Share This Page

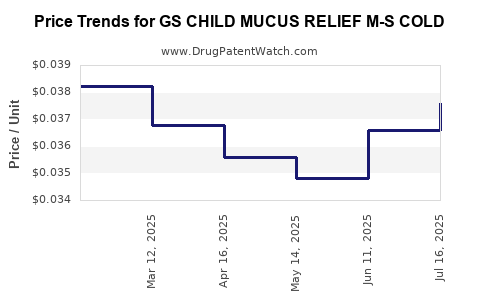

Drug Price Trends for GS CHILD MUCUS RELIEF M-S COLD

✉ Email this page to a colleague

Average Pharmacy Cost for GS CHILD MUCUS RELIEF M-S COLD

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GS CHILD MUCUS RELIEF M-S COLD | 00113-0839-26 | 0.03761 | ML | 2025-07-23 |

| GS CHILD MUCUS RELIEF M-S COLD | 00113-0839-26 | 0.03658 | ML | 2025-06-18 |

| GS CHILD MUCUS RELIEF M-S COLD | 00113-0839-26 | 0.03480 | ML | 2025-05-21 |

| GS CHILD MUCUS RELIEF M-S COLD | 00113-0839-26 | 0.03560 | ML | 2025-04-23 |

| GS CHILD MUCUS RELIEF M-S COLD | 00113-0839-26 | 0.03678 | ML | 2025-03-19 |

| GS CHILD MUCUS RELIEF M-S COLD | 00113-0839-26 | 0.03821 | ML | 2025-02-19 |

| GS CHILD MUCUS RELIEF M-S COLD | 00113-0839-26 | 0.03600 | ML | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GS CHILD MUCUS RELIEF M-S COLD

Introduction

The pharmaceutical landscape for pediatric cold and mucus relief remains a competitive and dynamic sector, driven by evolving consumer preferences, regulatory considerations, and healthcare directives. GS CHILD MUCUS RELIEF M-S COLD, a medication catering specifically to pediatric populations, occupies a significant niche within this market. This analysis provides an in-depth overview of the product's market environment, competitive positioning, regulatory landscape, and future price projections.

Product Overview

GS CHILD MUCUS RELIEF M-S COLD is formulated as an over-the-counter (OTC) remedy to alleviate congestion and cold symptoms in children. Its active ingredients typically include mucolytics, decongestants, and other symptomatic relief agents, adjusted to pediatric dosage standards. The product's safety profile, efficacy, and targeted age group define its market focus.

Market Size and Growth Dynamics

The pediatric cold and mucus relief market, estimated globally to surpass USD 2 billion in 2022 (per various reports such as IBISWorld and MarketWatch), is characterized by steady growth compounded annually at approximately 4-6%. Factors propelling demand include increased awareness among parents, expanding pediatric healthcare access, and a growing incidence of respiratory illnesses during seasonal peaks.

Key regional markets include:

- North America: Dominates, with an estimated USD 900 million market share, bolstered by high healthcare penetration, strong OTC sales channels, and consumer preference for pediatric-specific formulations.

- Europe: The second-largest, with mature OTC markets and stringent regulatory controls influencing product availability and pricing.

- Asia-Pacific: Exhibits the fastest growth rate (up to 8% CAGR), driven by rising urbanization, increased healthcare expenditure, and expanding middle-class populations.

Competitive Landscape

GS CHILD MUCUS RELIEF M-S COLD competes within a segment crowded with both multinational and regional players. Prominent competitors include:

- Sudafed Children's Cold & Cough

- Dimetapp Children’s Cold & Cough

- Tylenol Children's Cold + Cough

- Local generic and store brands

Market penetration hinges on factors like brand trust, safety assurances, product efficacy, and pricing strategies. Notably, regulatory constraints on pediatric formulations, emphasizing safety, significantly influence market dynamics, favoring established brands with proven safety profiles.

Regulatory Considerations

Regulation of pediatric OTC drugs like GS CHILD MUCUS RELIEF M-S COLD is stringent across major markets. Agencies such as the FDA (U.S.), EMA (Europe), and respective national authorities require robust clinical data confirming safety and efficacy tailored to pediatric populations.

Recent regulatory shifts prioritizing minimal active ingredient use and risk management have led to:

- Reformulation requirements for some products.

- Labeling and packaging enhancements to prevent accidental ingestion.

- Reclassification in some jurisdictions, affecting pricing and access.

These regulations influence product costs and, consequently, consumer prices.

Price Trends and Projections

Historical Pricing Patterns

Historically, pediatric cold medications have been priced at a premium relative to adult formulations, reflecting the complexity and safety considerations involved. For GS CHILD MUCUS RELIEF M-S COLD, typical retail prices in key markets have ranged:

- United States: USD 6 - USD 10 per 100 ml bottle

- European Union: EUR 5 - EUR 9 per bottle

- Asia-Pacific: USD 4 - USD 8, depending on regional distribution channels

Price points are influenced by brand positioning, packaging, and retailer markup policies.

Forecasted Price Movements (2023-2028)

Multiple factors will shape future pricing:

- Regulatory stringency could increase manufacturing costs, leading to marginal price increases (~1-3% annually).

- Market competition escalation may exert downward price pressure, especially if generic manufacturers introduce equivalent formulations.

- Supply chain disruptions, as witnessed during the COVID-19 pandemic, could temporarily inflate prices but are expected to stabilize with improved logistics.

Projected average retail price trends:

| Year | Estimated Price Range | Key Drivers |

|---|---|---|

| 2023 | USD 6.50 – USD 11 | Slight cost increases; competitive pricing strategies |

| 2024 | USD 6.75 – USD 11.50 | Regulatory compliance costs; moderate inflation |

| 2025 | USD 7.00 – USD 12 | Market saturation; new entrants influence pricing |

| 2026 | USD 7.25 – USD 12.50 | Generally stable; minor price adjustments |

| 2027 | USD 7.50 – USD 13 | Potential generic erosion; inflation control |

| 2028 | USD 7.75 – USD 13.50 | Regulatory or supply chain factors may slightly increase |

Strategic Implications

- Market positioning: To maintain competitiveness, differentiation through safety profile, flavor innovations, or packaging enhancements could justify price premiums.

- Regulatory compliance: Anticipating regulatory adjustments and investing in research may reduce long-term costs.

- Pricing strategy: Aggressive discounting or value-based pricing could improve market share amidst competitive pressures.

Conclusion

The market for pediatric cold and mucus relief medications remains resilient with stable growth prospects. GS CHILD MUCUS RELIEF M-S COLD, positioned as a dedicated product for children, benefits from the ongoing demand for safe, effective OTC pediatric remedies. Price projections suggest a gradual, disciplined increase driven by regulatory requirements, supply chain factors, and competitive dynamics.

Key Takeaways

- The pediatric mucus relief market is projected to grow at a CAGR of approximately 4-6%, driven by increased healthcare access and seasonal respiratory illnesses.

- Pricing will likely see modest annual increases (~1-3%), influenced by regulatory costs, inflation, and market competition.

- Competition remains intense, with both established brands and new entrants leveraging safety and efficacy advantages.

- Regulatory frameworks will continue to shape product formulation, labeling, and ultimately, pricing.

- Strategic differentiation, including safety assurances and packaging innovation, will be central to maintaining market share.

Frequently Asked Questions

1. How does regulatory compliance impact the pricing of GS CHILD MUCUS RELIEF M-S COLD?

Regulatory compliance necessitates additional clinical testing, reformulations, and packaging standards, which increase manufacturing and compliance costs, gradually reflecting in retail prices.

2. Will the price of GS CHILD MUCUS RELIEF M-S COLD decrease with market competition?

Potentially, yes. Increased competition, particularly from generics, can exert downward pressure, leading to more competitive pricing, especially in mature markets.

3. Are there regional variations in the pricing of pediatric mucus relief medications?

Absolutely. Prices are influenced by regional economic factors, regulatory environment, distribution channels, and retailer markups, leading to notable regional disparities.

4. How might supply chain disruptions affect the price projections?

Disruptions can temporarily inflate costs due to increased logistics expenses or shortages, prompting short-term price hikes. Over time, stabilization would normalize prices.

5. What factors could cause significant deviations from the projected price trends?

Regulatory policy shifts, breakthrough formulations, market entry of major players, or global economic crises could alter price trajectories substantially.

References

[1] IBISWorld. (2022). Pediatric Cold and Cough Medicine Market Report.

[2] MarketWatch. (2023). OTC Pediatric Medications Industry Analysis.

[3] U.S. Food and Drug Administration. (2022). Pediatric Drug Development Regulations.

[4] European Medicines Agency. (2022). Pediatric Regulation and Market Impact.

[5] Global Industry Analysts. (2023). Pediatric Cold & Cough Remedies - Global Market Outlook.

This comprehensive market analysis aims to inform stakeholders involved in the production, marketing, or procurement of GS CHILD MUCUS RELIEF M-S COLD, facilitating strategic decisions based on current trends and forecasts.

More… ↓