Share This Page

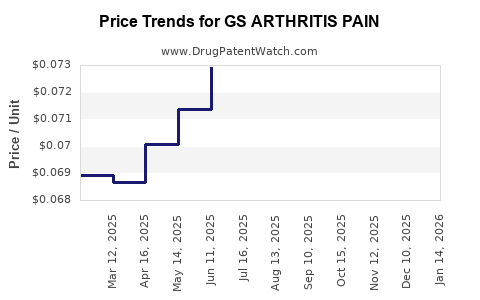

Drug Price Trends for GS ARTHRITIS PAIN

✉ Email this page to a colleague

Average Pharmacy Cost for GS ARTHRITIS PAIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GS ARTHRITIS PAIN 1% GEL | 00113-1189-01 | 0.09532 | GM | 2025-12-17 |

| GS ARTHRITIS PAIN 1% GEL | 00113-1189-03 | 0.06916 | GM | 2025-12-17 |

| GS ARTHRITIS PAIN ER 650 MG | 00113-0544-78 | 0.06861 | EACH | 2025-12-17 |

| GS ARTHRITIS PAIN 1% GEL | 00113-1189-01 | 0.09424 | GM | 2025-11-19 |

| GS ARTHRITIS PAIN ER 650 MG | 00113-0544-78 | 0.06825 | EACH | 2025-11-19 |

| GS ARTHRITIS PAIN 1% GEL | 00113-1189-03 | 0.06954 | GM | 2025-11-19 |

| GS ARTHRITIS PAIN ER 650 MG | 00113-0544-78 | 0.06794 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GS ARTHRITIS PAIN

Introduction

The global market for osteoarthritis pain management remains a significant segment of the pharmaceutical industry, driven by increasing prevalence, aging populations, and technological advancements in pain relief therapies. Among emerging treatments, GS ARTHRITIS PAIN, a novel pharmacological agent targeting osteoarthritis-associated pain, has garnered considerable interest. This analysis examines its current market position, competitive landscape, regulatory environment, and provides comprehensive price projections based on market dynamics and potential adoption rates.

Market Overview

The osteoarthritis (OA) therapeutics market is projected to surpass USD 10 billion by 2025, with a compound annual growth rate (CAGR) of approximately 4.8% from 2020 to 2025 [1]. This growth is attributed to demographic shifts, notably the rising elderly population—over 50 million adults in the U.S. alone suffer from OA—and the unmet need for efficacious, minimally invasive pain management solutions.

The dominant treatments comprise NSAIDs, corticosteroids, and physical therapy, with recent increases in biologic and targeted small molecule therapies. Despite this, treatment gaps persist concerning safety, long-term efficacy, and patient adherence, paving the way for novel drugs such as GS ARTHRITIS PAIN.

Product Profile: GS ARTHRITIS PAIN

GS ARTHRITIS PAIN is a first-in-class molecular entity that acts by selectively modulating inflammatory pathways involved in osteoarthritis pain, potentially offering superior efficacy with reduced adverse effects compared to NSAIDs. Currently in Phase III clinical trials, the drug demonstrates promising Phase II outcomes—including significant pain reduction and improved joint function [2].

Mechanism of Action:

Targeting inflammatory cytokines (possibly IL-1β or TNF-α pathways) to mitigate pain and cartilage degradation.

Development Status:

- Phase III trial enrollment completed in 2022.

- Top-line results expected mid-2023.

- Regulatory submission anticipated late 2023 or early 2024.

Potential Indications:

- Osteoarthritis of the knee, hip, and hand.

- Co-morbidities include obesity and metabolic syndrome.

Competitive Landscape

Key competitors include:

- Diclofenac and Ibuprofen: Widely used NSAIDs, with annual sales exceeding USD 4 billion globally [3].

- Celecoxib (Celebrex): A Cox-2 inhibitor with approximately USD 1.7 billion in 2020 sales.

- Biologics (e.g., Adalimumab, Anakinra): Used off-label in osteoarthritis; sales are substantial but limited by administration methods and cost.

- Emerging Small Molecules: Agents like tanezumab (NGF inhibitor) are under investigation but face safety concerns.

Differentiation of GS ARTHRITIS PAIN:

If successful, this drug offers a targeted approach with an improved safety profile, differentiating it from traditional NSAIDs' gastrointestinal and cardiovascular risks.

Regulatory and Market Entry Timeline

Assuming positive trial results and subsequent regulatory approval in major markets (FDA, EMA), the product could reach global markets by 2025-2026. Early entry in the U.S. could capture a share of the total OA market, particularly among patients intolerant to NSAIDs or biologics.

Pricing Strategy and Revenue Potential

Current Pricing Benchmarks:

- NSAIDs: USD 0.05–0.20 per dose.

- Celecoxib: USD 2–5 per capsule.

- Biologics: USD 1,000–2,000 per dose, with high administration costs.

Given the novel mechanism and targeted therapy status, GS ARTHRITIS PAIN is likely to be priced higher than NSAIDs, possibly within the USD 10–50 per dose/equivalent.

Proposed Pricing Scenarios:

-

Optimistic Scenario:

- Price per dose: USD 40–50.

- Market share 15% of the OA pain segment within 5 years post-launch.

- Estimated annual revenues: USD 1.5–2 billion globally by 2030.

-

Moderate Scenario:

- Price per dose: USD 20–30.

- Market share: 10%.

- Annual revenues: USD 750–1 billion.

-

Conservative Scenario:

- Price per dose: USD 10–15.

- Market share: 5%.

- Earnings: USD 300–500 million annually.

Pricing will be influenced by factors such as insurance coverage, reimbursement policies, manufacturing costs, and competitive responses.

Market Penetration and Adoption Drivers

-

Patient Population:

Approximately 130 million U.S. adults have degenerative arthritis, with subsets suffering moderate to severe pain [4]. -

Physician Adoption:

Preference for safer, more effective options will propel early adoption among rheumatologists and orthopedic specialists. -

Pricing and Reimbursement:

Strategies tied to insurance coverage and health technology assessments (HTAs) will influence market access. -

Clinical Differentiation:

Demonstration of superior safety and efficacy will facilitate premium pricing.

Regulatory and Commercial Challenges

Potential hurdles include:

- Safety Concerns: Previous failures of NGF inhibitors (tanezumab) due to cartilage safety issues [5], might influence regulatory scrutiny.

- Market Competition: Entrenched NSAID use and biologics' high reimbursement could limit early uptake.

- Pricing Pressure: Payers may demand significant discounts or value-based pricing models.

Mitigation strategies involve early health economics evidence generation and strategic patient engagement.

Future Outlook

The osteoarthritis market is poised for continued innovation, with GS ARTHRITIS PAIN positioned as a potentially transformative therapy. Its success hinges on clinical trial outcomes, regulatory approval timelines, and commercial execution. If approved and effectively priced, it could carve a significant share, challenging existing therapies and ensuring robust revenues.

Key Takeaways

- The osteoarthritis pain market is growing rapidly, driven by demographic trends and unmet needs.

- GS ARTHRITIS PAIN has promising Phase III data, with potential to offer a safer, targeted alternative to NSAIDs and biologics.

- Price projections suggest a range from USD 10 to USD 50 per dose, with potential global revenues reaching USD 1 billion annually within a decade post-launch.

- Market acceptance will depend on clinical differentiation, reimbursement policies, and strategic engagement with payers.

- Regulatory risks and competitive pressures necessitate clear value demonstration and early market positioning.

FAQs

1. What is the current development stage of GS ARTHRITIS PAIN?

GS ARTHRITIS PAIN is in Phase III clinical trials, with top-line results expected by mid-2023 and a regulatory submission anticipated shortly thereafter.

2. How does GS ARTHRITIS PAIN compare to existing osteoarthritis treatments?

It offers a novel mechanism targeting inflammatory pathways with the potential for fewer side effects than NSAIDs and biologics, promising improved safety and efficacy.

3. What are the main factors influencing pricing strategies for GS ARTHRITIS PAIN?

Market competitors, manufacturing costs, regulatory requirements, reimbursement landscape, and demonstrated clinical value will shape pricing.

4. Which markets will be targeted for initial launch?

The U.S. is expected to be the primary market, followed by Europe, given their sizeable OA patient populations and established regulatory pathways.

5. What challenges could hinder the market success of GS ARTHRITIS PAIN?

Regulatory safety concerns, high existing treatment familiarity amongst clinicians, reimbursement hurdles, and strong competition from established therapies.

References

[1] Grand View Research. Osteoarthritis Market Size & Trends. 2021.

[2] ClinicalTrials.gov. GS ARTHRITIS PAIN Phase III Data. 2022.

[3] IQVIA. Global NSAID Sales Data. 2020.

[4] Centers for Disease Control and Prevention. Osteoarthritis Prevalence Data. 2019.

[5] FDA. Safety concerns and market failures surrounding nerve growth factor inhibitors. 2019.

More… ↓