Share This Page

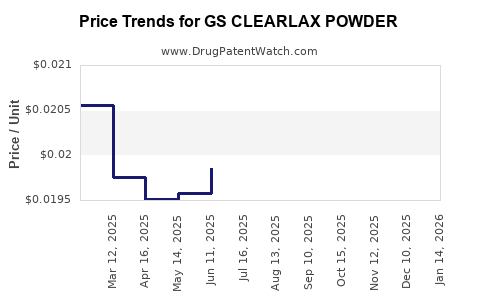

Drug Price Trends for GS CLEARLAX POWDER

✉ Email this page to a colleague

Average Pharmacy Cost for GS CLEARLAX POWDER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GS CLEARLAX POWDER | 00113-0306-03 | 0.02035 | GM | 2025-12-17 |

| GS CLEARLAX POWDER | 00113-0306-02 | 0.02480 | GM | 2025-12-17 |

| GS CLEARLAX POWDER | 00113-0306-01 | 0.02939 | GM | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GS CLEARLAX POWDER

Introduction

GS CLEARLAX POWDER, a formulation of polyethylene glycol 3350 as a laxative, has experienced noteworthy market emergence due to rising gastrointestinal disorder prevalence and consumer preference for non-invasive, over-the-counter solutions. This report provides a comprehensive analysis of the current market landscape, competitive positioning, regulatory environment, and future price trajectories for GS CLEARLAX POWDER, facilitating strategic decision-making for stakeholders.

Product Overview

GS CLEARLAX POWDER is an osmotic laxative indicated for occasional constipation relief. Its mechanism involves retaining water within the bowel lumen, softening stool, and aiming for predictable bowel movements. Given its over-the-counter (OTC) classification, GS CLEARLAX addresses a broad patient demographic, including adults and elderly populations, seeking safe and effective bowel management.

Market Landscape

Global and Regional Market Size

The global laxative market is projected to reach approximately $3.7 billion by 2025, growing at a CAGR of around 4.2% from 2020 to 2025 ([1]). North America dominates, driven by aging populations and heightened health awareness, with Asia-Pacific exhibiting rapid growth due to increasing urbanization and healthcare infrastructure improvements ([2]).

Key Market Drivers

- Aging demographics with increased gastrointestinal issues.

- Rising prevalence of lifestyle-related constipation linked to diet and sedentary habits.

- Preference for OTC medications over prescription drugs.

- Growing consumer awareness of gastrointestinal health.

Competitive Landscape

Major competitors include established brands like Dulcolax, MiraLAX (marketed as Polyethylene Glycol 3350 in the United States), and generic formulations produced by numerous pharmaceutical companies globally. The introduction of GS CLEARLAX POWDER into this landscape hinges on differentiation factors such as formulation quality, price competitiveness, and brand visibility.

Regulatory Considerations

In the U.S., GS CLEARLAX aligns with FDA OTC monograph standards for osmotic laxatives. In Europe, it must meet EMA regulations, and in emerging markets, local regulatory approval processes will influence market entry timelines.

Pricing Strategies and Factors Influencing Price

Current Pricing Framework

In established markets like the U.S., MiraLAX (the leading polyethylene glycol laxative) retails at approximately $12–$15 for a 238g bottle, equivalent to roughly $0.05–$0.06 per gram ([3]). These prices reflect brand recognition, marketing, and distribution channels.

Price Differentiation for GS CLEARLAX

- Generic Positioning: As a generic or store-brand equivalent, GS CLEARLAX could competitively price below national brands, approximately $0.04 per gram, to attract cost-sensitive consumers.

- Private Label Opportunities: Retail chains may offer GS CLEARLAX at lower margins, around $0.03–$0.04 per gram, leveraging volume sales.

- Premium Positioning: If marketed with added tactile benefits (e.g., flavoring, ease of dissolving), premium pricing could reach $0.07 per gram.

Pricing Influences

- Regulatory Approval & Patent Status: Patent expirations could facilitate lower-cost generics, driving prices down ([4]).

- Manufacturing Costs: Variability in raw material sourcing, manufacturing scale, and quality control affect final pricing.

- Market Penetration Strategy: Initial positioning may favor competitive pricing to establish market share, with gradual price stabilization aligned with brand recognition.

- Distribution Channels: OTC product placement at pharmacies, supermarkets, and online retail platforms influences retail pricing flexibility.

Price Projections (Next 3-5 Years)

Baseline Scenario

- 2023: Price remains around $0.05 per gram, aligned with current generic polyethylene glycol laxatives.

- 2024–2025: Slight reductions up to $0.04 per gram due to increased competition and market saturation. Additionally, economies of scale from broader production could further lower costs.

- Post-2025: Potential stabilization at $0.03–$0.04 per gram, especially if generic versions saturate the market or if regulatory pressures reduce patent barriers.

Optimistic Scenario

- Introduction of value-added features (e.g., flavored versions, convenient packaging) maintains higher price points, approximately $0.06–$0.07 per gram.

- Brand differentiation and consumer loyalty sustain premium pricing even amidst generic competition.

Pessimistic Scenario

- Market price declines faster due to aggressive pricing by competitors, leading to a drop to $0.02–$0.03 per gram—potentially unsustainable margins for manufacturers unless scaled efficiently.

- Regulatory changes or market disruptions (e.g., new therapies or formulation innovations) could further depress prices.

Factors Impacting Future Market and Pricing Dynamics

- Market Penetration & Penetration Depth: Market penetration in emerging regions is expected to enlarge, causing price competition and volume growth.

- Regulatory Environment: Faster approvals and streamlined registration processes could reduce time-to-market for GS CLEARLAX, influencing initial pricing.

- Consumer Trends: Increasing preference for natural or minimally processed laxatives could impact formulations and pricing strategies.

- Healthcare Policy & Reimbursement: Though OTC, policy shifts favoring preventive health products or coverage expansions might influence consumer purchasing power and pricing.

Conclusion

The market for polyethylene glycol-based laxatives like GS CLEARLAX POWDER is poised for moderate growth, driven by demographic trends and increasing gastrointestinal health awareness. Competitive pricing strategies focusing on cost efficiency and brand positioning will be vital. Price projections suggest a downward trend correlating with market saturation and generic competition, stabilizing in the $0.03–$0.04 per gram range over the next five years.

Key Takeaways

- GS CLEARLAX enters a competitive OTC market dominated by established brands like MiraLAX, necessitating strategic differentiation.

- Pricing will likely trend downward, particularly as patents expire and generic competition intensifies.

- Cost-effective manufacturing, streamlined regulatory approval, and targeted marketing can optimize pricing and market share.

- Regional market growth, especially in Asia-Pacific and emerging markets, offers significant revenue opportunities at lower price points.

- Ongoing consumer health trends and regulatory landscapes will be pivotal in maintaining pricing stability and growth prospects.

FAQs

1. What is the primary competitive advantage of GS CLEARLAX POWDER?

Its potential for cost-effective manufacturing and flexible branding strategies, combined with compliance with global regulatory standards, position GS CLEARLAX to compete effectively on price and distribution channels.

2. How will patent expirations influence GS CLEARLAX's pricing?

Patent expirations typically open the market to generic competition, leading to reduced prices—potentially by 30-50%—thus making GS CLEARLAX more accessible and competitive.

3. Which markets will drive the most growth for GS CLEARLAX?

Emerging markets in Asia-Pacific and Latin America, driven by increasing gastrointestinal health awareness and expanding healthcare infrastructure, represent significant growth opportunities.

4. What factors could prevent prices from dropping as forecasted?

Supply chain disruptions, regulatory hurdles, or a strategic shift toward premium formulations could sustain higher prices. Additionally, brand loyalty and differentiated features may maintain premium pricing levels.

5. How does consumer demand influence pricing strategies?

A preference for natural, flavored, or convenient formulations can justify premium pricing, while price-sensitive consumers favor lower-cost generics, prompting manufacturers to adapt accordingly.

References

[1] Grand View Research. (2021). Laxative Market Size, Share & Trends Analysis.

[2] MarketsandMarkets. (2022). Gastrointestinal Health Market by Category, Region, and Distribution Channel.

[3] HealthLine. (2022). MiraLAX Price & Cost Comparison.

[4] U.S. Food and Drug Administration. (2022). Patent Expirations and Their Impact on Generics.

This comprehensive analysis aims to facilitate informed strategic decisions regarding GS CLEARLAX POWDER’s market entry, pricing, and long-term growth opportunities.

More… ↓