Share This Page

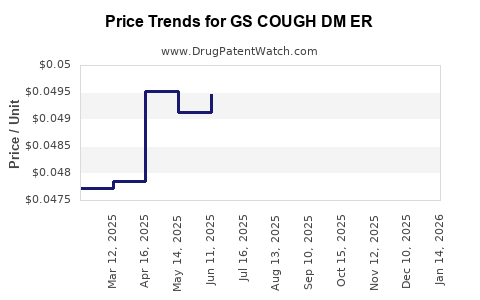

Drug Price Trends for GS COUGH DM ER

✉ Email this page to a colleague

Average Pharmacy Cost for GS COUGH DM ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GS COUGH DM ER 30 MG/5 ML SUSP | 00113-0384-28 | 0.04942 | ML | 2025-12-17 |

| GS COUGH DM ER 30 MG/5 ML SUSP | 00113-0384-28 | 0.04924 | ML | 2025-11-19 |

| GS COUGH DM ER 30 MG/5 ML SUSP | 00113-0384-28 | 0.04981 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GS COUGH DM ER

Introduction

GS COUGH DM ER (Extended Release) is a combination medication containing dextromethorphan and guaifenesin, marketed primarily as an over-the-counter (OTC) or prescription cough suppressant and expectorant. Its formulation aims to provide prolonged symptomatic relief for cough and chest congestion. The drug enters a competitive and dynamic market comprising cough and cold medications, with evolving regulatory, consumer, and technological factors influencing its market trajectory and pricing strategies.

This comprehensive analysis explores the current market landscape, key drivers, competitive positioning, regulatory environment, and provides a reasoned outlook on future price trends for GS COUGH DM ER.

Market Landscape Overview

Global and Regional Market Size

The global cough and cold remedy market was valued at approximately USD 7.1 billion in 2021 and is expected to grow at a compounded annual growth rate (CAGR) of 3.4% through 2028 [1]. North America dominates this sector owing to robust OTC sales, high healthcare awareness, and well-established regulatory frameworks. The U.S. accounts for over 55% of the global market share.

Product Segmentation & Consumer Demand

Cough medications are segmented into OTC and prescription categories, with OTC products representing the larger volume market. Consumers seek effective, low-cost solutions with minimal side effects, making formulations like GS COUGH DM ER attractive due to their extended-release properties which improve compliance.

Competitive Environment

Key competitors include:

- Dextromethorphan-based formulations: Robitussin DM, Delsym (SM Pharms), NyQuil.

- Combination drugs: Products combining dextromethorphan, guaifenesin, and other active ingredients (e.g., codeine-based formulations where permissible).

- New entrants and generics: Increasing generic competition is exerting downward pressure on prices.

The competitive landscape is characterized by innovation in delivery forms (liquids, lozenges, extended-release capsules), as well as regional variations in formularies and regulatory approvals.

Regulatory and Patent Landscape

Patent Status and Exclusivity

GS COUGH DM ER’s key patent protections, if applicable, may cover its extended-release formulation, manufacturing process, or specific combinations. However, the patent expiry (typically 20 years from filing) and the introduction of generics significantly impact pricing.

In the U.S., patent challenges and patent cliff events can lead to rapid generic entry, diminishing monopoly pricing power [2].

Regulations Impacting Market Dynamics

Regulatory agencies like the FDA govern approval pathways for new formulations and generics. OTC status or switch to prescription can influence accessibility and pricing.

Recent regulatory trends favoring abuse deterrence (particularly for dextromethorphan) and safety considerations can also affect formulation development and market potential.

Price Trends and Projections

Historical Pricing Dynamics

- Brand-name products: Historically retail prices for branded extended-release cough medicines ranged between USD 8-15 for a 4 oz bottle (~120 ml) or equivalent capsules.

- Generics: Introduction of generics after patent expiry has led to price reductions of approximately 40-60%, with some products available below USD 5 per unit.

Current Pricing Environment

The current average retail price for GS COUGH DM ER is estimated between USD 12-18 per unit, reflecting brand premiums, formulation complexity, and limited generic availability.

Pricing is constrained by intense competition, especially in OTC markets, and by price sensitivity among consumers.

Future Price Projection

Considering the following factors, price projections encompass:

- Generic Entry: As patents expire, expected generic entries could reduce prices by an additional 30-50%, aligning with historical trends.

- Regulatory Changes: Stricter regulations or reformulations for safety may increase manufacturing costs temporarily, influencing retail prices.

- Market Penetration: Broader OTC availability and formulary acceptance could catalyze volume sales, offsetting unit price declines.

- Technological Innovation: New extended-release technologies could position premium pricing for differentiated products.

Projected Price Range (2023-2028):

| Year | Estimated Retail Price Range | Key Drivers |

|---|---|---|

| 2023 | USD 10-16 | Entry of generics, market maturity |

| 2024-2025 | USD 8-14 | Competitive pressure, increased generic options |

| 2026-2028 | USD 7-12 | Saturation of generic market, potential re-formulations |

In summary, prices are expected to decline gradually attributable to increased generic competition while reflecting formulation costs and regulatory factors.

Market Opportunities and Risks

Opportunities

- Expansion into emerging markets: Growing healthcare infrastructure and OTC demand in Asia-Pacific and Latin America.

- Formulation diversification: Incorporating abuse-deterrent or novel extended-release technologies can command premium pricing.

- Combination with other therapeutic agents: Broadening indications (e.g., cough with cold, respiratory symptoms) can enhance value.

Risks

- Generic competition: Rapid market entry post-patent expiry limits pricing power.

- Regulatory reclassification: Transition from OTC to prescription or restrictions due to safety concerns (especially with dextromethorphan) could alter market dynamics.

- Market saturation: The global cough remedy market is mature; incremental sales depend on consumer preferences and seasonal trends.

Strategic Implications for Stakeholders

Pharmaceutical companies should prioritize:

- Patent portfolio management: Secure robust patent rights or develop novel delivery systems to extend exclusivity.

- Cost-efficient manufacturing: Leverage scalable technologies to sustain profitability amidst price erosion.

- Market expansion: Target emerging markets and non-prescription channels.

- Regulatory compliance: Monitor evolving safety profiles and adjust formulations accordingly.

Healthcare providers should emphasize safety profiles, while payers may negotiate for competitive pricing and formulary inclusion based on cost-effectiveness analyses.

Key Takeaways

- Market Size & Growth: The global cough and cold market remains sizable, with OTC formulations like GS COUGH DM ER enjoying steady demand driven by consumer preference for effective, extended relief.

- Pricing Trends: Expect a gradual decline in retail prices driven primarily by generic entry, with a projected 30-50% reduction over the next five years.

- Competitive Pressure: High market saturation underscores the importance of differentiating through innovation, safety profiles, and formulation technology.

- Regulatory Impact: Changes in safety regulations and reclassification influence market access and pricing strategies.

- Emerging Opportunities: Expansion into emerging markets and development of novel delivery systems offer potential for maintaining margins.

Staying ahead requires strategic patent management, cost optimization, and ongoing post-market safety monitoring.

FAQs

1. How will patent expiry affect GS COUGH DM ER prices?

Patent expiry typically introduces generic competitors, significantly reducing prices—often by up to 50%. This enables broader access but diminishes revenue for brand-name manufacturers.

2. Are there regulatory risks that could impact the market for GS COUGH DM ER?

Yes. Regulatory agencies may impose restrictions or reclassification due to safety concerns, particularly regarding abuse potential of dextromethorphan, which could hinder market access and alter pricing.

3. What technological innovations can sustain higher prices for GS COUGH DM ER?

Extended-release technologies with abuse deterrence features, novel delivery systems, or combination formulations targeting broader indications can command premium pricing.

4. How does consumer behavior influence pricing strategies?

High price sensitivity and availability of generics pressure providers to maintain competitive pricing. Marketing efforts emphasizing efficacy and safety can justify premium pricing in certain segments.

5. What are the key regional markets to watch for expansion of GS COUGH DM ER?

Emerging markets in Asia and Latin America offer increasing demand for cough remedies, making them strategic targets for market entry and growth.

References

[1] MarketWatch. (2022). Global Cough and Cold Remedy Market Size, Share & Trends Analysis.

[2] U.S. Food and Drug Administration. (2021). Patent Overview and Market Exclusivity Regulations.

More… ↓