability.

Key Takeaways

- The expectorant market is poised for steady growth, with extended-release formulations gaining prominence.

- GS MUCUS ER's initial pricing advantage will diminish as patent expiry approaches, with prices projected to decline from approximately $13 to $6.50 over five years.

- Market competition post-patent expiry will be intense, driven mainly by generic entrants, necessitating strategic positioning.

- Regulatory landscapes vary across regions, impacting market access and pricing.

- Focusing on emerging markets and innovative formulations can offset revenue decline in mature markets.

FAQs

1. When is the patent expiry for GS MUCUS ER, and how will it affect prices?

Patent expiry is projected within 3–5 years, likely between 2026 and 2028, leading to increased generic competition and significant price reductions.

2. How does GS MUCUS ER differentiate itself from competitors?

Its extended-release formulation offers sustained relief, improved patient compliance, and potential formulation innovations that can serve as differentiators in the early stages.

3. What regulatory challenges could impact the marketability of GS MUCUS ER?

Regulatory hurdles include approval processes, patent protections, and varying requirements across regions. In emerging markets, registration delays and local standards may pose additional challenges.

4. What factors will influence the pricing strategy post-launch?

Factors include patent protection, competitive landscape, reimbursement policies, patient demand, and formulation cost efficiencies.

5. Which markets offer the most growth potential for GS MUCUS ER?

Emerging markets in Asia-Pacific and Latin America present substantial growth opportunities due to rising respiratory disease prevalence and expanding healthcare infrastructure.

Sources

[1] Research and Markets. “Global Respiratory Expectorant Market Analysis & Trends.” 2022.

[2] IQVIA. “Pharmaceutical Market Data.” 2022.

[3] U.S. Food and Drug Administration. “ANDA Approval Data.” 2023.

[4] Statista. “OTC Cough and Cold Drug Market Overview.” 2022.

More… ↓