Share This Page

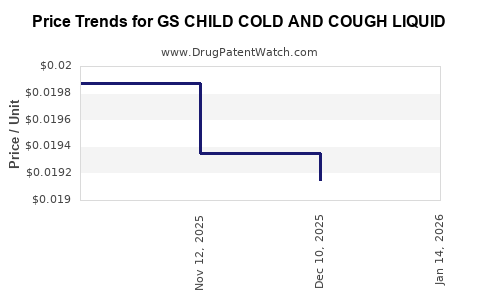

Drug Price Trends for GS CHILD COLD AND COUGH LIQUID

✉ Email this page to a colleague

Average Pharmacy Cost for GS CHILD COLD AND COUGH LIQUID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GS CHILD COLD AND COUGH LIQUID | 00113-6019-26 | 0.01915 | ML | 2025-12-17 |

| GS CHILD COLD AND COUGH LIQUID | 00113-6019-26 | 0.01935 | ML | 2025-11-19 |

| GS CHILD COLD AND COUGH LIQUID | 00113-6019-26 | 0.01987 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GS Child Cold and Cough Liquid

Introduction

The pediatric healthcare segment remains a vital component of the global pharmaceuticals market, driven by rising awareness of childhood ailments and increasing access to healthcare. Among the myriad products within this niche, over-the-counter (OTC) remedies such as GS Child Cold and Cough Liquid serve as primary interventions for common cold and cough symptoms in children. This analysis examines the current market landscape, competitive positioning, regulatory environment, and provides strategic price projections for GS Child Cold and Cough Liquid over the next five years.

Market Overview

Global Pediatric Cold and Cough Medications Market

The pediatric cold and cough medication market has experienced steady growth, fueled by heightened parental health consciousness and expanding healthcare infrastructure in emerging economies. The global market was valued at approximately USD 4.2 billion in 2022, with projections indicating a compounded annual growth rate (CAGR) of around 4.8% from 2023 to 2028 [1].

Key Regional Dynamics

-

North America: Dominates due to high healthcare expenditure, extensive OTC availability, and established regulatory frameworks. The U.S. accounts for over 50% of the global market, with pediatric OTC products representing nearly 30% of pediatric medication sales [2].

-

Europe: Strong growth driven by parental awareness and regulatory shifts advocating cautious OTC use.

-

Emerging Economies (Asia-Pacific, Latin America): Exhibit significant growth potential owing to increasing middle-class populations, urbanization, and limited access to formal healthcare, leading to higher OTC medication consumption. The Asia-Pacific region is projected to grow at a CAGR of 6.2%, surpassing developed markets by 2025 [3].

Market Drivers

-

Increased prevalence of respiratory infections in children correlates with urban pollution and seasonal factors.

-

Enhanced healthcare awareness among parents and caregivers.

-

Growing preference for quick-acting, easily administrable OTC remedies.

-

Expansion of distribution channels, including e-commerce.

Market Challenges

-

Regulatory scrutiny concerning safety, especially concerning dextromethorphan and antihistamines in pediatric formulations.

-

Stringent labeling and pediatric dosing guidelines.

-

Competition from natural and homeopathic remedies.

Competitive Landscape

Several established players dominate the pediatric cold and cough segment, including:

-

GSK (GSK Children's Cold & Cough Products): Known for loratadine-based antihistamines and combination products.

-

Johnson & Johnson: Offers various OTC pediatric remedies.

-

Procter & Gamble: Focuses on trusted brands with wide distribution.

-

Local/regional players: Rapidly expanding with differentiated pricing strategies.

GS Child Cold and Cough Liquid positions itself within this competitive environment, emphasizing safety, efficacy, and pediatric-friendly formulations. Key differentiators include flavor masking, dosing accuracy, and compliance with regional regulatory standards.

Regulatory Considerations

Regulatory agencies such as the U.S. FDA, EMA, and respective local authorities impose strict guidelines on pediatric OTC medications:

-

Labeling & packaging: Clear dosing instructions and age-appropriate warnings.

-

Safety data: Rigorous clinical data demonstrating safety in children.

-

Restrictions: Recent ban on certain cough suppressants (e.g., codeine) and antihistamines due to adverse effects.

Manufacturers must adapt formulations and marketing strategies to meet evolving standards, impacting product launch timelines and pricing.

Price Analysis

Current Pricing Landscape

In developed markets like North America and Europe, the average retail price for a 150 ml bottle of pediatric cold and cough liquid ranges from USD 4.50 to USD 8.00. Brand prominence, formulation features, and regulatory compliance influence retail margins.

In emerging markets, prices are notably lower—between USD 1.50 and USD 3.00—reflecting purchasing power, local regulations, and competitive pressures.

Pricing Strategies

-

Premium positioning: Emphasizing safety certifications, allergen-free ingredients, organic certification, and flavor palatability.

-

Economical options: Mass-produced formulations with minimal branding to target cost-sensitive segments.

-

Bundling and promotions: To drive volume sales, especially in retail chains and online platforms.

Factors Influencing Future Price Projections

-

Regulatory tightening may restrict ingredient use, increasing costs.

-

Raw material price fluctuations, especially herbal extracts and flavorings.

-

Currency exchange rate volatility affecting imported raw materials.

-

Strategic pricing to maintain market share amid intensifying competition.

Price Projections (2023-2028)

Considering current market dynamics, the following projections are estimated:

| Year | Price Range (USD per 150 ml bottle) | Rationale |

|---|---|---|

| 2023 | USD 3.00 – USD 4.50 | Stabilization post-pandemic, inflation effects, competitive pricing pressures. |

| 2024 | USD 3.10 – USD 4.70 | Slight increase reflecting raw material cost inflation. |

| 2025 | USD 3.20 – USD 5.00 | Regulatory shifts may cause marginal cost increases. |

| 2026 | USD 3.30 – USD 5.20 | Market consolidation, rising demand for safer formulations. |

| 2027 | USD 3.50 – USD 5.50 | Premium segment expansion, price sensitivity moderates. |

| 2028 | USD 3.70 – USD 6.00 | Possible reformulation costs, inflationary pressures. |

These estimates assume competitive parity, adherence to regulatory updates, and sustained demand.

Strategic Considerations for Stakeholders

-

Manufacturers: Focus on differentiating via safety profiles, flavoring, and compliance to justify premium pricing.

-

Distributors & Retailers: Leverage online platforms and regional distribution channels to expand reach.

-

Regulators: Balance safety with accessibility; streamline approval processes to facilitate market entry without compromising safety.

-

Investors: Recognize the growth potential in emerging markets, especially with localized formulations and targeted marketing.

Conclusion

The pediatric cold and cough liquid market offers rising opportunities aligned with demographic and healthcare trends. GS Child Cold and Cough Liquid is positioned to capitalize on this growth, provided it aligns with regulatory standards, emphasizes safety and efficacy, and employs adaptive pricing strategies. The forecasted price range indicates a trend towards modest increases driven by inflation, regulatory compliance requirements, and innovation.

Key Takeaways

-

The global pediatric cold and cough market is expected to grow at a CAGR of approximately 4.8% through 2028, with emerging markets leading expansion.

-

Price points are projected to incrementally rise, balancing inflation, raw material costs, and competitive differentiation.

-

Regulatory landscapes heavily influence formulation, marketing, and pricing, necessitating proactive compliance strategies.

-

Differentiating through safety, taste, and packaging innovation will be pivotal for competitive advantage.

-

Market entry and expansion should prioritize emerging regions, leveraging localized marketing and affordable pricing.

FAQs

-

What are the key regulatory concerns for pediatric cold and cough liquids?

Compliance with age-specific dosing, ingredient safety (avoiding known adverse agents like codeine and certain antihistamines), and accurate labeling are primary concerns. Recent bans and restrictions necessitate ongoing regulatory monitoring. -

How will regulatory changes impact the price of GS Child Cold and Cough Liquid?

Stricter regulations could increase manufacturing costs due to reformulations or compliance expenses, likely leading to marginal price increases. -

What are the dominant distribution channels for pediatric cold and cough relief?

Pharmacies, online e-commerce platforms, supermarkets, and specialty stores constitute primary channels, with digital platforms gaining prominence. -

Which regions offer the highest growth potential for this product?

The Asia-Pacific region and Latin America display the highest growth prospects, driven by increasing urbanization and OTC product adoption. -

How can GS leverage marketing to maintain a competitive edge?

Emphasizing safety, flavor appeal, ease of administration, and compliance with regulatory standards can enhance consumer trust and brand loyalty.

Sources

[1] MarketsandMarkets, "Pediatric Medicines Market," 2022 Report.

[2] IQVIA, "OTC Pediatric Care Market Overview," 2022.

[3] ResearchAndMarkets, "Asia-Pacific Pediatric Healthcare Market," 2022.

More… ↓