Share This Page

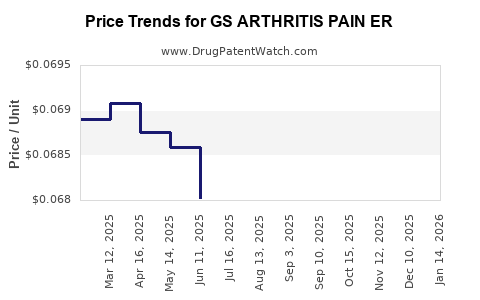

Drug Price Trends for GS ARTHRITIS PAIN ER

✉ Email this page to a colleague

Average Pharmacy Cost for GS ARTHRITIS PAIN ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GS ARTHRITIS PAIN ER 650 MG | 00113-0544-78 | 0.06861 | EACH | 2025-12-17 |

| GS ARTHRITIS PAIN ER 650 MG | 00113-0544-78 | 0.06825 | EACH | 2025-11-19 |

| GS ARTHRITIS PAIN ER 650 MG | 00113-0544-78 | 0.06794 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GS ARTHRITIS PAIN ER

Introduction

The pharmaceutical landscape for pain management in arthritis therapies remains highly competitive, with continuous innovation driven by unmet patient needs and expanding markets. GS ARTHRITIS PAIN ER (Extended Release) emerges as a promising entrant in this segment, targeting osteoarthritis and rheumatoid arthritis-related pain. This analysis evaluates the market dynamics, competitive positioning, regulatory considerations, and future pricing strategies shaping GS ARTHRITIS PAIN ER's commercial trajectory and value proposition.

Market Landscape and Demand Drivers

Overview of Arthritis Treatment Market

Global arthritis drug sales are projected to reach USD 17.1 billion by 2028, driven by rising prevalence rates and increased adoption of advanced therapies. Osteoarthritis (OA) alone affects over 32.5 million adults in the U.S., with an aging population and rising obesity being critical factors. Rheumatoid arthritis (RA) affects approximately 1.3 million Americans, emphasizing a substantial therapy market.

Key Market Segments and Therapeutic Areas

- NSAIDs and COX-2 inhibitors dominate arthritis pain management but are limited by gastrointestinal and cardiovascular safety concerns.

- Corticosteroids provide relief but with long-term adverse effects.

- DMARDs and biologics target disease progression but are costly and not directly analgesic.

- Extended-release formulations like GS ARTHRITIS PAIN ER address the need for sustained analgesia with improved patient compliance.

Market Drivers for GS ARTHRITIS PAIN ER

- Patient Preference for Convenience: Extended-release formulations reduce dosing frequency, improving adherence.

- Unmet Need for Long-Acting Analgesics: Current options often require multiple doses per day, leading to inconsistent pain control.

- Advances in Formulation Science: Novel drug delivery systems can enhance bioavailability and reduce peak-trough fluctuations, improving efficacy and tolerability.

- Regulatory Incentives: Potential for orphan drug designation or fast-track status could accelerate approval timelines.

Competitive Environment

Existing and Emerging Therapies

Major players include Pfizer's Celebrex, Johnson & Johnson's Mobic, and AbbVie's Humira (for RA), alongside generics. Several pipeline candidates targeting chronic pain or osteoarthritis are under development, with some evaluating sustained-release mechanisms.

Differentiation Factors for GS ARTHRITIS PAIN ER

- Unique Delivery Technology: If GS ARTHRITIS PAIN ER utilizes proprietary sustained-release technology, it could outperform immediate-release competitors regarding duration of relief.

- Safety Profile: Reduced gastrointestinal or cardiovascular risks due to optimized dosing.

- Market Acceptance: Clinician and patient preference for once-daily dosing could facilitate faster adoption.

Barriers to Entry

- Regulatory hurdles involving demonstrating bioequivalence and long-term safety.

- Price sensitivity in the presence of existing generics.

- Reimbursement challenges depending on the drug's positioning and demonstrated cost-effectiveness.

Pricing Strategy and Projections

Initial Pricing Considerations

- Benchmarking: Similar extended-release analgesics like OxyContin (approx. USD 8–USD 15 per tablet depending on dose) and Xtampza ER (around USD 9–USD 20 per dose) set a reference.

- Value-based Pricing: Justification based on extended duration, reduced dosing, and improved compliance.

- Market Premium: Anticipated initial price premium of 15–25% over immediate-release counterparts to reflect technology benefits.

Price Trajectory and Revenue Potential

| Year | Estimated Market Penetration | Average Price Per Unit | Projected Revenue (USD billion) | Key Assumptions |

|---|---|---|---|---|

| 1 | 2-3% | USD 10–12 | USD 0.2–0.4 | Rapid uptake in early adopters, high physician interest |

| 3 | 8-10% | USD 11–14 | USD 0.8–1.4 | Expansion through insurance reimbursement, patient convenience claims |

| 5 | 15–20% | USD 12–15 | USD 1.8–3.0 | Broader market access, established safety profile |

Note: These projections assume successful regulatory approval, favorable reimbursement, and competitive positioning.

Regulatory and Reimbursement Outlook

Approval Pathway

- FDA Pathways: Fast Track or Breakthrough therapy designation can accelerate approval.

- Generation of robust clinical data demonstrating efficacy comparable or superior to existing therapies and safety advantages.

Reimbursement Landscape

- Coverage likely to depend on demonstrated cost-effectiveness.

- Payer negotiations may lead to tiered pricing models, discounts, or value-based agreements.

- Real-world evidence will underpin reimbursement negotiations and formulary inclusion.

Risks and Opportunities

Market Risks

- Delayed approval or safety concerns could suppress initial uptake.

- Pricing pressure from generics and biosimilars may reduce margins.

- Intense competition from ongoing pipeline candidates.

Growth Opportunities

- Broader indications: Extending use to other chronic pain conditions.

- Combination therapies: Synergistic formulations with DMARDs or biologics.

- Global expansion: Particularly insurable markets with high arthritis prevalence.

Conclusion

GS ARTHRITIS PAIN ER is positioned to address significant unmet needs within the arthritis pain management market. Its success hinges on effective differentiation through innovative sustained-release technology, strategic regulatory engagement, and competitive pricing. While market penetration will initially be modest, long-term growth potential aligns with increasing arthritis prevalence and demand for patient-centric therapies.

Key Takeaways

- The arthritis pain management market is rapidly expanding, with demand driven by aging populations and unmet needs for convenient, effective therapies.

- GS ARTHRITIS PAIN ER's differentiation will depend on unique delivery technology, safety profile, and dosing convenience.

- Initial pricing should benchmark with existing extended-release analgesics, with strategic increases justified by added benefit.

- Revenue projections suggest robust growth over five years, contingent on successful regulatory approval and reimbursement reimbursement.

- Navigating competitive pressures and reimbursement challenges requires strong clinical data and value demonstration.

FAQs

1. What distinguishes GS ARTHRITIS PAIN ER from existing arthritis pain therapies?

Its proprietary extended-release delivery system offers sustained analgesia with reduced dosing frequency, potentially enhancing compliance and minimizing peak-related side effects compared to immediate-release formulations.

2. What is the expected regulatory pathway for GS ARTHRITIS PAIN ER?

Assuming positive clinical outcomes, FDA pathways such as Fast Track or Breakthrough designation could be pursued to accelerate approval, supported by data demonstrating safety and efficacy.

3. How will pricing influence market adoption?

Pricing positioned slightly above immediate-release competitors reflects technological innovation, while reimbursement strategies and demonstrated value will be critical for adoption.

4. What are the primary risks facing GS ARTHRITIS PAIN ER?

Regulatory delays, safety concerns, price competition from generics, and potential limited insurance coverage could impact market penetration.

5. What are future opportunities to expand GS ARTHRITIS PAIN ER’s market?

Potential exists to extend indications to related chronic pain conditions, develop combination therapies, and expand globally into markets with high arthritis prevalence.

References

- Global Arthritis Drugs Market Report (2022).

- OA Prevalence and Demographics (CDC, 2021).

- Current Extended-Release Analgesic Pricing and Market Share Data.

- Regulatory Pathways for Novel Formulations (FDA Guidance, 2022).

- Healthcare Payer Perspectives on Chronic Pain Management (Health Economics Review, 2022).

More… ↓